Garden Rooms Market Size

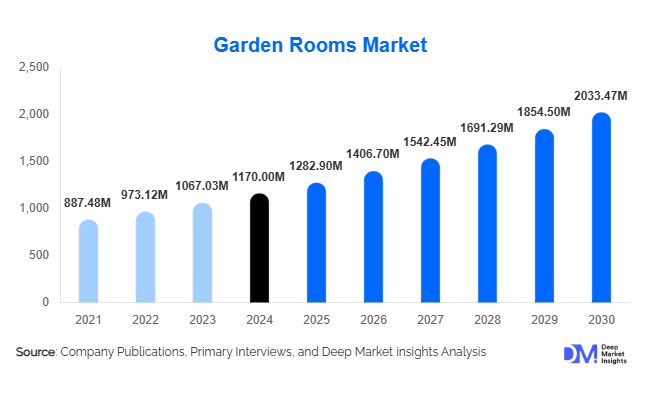

According to Deep Market Insights, the global garden rooms market size was valued at USD 1,170.00 million in 2024 and is projected to grow from USD 1,282.90 million in 2025 to reach USD 2,033.47 million by 2030, expanding at a CAGR of 9.65% during the forecast period (2025–2030). The garden rooms market growth is primarily driven by the global shift toward hybrid working models, increasing demand for flexible residential spaces, rising urban density, and advancements in prefabricated and modular construction technologies.

Key Market Insights

- Standalone and prefabricated garden rooms dominate demand, as homeowners seek fast-to-install, planning-friendly alternatives to home extensions.

- Residential applications account for the majority of installations, particularly home offices, studios, and leisure spaces.

- Europe leads global demand, supported by favourable planning regulations and high adoption in the U.K. and Germany.

- North America represents a strong secondary market, driven by suburban housing expansion and remote work adoption in the U.S.

- Asia-Pacific is the fastest-growing region, led by Australia and Japan, due to rising modular construction acceptance.

- Energy-efficient and all-season insulated garden rooms are becoming the standard, reflecting growing sustainability awareness.

What are the latest trends in the garden rooms market?

Rise of Hybrid Work Infrastructure

The widespread adoption of hybrid and remote work has transformed garden rooms into essential residential infrastructure. Homeowners increasingly invest in insulated, soundproof garden rooms designed as permanent home offices. Employers in several countries now support home workspace upgrades through stipends, indirectly stimulating demand. This trend has shifted garden rooms from discretionary purchases to productivity-focused investments, significantly expanding the addressable market.

Prefabrication and Modular Design Advancements

Technological advancements in off-site manufacturing are reshaping the garden rooms industry. Prefabricated units now offer improved structural integrity, superior insulation, and rapid installation timelines, often within one to two weeks. Digital design configurators allow customers to customise layouts, materials, and energy features online, reducing lead times and improving customer experience. This trend is driving higher adoption among time- and cost-sensitive buyers.

What are the key drivers in the garden rooms market?

Growing Demand for Flexible Living Spaces

Urban housing constraints and rising property prices have made traditional home extensions expensive and complex. Garden rooms offer a flexible, space-efficient solution that adds usable area without altering the main structure. This driver is particularly strong in dense urban and suburban markets across Europe and North America.

Favourable Planning and Zoning Regulations

In several countries, including the U.K., Germany, and parts of the U.S., garden rooms fall under permitted development rights, eliminating lengthy approval processes. This regulatory ease has significantly accelerated adoption, especially for standalone and prefabricated units.

Rising Focus on Sustainability and Energy Efficiency

Consumers increasingly prefer eco-friendly construction solutions. Garden room manufacturers are responding with certified timber, energy-efficient glazing, and passive insulation designs. All-season garden rooms capable of low-energy operation are gaining preference, supporting long-term market growth.

What are the restraints for the global market?

High Initial Investment for Premium Units

While entry-level garden rooms are affordable, premium all-season models can exceed USD 25,000–30,000, limiting adoption among price-sensitive consumers. This remains a key barrier in emerging markets and lower-income regions.

Volatility in Raw Material Prices

Fluctuations in timber, steel, and glass prices directly affect manufacturing costs and pricing stability. Material price volatility can compress margins and delay purchasing decisions, especially during periods of inflation.

What are the key opportunities in the garden rooms industry?

Expansion into Commercial and Institutional Applications

Beyond residential use, garden rooms are increasingly adopted for commercial offices, co-working spaces, hospitality units, and healthcare consultation rooms. Institutions seeking rapid, modular infrastructure present a high-growth opportunity for manufacturers offering scalable solutions.

Smart and Technology-Integrated Garden Rooms

Integration of smart lighting, climate control, energy monitoring, and IoT-enabled security systems is creating a premium segment within the market. Smart garden rooms command higher margins and appeal to tech-savvy consumers and commercial users.

Product Type Insights

Standalone garden rooms represent the largest product segment, accounting for approximately 42% of the global market in 2024, due to their flexibility and ease of installation. Modular and prefabricated garden rooms follow closely, driven by faster delivery times and cost efficiency. Custom-built garden rooms serve a premium niche, catering to high-income homeowners seeking bespoke architectural designs.

Construction Method Insights

Prefabricated garden rooms dominate the market with an estimated 55% share in 2024. Off-site manufacturing ensures consistent quality, reduced labour dependency, and predictable project timelines. Traditional on-site construction remains relevant for custom and large-format installations, but is gradually losing share.

End-Use Insights

The residential segment accounts for approximately 68% of global demand, primarily driven by home office and leisure applications. Commercial end use is the fastest-growing segment, expanding at over 11% CAGR, supported by co-working spaces, hospitality cabins, and retail pop-ups. Institutional demand is emerging in the education and healthcare sectors.

Distribution Channel Insights

Direct-to-consumer channels dominate with over 50% market share, enabled by online configuration tools and manufacturer-led sales models. Contractors and builders remain critical for large and custom projects, while digital platforms are gaining traction among younger buyers.

| By Product Type | By Construction Method | By Material Type | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe holds the largest share of the garden rooms market at approximately 38% in 2024. The U.K. and Germany lead demand due to favourable planning laws, high homeownership rates, and widespread remote working culture.

North America

North America accounts for nearly 29% of global market share, led by the U.S. Suburban expansion, rising disposable income, and strong demand for home offices are key growth drivers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR of approximately 12.5%. Australia and Japan dominate demand, supported by modular construction adoption and premium residential investments.

Latin America

Latin America remains an emerging market, with Brazil and Mexico showing early adoption driven by luxury residential developments and hospitality applications.

Middle East & Africa

Demand is niche but growing, particularly in the UAE and South Africa, where garden rooms are used for premium residential and hospitality purposes.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Garden Rooms Market

- Green Retreats

- ModGarden

- Room Outdoors

- Eurocell

- Crane Garden Buildings

- Studio Shed

- KODA

- Palmako

- Dunster House

- Smart Garden Offices

- Nordic Garden Rooms

- Summerwood

- Cubic Outdoor Living

- Backyard Rooms UK

- The Garden Room Company

Recent Developments

- In 2024, several European manufacturers expanded automated prefabrication facilities to reduce delivery timelines and improve scalability.

- In early 2025, leading garden room brands introduced smart-enabled, energy-positive models integrating solar panels and advanced insulation.

- In 2025, increased M&A activity was observed as regional players consolidated to expand geographic reach and product portfolios.