Guar Flour Market Size

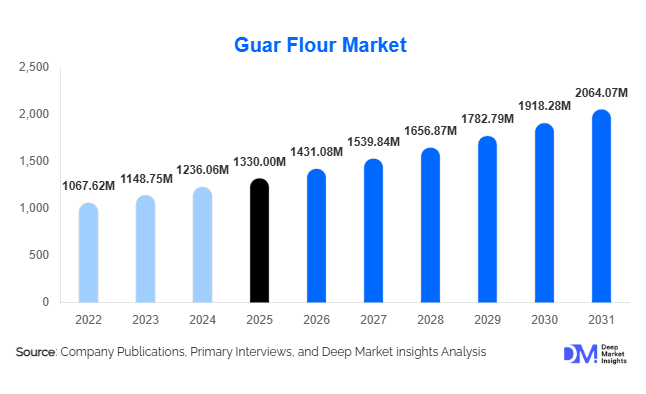

According to Deep Market Insights, the global guar flour market size was valued at USD 1,330 million in 2025 and is projected to grow from USD 1,431.08 million in 2026 to reach USD 2,064.07 million by 2031, expanding at a CAGR of 7.6% during the forecast period (2026–2031). The guar flour market is primarily driven by rising demand for natural hydrocolloids in food processing, increasing utilization in oil & gas hydraulic fracturing, and growing adoption across pharmaceutical, cosmetic, and industrial applications as a sustainable thickening and stabilizing agent.

Key Market Insights

- Food-grade guar flour remains the most stable and high-value segment, supported by clean-label food reformulation and plant-based product innovation.

- Oil & gas continues to be the largest volume-consuming application, particularly in North America and the Middle East, despite cyclical demand patterns.

- Asia-Pacific dominates global supply and demand, led by India’s agricultural production strength and export-oriented guar processing industry.

- Modified guar flour is gaining traction due to improved hydration speed, viscosity control, and suitability for pharmaceutical and cosmetic formulations.

- Direct B2B contracts account for the majority of sales, reflecting long-term supply agreements between manufacturers and large industrial buyers.

- Sustainability and biodegradability trends are strengthening guar flour’s position against synthetic stabilizers and petroleum-based additives.

What are the latest trends in the guar flour market?

Shift Toward Clean-Label and Natural Food Ingredients

One of the most prominent trends in the guar flour market is the accelerating shift toward clean-label and natural food formulations. Food manufacturers are increasingly replacing synthetic emulsifiers and stabilizers with plant-derived alternatives such as guar flour to meet evolving consumer preferences for transparency and minimal processing. Guar flour’s multifunctional properties—thickening, stabilizing, and water retention—make it a preferred ingredient in bakery products, dairy alternatives, sauces, dressings, and gluten-free foods. This trend is particularly strong in North America and Europe, where regulatory scrutiny and consumer awareness are reshaping ingredient sourcing strategies.

Rising Adoption of Modified Guar Flour

Technological advancements in guar processing have led to the development of modified guar flour variants with enhanced performance characteristics. These products offer faster hydration, improved solubility, and greater consistency across temperature and pH variations. As a result, modified guar flour is increasingly adopted in pharmaceuticals, cosmetics, and high-performance industrial applications. This trend enables manufacturers to command premium pricing while reducing dependency on commodity-grade guar flour.

What are the key drivers in the guar flour market?

Growing Demand from Food & Beverage Industry

The food and beverage sector is a key growth driver for the guar flour market, accounting for approximately 38% of global demand in 2025. Rising consumption of processed foods, ready-to-eat meals, and plant-based alternatives has significantly increased demand for natural hydrocolloids. Guar flour’s cost efficiency and functional versatility make it an attractive option for food manufacturers seeking clean-label compliance without compromising texture or shelf life.

Continued Reliance of Oil & Gas Industry on Guar-Based Fracturing Fluids

Despite global energy transition initiatives, oil & gas exploration remains a major driver of guar flour demand. Guar flour is widely used in hydraulic fracturing fluids due to its superior viscosity and proppant-carrying capabilities. Periods of high crude oil prices typically result in increased drilling activity, directly boosting industrial-grade guar flour consumption, particularly in the U.S., Canada, Saudi Arabia, and the UAE.

What are the restraints for the global market?

Volatility in Raw Material Prices

Guar flour prices are highly sensitive to fluctuations in guar bean production, which is largely dependent on monsoon conditions in India. Weather variability, acreage shifts, and export policy changes can lead to sharp price swings, impacting manufacturer margins and long-term supply contracts. This volatility remains a key challenge for both producers and end users.

Competition from Alternative Hydrocolloids

The guar flour market faces competition from substitutes such as xanthan gum, locust bean gum, and carrageenan. In certain applications, these alternatives offer superior thermal stability or clarity, limiting guar flour’s penetration in specialized formulations. Ongoing product innovation is required to maintain competitiveness.

What are the key opportunities in the guar flour industry?

Expansion of Pharmaceutical and Cosmetic Applications

Pharmaceutical-grade and cosmetic-grade guar flour present significant growth opportunities due to increasing demand for natural excipients and stabilizers. Rising production of tablets, syrups, topical formulations, and personal care products is driving adoption of high-purity guar flour variants. These applications offer higher margins compared to food and industrial grades.

Emerging Demand from New Regional Markets

Rapid industrialization and food processing expansion in Southeast Asia, Africa, and Latin America are creating new demand centers for guar flour. Countries such as Vietnam, Nigeria, and Brazil are witnessing increasing imports driven by growth in food manufacturing, pharmaceuticals, and personal care industries.

Product Type Insights

Natural guar flour continues to dominate the global guar flour market, accounting for approximately 58% of total demand in 2025. This leadership is primarily driven by its extensive utilization across food processing, oilfield services, and textile applications, owing to its excellent thickening, stabilizing, and emulsifying properties. Its cost-effectiveness and wide regulatory acceptance further reinforce its dominance.

Modified guar flour represents the fastest-growing product type segment, supported by increasing demand for customized viscosity, improved hydration speed, and enhanced temperature and pH stability. These functional advantages make modified guar flour highly suitable for advanced food formulations, pharmaceutical excipients, and complex oil & gas applications.Organic guar flour, while accounting for a relatively smaller share, is gaining significant traction in premium food, nutraceutical, and health-focused applications. Growth in this segment is driven by rising consumer preference for organic, non-GMO, and sustainably sourced ingredients, particularly in developed markets such as North America and Europe.

Grade Insights

Food-grade guar flour leads the market with an estimated 46% share, supported by expanding use in bakery products, dairy alternatives, sauces, and gluten-free formulations. The segment benefits strongly from clean-label trends, increasing regulatory approvals, and the growing demand for natural hydrocolloids in processed foods.

Industrial-grade guar flour accounts for approximately 34% of global consumption, with demand primarily driven by the oil & gas sector for hydraulic fracturing fluids, as well as textile printing and paper manufacturing applications. The segment’s growth is closely tied to upstream energy investments and industrial production levels.Pharmaceutical-grade guar flour, though smaller in volume, delivers higher value realization due to its stringent quality requirements and specialized functionality. Growth in this segment is supported by its use as a binder, disintegrant, and controlled-release agent in tablet formulations, alongside expanding nutraceutical production.

Application Insights

Oil & gas applications account for nearly 32% of global guar flour demand, making it the largest application segment. Demand is driven by the continued reliance on guar-based polymers in hydraulic fracturing fluids due to their superior viscosity control, thermal stability, and cost efficiency.

Food processing remains the most stable and resilient application segment, supported by consistent consumption across bakery, confectionery, dairy, and ready-to-eat food categories. Growth is reinforced by rising demand for clean-label thickeners and texture enhancers.Pharmaceuticals, cosmetics, paper & pulp, and textile processing collectively contribute to diversified market expansion. Increasing use in personal care formulations, specialty papers, and textile sizing applications supports long-term demand diversification beyond energy markets.

Distribution Channel Insights

Direct sales through long-term B2B contracts dominate the guar flour market, representing approximately 55% of total transactions. This channel is preferred by large food manufacturers and oilfield service providers seeking consistent quality, stable pricing, and reliable supply.

Distributors and traders play a critical role in regional supply balancing, particularly in emerging markets and regions with limited local processing capacity. Their role is essential in managing price volatility and ensuring timely availability.Export-oriented bulk supply remains a key distribution mode, especially for serving international buyers in North America, Europe, and the Middle East, with India acting as the primary global export hub.

| By Product Type | By Grade | By Functionality | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global guar flour market with approximately 48% share in 2025, led by India, China, and Japan. India alone accounts for over 35% of global demand, driven by strong domestic consumption and robust export activity supported by abundant guar bean cultivation, established processing infrastructure, and cost-competitive labor.

Regional growth is further supported by expanding food processing industries, rising pharmaceutical manufacturing, and increasing investments in oilfield services across China and Southeast Asia.

North America

North America holds around 22% market share, with the United States as the primary consumer. Growth is driven by extensive shale gas exploration, particularly in the Permian and Eagle Ford basins, where guar flour remains a critical input for hydraulic fracturing.

Additionally, rising demand for clean-label food ingredients and plant-based food formulations supports steady consumption in the food processing sector.

Europe

Europe represents approximately 17% of global demand, led by Germany, France, and the U.K. Growth is supported by stringent clean-label food regulations, strong demand for organic and non-GMO ingredients, and increasing adoption of guar flour in pharmaceutical and nutraceutical formulations.

Sustainable sourcing initiatives and regulatory emphasis on natural additives continue to strengthen regional market prospects.

Middle East & Africa

The Middle East & Africa region accounts for nearly 8% of global demand, primarily supported by oilfield services activity in Saudi Arabia, the UAE, and Qatar. Ongoing investments in upstream oil & gas projects and enhanced oil recovery techniques drive consistent guar flour consumption.

Growing food processing capacity in select African economies also contributes to incremental demand.

Latin America

Latin America contributes approximately 5% of the global guar flour market, with Brazil and Argentina emerging as key growth markets. Regional growth is supported by expanding food manufacturing, increasing adoption in pharmaceutical applications, and rising oil & gas exploration activities.

Improving trade relations and growing awareness of natural hydrocolloids further support long-term market development in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Guar Flour Market

- Vikas WSP Ltd

- Jai Bharat Gum & Chemicals

- Hindustan Gum & Chemicals

- India Glycols Ltd

- Lucid Group

- Supreme Gums

- Neelkanth Polymers

- Shree Ram Industries

- Premcem Gums

- Raj Gum Industries

- Altrafine Gums

- Guangrao Liuhe Chemical

- Wuzhou Chemical

- Synergy Gums

- Ruchi Soya Industries