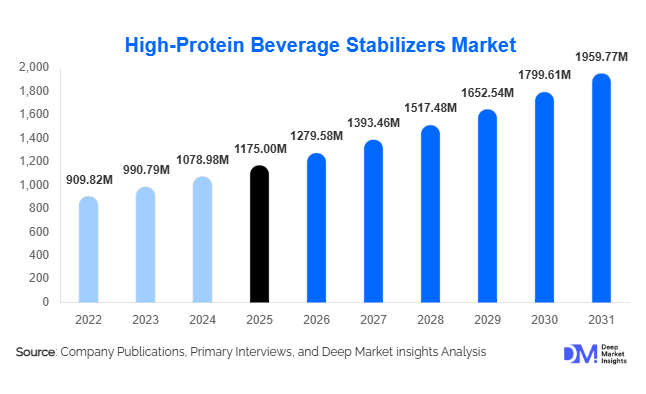

High-Protein Beverage Stabilizers Market Size

According to Deep Market Insights, the global high-protein beverage stabilizers market size was valued at USD 1,175 million in 2025 and is projected to grow from USD 1,279.58 million in 2026 to reach USD 1,959.77 million by 2031, expanding at a CAGR of 8.9% during the forecast period (2026–2031). Market growth is primarily driven by the rapid expansion of ready-to-drink (RTD) protein beverages, increasing adoption of plant-based proteins, and rising demand for clean-label functional ingredients that improve texture, suspension stability, and shelf life in high-protein formulations.

Key Market Insights

- Hydrocolloids dominate the market, accounting for nearly 46% of total revenue in 2025, owing to their superior suspension and viscosity control properties in protein-rich beverages.

- RTD protein beverages represent the largest application segment, contributing approximately 41% of overall demand, supported by convenience-driven consumption trends.

- North America leads the global market with around 34% share in 2025, driven by strong sports nutrition and functional beverage penetration.

- Asia-Pacific is the fastest-growing region, expanding at over 10% CAGR, fueled by rising urbanization and increasing health awareness in China and India.

- Powder-form stabilizers account for nearly 63% of total sales, favored for their longer shelf life and cost-efficient transportation.

- The top five players control approximately 48% of global market share, indicating moderate consolidation with strong R&D-driven competition.

What are the latest trends in the high-protein beverage stabilizers market?

Clean-Label and Plant-Derived Stabilizers Gaining Momentum

Consumer preference for natural, recognizable ingredients is reshaping stabilizer formulations. Beverage manufacturers are increasingly replacing synthetic emulsifiers with plant-derived hydrocolloids such as pectin, gellan gum, and guar gum. Clean-label positioning has become a competitive differentiator, particularly in North America and Europe, where regulatory scrutiny and consumer awareness are high. Fermentation-derived stabilizers and customized protein–polysaccharide complexes are also gaining traction, enabling manufacturers to maintain functionality while aligning with transparency and sustainability goals.

High-Protein RTD Innovation and Texture Optimization

Product innovation in high-protein coffees, smoothies, fortified waters, and dairy alternatives is driving demand for multifunctional stabilizer systems. As protein content per serving increases beyond 15–20 grams, maintaining suspension stability and desirable mouthfeel becomes technically complex. Advanced stabilizer blends are being adopted to prevent sedimentation, reduce grittiness in plant proteins, and ensure extended shelf stability in ambient storage conditions. This trend is particularly strong in premium beverage segments where texture consistency directly influences brand perception.

What are the key drivers in the high-protein beverage stabilizers market?

Expansion of Functional and Sports Nutrition Beverages

The global functional beverage industry, valued at over USD 140 billion in 2025, continues to expand at nearly 7% annually. High-protein beverages represent one of the fastest-growing subcategories, particularly in sports nutrition and meal replacement applications. Stabilizers play a critical role in ensuring uniform dispersion of proteins, preventing phase separation, and extending shelf life, directly linking their demand to overall protein beverage growth.

Rise of Plant-Based Protein Consumption

Plant-based protein beverages formulated with pea, soy, rice, and oat proteins are expanding rapidly, particularly in Asia-Pacific and Europe. These proteins present formulation challenges including sedimentation and off-texture, increasing reliance on advanced stabilizer systems. The growth of vegan and flexitarian diets is therefore a structural driver for stabilizer manufacturers developing plant-compatible solutions.

What are the restraints for the global market?

Raw Material Price Volatility

Seaweed-derived hydrocolloids such as carrageenan and gellan gum are subject to supply fluctuations influenced by climatic conditions and geopolitical trade factors. Price volatility impacts production costs and compresses margins, particularly for small and mid-sized ingredient manufacturers.

Regulatory and Reformulation Pressures

Stringent food safety regulations in North America and Europe, coupled with periodic scrutiny of certain hydrocolloids, create compliance challenges. Reformulating beverages to align with regional standards increases R&D expenses and may delay product launches.

What are the key opportunities in the high-protein beverage stabilizers industry?

Emerging Market Penetration

Asia-Pacific and Latin America present substantial growth opportunities. China is projected to be the fastest-growing national market with double-digit CAGR through 2031, driven by expanding middle-class consumption and increasing fitness culture. India and Brazil are also witnessing rising demand for affordable protein beverages, creating opportunities for cost-effective stabilizer solutions tailored to regional formulations.

Customized Functional Blends and Premiumization

As beverage brands move toward premium positioning, demand for proprietary stabilizer blends is increasing. Ingredient suppliers offering application-specific systems for high-protein coffee, medical nutrition drinks, and hybrid dairy-plant beverages can secure long-term contracts and command higher margins, often ranging between 18% and 25%.

Product Type Insights

Hydrocolloids dominate the high-protein beverage stabilizers market, accounting for approximately 46% share in 2025, primarily driven by their superior functionality in suspension stabilization, viscosity enhancement, and texture optimization in protein-rich systems. The leading segment driver for hydrocolloids is their ability to prevent phase separation and sedimentation in high-protein formulations, particularly in ready-to-drink beverages where long shelf stability is critical. Ingredients such as carrageenan and gellan gum are extensively utilized in dairy-based RTD protein beverages to maintain uniform protein dispersion and improve mouthfeel, while xanthan gum and pectin are increasingly adopted in plant-based protein drinks to address challenges associated with plant protein solubility and texture. Emulsifiers account for a significant secondary share, particularly in hybrid protein beverages combining dairy and plant proteins, where enhanced emulsion stability and fat-protein interaction control are essential. Functional stabilizer blends represent the fastest-growing product category, supported by increasing demand for customized, clean-label, and application-specific solutions that combine hydrocolloids, emulsifiers, and texturizers to deliver optimized performance in complex beverage matrices.

Application Insights

Ready-to-drink (RTD) protein beverages lead the application segment with nearly 41% share of total demand in 2025, supported by the leading segment driver of growing consumer preference for convenient, on-the-go nutrition solutions. The expanding base of health-conscious consumers, athletes, and working professionals continues to accelerate RTD product launches globally. Meal replacement shakes and sports performance drinks follow closely, fueled by rising gym participation, weight management trends, and performance-focused dietary regimens. Medical nutrition beverages represent an emerging high-growth niche, benefiting from increasing aging populations, post-operative recovery requirements, and higher clinical nutrition awareness. In terms of protein compatibility, dairy-based protein beverages currently hold around 52% share due to established consumer acceptance and functional ease in formulation; however, plant-based systems are expanding at a faster rate globally, driven by lactose intolerance prevalence, vegan lifestyles, and sustainability considerations, thereby increasing demand for advanced stabilization systems tailored to plant proteins.

Form Insights

Powder stabilizers account for approximately 63% of total market revenue in 2025, with the leading segment driver being their extended shelf life, cost efficiency in bulk handling, and logistical advantages in global trade. Powdered formats allow manufacturers to achieve formulation flexibility, ease of storage, and reduced transportation costs, particularly in export-oriented markets. Their compatibility with dry blending processes in beverage premixes further strengthens adoption. Liquid stabilizers, while representing a smaller market share, are gaining traction in large-scale beverage manufacturing facilities where precise dosing, faster dispersion, and shorter mixing cycles are operational priorities. Automated production lines and high-throughput processing environments increasingly favor liquid systems to improve production efficiency and batch consistency.

End-Use Industry Insights

The functional beverage manufacturing sector remains the largest end-use industry for high-protein beverage stabilizers, driven by continuous innovation in fortified drinks and performance nutrition products. Sports nutrition beverages are expanding at a CAGR of 9–11%, generating sustained demand for advanced stabilizer systems that enhance texture, improve protein suspension, and maintain sensory quality throughout shelf life. The medical nutrition segment is emerging as one of the fastest-growing end-use industries, particularly in North America and Europe, supported by expanding hospital nutrition programs, elderly care facilities, and rising awareness of therapeutic dietary management. Export-driven demand is also increasing significantly, with the United States, Germany, and China acting as major importers of hydrocolloid-based stabilizers used in protein beverage manufacturing, reflecting strong cross-border ingredient trade and globalized supply chains.

| By Product Type | By Source | By Functionality | By Beverage Type | By Form | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of global market share in 2025, led by the United States, with Canada contributing steadily to regional growth. The primary regional growth driver is the high penetration of sports nutrition and functional beverages across mainstream retail channels. Advanced beverage processing infrastructure, strong R&D capabilities, and rapid product commercialization cycles further support stabilizer demand. Clean-label reformulations, increasing plant-based beverage launches, and premiumization trends are encouraging manufacturers to adopt multifunctional hydrocolloid systems. High consumer spending power and established distribution networks across supermarkets, convenience stores, and e-commerce platforms continue to sustain market expansion.

Europe

Europe holds nearly 27% share of the global market, with Germany, France, and the United Kingdom leading demand. The key growth driver in this region is stringent regulatory standards combined with strong consumer preference for natural, clean-label ingredients, which encourages innovation in plant-derived stabilizers. Rising adoption of plant-based beverages, sustainability-focused product development, and transparent labeling requirements are accelerating demand for pectin, xanthan gum, and other naturally sourced hydrocolloids. Additionally, established dairy industries and expanding clinical nutrition applications support steady consumption of stabilizers in both traditional and specialized beverage formulations.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at over 10% CAGR. China is projected to be the fastest-growing country within the region, driven by rising middle-class income levels, increasing protein awareness, and strong growth in domestic RTD beverage production. India represents a rapidly emerging market supported by urbanization, expanding modern retail networks, and growing interest in fitness and dietary supplementation among younger populations. Japan contributes through its mature functional beverage market and advanced food processing technologies. The overarching regional growth driver is the shift toward protein-enriched convenience beverages alongside expanding manufacturing capabilities and foreign direct investments in the food and beverage sector.

Latin America

Latin America accounts for around 7–8% of global market share, led by Brazil and Mexico. The primary growth driver is the rising fitness culture and increasing consumer awareness of protein supplementation, particularly in urban centers. Expanding retail distribution networks, improving cold chain infrastructure, and growth in private-label functional beverages are supporting market penetration. Economic stabilization in key countries and growing investments in local beverage manufacturing are further enhancing demand for cost-effective stabilizer solutions.

Middle East & Africa

The Middle East & Africa region contributes nearly 6% of global demand, with the United Arab Emirates and South Africa acting as key markets. The main regional growth driver is increasing consumption of premium imported functional beverages and rising health consciousness among urban populations. Expanding modern retail infrastructure, tourism-driven hospitality demand, and a growing expatriate population are supporting protein beverage sales. Additionally, gradual development of local beverage manufacturing capabilities is creating incremental opportunities for stabilizer suppliers across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Stabilizers for High-Protein Yogurt Market

- Cargill Incorporated

- Ingredion Incorporated

- IFF (DuPont)

- CP Kelco

- DSM-Firmenich

- Kerry Group

- Tate & Lyle PLC

- Ashland Global

- Palsgaard A/S

- Fufeng Group

- Nexira

- Hydrosol GmbH

- Glanbia Nutritionals

- Fiberstar Inc.

- Darling Ingredients