Hair, Skin & Nails Gummies Market Size

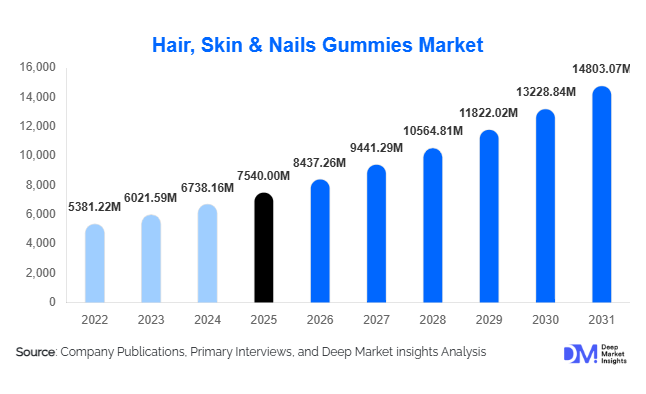

According to Deep Market Insights,the global hair, skin & nails gummies market size was valued at USD 7,540 million in 2025 and is projected to grow from USD 8,437.26 million in 2026 to reach USD 14,803.07 million by 2031, expanding at a CAGR of 11.9% during the forecast period (2026–2031). The market growth is primarily driven by rising consumer inclination toward preventive healthcare, increasing adoption of beauty-from-within supplements, and strong expansion of e-commerce-driven nutraceutical sales channels. Growing awareness about micronutrient deficiencies, particularly biotin, collagen, and vitamin D, is further accelerating global demand for convenient and palatable gummy formats over traditional capsules and tablets.

Key Market Insights

- Biotin-based formulations dominate the market, accounting for nearly 32% of total revenue in 2025 due to strong consumer association with hair growth benefits.

- Women aged 31–50 years represent the largest consumer group, contributing approximately 38% of global demand driven by anti-aging and post-partum hair health concerns.

- Online retail channels account for over 41% of global sales, supported by subscription models and influencer-led marketing strategies.

- North America leads with 36% market share in 2025, while Asia-Pacific is the fastest-growing region at over 14% CAGR.

- Mid-premium products hold 45% share, balancing affordability and clinically positioned value propositions.

- Clean-label, vegan, and sugar-free gummies are gaining rapid traction, reshaping formulation and packaging strategies globally.

What are the latest trends in the hair, skin & nails gummies market?

Clean-Label and Vegan Formulations Reshaping Product Innovation

Consumers are increasingly prioritizing transparency in ingredient sourcing, leading to strong growth in vegan, non-GMO, gluten-free, and sugar-free gummy formulations. Manufacturers are replacing gelatin with plant-based pectin and reducing refined sugar content through natural sweeteners. Clean-label positioning is no longer a niche offering but a mainstream expectation, particularly in North America and Europe. Sustainability initiatives, including recyclable bottles and refill pouches, are also becoming standard, reinforcing brand credibility among environmentally conscious consumers.

Personalized Nutrition and Subscription-Based Models

The convergence of nutraceuticals with digital health platforms is accelerating personalized supplement offerings. AI-driven quizzes and health assessments enable brands to recommend customized gummy combinations tailored to individual deficiencies and lifestyle needs. Direct-to-consumer subscription models are strengthening recurring revenue streams and improving customer retention rates. This digital integration is particularly effective among millennials and Gen Z consumers, who prioritize convenience and personalization in wellness purchases.

What are the key drivers in the hair, skin & nails gummies market?

Rising Beauty-From-Within Consumer Mindset

The global shift toward holistic wellness has significantly elevated demand for ingestible beauty supplements. Consumers increasingly perceive internal supplementation as complementary to topical skincare. Social media influence, dermatologist endorsements, and preventive health awareness are collectively reinforcing this trend. The growing global nutraceutical industry, valued at over USD 450 billion, continues to create strong cross-category synergies.

E-Commerce Expansion and Influencer Marketing

Rapid digital retail penetration has expanded product accessibility across both developed and emerging economies. Influencer-driven campaigns and user-generated testimonials significantly impact purchasing decisions. Subscription services offering discounted monthly deliveries enhance repeat purchase rates and stabilize revenue streams.

What are the restraints for the global market?

Regulatory Scrutiny and Health Claim Limitations

Stringent labeling regulations and restrictions on functional health claims limit aggressive product marketing. Compliance costs and differing regional regulations create complexity for multinational brands seeking global expansion.

Concerns Regarding Sugar Content

Traditional gummy formats contain added sugars, which may discourage health-conscious consumers. Reformulation toward sugar-free alternatives increases production costs, potentially impacting pricing competitiveness.

What are the key opportunities in the hair, skin & nails gummies industry?

Expansion in Emerging Markets

Asia-Pacific and Latin America present significant untapped demand potential. Rising disposable incomes in India, China, Brazil, and Mexico are supporting premium beauty supplement adoption. Localized flavor innovations and affordable pack sizes can accelerate mass-market penetration.

Dermatology-Backed Clinical Validation

Brands investing in clinical trials and dermatologist partnerships can command premium pricing and enter pharmacy-dominated retail channels. Evidence-based formulations strengthen consumer trust and support long-term brand differentiation.

Ingredient Type Insights

Biotin-based gummies dominate the market, accounting for approximately 32% of total revenue in 2025, primarily driven by strong consumer awareness linking biotin supplementation to improved hair strength, thickness, and reduced breakage. The leading position of this segment is supported by growing incidences of hair thinning caused by stress, pollution exposure, hormonal imbalance, and nutritional deficiencies. Increased marketing by nutraceutical brands emphasizing clinically backed hair health benefits further strengthens demand. In addition, dermatologist endorsements and influencer-led beauty campaigns continue to reinforce biotin’s positioning as an essential beauty-from-within ingredient, making it the primary driver of segment growth.

Collagen-infused gummies represent the fastest-growing ingredient category, fueled by rising anti-aging awareness and expanding consumer focus on skin elasticity, hydration, and wrinkle reduction. The shift toward preventive skincare routines and ingestible beauty solutions is accelerating collagen gummy adoption across both developed and emerging markets. Hydrolyzed collagen formulations with improved absorption rates are enhancing product efficacy, thereby strengthening repeat purchases.

Multivitamin complexes integrating vitamins A, C, D, and E maintain strong cross-demographic appeal, particularly among first-time supplement users seeking comprehensive health and beauty benefits in a single formulation. The convenience of combined nutritional support, alongside immunity-boosting and antioxidant properties, supports steady demand across diverse age groups. As consumers increasingly prefer multifunctional supplements, multivitamin gummies continue to capture a significant share of entry-level buyers transitioning from traditional tablets to chewable formats.

Consumer Demographic Insights

Women aged 31–50 years represent the largest consumer group, accounting for nearly 38% of global demand. Growth within this segment is primarily driven by higher disposable incomes, increasing awareness of age-related hair and skin concerns, and greater investment in preventive wellness routines. This demographic demonstrates strong brand loyalty and repeat purchasing behavior, particularly for clinically positioned formulations targeting anti-aging and hair strengthening.

Younger women aged 18–30 years significantly influence trend-based purchasing patterns through social media platforms and beauty influencer endorsements. Their preference for aesthetically appealing packaging, vegan formulations, and clean-label claims drives innovation across flavor profiles and ingredient transparency. Meanwhile, the male consumer base is steadily expanding as grooming awareness increases globally. Rising interest in hair health solutions among men, particularly in developed markets, is supporting diversification of product lines tailored specifically for male consumers.

Distribution Channel Insights

Online retail leads the distribution landscape with approximately 41% global market share, making it the primary growth engine of the industry. The dominance of this channel is driven by convenience, subscription-based pricing models, targeted digital marketing, and direct-to-consumer brand strategies. E-commerce platforms enable detailed ingredient comparisons, customer reviews, and promotional bundling, which significantly enhance purchase confidence and repeat buying behavior.

Pharmacies and drug stores remain critical for clinically positioned and dermatologist-recommended products, particularly across regulated European markets where consumer trust in pharmacy channels remains strong. These outlets support premium pricing strategies through professional validation and in-store consultation. Specialty wellness stores continue to play an important role in premium brand positioning by catering to health-conscious consumers seeking organic, vegan, and non-GMO formulations.

| By Ingredient Type | By Consumer Demographics | By Distribution Channel | By Price Tier | By Nature |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 36% of global revenue in 2025, with the United States contributing nearly 29% of global demand. Regional growth is primarily driven by high nutraceutical penetration, strong consumer awareness regarding preventive healthcare, and widespread adoption of subscription-based supplement models. The presence of established supplement brands, robust digital marketing ecosystems, and strong purchasing power further accelerates market expansion. Canada complements regional growth through rising clean-label adoption, increased demand for plant-based gummies, and heightened regulatory oversight that strengthens consumer confidence in product safety and efficacy.

Europe

Europe holds around 24% of the global market share, led by Germany, the United Kingdom, France, and Italy. Growth in this region is supported by strict regulatory frameworks that favor clinically validated and high-quality formulations, enhancing consumer trust. Rising demand for vegan, organic, and sugar-free gummies is driving product innovation. Additionally, aging populations across Western Europe and increasing interest in holistic wellness solutions contribute to sustained regional expansion. Strong pharmacy distribution networks further reinforce stable demand for premium-positioned products.

Asia-Pacific

Asia-Pacific represents approximately 27% of global revenue and is the fastest-growing region, expanding at a CAGR exceeding 14%. Rapid urbanization, rising disposable incomes, and expanding middle-class populations in China and India serve as primary growth drivers. The proliferation of digital retail ecosystems and cross-border e-commerce platforms significantly enhances product accessibility. In Japan and South Korea, strong cultural emphasis on skincare and anti-aging solutions drives premium collagen and beauty-focused gummy demand. Increasing health awareness and Western lifestyle influence further accelerate regional adoption.

Latin America

Latin America contributes nearly 6% of global revenue, with Brazil and Mexico leading regional consumption. Growth is driven by increasing urbanization, expanding retail infrastructure, and rising beauty consciousness among younger demographics. Social media influence and growing middle-income groups are supporting demand for affordable yet premium-positioned supplements. Improving distribution networks and expanding online retail penetration are expected to further stimulate market growth in the region.

Middle East & Africa

The Middle East & Africa region accounts for approximately 7% of global market share. The United Arab Emirates and Saudi Arabia serve as primary demand centers due to high disposable incomes and increasing adoption of premium wellness products. Growing awareness regarding preventive healthcare, expanding retail infrastructure, and rising expatriate populations contribute to steady market development. Additionally, increasing interest in beauty-enhancing nutraceuticals among urban consumers is expected to sustain long-term regional growth.The hair, skin & nails gummies market is moderately consolidated, with the top five players accounting for approximately 42% of global revenue. Competition is centered on innovation, branding, subscription models, and clean-label positioning. Mid-sized nutraceutical brands are expanding rapidly through influencer partnerships and D2C channels.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hair, Skin & Nails Gummies Market

- Church & Dwight Co., Inc.

- Haleon plc

- Nestlé S.A.

- Bayer AG

- OLLY Public Benefit Corporation

- Nature’s Way Products, LLC

- Amway Corp.

- GNC Holdings LLC

- Herbaland Naturals Inc.

- HUM Nutrition Inc.

- Swisse Wellness Pty Ltd

- Blackmores Limited

- Nature’s Bounty Co.

- Pharmavite LLC

- Jamieson Wellness Inc.