Glamping Tents Market Size

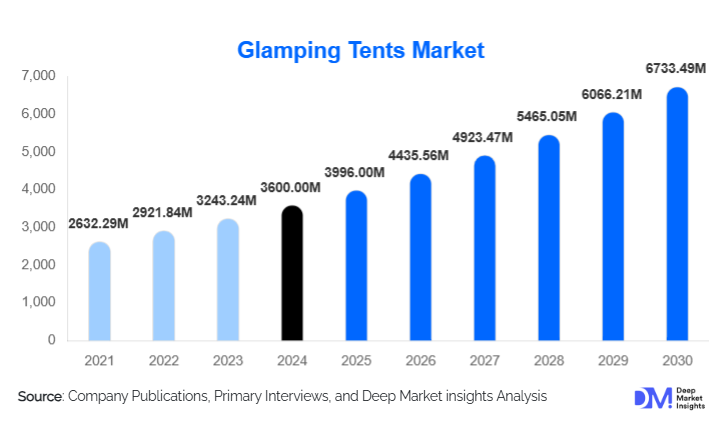

According to Deep Market Insights, the global glamping tents market size was valued at USD 3,600.00 million in 2024 and is projected to grow from USD 3,996.00 million in 2025 to reach USD 6,733.49 million by 2030, expanding at a CAGR of 11.0% during the forecast period (2025–2030). The glamping tents market growth is driven by rising demand for experiential and nature-based tourism, increasing investments in luxury outdoor hospitality infrastructure, and the global shift toward sustainable, low-impact accommodation solutions.

Key Market Insights

- Luxury and premium glamping tents dominate global demand, as hospitality operators prioritize high-revenue, experience-led accommodations.

- Commercial glamping resorts remain the largest end-use segment, supported by institutional investments and tourism-led development projects.

- Europe leads global adoption, driven by mature eco-tourism markets and strict sustainability standards.

- Asia-Pacific is the fastest-growing regional market, fueled by domestic tourism growth in China, India, and Australia.

- Permanent and semi-permanent installations are replacing seasonal tents, enabling year-round operations and higher ROI.

- Smart and sustainable technologies, including solar integration and modular construction, are reshaping product differentiation.

What are the latest trends in the glamping tents market?

Premiumization of Outdoor Accommodation

Glamping tents are increasingly positioned as luxury hospitality assets rather than temporary camping solutions. Safari tents, geodesic domes, and hybrid fabric-wood structures are being designed with ensuite bathrooms, climate control, premium interiors, and architectural aesthetics comparable to boutique hotels. This trend is driven by affluent travelers seeking exclusivity, privacy, and immersive nature experiences without compromising comfort. As a result, the premium and luxury price tier accounts for nearly half of total market revenue, with operators favoring fewer but higher-yield units.

Sustainability-Driven Design and Materials

Environmental responsibility has become a central purchasing criterion in the glamping tents market. Canvas and poly-cotton fabrics, recyclable structural components, and low-impact foundations are widely adopted to meet eco-certification requirements. Manufacturers are also offering off-grid solutions incorporating solar panels, rainwater harvesting, and natural insulation. These innovations allow operators to access protected landscapes where permanent construction is restricted, while appealing to environmentally conscious travelers and regulators.

What are the key drivers in the glamping tents market?

Growth in Experiential and Eco-Tourism

Global tourism demand is shifting toward immersive, experience-based travel centered on nature, wellness, and authenticity. Glamping tents align closely with this trend by offering unique stays in forests, deserts, mountains, and coastal locations. This has significantly increased demand from adventure tourism operators, eco-lodges, and destination resorts seeking differentiated offerings.

Rising Investments in Outdoor Hospitality Infrastructure

Hospitality groups and private investors are increasingly deploying glamping tents as cost-effective alternatives to traditional hotels. Compared to brick-and-mortar construction, glamping tents require lower capital expenditure, shorter installation timelines, and greater flexibility. This makes them particularly attractive for emerging tourism destinations and seasonal demand hubs.

Advancements in Modular and Weather-Resistant Designs

Technological improvements in fabric engineering, insulation, and structural frameworks have expanded the usability of glamping tents across diverse climates. Modern tents can now support year-round occupancy in extreme temperatures, enabling global adoption and improving asset utilization for operators.

What are the restraints for the global market?

High Initial Investment for Premium Installations

While glamping tents offer long-term cost advantages, premium and permanent installations require significant upfront investment. High-quality materials, customized interiors, and integrated utilities increase capital requirements, which can limit adoption among small-scale operators.

Regulatory and Land-Use Constraints

Glamping projects often face zoning restrictions, environmental regulations, and permitting delays, particularly in protected or rural areas. Compliance with local land-use laws and sustainability standards can increase project complexity and timelines, acting as a restraint on rapid expansion.

What are the key opportunities in the glamping tents industry?

Government-Supported Eco and Rural Tourism Projects

Governments across Asia-Pacific, the Middle East, and Latin America are promoting eco-tourism as a driver of rural development. Incentives such as land leases, infrastructure funding, and rural tourism grants present strong opportunities for glamping tent manufacturers to partner with developers and public agencies.

Smart and Off-Grid Glamping Solutions

The integration of smart energy systems, IoT-enabled monitoring, and off-grid utilities presents a major opportunity for product innovation. Operators increasingly seek turnkey solutions that reduce operating costs and enhance sustainability credentials, creating scope for premium pricing and long-term contracts.

Product Type Insights

Safari tents represent the largest product segment in the global glamping tents market, accounting for approximately 34% of total revenue in 2024. Their leadership is primarily driven by spacious layouts, high ceiling heights, and the ability to integrate luxury amenities such as ensuite bathrooms, climate control, and premium furnishings. Safari tents are particularly favored for permanent and semi-permanent resort installations, making them the preferred choice for commercial glamping operators seeking high occupancy rates and strong average revenue per unit.

Geodesic domes and yurt-style tents are gaining significant traction, especially in regions focused on architectural differentiation and year-round usability. Geodesic domes benefit from superior structural stability, snow and wind resistance, and energy efficiency, making them suitable for extreme climates and off-grid installations. Yurt-style tents, on the other hand, are increasingly adopted in wellness retreats and cultural tourism projects due to their heritage appeal and circular spatial design.

Material Insights

Canvas and poly-cotton fabrics dominate the global glamping tents market, collectively accounting for over 40% market share in 2024. This leadership is driven by their durability, breathability, thermal comfort, and strong alignment with eco-tourism and sustainability standards. Canvas materials are especially preferred for luxury and long-stay installations, as they provide superior indoor comfort and natural insulation compared to synthetic alternatives.

PVC-coated polyester and advanced technical fabrics are increasingly adopted in regions with extreme weather conditions, including deserts, coastal zones, and high-altitude locations. These materials offer enhanced resistance to UV exposure, moisture, and temperature fluctuations, making them ideal for the Middle East, Australia, and parts of North America. Technical fabrics are also gaining acceptance in modular and semi-permanent installations where low maintenance and extended lifespan are critical.

End-Use Insights

Commercial glamping resorts represent the largest end-use segment, accounting for over 50% of total market demand in 2024. This dominance is supported by strong post-pandemic tourism recovery, increasing investments in experiential hospitality, and the growing preference for low-impact accommodation models. Resort operators are increasingly deploying glamping tents to expand capacity rapidly, access environmentally sensitive locations, and enhance return on investment compared to traditional hotel construction.

Hospitality chains and boutique hotels are expanding glamping offerings as part of portfolio diversification strategies. These operators use glamping tents to attract experience-driven travelers, extend seasonal operations, and differentiate brand positioning. Event-based luxury accommodation, including destination weddings, music festivals, and corporate retreats, represents a smaller but fast-growing segment, driven by demand for temporary yet premium accommodation solutions.

Distribution Channel Insights

Direct B2B sales dominate the global glamping tents market, accounting for the largest share of revenue, as large-scale resort and eco-tourism projects typically involve customized designs, bulk procurement, and long-term supply contracts. Manufacturers offering end-to-end solutions, covering design, fabrication, installation, and after-sales support, are particularly well positioned within this channel.

Online direct-to-consumer (D2C) channels are growing rapidly, especially for portable, mid-range, and modular tents. Digital marketing, global e-commerce platforms, and improved logistics capabilities have enabled manufacturers to reach private buyers and small operators across international markets. Specialty outdoor retailers continue to play an important role in regional distribution, particularly in Europe and North America, where established outdoor recreation ecosystems support offline sales.

| By Product Type | By Material Type | By End-Use Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe holds approximately 32% of the global glamping tents market, led by France, the United Kingdom, Germany, and Italy. Regional leadership is driven by a well-established eco-tourism culture, strong regulatory support for sustainable accommodations, and high domestic travel penetration. Government incentives promoting low-impact tourism, coupled with consumer preference for experiential stays, have accelerated the adoption of permanent glamping installations across rural and protected landscapes. Additionally, Europe’s mature campsite infrastructure has enabled rapid integration of premium glamping tents into existing hospitality ecosystems.

North America

North America accounts for around 28% of global demand, supported by strong luxury domestic tourism in the United States and Canada. Growth is driven by increasing investments in national park-adjacent accommodations, private ranch developments, and adventure tourism resorts. High disposable incomes, preference for spacious accommodations, and strong demand for year-round outdoor experiences have boosted the adoption of high-end safari tents and geodesic domes. Regulatory clarity around temporary structures also supports faster project execution in this region.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR exceeding 14%. China, India, Australia, and Japan are witnessing the rapid adoption of glamping concepts, driven by rising middle-class incomes, increasing domestic tourism, and government-led tourism development initiatives. In emerging markets such as India and Southeast Asia, glamping tents are being deployed as cost-effective hospitality solutions in remote and scenic locations, while mature markets like Australia and Japan favor premium, design-focused installations.

Latin America

Latin America is an emerging market for glamping tents, with growth driven by eco-resorts and nature-based tourism projects in Mexico, Brazil, and Chile. Increasing foreign investment in sustainable tourism infrastructure, coupled with growing interest in experiential travel, is supporting gradual market expansion. The region’s diverse natural landscapes and improving tourism connectivity present long-term growth potential, particularly for modular and semi-permanent installations.

Middle East & Africa

The Middle East and Africa region benefits from strong demand for desert tourism and safari-linked glamping experiences. Key markets include the UAE, Saudi Arabia, Kenya, and Morocco, where luxury travel demand and government-led tourism diversification strategies are accelerating adoption. In the Middle East, large-scale destination projects and seasonal desert camps are driving demand for high-end, climate-resilient tents, while in Africa, safari tourism and eco-lodges continue to underpin steady growth in premium canvas and hybrid tent installations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Glamping Tents Market

- CanvasCamp

- White Duck Outdoors

- Lotus Belle

- Zingerle Group

- Glitzcamp

- Pacific Domes

- Free Spirit Structures

- FDomes

- YALA Luxury Canvas Lodges

- Bushtec Safari

- Dream Domes

- Shelter Structures

- Nordic Tipis

- Treeline Outdoors

- Tentickle Stretch Tents