Halal Food and Beverage Market Size

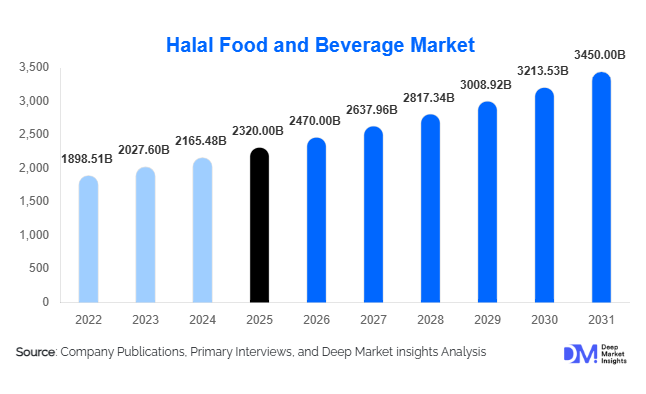

According to Deep Market Insights, the global halal food and beverage market size was valued at USD 2,320 billion in 2025 and is projected to grow from USD 2,470 billion in 2026 to reach USD 3,450 billion by 2031, expanding at a CAGR of 6.8% during the forecast period (2026–2031). The market growth is primarily driven by the expanding global Muslim population, rising awareness of halal-certified food safety and ethical standards, and the increasing integration of halal products into mainstream global food systems.

Key Market Insights

- Halal food demand extends beyond religious consumption, with non-Muslim consumers increasingly associating halal products with higher hygiene, ethical sourcing, and food safety standards.

- Halal meat and poultry dominate the market, accounting for more than half of the global market value due to religious necessity and strong institutional demand.

- Asia-Pacific leads global consumption, driven by large Muslim populations in Indonesia, India, Pakistan, and Malaysia.

- The Middle East remains the largest import-dependent region, relying heavily on halal food imports to ensure food security.

- E-commerce and modern retail channels are rapidly expanding, improving access to certified halal products across urban and semi-urban markets.

- Technology-enabled halal traceability, including blockchain and digital certification platforms, is becoming a critical competitive differentiator.

What are the latest trends in the halal food and beverage market?

Premiumization and Value-Added Halal Products

The halal food and beverage market is experiencing a strong shift toward premium and value-added offerings. Consumers are increasingly demanding halal-certified ready-to-eat meals, organic halal foods, functional beverages, and clean-label products. This trend is particularly prominent in urban Asia-Pacific, the Middle East, Europe, and North America, where rising disposable incomes and lifestyle changes are accelerating demand for convenience-driven halal products. Manufacturers are investing in product innovation, focusing on nutrition enrichment, plant-based halal alternatives, and fortified foods to capture higher margins and differentiate from commoditized meat segments.

Digitalization of Halal Certification and Supply Chains

Technology adoption is reshaping halal food production and distribution. Blockchain-enabled traceability systems, QR-code-based halal verification, and AI-driven supply chain audits are improving transparency and consumer trust. Digital halal assurance platforms allow end consumers to verify product origin, slaughtering methods, and certification authenticity in real time. These innovations are especially critical for export-oriented manufacturers supplying multiple international markets with differing halal standards, helping reduce compliance risks and streamline certification processes.

What are the key drivers in the halal food and beverage market?

Growing Muslim Population and Urbanization

The expanding global Muslim population remains the most significant growth driver for the halal food and beverage market. Rapid urbanization in Asia-Pacific, the Middle East, and Africa is increasing the consumption of packaged, processed, and convenience halal foods. Urban consumers increasingly rely on modern retail formats, boosting demand for branded halal products across multiple price tiers. Government-backed halal assurance laws in key markets are further reinforcing structured demand growth.

Expansion of Global Halal Trade and Exports

International halal trade continues to accelerate as import-dependent regions such as the GCC rely on exporting countries, including Brazil, Australia, India, and Thailand. Large-scale investments in halal-certified slaughterhouses, cold-chain logistics, and export-oriented processing facilities are strengthening global supply chains. This has enabled consistent availability of halal food products across borders, supporting long-term market expansion.

What are the restraints for the global market?

Fragmented Halal Certification Standards

One of the primary restraints facing the halal food and beverage market is the lack of globally unified halal certification standards. Differences in slaughtering practices, ingredient approvals, and certification authority recognition increase operational complexity for multinational manufacturers. This fragmentation raises compliance costs, delays product launches, and limits scalability across international markets.

Rising Raw Material and Production Costs

Volatility in livestock prices, feed costs, energy prices, and transportation expenses poses challenges for halal food producers. Segregated production requirements and limited availability of certified suppliers further amplify cost pressures. Smaller players are particularly vulnerable, facing margin compression in price-sensitive markets.

What are the key opportunities in the halal food and beverage industry?

Government-Led Halal Ecosystem Development

Governments across Asia-Pacific and the Middle East are investing heavily in halal industrial parks, export facilitation programs, and unified certification frameworks. Initiatives such as national halal assurance laws and halal trade hubs are creating attractive entry points for both domestic and international manufacturers. These ecosystems lower operational barriers and improve export competitiveness.

Non-Muslim Adoption of Halal Foods

The growing perception of halal food as cleaner, safer, and ethically produced presents significant opportunities beyond traditional Muslim consumer bases. In Europe and North America, halal-certified products are increasingly positioned as premium and ethical alternatives, enabling manufacturers to expand addressable markets and command higher margins.

Product Type Insights

Halal meat, poultry, and seafood continue to be the largest product segment, accounting for approximately 55% of the global halal food and beverage market in 2025. The dominance of this segment is driven by religious dietary compliance, high-frequency consumption, and strong demand from institutional buyers such as hotels, airlines, and catering companies. Processed and packaged halal foods follow as the second-largest segment, benefiting from urbanization, busier lifestyles, and rising demand for convenience foods in Asia-Pacific, the Middle East, and Europe. Halal beverages, including dairy-based drinks, functional beverages, and fortified products, are gaining traction among younger consumers and health-conscious buyers, while halal ingredients and additives, such as gelatin, enzymes, and flavorings, are experiencing steady growth due to their use in industrial food processing, confectionery, and pharmaceuticals. Halal infant and medical nutrition, although smaller in volume, represent a high-margin, niche segment driven by parents’ demand for certified safe nutrition and hospitals’ reliance on halal-compliant clinical nutrition products. Innovations in plant-based halal alternatives and fortified functional products are also expanding this segment, offering opportunities for premiumization and export-focused growth.

Application Insights

Household consumption remains the dominant application, representing a majority of global demand due to daily dietary requirements and regular protein consumption patterns. The foodservice and catering segment is the fastest-growing, fueled by the expansion of halal-certified quick-service restaurants, airline catering services, institutional contracts, and global tourism that emphasizes ethical food consumption. Industrial food processing applications are steadily increasing as manufacturers integrate halal-certified ingredients into mainstream food products such as ready-to-eat meals, snacks, beverages, and baked goods. This trend is further supported by multinational food companies standardizing halal-compliant production lines to meet export and international trade requirements.

Distribution Channel Insights

Modern retail formats, including supermarkets, hypermarkets, and organized retail chains, account for nearly 40% of total halal food sales. Growth is driven by improved cold-chain infrastructure, private-label expansion, and urban consumer adoption of branded halal products. Traditional retail, including local grocery stores and butchers, remains significant in emerging markets due to accessibility and affordability. E-commerce is the fastest-growing channel, fueled by cross-border halal platforms, direct-to-consumer (D2C) brands, and digital traceability systems that allow consumers to verify halal certification online. Institutional distribution, including schools, hospitals, airlines, and government procurement, continues to grow due to rising demand for bulk halal-certified products and long-term supply contracts, particularly in regions with high import dependence.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds approximately 45% of the global halal food and beverage market share, driven by large Muslim populations in Indonesia, India, Pakistan, Malaysia, and China. Indonesia alone accounts for over 12% of global demand, supported by strong domestic consumption, government-backed halal regulations, and initiatives to promote local halal food production and exports. Growth is fueled by urbanization, rising disposable incomes, and increasing preference for processed and ready-to-eat halal foods. Rapid adoption of modern retail and e-commerce platforms is accelerating market penetration, while governments’ focus on strengthening certification standards and food traceability enhances consumer confidence and export potential.

Middle East & Africa

The Middle East and Africa account for nearly 25% of global halal food demand. Saudi Arabia, the UAE, and Qatar are major import hubs due to limited domestic production and high per capita consumption. Africa is witnessing growing intra-regional halal trade, particularly in Nigeria, South Africa, and Egypt. Regional growth is driven by government investments in food security, modern processing facilities, and halal logistics infrastructure, coupled with rising consumer awareness of food quality and certification. The demand for high-value, processed halal foods and beverages is increasing, supported by tourism, hospitality, and institutional procurement in urban centers.

Europe

Europe represents around 15% of the global market, led by France, Germany, and the U.K. Growth is supported by immigrant Muslim populations, rising non-Muslim adoption of halal products, and increasing demand for ethical and clean-label foods. Urbanization, organized retail expansion, and e-commerce penetration are further fueling accessibility. Drivers for market growth include foodservice adoption, halal-certified institutional catering, and premiumization trends among health-conscious consumers. Exported halal products from Asia and the Middle East also strengthen supply chains to meet European demand.

North America

North America accounts for approximately 10% of global demand, with the U.S. emerging as the fastest-growing country. Market growth is driven by the premium positioning of halal products, rising demand among Muslim communities, and increasing adoption by non-Muslim consumers seeking high-quality, ethical food options. Modern retail, specialty halal stores, and e-commerce platforms are expanding distribution, while multinational food manufacturers are investing in halal-certified production lines to supply domestic and export markets. Government regulations, certification standardization, and awareness campaigns are also supporting growth.

Latin America

Latin America remains largely export-oriented, with Brazil serving as the world’s largest halal meat exporter. Domestic consumption is gradually increasing among Muslim communities and urban populations seeking premium, ethically certified foods. Regional growth is driven by increasing awareness of halal standards among consumers, expansion of export-focused production infrastructure, and investments in modern slaughterhouses and cold-chain logistics. Demand is expected to grow steadily as more Latin American manufacturers cater to both domestic niche markets and international halal export opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Halal Food and Beverage Market

- Nestlé

- BRF S.A.

- JBS S.A.

- Tyson Foods

- Cargill

- Al Islami Foods

- Savola Group

- Indofood

- QL Resources

- Wilmar International

- Japfa Ltd

- Fraser & Neave

- Perdue Farms

- Mamee-Double Decker

- Grupo Seara