Gum Arabic Market Size

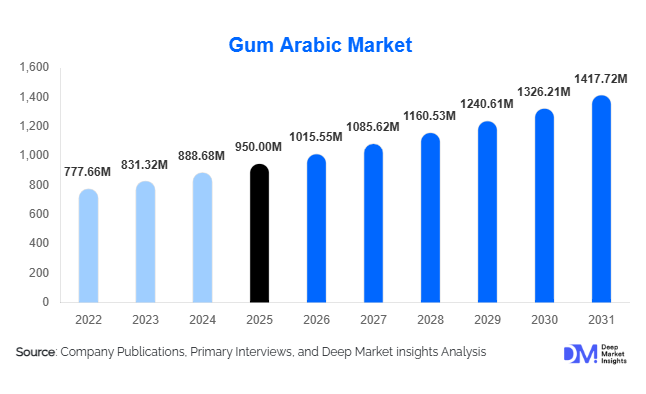

According to Deep Market Insights, the global gum arabic market size was valued at USD 950 million in 2025 and is projected to grow from USD 1,015.55 million in 2026 to reach USD 1,417.72 million by 2031, expanding at a CAGR of 6.9% during the forecast period (2026–2031). The gum arabic market growth is primarily driven by rising demand for natural emulsifiers, increasing adoption of clean-label food ingredients, and expanding utilization of soluble dietary fibers in functional beverages and nutraceutical products.

Gum arabic, derived mainly from Acacia Senegal and Acacia Seyal trees across Sub-Saharan Africa, is widely used in carbonated beverages, confectionery, pharmaceuticals, and encapsulation systems. Its superior emulsification, film-forming, and stabilizing properties make it indispensable in flavor stabilization and texture enhancement applications. Growing regulatory pressure to replace synthetic additives, combined with increasing global interest in plant-based ingredients, continues to strengthen demand. Meanwhile, investments in spray-drying capacity and supply chain diversification across Africa are supporting stable long-term industry expansion.

Key Market Insights

- Food & beverages account for nearly 55% of global demand, driven by beverage emulsification and confectionery stabilization applications.

- Acacia Senegal (Hashab grade) dominates with approximately 62% market share due to superior solubility and emulsification performance.

- Europe leads global demand with around 30% share, supported by strong clean-label reformulation trends.

- North America accounts for nearly 28% of the market, driven by functional beverages and dietary supplement growth.

- Asia-Pacific is the fastest-growing region, expanding at over 8% CAGR due to beverage and pharmaceutical demand in China and India.

- The top five companies control approximately 55% of the global market share, indicating moderate consolidation and strong vertical integration.

What are the latest trends in the gum arabic market?

Rising Adoption in Functional and Prebiotic Beverages

One of the most prominent trends in the gum arabic market is its increasing use as a soluble dietary fiber in functional beverages. Beverage manufacturers are reformulating products to incorporate digestive health claims, and gum arabic serves as a natural prebiotic fiber that supports gut microbiome balance. Low-sugar carbonated drinks, flavored waters, and fortified beverages increasingly rely on gum arabic for both fiber enrichment and flavor oil stabilization. As global functional beverage sales continue to grow at high single-digit rates, gum arabic demand is benefiting directly from this transition toward health-oriented drink formulations.

Supply Chain Diversification and Origin Processing Expansion

Traditionally concentrated in Sudan, gum arabic sourcing is diversifying into Chad, Nigeria, and Ethiopia. Governments in producing regions are investing in local spray-drying and value-addition facilities to reduce dependency on raw exports. This shift improves traceability, enhances margins for producers, and stabilizes supply for multinational buyers. Vertical integration by global ingredient manufacturers into African processing infrastructure is emerging as a long-term strategy to mitigate geopolitical and climatic risks.

What are the key drivers in the gum arabic market?

Growing Clean-Label Reformulation

Food and beverage manufacturers are increasingly replacing synthetic emulsifiers with plant-derived alternatives. Gum arabic’s natural origin, strong regulatory acceptance, and multifunctional properties make it a preferred solution in reformulated beverages, bakery products, and confectionery. Regulatory bodies in North America and Europe have accelerated clean-label adoption, driving consistent demand growth.

Expansion of the Nutraceutical and Dietary Supplement Industry

The rapid expansion of the global nutraceutical market, growing above 7% annually, is creating sustained demand for gum arabic as a soluble fiber ingredient. Capsules, syrups, and chewable supplements use gum arabic for binding, encapsulation, and digestive health positioning. Increasing consumer focus on preventive healthcare further supports this driver.

What are the restraints for the global market?

Supply Concentration and Climatic Risks

More than 70% of the global raw gum arabic supply originates from politically and climatically sensitive African regions. Drought cycles, desertification, and geopolitical instability can disrupt harvesting and exports, leading to price volatility and procurement challenges for downstream manufacturers.

Competition from Alternative Hydrocolloids

Modified starches, xanthan gum, and other hydrocolloids present cost-effective substitutes in certain applications. In price-sensitive emerging markets, buyers may shift toward lower-cost alternatives, limiting gum arabic’s penetration in industrial food formulations.

What are the key opportunities in the gum arabic industry?

Encapsulation and Flavor Delivery Innovations

Gum arabic’s superior film-forming ability positions it as a critical material for microencapsulation of flavors, vitamins, and probiotics. Growing demand for fortified foods and functional ingredients offers opportunities for premium-grade spray-dried gum arabic formulations. Manufacturers investing in advanced encapsulation technologies can capture higher-margin specialty segments.

Local Value Addition in Producing Countries

African governments are encouraging domestic processing instead of exporting raw gum. Investments in spray-drying plants and export infrastructure can significantly increase value capture within origin countries. This creates opportunities for joint ventures between multinational ingredient firms and local cooperatives, improving sustainability and supply stability.

Product Type Insights

Acacia Senegal (Hashab grade) continues to lead the global gum arabic market, accounting for approximately 62% share in 2025. The dominance of this segment is primarily driven by its superior emulsification capacity, high solubility, low viscosity at high concentrations, and excellent film-forming properties. These functional advantages make Acacia Senegal the preferred grade for carbonated beverages, flavor emulsions, microencapsulation systems, and premium confectionery applications. Global beverage manufacturers favor Hashab grade due to its ability to stabilize flavor oils efficiently while maintaining clarity and sensory consistency in soft drinks. Additionally, regulatory acceptance across the U.S. and Europe strengthens its adoption in clean-label reformulations.

Acacia Seyal (Talha grade) represents the remaining market share and is largely utilized in cost-sensitive food, industrial, and adhesive applications. Although it offers lower emulsification performance compared to Senegal grade, its competitive pricing supports adoption in emerging markets and industrial uses. By form, spray-dried powder dominates the market with nearly 68% share due to its standardized quality, ease of transportation, longer shelf life, and compatibility with automated manufacturing systems. The shift toward processed, value-added gum rather than raw kibbled form is a major structural trend, driven by multinational buyers seeking supply reliability, traceability, and formulation efficiency.

Application Insights

The food and beverages segment accounts for nearly 55% of total market revenue in 2025, making it the leading application category. Growth is primarily supported by expanding carbonated beverage production, rising demand for natural stabilizers, and increasing reformulation toward plant-based and clean-label ingredients. Within this segment, carbonated drinks and confectionery applications generate the highest volume demand due to gum arabic’s emulsifying and texture-enhancing properties.

Pharmaceuticals and nutraceuticals collectively contribute over 20% of global demand. This segment is expanding steadily due to rising consumption of dietary supplements and fiber-enriched formulations. Gum arabic’s role as a binder, encapsulating agent, and soluble prebiotic fiber supports its penetration in capsules, syrups, chewables, and functional powders. Meanwhile, cosmetics and personal care applications are gaining traction as natural formulation trends accelerate, particularly in skincare and oral care products emphasizing plant-derived ingredients.

Distribution Channel Insights

Direct industrial sales dominate the gum arabic market with approximately 60% share, reflecting the importance of long-term procurement contracts between global beverage manufacturers and primary processors. Large multinational buyers prioritize direct sourcing agreements to ensure quality consistency, traceability, and price stability, especially given raw material supply volatility.

Ingredient distributors and specialty suppliers remain crucial in Asia-Pacific and Latin America, where fragmented food manufacturing sectors rely on regional intermediaries for smaller-volume procurement. These channels facilitate market penetration among mid-sized and emerging food, pharmaceutical, and nutraceutical manufacturers, supporting broader geographic expansion.

End-Use Industry Insights

The beverage industry remains the largest end-use sector for gum arabic, with demand directly correlated to global soft drink and flavored beverage production volumes. Functional beverages are expanding at over 8% annually, significantly increasing demand for fiber-grade gum arabic used in digestive health formulations. Additionally, the global dietary supplement industry continues to expand steadily, driving consistent growth in encapsulation and fiber applications.

Export-driven demand from Europe and North America sustains steady trade flows from African producing nations, reinforcing the market’s global supply chain structure. Emerging applications in plant-based dairy alternatives, edible coatings for fresh produce, and reduced-sugar bakery products are creating incremental growth opportunities beyond traditional beverage uses.

| By Product Type | By Form | By Function | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of global demand in 2025, led predominantly by the United States. Regional growth is driven by strong clean-label reformulation trends, high per-capita consumption of carbonated and functional beverages, and a rapidly expanding dietary supplement market. The U.S. remains one of the largest importers of processed gum arabic for beverage stabilization and fiber enrichment. Technological advancements in encapsulation and increasing demand for natural food additives further strengthen regional growth prospects.

Europe

Europe leads the global market with around 30% market share. France, Germany, and the United Kingdom are major consumption centers, with France also serving as a global processing hub due to advanced spray-drying capabilities. Regional growth is driven by stringent regulatory emphasis on natural additives, strong consumer preference for clean-label products, and increasing fiber-enrichment initiatives in bakery and dairy applications. The European Union’s focus on food safety, traceability, and sustainability further supports high-quality gum arabic imports.

Asia-Pacific

Asia-Pacific holds roughly 22% of the global market and is the fastest-growing region, expanding at over 8% CAGR. China and India are key demand centers, supported by rapid beverage industry expansion, rising disposable incomes, and growing pharmaceutical manufacturing capacity. Increasing health awareness and rising demand for dietary supplements are accelerating fiber-grade gum arabic adoption. Additionally, urbanization and Westernization of food consumption patterns are contributing to sustained growth across Southeast Asia.

Latin America

Latin America represents approximately 5% of global demand, with Brazil and Mexico leading consumption. Growth is primarily driven by regional soft drink production, confectionery manufacturing, and gradual clean-label adoption. Expanding middle-class populations and increasing processed food consumption are supporting incremental market expansion, although price sensitivity limits premium-grade adoption.

Middle East & Africa

The Middle East & Africa region accounts for approximately 15% of global demand. Sudan and Chad dominate raw gum production, supplying the majority of global exports. Increasing government initiatives to promote domestic processing and value addition are strengthening regional participation beyond raw material exports. The UAE functions as a strategic re-export hub, facilitating global trade flows. Rising intra-African beverage production and growing industrialization are gradually increasing local consumption alongside export-driven demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Gum Arabic Market

- Nexira

- Alland & Robert

- Kerry Group

- Ingredion Incorporated

- Ashland

- Archer Daniels Midland

- Tate & Lyle

- Agrigum International

- Farbest Brands

- EPO S.p.A.

- Kapadia Gum Industries

- Dangote Industries

- Hawkins Watts

- TIC Gums

- Hawkins Inc.