Gluten-Free Products Market Size

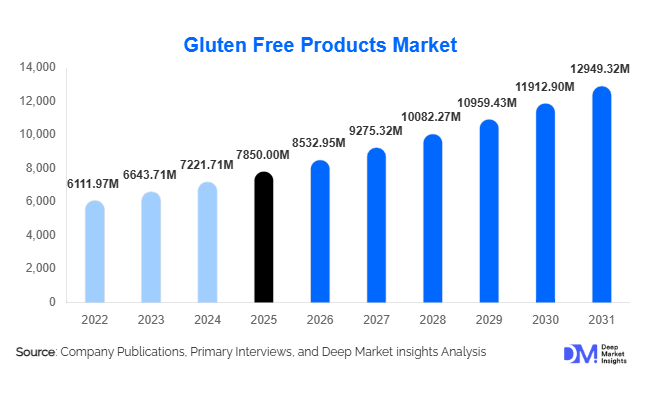

According to Deep Market Insights, the global gluten-free products market size was valued at USD 7,850 million in 2025 and is projected to grow from USD 8,532.95 million in 2026 to reach USD 12,949.32 million by 2031, expanding at a CAGR of 8.7% during the forecast period (2026–2031). The market growth is primarily driven by increasing diagnoses of celiac disease, rising gluten sensitivity awareness, expanding lifestyle-driven gluten avoidance, and strong retail penetration across developed economies. The category has evolved from a niche medical diet segment into a mainstream health and wellness industry supported by innovation in alternative grains, improved product texture, and premium positioning.

Key Market Insights

- Bakery products dominate the category, accounting for nearly 38% of global revenue, led by gluten-free bread and baked staples.

- Lifestyle and wellness consumers represent over 55% of total demand, surpassing medically diagnosed celiac consumers.

- North America holds approximately 38% market share, supported by advanced labeling regulations and high awareness.

- Asia-Pacific is the fastest-growing region, expanding at over 11% CAGR due to urbanization and premium health food adoption.

- Supermarkets and hypermarkets account for 46% of sales, while e-commerce is the fastest-growing distribution channel.

- Product reformulation and functional fortification (high-protein, fiber-enriched, keto-compatible) are reshaping competitive differentiation.

What are the latest trends in the gluten-free products market?

Functional and Clean-Label Reformulation

Manufacturers are increasingly reformulating gluten-free products to improve nutritional density and sensory quality. Historically criticized for being low in fiber and protein, modern gluten-free formulations now incorporate chickpea flour, sorghum, lentil protein, quinoa, and resistant starch. Clean-label positioning, non-GMO certification, and minimal processing claims are gaining traction among health-conscious consumers. Brands are also fortifying products with probiotics and digestive enzymes, positioning gluten-free items within the broader gut-health movement. This shift has improved repeat purchase rates and reduced the perception of gluten-free products as inferior substitutes.

Expansion into Foodservice and Institutional Channels

Gluten-free offerings are expanding beyond retail shelves into foodservice, airline catering, hospitals, and corporate cafeterias. The global foodservice gluten-free segment exceeded USD 1,200 million in 2025 and is growing faster than retail channels. Restaurants are introducing dedicated gluten-free menus to comply with allergen regulations and attract lifestyle-driven consumers. Frozen par-baked gluten-free products are enabling scalability in commercial kitchens, reducing cross-contamination risks while improving operational efficiency. Institutional procurement contracts are becoming a stable revenue source for manufacturers.

What are the key drivers in the gluten-free products market?

Rising Celiac and Gluten Sensitivity Diagnosis

Global celiac disease prevalence ranges between 1–1.4%, with improved screening increasing diagnosis rates. Regulatory requirements limiting gluten content to below 20 ppm in many developed markets have strengthened consumer confidence. Medical endorsement and physician-guided dietary recommendations continue to support consistent demand from diagnosed patients.

Growth of Lifestyle-Driven Gluten Avoidance

Beyond medical necessity, gluten avoidance has become a wellness choice. Consumers perceive gluten-free diets as supportive of digestive health and weight management. Social media influence, celebrity endorsements, and broader clean-eating trends are expanding the addressable consumer base. Lifestyle consumers now account for the majority of market demand globally.

Retail Penetration and Private Label Expansion

Major retailers have introduced private-label gluten-free product lines, improving price accessibility. Supermarkets and hypermarkets account for 46% of 2025 revenue, supported by enhanced shelf visibility and promotional strategies. E-commerce growth has improved access to specialty SKUs, particularly in emerging markets.

What are the restraints for the global market?

Premium Pricing Structure

Gluten-free products typically cost 30–80% more than conventional equivalents due to dedicated manufacturing lines, specialized ingredients, and certification costs. Price sensitivity in developing regions limits rapid adoption, particularly among middle-income consumers.

Texture and Sensory Limitations

Replicating gluten’s elasticity remains technologically complex. Inconsistent product quality may affect consumer satisfaction and brand loyalty. Continuous R&D investment is required to maintain competitive differentiation.

What are the key opportunities in the gluten-free products industry?

Emerging Market Expansion

Asia-Pacific and Middle Eastern markets present underpenetrated growth opportunities. Rising disposable income, expanding modern retail infrastructure, and increasing health awareness are supporting adoption in countries such as India, China, and the UAE. Local sourcing of alternative grains such as millet offers cost advantages and supply chain resilience.

High-Protein and Specialized Diet Integration

Combining gluten-free positioning with keto, plant-based, and high-protein claims enables premium pricing. Cross-category innovation, such as gluten-free protein bars and fortified breakfast cereals, broadens consumer appeal. This hybrid positioning is expected to sustain long-term category expansion.

Product Type Insights

Bakery products account for approximately 38% of the 2025 global gluten-free products market, making them the dominant product segment. The leadership of this category is primarily driven by the staple nature of baked goods in daily diets, particularly in North America and Europe, where bread consumption per capita remains high. Gluten-free bread alone contributes over 20% of total global revenue, supported by continuous improvements in texture, shelf stability, and fortification with fiber and protein. Technological advancements in hydrocolloids, starch blends, and enzyme systems have significantly narrowed the sensory gap between conventional and gluten-free bread, strengthening repeat purchases. Additionally, frozen and par-baked formats have expanded accessibility in foodservice and retail chains.

Snacks and ready-to-eat (RTE) products represent the fastest-evolving product cluster, driven by convenience-oriented lifestyles and rising demand for on-the-go nutrition. Gluten-free snack bars, extruded savory snacks, and breakfast cereals are increasingly positioned as clean-label and high-protein alternatives, expanding their appeal beyond medically restricted consumers. Gluten-free pasta and noodles maintain strong demand in Europe and North America, supported by Mediterranean dietary patterns and premiumization strategies by established pasta manufacturers. Meanwhile, flour and baking mixes are benefiting from home-baking trends, digital recipe communities, and direct-to-consumer e-commerce distribution, particularly in urban markets seeking customizable dietary solutions.

Distribution Channel Insights

Supermarkets and hypermarkets hold approximately 46% of the total market share in 2025, maintaining dominance due to high shelf visibility, promotional bundling, and private label expansion. Large retail chains have significantly improved price accessibility by introducing competitively priced in-house gluten-free product lines, reducing the historical cost premium barrier. Dedicated gluten-free aisles and improved allergen labeling standards further enhance consumer confidence and purchasing convenience.

Online retail is the fastest-growing distribution channel, expanding at double-digit growth rates. Subscription-based models, direct-to-consumer brand websites, and digital marketplaces are enabling niche manufacturers to scale globally without heavy physical retail dependence. E-commerce platforms also allow consumers to access a broader SKU range, including specialty flours and imported gluten-free snacks not widely available in brick-and-mortar stores. Specialty health stores continue to retain importance among premium and medically diagnosed consumers who prioritize certified, organic, and allergen-safe products.

Consumer Type Insights

Lifestyle and wellness consumers account for approximately 55% of total market demand in 2025, surpassing medically diagnosed celiac consumers. The leading driver for this segment is preventive health behavior, with consumers increasingly associating gluten avoidance with improved digestive health, reduced inflammation, and clean eating practices. Social media influence and wellness-focused marketing campaigns have further normalized gluten-free diets among non-celiac populations.

Gluten-sensitive individuals represent a significant secondary segment, contributing a stable, recurring demand. Pediatric gluten-free products are an emerging sub-segment, supported by improved early-age diagnostic capabilities and increased parental awareness of food intolerances. The shift from reactive dietary restriction (post-diagnosis) to proactive lifestyle adoption continues to expand the addressable consumer base globally.

End-Use Insights

Household retail consumption accounts for nearly 72% of total global revenue in 2025, reflecting the fact that gluten-free diets are predominantly managed at the household level. Growth in this segment is supported by expanding packaged food assortments, meal-prep culture, and private label affordability.

Foodservice is the fastest-growing end-use segment, expanding at approximately 10% CAGR. Restaurants, quick-service chains, and airline catering providers are increasingly incorporating gluten-free menu options to comply with allergen regulations and capture lifestyle-driven consumers. Institutional demand from hospitals, schools, and corporate cafeterias is also increasing due to stricter allergen management standards and dietary inclusion policies. Export-driven demand is notable in North America and Europe, which act as production hubs supplying Asia-Pacific and Middle Eastern markets with premium gluten-free bakery and snack products.

| By Product Type | By Consumer Type | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 38% of the global gluten-free products market share in 2025, with the United States accounting for nearly 85% of regional demand. Regional growth is driven by high celiac disease diagnosis rates, strong regulatory enforcement limiting gluten content to below 20 ppm, and advanced retail infrastructure. The presence of major multinational food manufacturers and extensive private label penetration strengthens product availability and competitive pricing. Consumer preference for clean-label and fortified products further accelerates innovation. Canada follows with steady growth supported by organized retail expansion, rising health awareness, and government-backed food labeling clarity.

Europe

Europe accounts for approximately 32% of global revenue. Italy leads regional consumption due to one of the highest per capita celiac populations globally and strong reimbursement policies for gluten-free foods. Germany, the U.K., and France are major contributors, driven by high bakery consumption and strong private label competition. The region benefits from well-defined gluten labeling regulations under EU food safety frameworks, enhancing consumer trust. Increasing demand for organic and fortified gluten-free products, along with established bakery culture, continues to support stable regional growth.

Asia-Pacific

Asia-Pacific holds around 18% market share but is the fastest-growing region, expanding at over 11% CAGR. India is emerging as the fastest-growing country (approximately 12% CAGR), supported by urbanization, rising disposable income, and millet-based product innovation aligned with traditional grains. China’s expanding middle class and increasing Western dietary influence are boosting demand for premium imported gluten-free snacks and bakery products. Japan and Australia represent mature sub-markets with strong demand for specialty health foods and high-quality packaged products. Rapid e-commerce growth and expanding supermarket chains are key drivers of regional expansion.

Latin America

Latin America accounts for nearly 7% of global revenue, with Brazil and Mexico dominating regional consumption. Growth drivers include expanding supermarket infrastructure, increasing awareness of food intolerances, and rising urban middle-class populations. Import reliance remains relatively high, but local manufacturing capacity is gradually expanding, particularly in Brazil. Government-led food safety awareness campaigns are also contributing to higher adoption rates.

Middle East & Africa

The Middle East & Africa region represents about 5% of global demand. The UAE and Saudi Arabia lead due to strong premium retail ecosystems, high expatriate populations familiar with gluten-free diets, and significant import volumes from Europe and North America. Growth in this region is supported by increasing lifestyle-related dietary shifts, rising disposable incomes, and the expansion of modern retail chains. In Africa, South Africa shows emerging potential due to improving retail infrastructure and growing health awareness, although price sensitivity remains a limiting factor in several sub-markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|