Gelatin Substitutes Market Size

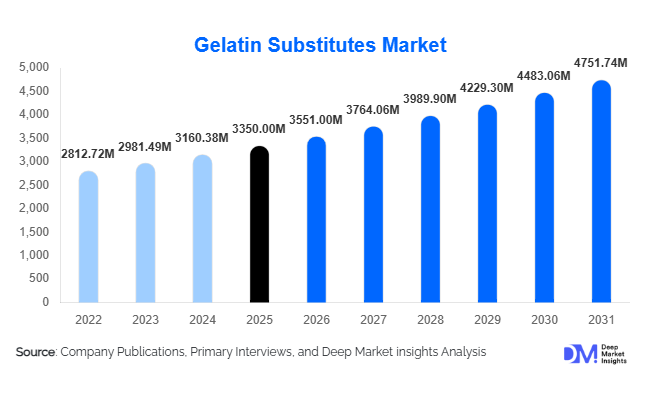

According to Deep Market Insights, the global gelatin substitutes market size was valued at USD 3,350.00 million in 2025 and is projected to grow from USD 3,551.00 million in 2026 to reach USD 4,751.74 million by 2031, expanding at a CAGR of 6.0% during the forecast period (2026–2031). The gelatin substitutes market growth is primarily driven by the rising adoption of plant-based, vegan, halal, and kosher-certified ingredients across food, pharmaceutical, nutraceutical, and personal care industries, along with increasing regulatory and sustainability pressures on animal-derived gelatin.

Key Market Insights

- Plant-based hydrocolloids dominate the market, supported by strong demand for agar, pectin, and carrageenan in food and pharmaceutical formulations.

- Food & beverage applications account for over half of global demand, driven by clean-label reformulations and growth in plant-based foods.

- Asia-Pacific leads the global market in volume consumption, supported by large-scale food and pharmaceutical manufacturing in China and India.

- Pharmaceutical-grade gelatin substitutes are the fastest-growing segment, driven by the shift toward non-animal capsules and excipients.

- Fermentation-based and microbial polymers are gaining traction, offering improved consistency, scalability, and sustainability.

- Regulatory preference for non-animal excipients is accelerating adoption across regulated industries.

What are the latest trends in the gelatin substitutes market?

Rising Adoption of Vegan and Clean-Label Ingredients

Manufacturers across the food and beverage industries are increasingly reformulating products to eliminate animal-derived ingredients. Gelatin substitutes such as pectin, agar, and gellan gum are favored for their plant-based origin, label-friendly perception, and broad regulatory acceptance. This trend is especially pronounced in confectionery, dairy alternatives, and bakery products, where clean-label positioning directly influences consumer purchasing behavior.

Growth of Fermentation-Derived Polymers

Microbial and fermentation-based polymers such as xanthan gum and pullulan are gaining market share due to their consistent quality, lower dependence on agricultural variability, and suitability for pharmaceutical applications. Advances in biotechnology and precision fermentation are enabling manufacturers to improve functional performance while reducing environmental impact, making this a key technological trend shaping the market.

What are the key drivers in the gelatin substitutes market?

Expansion of Plant-Based and Ethical Consumption

Rising consumer awareness around animal welfare, sustainability, and dietary preferences is driving demand for gelatin substitutes. Veganism, flexitarian diets, and religious dietary compliance are accelerating adoption across both developed and emerging markets, particularly in food and nutraceutical products.

Regulatory and Safety Advantages over Animal Gelatin

Gelatin substitutes offer improved safety profiles by eliminating risks associated with animal-borne diseases and supply chain traceability issues. Regulatory bodies increasingly favor non-animal excipients in pharmaceuticals, boosting demand for plant-based and microbial alternatives in capsules, coatings, and drug delivery systems.

What are the restraints for the global market?

Functional Performance Limitations

Despite advancements, certain gelatin substitutes struggle to fully replicate the elasticity, thermo-reversibility, and mouthfeel of animal gelatin in high-performance applications such as traditional confectionery and soft gel capsules, limiting complete substitution.

Raw Material Price Volatility

Seaweed-based and fermentation-derived raw materials are exposed to fluctuations in energy, agricultural, and processing costs. This can impact pricing stability and margins, particularly for small- and mid-sized manufacturers operating in cost-sensitive markets.

What are the key opportunities in the gelatin substitutes industry?

Pharmaceutical Capsule Replacement

The shift toward vegetarian and non-animal capsules presents a major growth opportunity. Pharmaceutical-grade gelatin substitutes are increasingly used in hard and soft capsules, offering high margins and long-term supply contracts for compliant manufacturers.

Emerging Demand in Halal and Kosher Markets

Rapid growth in halal-certified food and pharmaceutical consumption across the Middle East, Southeast Asia, and parts of Europe is creating strong demand for gelatin substitutes that meet religious compliance requirements, enabling manufacturers to access premium and underserved markets.

Product Type Insights

Plant-based hydrocolloids account for approximately 46% of the global gelatin substitutes market, making them the leading product category by revenue in 2025. This dominance is driven by their exceptional functional versatility, reliable gelling performance, scalability of production, and widespread regulatory acceptance across food, pharmaceutical, and personal care applications. Ingredients such as agar-agar, pectin, carrageenan, and gellan gum are extensively used as direct gelatin replacements in confectionery, dairy desserts, bakery fillings, and pharmaceutical coatings. Their compatibility with vegan, halal, and kosher formulations further strengthens demand, particularly among multinational food and nutraceutical manufacturers seeking globally compliant ingredients.

Microbial and fermentation-based polymers represent the fastest-growing product segment, supported by rising investment in precision fermentation technologies and increasing pharmaceutical-grade demand. Polymers such as xanthan gum and pullulan offer superior batch-to-batch consistency, improved purity levels, and lower contamination risks compared to animal-derived gelatin, making them highly attractive for capsules, controlled-release drug systems, and nutraceutical delivery formats.

Application Insights

Food and beverage applications dominate the gelatin substitutes market with an estimated 52% share in 2025. This leadership is primarily driven by the rapid growth of plant-based confectionery, vegan desserts, dairy alternatives, and clean-label bakery products. Manufacturers are increasingly replacing animal gelatin to address consumer demand for ethical, allergen-free, and religiously compliant food products. The segment also benefits from high-volume consumption and recurring demand from large food processors, particularly in the Asia-Pacific and Europe.

Pharmaceutical applications represent the fastest-growing application segment, supported by increasing adoption of non-animal capsules, tablet coatings, and drug delivery systems. Regulatory scrutiny on animal-derived excipients, combined with rising demand for vegetarian capsules in nutraceuticals, is accelerating the shift toward plant-based and microbial gelatin substitutes. This segment commands higher average selling prices and margins compared to food applications.

End-Use Industry Insights

The food processing industry remains the largest end-use segment for gelatin substitutes, accounting for the majority of global consumption due to its extensive use in confectionery, dairy, bakery, and processed food formulations. Growth in this segment is supported by rising urbanization, increasing consumption of packaged foods, and ongoing reformulation initiatives by multinational food brands.

The pharmaceutical and healthcare industry is the fastest-growing end-use segment, expanding at over 9% CAGR. Growth is driven by increasing global pharmaceutical production, rising demand for vegetarian and halal-certified medicines, and the expanding nutraceutical supplements market. Gelatin substitutes are increasingly being used in capsules, wound care products, and advanced drug delivery systems. Emerging end-use applications in biodegradable packaging, industrial adhesives, paper processing, and binders are creating additional demand channels. These applications are gaining traction as industries seek bio-based, sustainable alternatives to synthetic polymers, further diversifying the market’s end-use profile.

| By Product Type | By Application | By End-Use Industry |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global gelatin substitutes market with approximately 38% share in 2025, supported by its large-scale food processing and pharmaceutical manufacturing base. China and India dominate regional demand due to high production volumes, cost-efficient manufacturing, and strong export-oriented industries. Growth in this region is driven by rising consumption of processed and packaged foods, rapid expansion of pharmaceutical exports, and increasing adoption of plant-based diets in urban populations. India is the fastest-growing country in the region, fueled by government initiatives supporting food processing, strong growth in nutraceutical exports, and rising demand for halal- and vegetarian-compliant products.

North America

North America accounts for approximately 24% of the global market, led by the United States. Regional growth is driven by strong demand for clean-label and plant-based foods, widespread adoption of vegan dietary supplements, and advanced pharmaceutical manufacturing capabilities. The presence of leading ingredient manufacturers, high R&D investments, and early adoption of fermentation-based technologies further support market expansion. Consumer awareness around sustainability and animal welfare continues to accelerate the replacement of animal gelatin across multiple applications.

Europe

Europe holds nearly 22% market share, with Germany, France, and the UK leading regional adoption. Growth in Europe is driven by strict regulatory standards on food additives and excipients, strong consumer preference for sustainable and ethically sourced ingredients, and high penetration of vegan and flexitarian diets. The region is also a major hub for pharmaceutical innovation, where non-animal excipients are increasingly preferred to ensure regulatory compliance and supply chain transparency.

Latin America

Latin America represents an emerging growth market for gelatin substitutes, led by Brazil and Mexico. Expansion in this region is supported by the growth of processed food industries, rising middle-class consumption, and increasing export-oriented manufacturing of food and nutraceutical products. Multinational food companies are gradually introducing plant-based formulations in the region, supporting steady long-term demand growth.

Middle East & Africa

Demand in the Middle East & Africa is primarily driven by rising consumption of halal-certified food and pharmaceutical products. Saudi Arabia and the UAE are emerging as key growth hubs due to strong pharmaceutical imports, expanding food processing sectors, and government initiatives to develop domestic manufacturing capabilities. In Africa, growing urban populations and increasing investment in food processing infrastructure are supporting the gradual adoption of gelatin substitutes, particularly in export-focused applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|