Gas Stoves Market Size

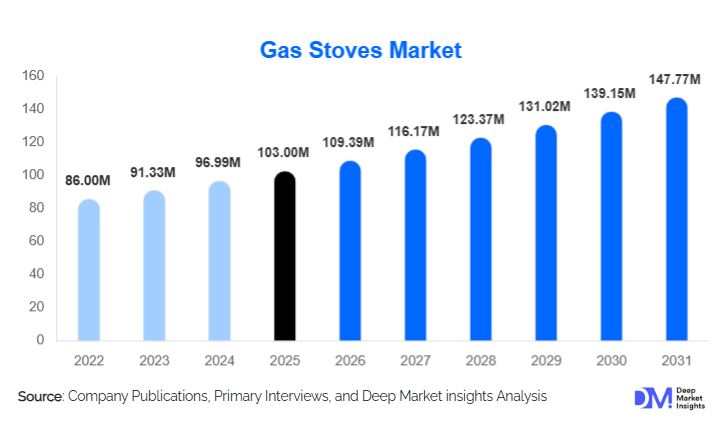

According to Deep Market Insights, the global gas stoves market size was valued at USD 103.00 billion in 2025 and is projected to grow from USD 109.39 billion in 2026 to reach USD 147.77 billion by 2031, expanding at a CAGR of 6.2% during the forecast period (2026–2031). The gas stoves market growth is primarily driven by expanding access to liquefied petroleum gas (LPG) and piped natural gas (PNG), rising urban housing construction, and sustained demand from residential households and commercial foodservice establishments. Despite increasing electrification trends, gas stoves continue to hold a strong position globally due to cost efficiency, precise heat control, and widespread fuel availability.

Key Market Insights

- Residential households dominate global demand, accounting for nearly 70% of total gas stove consumption in 2024, supported by urbanization and replacement cycles.

- LPG-based gas stoves remain the preferred fuel type, contributing over 60% of global sales due to broader infrastructure reach than piped gas.

- Asia-Pacific leads the global market, driven by China and India, together accounting for a significant share of global production and consumption.

- Mid-range gas stoves command the largest price-band share, balancing affordability with safety features and modern design.

- Commercial foodservice is the fastest-growing end-use segment, supported by the expansion of restaurants, cloud kitchens, and hospitality infrastructure.

- Technology integration, including auto-ignition, flame failure protection, and smart safety features, is improving product differentiation and consumer confidence.

What are the latest trends in the gas stoves market?

Premiumization and Design-Led Upgrades

The gas stoves market is witnessing a steady shift toward premium and aesthetically enhanced products, particularly in urban and developed markets. Built-in gas stoves, tempered glass cooktops, brass burners, and minimalist designs are increasingly preferred by consumers upgrading modular kitchens. Premium gas stoves offer higher margins for manufacturers while catering to lifestyle-driven demand, especially in North America, Europe, and urban Asia. This trend is also evident in the rising popularity of four- and five-burner configurations that support multi-dish cooking and professional-style kitchen setups.

Safety and Smart Feature Integration

Manufacturers are increasingly integrating safety and convenience technologies to address consumer concerns and regulatory standards. Features such as flame failure devices (FFD), auto shut-off valves, child-lock systems, and smart knobs are becoming standard across mid-range and premium models. In select markets, early adoption of IoT-enabled gas stoves with usage monitoring and remote shut-off capabilities is emerging, aligning with broader smart-home adoption trends and enhancing long-term market competitiveness.

What are the key drivers in the gas stoves market?

Expansion of Clean Cooking Fuel Infrastructure

Government-led initiatives aimed at promoting clean cooking fuels are a major driver of gas stove adoption. Large-scale LPG distribution programs and piped gas expansion across Asia-Pacific, Latin America, and Africa are directly increasing first-time gas stove purchases. These programs are designed to reduce indoor air pollution and dependence on solid fuels, making gas stoves the default cooking appliance for newly connected households.

Urban Housing Growth and Appliance Replacement Demand

Rapid urbanization and residential construction are driving consistent demand for gas stoves. New housing projects often include standardized kitchen appliance installations, while aging households in developed markets are replacing older models with safer and more efficient designs. Replacement demand, particularly in Europe and North America, is increasingly driven by energy efficiency, safety compliance, and design upgrades rather than basic functionality.

What are the restraints for the global market?

Rising Competition from Electric and Induction Cooktops

The growing adoption of electric and induction cooktops presents a long-term restraint for the gas stoves market, particularly in regions promoting electrification and decarbonization. Policy initiatives encouraging electric cooking, especially in Europe, may gradually limit gas stove installations in new residential developments.

Raw Material Price Volatility

Fluctuations in the prices of stainless steel, aluminum, brass, and glass directly impact gas stove manufacturing costs. This volatility pressures margins, particularly in price-sensitive emerging markets, and limits pricing flexibility for manufacturers competing in the economy and mid-range segments.

What are the key opportunities in the gas stoves industry?

Growth in Commercial and Institutional Kitchens

The rapid expansion of restaurants, quick-service chains, cloud kitchens, hotels, and institutional kitchens presents a significant opportunity for gas stove manufacturers. Commercial kitchens prioritize high heat output, durability, and fuel efficiency, making gas stoves indispensable despite the availability of electric alternatives. This segment is expected to grow faster than residential demand, particularly in the Asia-Pacific and the Middle East.

Export-Oriented Manufacturing and Emerging Markets

Countries such as China, India, Turkey, and Italy are strengthening their positions as export hubs for gas stoves. Competitive manufacturing costs, established supply chains, and favorable trade policies allow producers to serve global demand efficiently. Untapped rural and semi-urban markets in Africa and Southeast Asia also offer long-term volume growth opportunities.

Product Type Insights

Freestanding gas stoves dominate the global market, accounting for approximately 38% of total revenue in 2024. Their leadership is driven by affordability, ease of installation, and wide availability, making them the preferred choice for first-time buyers and budget-conscious households in emerging markets. Built-in gas stoves and standalone cooktops are increasingly gaining share in premium residential kitchens, as consumers upgrade for aesthetic appeal, modern design, and space efficiency. Gas range ovens remain widely adopted in commercial kitchens and high-income households due to their large cooking capacity and robust performance. Product innovation is increasingly focused on multi-burner configurations and modular designs, allowing households and commercial kitchens to adapt stoves for diverse cooking needs, including professional-style meal preparation, quick-service operations, and multi-dish cooking.

Fuel Type Insights

LPG-based gas stoves represent the largest fuel segment, contributing nearly 61% of global market value in 2024. This dominance is primarily driven by extensive LPG distribution networks in Asia-Pacific, Latin America, and Africa, which facilitate accessibility in both urban and semi-urban households. Natural gas (PNG) stoves are concentrated in regions with established piped infrastructure, including North America, Europe, China, and select Middle Eastern countries, offering a convenient and cost-efficient alternative for high-density urban environments. PNG adoption is further supported by government initiatives promoting clean energy and urban fuel connectivity, which reduce reliance on bottled LPG and strengthen infrastructure-driven market growth.

Distribution Channel Insights

Offline retail channels continue to dominate gas stove sales, accounting for around 64% of global distribution. Appliance stores, specialty kitchen retailers, and large-format retail chains remain key touchpoints, particularly in emerging markets where in-person demonstration and installation services influence purchase decisions. Online retail channels are rapidly gaining ground, driven by brand-owned e-commerce platforms, online marketplaces, and competitive pricing strategies. These channels appeal strongly to younger, urban consumers who prioritize convenience, detailed product information, and doorstep installation support. The rise of online channels also enables manufacturers to expand reach to tier-2 and tier-3 cities, driving incremental volume growth in previously under-penetrated markets.

End-Use Insights

Residential households account for approximately 70% of global gas stove demand, reflecting widespread reliance on gas as a primary cooking fuel. Market penetration is strongest in urban and semi-urban households, where kitchen modernization and replacement cycles stimulate consistent demand. Commercial foodservice is the fastest-growing end-use segment, expanding at over 6.5% CAGR, driven by the proliferation of quick-service restaurants, cloud kitchens, hotels, and institutional catering. Gas stoves in commercial settings are favored for high heat output, durability, and fuel efficiency. Institutional kitchens, including hospitals, schools, and government facilities, contribute steady demand as they seek reliable, large-capacity stoves that support bulk meal preparation with low operational costs.

| By Product Type | By Fuel Type | By Installation Type | By Burner Configuration | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global gas stoves market with about 42% share in 2024. China and India are the largest contributors, driven by population density, expanding LPG access, government clean-cooking initiatives, and robust domestic manufacturing bases that support both local consumption and exports. Southeast Asia is emerging as a high-growth sub-region due to rapid urban expansion, rising disposable incomes, and increasing household appliance penetration. The growth in freestanding gas stoves is particularly notable, as affordability aligns with the needs of first-time buyers. Additionally, government-led initiatives such as LPG subsidy programs, piped gas expansion, and urban housing projects continue to fuel demand across both residential and commercial segments.

North America

North America accounts for approximately 18% of global gas stove demand, led by the United States. The market is driven by replacement demand, premium product adoption, and strong commercial kitchen usage in foodservice chains. Growth is further supported by infrastructure reliability and high consumer preference for multi-burner, built-in, and energy-efficient stoves. Rising demand for smart and safety-equipped gas stoves, including flame failure protection and auto-ignition systems, is enhancing market adoption, particularly in urban households seeking convenience and high-end kitchen solutions.

Europe

Europe holds nearly 17% of the gas stoves market, with Italy, Germany, France, and the U.K. as key contributors. Southern Europe demonstrates higher adoption due to culinary preferences favoring gas cooking, while regulatory scrutiny and emissions standards are shaping long-term product evolution. Drivers include a preference for built-in and premium gas stoves in modern kitchens, replacement demand in mature urban markets, and continued expansion of piped natural gas infrastructure. Adoption of LPG-based stoves remains relevant in areas where pipeline connectivity is limited, while innovation in design, modularity, and safety features continues to appeal to environmentally conscious consumers.

Latin America

Latin America represents around 10% of global gas stove demand, led by Brazil and Mexico. Market growth is supported by urban housing development, expanding LPG accessibility, and rising disposable incomes. Freestanding stoves dominate this region due to their affordability and ease of installation in both new and existing homes. Drivers include urban population growth, rising household appliance penetration, and a shift from traditional biomass fuels to LPG-based stoves, encouraged by regional government programs promoting clean cooking solutions.

Middle East & Africa

The Middle East & Africa region accounts for roughly 13% of global gas stove demand. Demand is driven by the proliferation of commercial kitchens, hospitality growth, and clean cooking initiatives across African countries. GCC nations, including the UAE, Saudi Arabia, and Qatar, show strong adoption of premium and commercial-grade stoves, supported by high disposable incomes and a preference for high-performance appliances. In Africa, government initiatives for LPG distribution and clean-cooking programs are key growth drivers, while urbanization and infrastructure development are expanding residential adoption. Freestanding and multi-burner stoves dominate in emerging African markets, while premium built-in designs are gaining traction in urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Gas Stoves Market

- Whirlpool Corporation

- Haier Group

- Electrolux AB

- Samsung Electronics

- LG Electronics

- Bosch (BSH Hausgeräte)

- Panasonic Corporation

- Midea Group

- Arçelik

- Rinnai Corporation

- SMEG

- Teka Group

- Elica

- Glen Appliances

- Sub-Zero Group