Helicopter Tourism Market Size

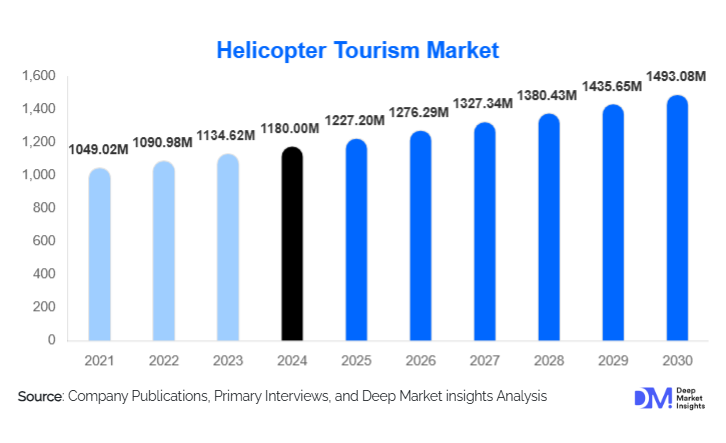

According to Deep Market Insights, the global helicopter tourism market size was valued at USD 1,180.00 million in 2024 and is projected to grow from USD 1,227.20 million in 2025 to reach USD 1,493.08 million by 2030, expanding at a CAGR of 4.00% during the forecast period (2025–2030). Market expansion is driven by rising demand for experiential travel, an increasing preference for aerial sightseeing, and growing investment in premium tourism services across urban, coastal, mountain, and remote destinations.

Key Market Insights

- General helicopter tours dominate, accounting for over 60% of global revenue due to their affordability and high tourist adoption.

- Charter services lead the ownership model segment, contributing more than 50% of the 2024 market share as travelers seek flexibility without long-term commitments.

- Urban tourism routes are the most popular globally, driven by demand for skyline tours, landmark routes, and coastal-city experiences.

- Asia-Pacific is the fastest-growing region, supported by rising middle-class affluence, destination infrastructure upgrades, and tourism expansion.

- North America holds the largest market share in 2024, supported by high disposable income and mature tourism ecosystems.

- Digital booking platforms, VR previews, and AI-based route optimization are reshaping customer experience and operator efficiency.

What are the latest trends in the helicopter tourism market?

Eco-Friendly & Hybrid Helicopter Adoption

Operators are increasingly exploring hybrid-electric helicopters to reduce fuel consumption, meet tightening noise regulations, and appeal to eco-conscious travelers. Governments in tourism-heavy regions are encouraging low-emission aircraft adoption through incentives and infrastructure support. Hybrid models not only reduce operational costs but also unlock permissions in noise-sensitive destinations, enabling extended coverage of urban and protected landscapes.

Technology-Driven Passenger Experiences

Technological integration is transforming the helicopter tourism value chain. VR-based previews allow tourists to experience flight routes before booking, boosting conversion rates. GPS-enabled onboard systems, AI-powered safety monitoring, and interactive customer interfaces enhance both flight safety and passenger engagement. Mobile applications offering one-click booking, real-time flight updates, and dynamic pricing models are attracting younger, tech-first travelers.

What are the key drivers in the helicopter tourism market?

Growing Demand for Experiential & Luxury Travel

Modern travelers increasingly prefer immersive experiences over conventional sightseeing. Aerial views of coastlines, city skylines, islands, canyons, and mountains offer unmatched novelty, pushing helicopter tours into mainstream premium travel. Rising high-net-worth populations in North America, Europe, the Gulf region, China, and India contribute significantly to increased private charters and bespoke tour packages.

Tourism Infrastructure Expansion

Countries across Asia-Pacific, the Middle East, and Latin America are investing heavily in tourism infrastructure, new heliports, coastal terminals, resort-linked landing pads, and safety-certified flight corridors. This expansion improves accessibility in remote or mountainous destinations, attracting both domestic and international tourists while enabling operators to scale routes cost-effectively.

Advancements in Safety, Fuel Efficiency & Comfort

New-generation helicopters equipped with quieter engines, enhanced cabin comfort, real-time navigation systems, and automated safety checks have significantly improved traveler confidence. Enhanced operational efficiency lowers downtime, reduces maintenance frequency, and enables operators to run more frequent tours, directly contributing to market growth.

What are the restraints for the global market?

High Operating, Maintenance & Fuel Costs

Helicopter tourism is inherently expensive due to fuel volatility, rigorous maintenance schedules, pilot training costs, and insurance requirements. These high operational costs limit ticket affordability, reducing accessibility for price-sensitive travelers. Seasonal demand fluctuations further increase cost pressure, particularly for small and mid-sized operators.

Regulatory Restrictions & Environmental Sensitivities

Tight aviation regulations, air-traffic constraints, noise-sensitive zones, and environmental restrictions significantly limit helicopter operations in many countries. Urban areas and protected landscapes often impose strict flight-path limitations, affecting route planning and tour frequency. Additionally, safety incidents, though rare, affect consumer perception and can temporarily reduce demand.

What are the key opportunities in the helicopter tourism industry?

Expansion into Emerging Tourism Hubs

Rapid tourism growth in Southeast Asia, India, the Middle East, and Latin America presents enormous potential for helicopter tour expansion. Destinations with emerging beach resorts, high-altitude retreats, island circuits, and cultural hotspots are ideal for aerial sightseeing development. Governments are increasingly open to partnering with private operators to enhance tourism appeal and attract international travelers.

Premiumization & Personalized Helicopter Experiences

Bespoke helicopter experiences, private charters, couple packages, luxury resort transfers, VIP city tours, and special-event flights are becoming a critical revenue driver. High-income travelers seek exclusive, customizable itineraries, offering operators opportunities to introduce premium lounges, curated flight routes, gourmet onboard experiences, and integrated luxury travel packages.

Digital Platforms & AI-Based Customization

AI-driven customer profiling, dynamic pricing, and personalized routing recommendations enable operators to optimize utilization rates and enhance customer experience. Digital booking ecosystems, integrating reviews, sustainability ratings, VR previews, and customized package suggestions, boost conversion rates and expand market reach, particularly among tech-savvy global travelers.

Product Type Insights

General helicopter tours dominate the market, accounting for 60–65% of 2024 revenue. These standardized, cost-effective sightseeing flights appeal to a broad customer base and offer high scalability for operators. Customized and luxury tours are rapidly expanding due to premium travel demand, particularly in resort and urban destinations. Ultra-luxury tours, including private charter packages with VIP services, cater to high-net-worth travelers, commanding the highest per-flight margins despite lower volume. Budget-friendly short scenic tours, often used as entry-level aerial experiences, are gaining adoption in emerging markets to stimulate first-time travelers.

Application Insights

Urban tourism accounts for 40–45% of application revenue, making it the largest application category. Skyline viewing, architectural routes, coastal urban flights, and metropolitan landmark tours dominate due to high year-round demand. Coastal and island routes are gaining popularity in Hawaii, the Caribbean, Southeast Asia, and the Mediterranean. Mountain and wilderness tours are growing steadily, driven by demand for remote scenic experiences. Resort-linked helicopter tourism is expanding as luxury resorts integrate aerial views and helicopter transfers into premium guest packages.

Distribution Channel Insights

Online booking platforms and D2C websites dominate, enabling real-time flight availability, transparent pricing, and convenient mobile reservations. Specialist travel agencies continue to serve luxury and corporate clients requiring curated aerial itineraries. Direct resort-linked bookings are growing fast as hotels bundle helicopter tours with premium stay packages. Social media-driven marketing, influencer partnerships, and VR-based previews are increasingly shaping consumer decisions, particularly among younger travelers.

Traveler Type Insights

Family travelers represent the largest share (45–50% of 2024 demand), as helicopter sightseeing is increasingly adopted as a memorable family vacation activity. Couples and honeymooners form a high-value segment, favoring private or romantic aerial experiences. Group travelers, including corporate teams and tour groups, are expanding, driven by event-linked charter demand. Solo travelers contribute moderately, typically selecting short scenic flights integrated into broader trip itineraries.

Age Group Insights

Travelers aged 31–50 years represent the largest demographic segment due to higher purchasing power and a strong preference for immersive travel. The 18–30 age group drives growth in short scenic and adventure-linked tours, booking primarily through digital channels. Travelers aged 51–65 years are major contributors to premium helicopter tourism, drawn to comfort-focused private charters. The 65+ segment, while niche, is increasingly adopting medically assisted or comfort-enhanced helicopter tours.

| By Tour Type | By Service Model | By Application | By Traveler Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates the helicopter tourism market with 30–35% of the 2024 global share. The U.S. and Canada benefit from mature tourism infrastructure, high disposable incomes, and iconic aerial destinations such as the Grand Canyon, New York skyline, Hawaiian islands, and Canadian Rockies. High adoption of private charters and premium sightseeing experiences strengthens regional leadership.

Europe

Europe contributes 15–20% of global revenue, driven by tourism hotspots in France, Italy, the U.K., Spain, and Switzerland. European travelers show a strong preference for curated aerial experiences, sustainable aviation solutions, and integration with cultural or luxury itineraries. Strict noise and environmental regulations moderate growth, but demand remains robust in coastal and alpine tourism circuits.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding 25–30% of 2024 revenue and projected to outpace all regions through 2030. China, India, Japan, Australia, Thailand, and Indonesia are driving demand through rising middle-class affluence, tourism infrastructure upgrades, and expansion of resort-linked helicopter offerings. Increasing connectivity and social media influence accelerate the adoption of aerial sightseeing among young and affluent travelers.

Latin America

Latin America captures 5–7% of the global share, with emerging demand in Brazil, Mexico, Argentina, and Chile. Scenic coastal, rainforest, and mountain destinations present strong long-term potential. Growth is supported by rising adventure tourism trends and expanding luxury hotel networks integrating helicopter excursions.

Middle East & Africa

The region accounts for 10% of the market, led by tourism-centric economies such as the UAE, Saudi Arabia, Qatar, South Africa, and Kenya. High-income populations in the Gulf region prefer premium helicopter charters, while African coastal and safari regions increasingly adopt aerial sightseeing for wildlife and landscape viewing. Government-driven tourism diversification initiatives boost long-term prospects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Helicopter Tourism Market

- Maverick Helicopters

- Blue Hawaiian Helicopters

- Liberty Helicopters

- Chicago Helicopter Tours

- Cape Town Helicopters

- Tibet Helicopter Tours

- Nautilus Aviation

- HeliDubai

- Salt Lake City Helicopter Tours

- Helicopter New Zealand Tourism

- Aspen Helicopters

- Heli Air Monaco

- Air Zermatt Tourism Division

- Heli-Jet Aviation

- Seawings Aerial Tours

Recent Developments

- In March 2025, Maverick Helicopters expanded its urban night-tour portfolio with new AI-assisted flight paths, enhancing skyline viewing safety.

- In January 2025, Blue Hawaiian Helicopters launched eco-friendly hybrid aircraft on its coastal scenic routes, reducing fuel emissions by nearly 30% per flight.

- In April 2025, HeliDubai partnered with luxury hotels to introduce VIP aerial wedding and anniversary packages, integrating private charters with premium hospitality offerings.