Rural Tourism Market Size

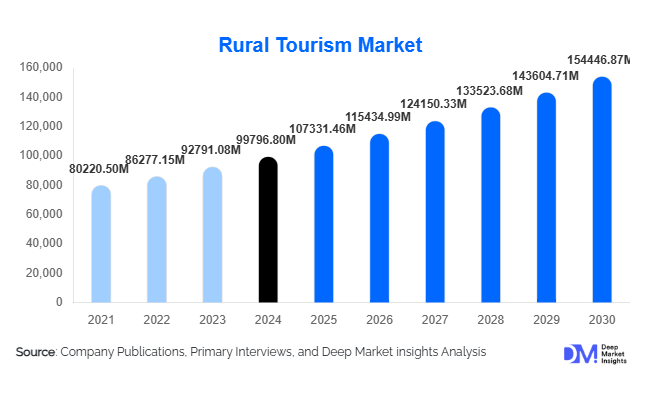

According to Deep Market Insights, the global rural tourism market size was valued at USD 99,796.80 million in 2024 and is projected to grow from USD 107,331.46 million in 2025 to reach USD 154,446.87 million by 2030, expanding at a CAGR of 7.55% during the forecast period (2025–2030). Rural tourism market growth is primarily driven by rising demand for authentic countryside experiences, increasing adoption of sustainable and nature-based tourism, and strong government initiatives promoting rural economic development and community-based tourism.

Key Market Insights

- Eco-conscious and sustainable travel practices are reshaping rural tourism, with travelers seeking low-impact experiences rooted in culture, nature, and local lifestyles.

- Farm stays, agro-tourism, and eco-lodges are rapidly expanding due to rising interest in experiential travel and farm-to-table living.

- Europe remains the largest market for rural tourism, supported by strong heritage routes, countryside infrastructure, and domestic travel cultures.

- Asia-Pacific is the fastest-growing region, driven by major government investment in rural revitalization and domestic tourism surges.

- Digitalization, including mobile booking, VR previews, and AI-driven itinerary planning, is accelerating rural tourism adoption among younger demographics.

- Community-based tourism models are gaining momentum as rural destinations seek to increase local employment and preserve cultural assets.

What are the latest trends in the rural tourism market?

Sustainability and Eco-Integrated Rural Travel

Rural tourism is witnessing a major shift toward sustainability-driven experiences. Travelers increasingly prioritize stays that incorporate renewable energy, farm-grown food, and environmentally responsible practices. Eco-lodges, organic farms, heritage villages, and off-grid retreats are becoming central to rural tourism’s appeal. Conservation-linked tourism, such as forest restoration volunteering, biodiversity projects, and cultural heritage preservation, is also expanding, attracting visitors seeking meaningful impact. Hosts are adopting eco-certification programs, carbon-neutral operations, and ethical tourism guidelines, further elevating rural destinations’ global competitiveness.

Technology-Enhanced Rural Experiences

The integration of technology is transforming how rural destinations are marketed and experienced. VR-based previews now allow travelers to visualize remote villages, hiking routes, and farm activities before booking. AI-powered platforms curate personalized rural itineraries based on traveler preferences, budgets, and seasonal events. Digital storytelling, drone videography, and community livestreams are increasing the global visibility of lesser-known villages. On-ground enhancements, such as smart signage, GPS-enabled rural trails, digital booking kiosks, and app-based cultural guides, are making rural tourism more accessible and engaging across diverse age groups.

What are the key drivers in the rural tourism market?

Growing Demand for Authentic and Experiential Travel

Modern travelers increasingly seek immersive, slow-paced, and culturally rich experiences that differ from traditional mass tourism. Rural tourism offers heritage trails, farming activities, homestays, artisanal workshops, and nature immersion, making it highly appealing to experience-driven travelers. This shift aligns with global trends toward mindfulness, local living, and experiential enrichment, positioning rural destinations as attractive alternatives to urban tourism.

Government Programs and Rural Revitalization Initiatives

Governments across Europe, India, China, and Latin America are investing heavily in rural development, viewing tourism as a catalyst for job creation and community upliftment. Infrastructure upgrades, grants for homestays, village digitalization programs, and subsidies for rural entrepreneurs are expanding rural tourism opportunities. Initiatives such as "Rural Revitalization," “Smart Village Programs,” and agritourism development policies have significantly boosted the market’s appeal and accessibility.

Shift Toward Outdoor, Wellness, and Nature-Based Tourism

Post-pandemic travel behavior strongly favors outdoor activities, wellness retreats, hiking, farm-based experiences, and countryside escapes. Rural destinations naturally align with these preferences, allowing visitors to enjoy low-density travel and nature-led therapies. Wellness-oriented rural retreats, integrating yoga, organic meals, meditation, and eco-living, are attracting premium travelers and reinforcing long-term demand.

What are the restraints for the global market?

Limited Infrastructure and Accessibility Challenges

Rural regions often lack robust transport networks, accommodation standards, medical facilities, and digital connectivity. This limits scalability and reduces traveler confidence, particularly among international tourists. Seasonal inaccessibility and limited public transport further restrict seamless travel experiences.

Low Service Standardization and Workforce Skill Gaps

Rural tourism relies heavily on community participation, but inconsistent service quality and limited hospitality training can hinder visitor satisfaction. Lack of standardized safety protocols, varied accommodation quality, and unstructured tourism offerings pose ongoing challenges for rural destinations aiming to compete globally.

What are the key opportunities in the rural tourism industry?

Digital Rural Tourism Ecosystems

There is a vast opportunity for platforms offering online rural experience booking, virtual farm tours, personalized itineraries, and digital host-visitor engagement. Enhanced digital footprints can help small rural operators gain global visibility and attract new traveler segments.

Community-Based Tourism Development

Empowering local communities to manage tourism services can unlock major employment opportunities, strengthen cultural preservation, and differentiate rural destinations through authentic storytelling. Community-led stays, craft workshops, and cultural immersion programs are expanding fast.

Eco-Lodges, Farm Stays & Wellness Retreats

Investors and operators can capitalize on rising demand for sustainable accommodations, organic dining, and wellness escapes. Eco-lodges, bio-architectural cottages, and nature-integrated wellness facilities represent high-growth, premium segments with long-term profitability.

Product Type Insights

Agro-tourism and farm stays dominate the market, appealing to travelers seeking authentic rural lifestyles, organic farming exposure, and hands-on cultural experiences. Eco-lodges are expanding rapidly as sustainability becomes a mainstream travel preference. Wilderness tourism, including hiking, bird-watching, and camping, is gaining traction among younger adventure-driven travelers. Cottage rentals and homestays remain essential mid-range options, offering budget-friendly yet personalized rural experiences. Premium eco-retreats and boutique countryside resorts are emerging as niche luxury offerings for affluent visitors seeking privacy and curated wellness experiences.

Application Insights

Nature-based rural tourism, including forest trails, hiking, farm visits, and eco-exploration, accounts for the largest share. Cultural rural tourism is growing quickly, driven by indigenous traditions, artisanal crafts, and local festivals. Wellness-based rural tourism is emerging as a major growth area, integrating yoga retreats, organic dining, and stress-relief experiences. Volunteer tourism, conservation programs, and community engagement activities are attracting purpose-driven travelers seeking to contribute to rural development.

Distribution Channel Insights

Online platforms dominate bookings due to improved digital access, transparent pricing, and social media-driven travel inspiration. Direct bookings via homestay websites and local tourism apps are rising sharply. Travel agencies specializing in rural circuits and cultural tours continue to play a strong role, especially in long-haul markets. Social media influencers and travel content creators increasingly shape rural destination awareness and traveler decision-making.

Traveler Type Insights

Family and group travelers form a major share, as rural destinations offer safe, educational, and recreational activities. Solo travelers, especially digital nomads and younger tourists, are driving demand for flexible stays and adventure-oriented rural experiences. Couples and honeymooners prefer premium eco-lodges and heritage cottages. Senior travelers contribute significantly to wellness and cultural tourism due to their preference for slow-paced, meaningful experiences.

Age Group Insights

Travelers aged 26–45 years dominate the market, balancing disposable income with a strong preference for experiential travel. Younger travelers (16–25 years) are accelerating growth in low-budget and adventure-based rural tourism. Older demographics (55+ years) are emerging as a high-value segment, preferring wellness retreats, guided cultural tours, and comfortable countryside stays.

| By Tourism Type | By Accommodation Type | By Traveler Type | By Age Group | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds a strong share in outbound rural tourism and domestic countryside travel. The U.S. and Canada show rising demand for farm stays, ranch tourism, and wellness-oriented rural retreats. High digital adoption and increasing interest in sustainable living bolster growth.

Europe

Europe is the largest regional market, accounting for approximately 38% of global rural tourism in 2024. Countries such as France, Italy, Germany, Spain, and the U.K. have well-developed rural tourism infrastructures, heritage villages, and strong domestic tourism cultures. EU sustainability policies and cultural preservation programs continue to drive adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 9% annually. China, India, Japan, and Australia lead demand, supported by rural revitalization policies, rising middle-class spending, and booming domestic travel markets. Large-scale investments in rural homestays and digital rural tourism ecosystems are accelerating growth.

Latin America

Countries such as Brazil, Chile, Peru, and Mexico show growing interest in agro-tourism, eco-villages, and cultural rural circuits. While a smaller market compared to Europe or APAC, Latin America has high potential due to its rich biodiversity and strong indigenous cultural assets.

Middle East & Africa

Rural tourism in Africa is expanding alongside conservation tourism and community-led cultural tourism. In the Middle East, countries like Saudi Arabia and the UAE are investing in heritage villages and desert rural experiences as part of national tourism diversification programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rural Tourism Market

- Agrotours International

- Responsible Travel

- Village Ways

- AgriTourism World

- Rural Escape Travel

- Eco Retreats International

- Farm Stay Planet

Recent Developments

- In June 2025, multiple European rural tourism boards announced joint investment funds to modernize eco-lodges and support digital rural tourism platforms.

- In March 2025, India launched a nationwide “Smart Village Tourism” program focused on digital infrastructure, homestay modernization, and community tourism training.

- In January 2025, several APAC operators introduced hybrid wellness–agro tourism retreats integrating meditation, organic farming, and sustainability workshops.