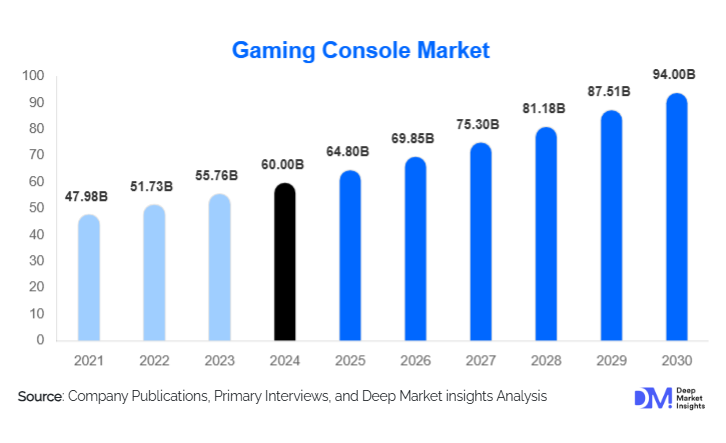

Gaming Console Market Size

According to Deep Market Insights, the global gaming console market size was valued at USD 60 billion in 2024 and is projected to grow from USD 64.8 billion in 2025 to reach USD 94 billion by 2030, expanding at a CAGR of 7.8% during the forecast period (2025–2030). The gaming console market growth is primarily driven by rising digitalization, increasing adoption of online multiplayer gaming, technological advancements in next-generation consoles, and the growing popularity of eSports and immersive gaming experiences worldwide.

Key Market Insights

- Home consoles dominate the market, driven by high-end gaming hardware, rich game libraries, and superior graphics performance, accounting for 55% of the 2024 market.

- Software and subscription services are gaining prominence, representing 45% of total revenue, reflecting the shift toward digital content consumption and recurring revenue models.

- North America and Europe remain leading regions, with strong disposable income, gaming culture, and early adoption of next-generation consoles.

- Asia-Pacific is emerging as the fastest-growing region, fueled by an increasing middle-class population, smartphone gaming influence, and rising interest in premium and hybrid consoles.

- Online retail channels are expanding, enabling easy access to digital content, pre-orders, and promotions, constituting 40% of the market.

- Technological integration, including cloud gaming, AI-driven game personalization, and AR/VR-enabled consoles, is reshaping user engagement and monetization models.

What are the latest trends in the gaming console market?

Cloud Gaming and Subscription Services

Cloud gaming platforms and subscription models are increasingly adopted to provide access to high-quality games without investing in expensive hardware. Services like Xbox Game Pass and PlayStation Plus are attracting casual and hardcore gamers by offering large game libraries, regular updates, and exclusive content. Improved internet infrastructure, particularly 5G networks in Asia-Pacific and Latin America, supports the rapid adoption of cloud-based gaming, making it a major growth trend for console manufacturers.

Next-Generation Hardware Adoption

Gaming consoles are witnessing rapid technological innovation, including ultra-fast SSDs, ray-tracing graphics, higher frame rates, and enhanced processing power. These upgrades are driving consumer upgrades from previous-generation devices. Hybrid consoles, which combine portable and home gaming functionalities, are also gaining traction, providing flexibility for gamers and supporting increased content consumption across multiple platforms.

What are the key drivers in the gaming console market?

Rising Popularity of Multiplayer and eSports Gaming

The growth of online multiplayer games and competitive eSports has significantly boosted console demand. Players increasingly seek consoles capable of high-speed connectivity, realistic graphics, and seamless multiplayer experiences. Competitive gaming further drives purchases of high-performance consoles and software, increasing market revenue and recurring spending through subscriptions and downloadable content.

Technological Advancements in Gaming Hardware

Next-generation consoles are offering immersive gameplay through advanced processors, faster storage, and enhanced graphics. Backward compatibility, integration with VR and AR devices, and enhanced AI-powered gaming experiences are attracting both casual and hardcore gamers, contributing to market expansion. The continuous introduction of innovative features strengthens brand differentiation and justifies premium pricing.

What are the restraints for the global market?

High Price of Premium Consoles

While next-generation consoles provide cutting-edge features, their premium pricing limits adoption in price-sensitive markets. This creates a challenge for manufacturers to balance innovation with affordability, particularly in emerging economies. Mid-range and entry-level offerings are essential to broaden market penetration.

Supply Chain and Component Shortages

Global semiconductor shortages and supply chain disruptions affect console production and availability. These challenges lead to delayed launches, reduced inventory, and potentially higher costs for end consumers, slowing overall market growth.

What are the key opportunities in the gaming console industry?

Expansion of Cloud Gaming Services

Cloud gaming enables access to premium games without high upfront costs. Console manufacturers and software providers can leverage subscription models to generate recurring revenue. Increasing 5G penetration, particularly in Asia-Pacific and Latin America, creates a significant opportunity to expand cloud gaming adoption and target new customer segments.

Emerging Markets Demand

Rapidly growing markets such as India, Brazil, and Mexico present opportunities for mid-range and budget consoles. Localized content, strategic e-commerce partnerships, and region-specific marketing can help manufacturers penetrate these markets and increase overall market share.

Integration of Advanced Technologies

Adoption of AR, VR, and AI in gaming consoles enhances user experience and provides a differentiator in a highly competitive market. AI-driven analytics enable personalized gaming experiences, while VR/AR integration drives higher engagement, supporting premium pricing and long-term customer loyalty.

Product Type Insights

Home consoles dominate with 55% market share, offering high-end graphics and comprehensive game libraries. Handheld and hybrid consoles are growing due to portability and versatility, appealing to gamers seeking flexibility. Software and subscription services represent 45% of market revenue, reflecting the increasing importance of digital content, downloadable games, and cloud gaming platforms. Premium consoles account for 50% of sales, while mid-range and entry-level consoles serve price-sensitive consumers, particularly in emerging markets.

Application Insights

Gaming consoles are widely used for casual gaming, competitive eSports, and content creation. Casual gamers constitute 60% of the market, driving mass adoption. Hardcore and professional gamers fuel demand for high-performance consoles and exclusive game titles. Emerging applications include VR-based training, educational gaming, and interactive entertainment, broadening the end-use base.

Distribution Channel Insights

Online retail dominates with 40% of sales, enabling pre-orders, digital downloads, and promotional campaigns. Offline retail remains significant in regions with established electronics stores and specialty gaming outlets. Subscription-based sales and cloud gaming services are becoming important digital channels, offering recurring revenue streams for manufacturers and publishers.

Traveler Type Insights

Console users can be segmented into casual, hardcore, and professional gamers. Casual gamers represent the largest user base, driving hardware and software sales. Hardcore gamers demand high-performance consoles and immersive gameplay, while professional gamers and eSports participants seek specialized features, exclusive content, and accessories, influencing premium product adoption.

Age Group Insights

Gamers aged 18–30 are early adopters of budget and mid-range consoles, leveraging online platforms for content access. Users aged 31–50 contribute to premium console demand, with higher disposable income and interest in immersive experiences. Older demographics (51–65) prefer guided gaming experiences, with professional or eSports setups showing steady growth.

| By Console Type | By Component | By Price Range | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 35% of the market in 2024, with the U.S. and Canada leading due to high disposable income, technological infrastructure, and early adoption of next-gen consoles. Online multiplayer and eSports popularity support growth, while cloud gaming is gaining traction among casual and hardcore gamers.

Europe

Europe represents 25% of the market in 2024, with the U.K. and Germany dominating. Strong gaming culture, high disposable income, and extensive retail and online infrastructure drive growth. The region is receptive to digital content, subscriptions, and cloud gaming platforms, supporting mid-range and premium console sales.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, Japan, India, and Australia. Rising middle-class populations, gaming culture adoption, and social media influence are driving console purchases. Premium and hybrid consoles are gaining popularity, supported by increased internet connectivity and eSports tournaments.

Latin America

Brazil, Mexico, and Argentina are emerging markets, showing increasing demand for mid-range consoles and casual gaming. Export-driven growth is significant, with consoles shipped from North America and Japan. Adventure gaming and community-driven content are influencing preferences.

Middle East & Africa

Africa hosts increasing console demand in South Africa and Nigeria, while the Middle East, led by the UAE and Saudi Arabia, sees growth in luxury console adoption. High-income populations and eSports interest support premium console sales. Intra-regional trade and connectivity enhance market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Gaming Console Market

- Sony

- Microsoft

- Nintendo

- Tencent

- Electronic Arts

- Activision Blizzard

- Ubisoft

- Take-Two Interactive

- Square Enix

- Capcom

- Bandai Namco

- Sega

- NetEase

- Konami

- CD Projekt

Recent Developments

- In March 2025, Sony launched the PlayStation VR2, expanding immersive gaming experiences with enhanced graphics and AI integration.

- In February 2025, Microsoft expanded Xbox Game Pass to new regions in Asia-Pacific, boosting cloud gaming adoption and subscription revenues.

- In January 2025, Nintendo announced a hybrid console upgrade, enhancing portability and connectivity for global users, targeting emerging markets in Latin America and Asia.