Gaming Steering Wheels Market Size

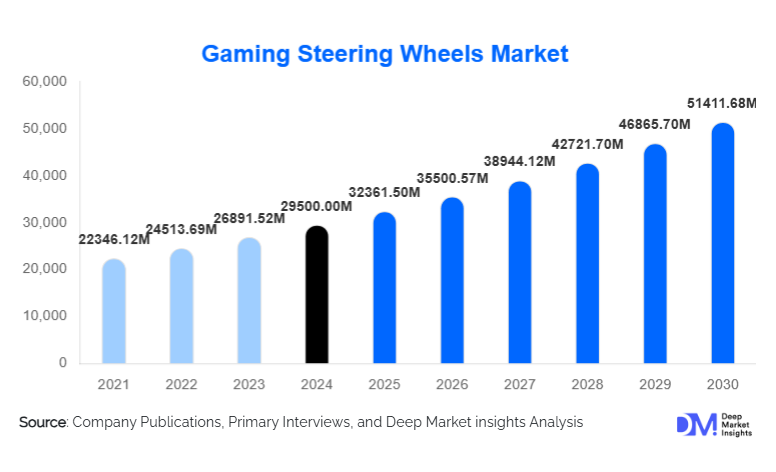

According to Deep Market Insights, the global gaming steering wheels market size was valued at USD 29,500.00 million in 2024 and is projected to grow from USD 32,361.50 million in 2025 to reach USD 51,411.68 million by 2030, expanding at a CAGR of 9.70% during the forecast period (2025–2030). The market growth is primarily driven by the increasing popularity of simulation racing and eSports, rising adoption of immersive gaming technologies such as VR/AR, and expansion of mid- to high-end gaming peripheral offerings tailored to both casual and professional gamers globally.

Key Market Insights

- Mid-range and premium steering wheels with force-feedback and modular accessories are leading demand, catering to both home enthusiasts and professional sim-racers seeking realistic driving experiences.

- Simulation racing remains the dominant application, with home gaming and professional eSports setups driving upgrades to more advanced steering wheels and bundled kits.

- North America dominates the market, with the U.S. and Canada showing strong adoption due to mature gaming ecosystems and high disposable incomes.

- Asia-Pacific is the fastest-growing region, led by rising middle-class gamer populations in China, India, Japan, and South Korea.

- Europe maintains steady growth, supported by strong adoption of console and PC gaming, as well as professional eSports infrastructure.

- Technological integration, including direct-drive motors, wireless connectivity, VR compatibility, and modular add-ons, is reshaping user experience and driving higher adoption in premium segments.

What are the latest trends in the gaming steering wheel market?

Immersive and VR-Compatible Gaming

Manufacturers are increasingly developing steering wheels and accessories optimized for VR and immersive gaming experiences. Direct-drive systems, advanced force-feedback mechanisms, and modular pedals/shifters are becoming standard for simulation enthusiasts. VR-compatible rigs allow users to experience realistic racing dynamics, creating demand for high-end, feature-rich hardware. This trend appeals strongly to professional gamers and eSports participants, as well as serious home enthusiasts seeking realism.

Modular and Bundle Offerings

Bundled kits, including steering wheels, pedal sets, and gear shifters, are gaining popularity. Consumers are seeking customizable setups that can be upgraded over time, from entry-level models to high-end direct-drive systems. Subscription-based accessory models and modular add-ons allow flexibility for users to expand their rigs, enhancing overall engagement and brand loyalty. These bundled solutions also simplify purchasing decisions, especially for first-time buyers.

What are the key drivers in the gaming steering wheels market?

Growth of eSports and Competitive Gaming

The rising popularity of competitive racing games and professional sim-racing leagues is driving demand for high-performance steering wheels. Gamers require precision, durability, and realism, pushing them toward mid- and premium-level products. eSports tournaments increasingly rely on certified hardware, further boosting the adoption of professional-grade peripherals.

Technological Advancements in Gaming Peripherals

Adoption of advanced technologies such as VR/AR integration, wireless connectivity, and high-torque direct-drive motors has increased the appeal of modern steering wheels. Enhanced force-feedback systems, multi-platform compatibility, and modular designs attract enthusiasts who want an immersive experience comparable to real-life racing.

Expansion of Home Gaming and Simulation Ecosystem

The home gaming market is expanding due to higher disposable incomes, lockdown-driven gaming trends, and lifestyle adoption of gaming rigs. Consumers are increasingly investing in premium peripherals, driving higher revenues for mid-range and high-end steering wheels, while casual gamers maintain steady unit sales in entry-level segments.

What are the restraints for the global market?

High Cost of Premium Steering Wheels

Advanced direct-drive and force-feedback systems remain expensive, limiting adoption among casual gamers and price-sensitive segments. This price barrier is particularly relevant in emerging markets, where disposable income is lower and entry-level or mid-range wheels dominate.

Technical Compatibility Challenges

Steering wheels must integrate with multiple platforms (PC, consoles, VR), and require software drivers, firmware updates, and proper rig setup. Technical integration challenges, coupled with supply chain constraints for precision motors and sensors, can hinder adoption and slow commercial growth.

What are the key opportunities in the gaming steering wheel industry?

Expansion into Emerging Markets

Emerging regions such as India, Southeast Asia, and Latin America present significant growth potential. Rising middle-class populations, increasing console and PC penetration, and growing awareness of eSports and simulation gaming create opportunities for mid-range and entry-level steering wheels. Targeted marketing and region-specific product development can capture this new consumer base.

Integration of Advanced Technologies

Steering wheels incorporating direct-drive motors, force-feedback systems, VR/AR compatibility, and wireless functionality offer differentiation. Manufacturers focusing on these innovations can capture high-end segments, command premium pricing, and build brand loyalty among enthusiasts and professional gamers.

Growth of Professional Sim Racing and eSports Ecosystem

Professionalization of sim-racing and expansion of eSports leagues create demand for competition-grade peripherals. Partnerships with game developers and eSports organizations provide opportunities for co-branded hardware, specialized training rigs, and commercial installations in simulation centers.

Product Type Insights

Mid-range steering wheels with force-feedback dominate the market, representing roughly 35% of the 2024 value. They offer an optimal balance of performance and cost, attracting both casual enthusiasts and semi-professional sim racers. Premium direct-drive systems capture high-value segments despite lower unit volumes, while entry-level wheels dominate volume sales among casual gamers seeking affordability.

Application Insights

Simulation racing is the leading application, accounting for approximately 50% of the 2024 market. Home gaming enthusiasts and professional sim racers are driving demand for immersive experiences, leveraging force-feedback wheels, modular pedals, and VR integration. Console-only and casual racing applications are growing steadily, but contribute a smaller proportion of market value.

Distribution Channel Insights

Online retail platforms dominate, providing easy access, transparent pricing, and direct-to-consumer delivery. Offline electronics and specialty gaming stores maintain relevance for enthusiasts seeking hands-on experiences. OEM and commercial channels serve simulation centers and professional gaming facilities, particularly for bulk or high-end installations.

End-User Insights

Casual gamers account for the largest share (45%) due to high volume sales of entry-level and mid-range wheels. Enthusiast and professional sim-racers represent higher-value purchases, driving growth in premium segments. Commercial buyers, such as simulation centers and eSports facilities, are an emerging end-use segment, contributing to export-driven demand for high-end equipment.

| By Product Type | By Application / Use Case | By End-User / Customer Type | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest share (40%) of the market, led by the U.S. and Canada. High disposable income, mature gaming ecosystems, and strong eSports infrastructure drive steady growth. Upgrades to mid- and high-end systems are common, and demand for VR-compatible peripherals is increasing.

Europe

Europe contributes 20–25% of the market, with the U.K., Germany, and France leading demand. Growth is driven by simulation enthusiasts and professional eSports players. The market is receptive to mid-range and premium systems, and adoption of sustainable production and gaming setups is rising.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and South Korea. Rising gamer populations, expanding console/PC penetration, and social media influence are fueling adoption. Mid-range wheels dominate, but premium segments are growing as high-income users invest in immersive simulation rigs.

Latin America

Latin America represents 7–8% of the market, with Brazil and Mexico leading adoption. Demand is primarily driven by adventure and casual gaming, with growth potential in premium and bundled offerings.

Middle East & Africa

MEA accounts for 5% of the global market value. Iconic African destinations host simulation and eSports events, while the Middle East (UAE, Saudi Arabia) contributes high-income, luxury-focused demand. Intra-African adoption is growing moderately.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Gaming Steering Wheels Market

- Logitech

- Thrustmaster

- Fanatec (Endor AG)

- Hori

- Simucube

- Mad Catz

- Razer Inc.

- Nacon

- MOZA Racing

- Next Level Racing

- Simagic

- Heusinkveld Engineering

- Speed3D

- VRS (Virtual Racing School)

- Playseat

Recent Developments

- In March 2025, Logitech launched a new mid-range force-feedback wheel with modular pedal upgrades, targeting casual and enthusiast gamers.

- In January 2025, Thrustmaster introduced a VR-compatible direct-drive racing kit for professional sim racers, including advanced haptic feedback and wireless connectivity.

- In February 2025, Fanatec expanded its eSports and professional sim-racing portfolio, releasing a premium bundle including a steering wheel, pedals, and shifter modules optimized for competitive leagues.