Grow Light Market Size

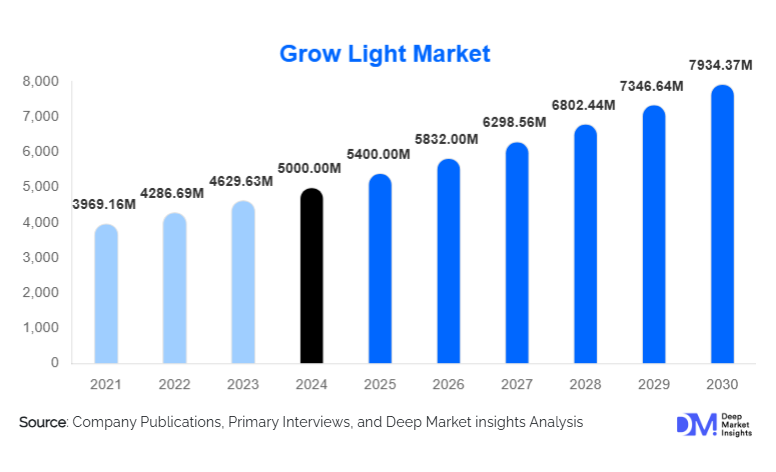

According to Deep Market Insights, the global grow light market size was valued at USD 5,000.00 million in 2024 and is projected to grow from USD 5,400.00 million in 2025 to reach USD 7,934.37 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). Growth is driven by the rising adoption of controlled-environment agriculture (CEA), the rapid shift toward high-efficiency LED horticultural lighting, legalization-led expansion of cannabis cultivation, and increasing investments in urban vertical farming. As global food systems transition toward localized, sustainable, and climate-resilient production, advanced grow lighting technologies have become essential to achieving consistent year-round yields.

Key Market Insights

- LED grow lights dominate the market due to energy efficiency, tunable spectrum outputs, and falling semiconductor costs, accounting for 62% of global 2024 revenue.

- Controlled-environment agriculture (CEA) expansion is accelerating adoption, especially in North America, Europe, China, and Japan.

- Legalized cannabis cultivation is a major demand engine, with commercial growers requiring high-density lighting systems for multi-cycle annual production.

- AI-, IoT-, and sensor-integrated grow lighting systems are gaining strong traction, enabling real-time spectrum optimization and energy savings.

- Asia-Pacific is the fastest-growing regional market, driven by food security programs, increasing vertical farming installations, and government incentives.

- Greenhouses remain the largest application segment globally, contributing 41% of market share in 2024.

What are the latest trends in the grow light market?

AI-Integrated and Sensor-Based Smart Lighting Systems

Grow light manufacturers are increasingly integrating IoT sensors, AI algorithms, and cloud-based controls to automate lighting cycles, spectrum output, and energy usage. Smart grow lights can now assess plant photosynthetic response and self-adjust the color spectrum, intensity, and photoperiod to optimize yield and nutrient density. These systems also support remote farm management and predictive maintenance, making them particularly suitable for large commercial greenhouses and vertical farms. As energy costs rise and labor shortages intensify, smart lighting ecosystems are becoming a defining trend across CEA.

Expansion of Urban Vertical Farming and Compact Multi-Layer Lighting

The growth of indoor vertical farms in major metropolitan regions is fueling demand for compact, low-heat, high-efficiency lighting systems. Multi-layer LED bars and inter-lighting fixtures are being engineered for stacked cultivation environments where uniformity and heat control are critical. Urban vertical farms increasingly rely on adjustable-spectrum LEDs to cultivate leafy greens, microgreens, herbs, and berries close to end consumers, reducing logistics emissions and improving freshness. This trend is accelerating investments in specialized spectrum formulas, photobiology research, and adaptive lighting architectures.

What are the key drivers in the grow light market?

Rapid Global Adoption of Controlled-Environment Agriculture (CEA)

CEA has emerged as a vital solution to climate volatility, land scarcity, and supply chain disruptions. Grow lights play an indispensable role by replicating optimal sunlight conditions, enabling year-round production of high-value crops. Governments worldwide are supporting CEA through incentives for indoor farming infrastructure, renewable-powered greenhouses, and agricultural modernization schemes. The strong global momentum behind CEA is directly boosting demand for advanced grow lighting systems across commercial farming operations.

Legalization and Commercial Expansion of Cannabis Cultivation

Cannabis is one of the most light-intensive commercial crops, requiring precise spectrum and high PAR output. With legalization expanding across North America, parts of Europe, and Latin America, cannabis producers are investing heavily in high-intensity LED systems to maximize potency, terpene expression, and yield per square foot. Large-scale cannabis greenhouses and indoor grow facilities often deploy thousands of fixtures, making lighting one of their largest CapEx components and a key market driver.

What are the restraints for the global market?

High Initial Capital Investment

Despite declining LED costs, commercial-grade grow lighting requires significant upfront investment. Large indoor farms and greenhouses may require millions of dollars in lighting infrastructure, wiring, automation, and cooling systems. These costs, combined with energy expenses, create barriers for small and mid-sized growers, especially in developing markets.

Limited Technical Knowledge Among Growers

Many traditional farmers lack expertise in light spectra, DLI management, photon efficiency metrics, and crop-specific lighting requirements. Without proper training or agronomic support, growers may underutilize advanced lighting technologies, limiting adoption. This knowledge gap slows market penetration in regions transitioning from conventional farming to CEA.

What are the key opportunities in the grow light industry?

Smart Lighting Ecosystems and AI-Based Crop Optimization

The integration of AI, IoT, thermal sensors, and cloud analytics into horticultural lighting is creating massive opportunities. These systems automate spectrum tuning, minimize energy consumption, and enhance crop morphology. Vendors offering full-stack solutions—lighting hardware plus analytics software—are poised for long-term competitive advantage as farms shift toward data-driven decision-making.

Government-Supported Urban Farming and Food Security Programs

Countries across APAC, the Middle East, and Europe are investing heavily in vertical farms, R&D greenhouses, and smart agriculture parks. Subsidies, tax incentives, and sustainability mandates are fueling demand for LED grow lights. Regions with arid climates or limited arable land—such as the UAE, Japan, and Singapore—represent high-growth opportunities for lighting manufacturers as they scale up domestic food production.

Product Type Insights

LED grow lights lead the market, accounting for 62% of 2024 revenue due to superior energy efficiency, tunable spectrum, lower heat output, and long lifespan. Fluorescent lights maintain relevance for home growers and low-budget applications, while HID systems still serve legacy greenhouses and cannabis operators seeking high-intensity coverage. Plasma lights, though niche, appeal to research institutes due to their full-spectrum sunlight replication properties.

Application Insights

Greenhouses remain the dominant application with 41% share, driven by commercial production of vegetables, berries, and ornamentals. Indoor vertical farming is experiencing the fastest growth, supported by urban agriculture initiatives and retail demand for pesticide-free produce. Cannabis cultivation is a major growth engine, requiring dense lighting arrays for each growth cycle. Research laboratories continue to adopt advanced lighting for plant genetics, pharmaceutical crops, and photobiology studies.

Distribution Channel Insights

Direct OEM sales dominate the market, especially for large-scale greenhouses, cannabis facilities, and smart farming integrators requiring custom installations. Online retail continues to grow among hobbyists and small growers, while B2B distributors support regional agricultural projects. Specialty horticulture stores maintain a strong presence in Europe and North America by offering tailored advisory services.

End-User Insights

Commercial agriculture and horticulture producers represent the largest end-user group, accounting for nearly half of global demand. Cannabis producers are the fastest-growing segment, showing annual growth above 18% as legalization expands. Biotech and pharmaceutical users are increasingly cultivating medicinal plants under controlled environments, while academic and government research facilities drive demand for spectrum-tunable lighting systems.

| By Light Source Technology | By Application | By Distribution Channel | By Form Factor | By Spectrum Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share (34%), driven by cannabis legalization, vertical farm expansion, and the adoption of advanced greenhouse technologies. The U.S. leads with large-scale cannabis producers and urban farming networks, while Canada continues investing in high-tech greenhouses and LED retrofit programs.

Europe

Europe accounts for 28% of global demand, supported by high-tech greenhouse clusters in the Netherlands, Germany, and Scandinavia. Strong sustainability mandates and energy-efficiency regulations accelerate LED adoption. The region is also a global leader in agricultural R&D and photobiology innovation.

Asia-Pacific

APAC is the fastest-growing region (CAGR 17%), driven by food security initiatives and rapid vertical farming adoption. China leads in both manufacturing and deployment of LED horticultural systems. Japan and South Korea are pioneers of automated indoor farming, while India is emerging as a large market through agricultural modernization projects.

Latin America

LATAM shows steady demand led by Brazil, Mexico, and Colombia. Colombia’s regulated cannabis industry is a major growth contributor, while Mexico’s greenhouse farming supports vegetable exports to North America.

Middle East & Africa

MEA demand is rising due to harsh climates and reliance on food imports. The UAE and Saudi Arabia are heavily investing in vertical mega-farms to bolster food security. Israel continues to drive innovation in precision agriculture and LED photobiology.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Grow Light Market

- Signify (Philips Horticulture)

- Gavita / Horticulture Lighting Group

- Fluence (by OSRAM)

- Heliospectra

- Valoya

- Hortilux Schréder

- California Lightworks

- Black Dog LED

- Illumitex

- LumiGrow

- ViparSpectra

- Spectrum King LED

- Cycloptics Technologies

- Current Lighting Solutions

- SANANBIO

Recent Developments

- In March 2025, Signify expanded its Philips GreenPower LED product line with AI-enabled spectral optimisation for commercial greenhouses.

- In January 2025, Fluence announced a partnership with a major U.S. vertical farming operator to deploy smart lighting and environmental control systems across multiple states.

- In July 2024, Heliospectra launched a new adaptive lighting platform integrating real-time crop feedback using multispectral sensors and machine learning.