Online Casual Games Market Size

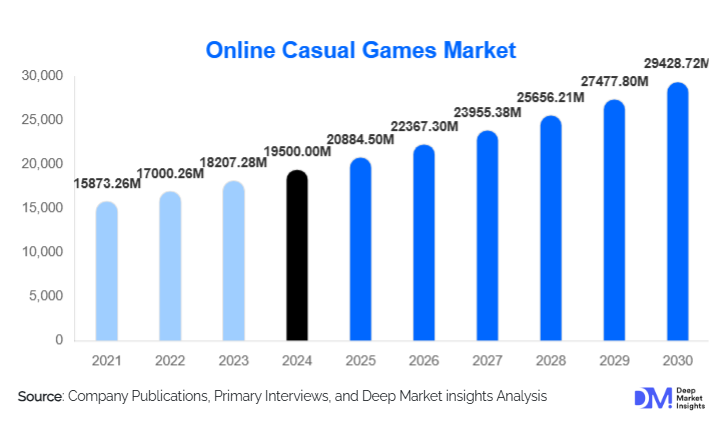

According to Deep Market Insights, the global online casual games market size was valued at USD 19,500.00 million in 2024 and is projected to grow from USD 20,884.50 million in 2025 to reach USD 29,428.72 million by 2030, expanding at a CAGR of 7.10% during the forecast period (2025–2030). The market’s growth is driven by the rising penetration of smartphones and high-speed internet, the evolution of free-to-play and micro-transaction models, and the expanding adoption of casual gaming across emerging markets. Casual games’ accessibility, short play sessions, and cross-platform availability continue to make them one of the most widely consumed digital entertainment forms globally.

Key Market Insights

- Mobile dominates the online casual games ecosystem, accounting for more than 70% of total market revenue in 2024, supported by widespread smartphone ownership and app-store distribution.

- Puzzle and Match-3 games remain the leading genre, representing roughly 25–30% of global revenue due to universal appeal, easy mechanics, and repeat-play value.

- Asia-Pacific leads the global market with a 35% share in 2024, driven by strong mobile adoption and micro-transaction culture in China, Japan, and India.

- In-App Purchases (IAP) are the largest monetization stream, generating over 30% of global casual gaming revenue in 2024.

- Young adults (18–35 years) represent the largest player demographic, contributing about 45–50% of total market spending.

- Technological integration, including cloud gaming, AI-based personalization, and cross-platform play, is reshaping engagement and retention strategies.

What are the latest trends in the online casual games market?

Cross-Platform Integration and Cloud Gaming

Developers are increasingly adopting cross-platform frameworks and cloud infrastructure to allow seamless gameplay across mobile, PC, and smart-TV devices. This integration reduces device dependency and enhances user retention by enabling multi-screen continuity. The expansion of 5G networks and lightweight game-streaming platforms is further driving demand for casual cloud games that require minimal downloads. These innovations also allow developers to target broader demographics with consistent experiences and reduce churn caused by storage constraints or hardware limitations.

Rise of Hybrid Monetization Models

While advertising remains vital, a growing trend is the combination of ad-supported free play with optional subscriptions and in-app purchases. Hybrid models improve revenue stability and provide players with flexibility, offering ad-free experiences for subscribers while maintaining free-to-play access for others. Subscription-bundled casual games, integrated within entertainment platforms or telco packages, are gaining traction, particularly in emerging economies where payment reliability is improving.

What are the key drivers in the online casual games market?

Expanding Smartphone and Internet Penetration

The continuing spread of affordable smartphones and reliable mobile internet access is the foremost driver for the online casual games market. Billions of users in Asia, Latin America, and Africa are gaining first-time access to gaming content via mobile platforms, fueling exponential increases in daily active users (DAUs) and overall market value.

Inclusive and Accessible Gameplay

Casual games’ simplicity and short engagement loops make them accessible to a diverse audience, including non-traditional gamers such as women, seniors, and children. This inclusivity broadens the player base and underpins steady engagement across age groups. The universal appeal of puzzle and trivia formats exemplifies this driver.

Improved Monetization and Live-Ops Strategies

Enhanced live-ops features such as seasonal events, leaderboards, and limited-time rewards extend player lifetime value. Combined with optimized micro-transaction pricing and ad-placement algorithms, these systems enable sustainable profitability even at low per-user spending levels. Developers adopting live-ops models report improved retention rates and predictable recurring revenues.

What are the restraints for the global market?

Rising User-Acquisition Costs

High competition in app stores and digital advertising channels has inflated customer-acquisition costs. Small and mid-size studios struggle to achieve visibility without heavy marketing expenditure, which compresses margins. Saturation in mature markets such as the U.S. and Western Europe has further limited organic growth potential.

Regulatory and Monetization Challenges

Increasing scrutiny over data privacy, advertising transparency, and micro-transaction models poses operational risks. Restrictions on tracking identifiers (e.g., Apple’s App Tracking Transparency) reduce ad-targeting efficiency, while evolving legislation around loot boxes and child-protection standards could constrain monetization in certain regions.

What are the key opportunities in the online casual games industry?

Emerging Market Expansion

Rapid smartphone adoption in Southeast Asia, Africa, and Latin America presents untapped potential for casual gaming. Localization, lightweight game design, and alternative payment solutions such as carrier billing or e-wallets will be key for capturing these audiences. Developers focusing on regional language content and culturally relevant themes stand to gain an early-mover advantage.

Integration of New Technologies

Adoption of augmented reality (AR), voice interaction, and social integration features creates immersive yet casual experiences. AI-driven personalization can optimize difficulty curves and tailor in-game recommendations, boosting player retention. Cloud-based analytics platforms also enable developers to fine-tune monetization models dynamically.

Monetization Innovation and Partnerships

Hybrid subscriptions, brand partnerships, and integration with streaming or social-media ecosystems are creating new revenue streams. For instance, collaborations between casual game studios and OTT platforms allow bundled entertainment packages. This model enhances user engagement and expands the monetization base beyond in-game purchases alone.

Product Type Insights

Puzzle and Match-3 games dominate global revenues, accounting for nearly 30% of the total market in 2024. Their simple mechanics, high replay value, and strong monetization through boosters and level unlocks make them perennial top-grossing titles. Arcade and endless-runner games appeal to mobile users seeking short-burst entertainment, while card and board games retain steady engagement across older demographics. Hybrid-casual and merge-game subgenres are emerging as fast-growing niches, leveraging social features and ongoing live-ops support.

Platform Insights

Mobile platforms overwhelmingly dominate, contributing more than 70% of the online casual games market revenue in 2024. High device penetration, app-store accessibility, and the proliferation of free-to-play titles drive this dominance. Web/PC games maintain a smaller but loyal base among office and browser users, while console and smart-TV casual titles are gaining interest as family-friendly living-room entertainment experiences.

Monetization Model Insights

In-App Purchases (IAP) are the leading revenue model, contributing about 30–35% of total 2024 market revenue. The combination of low-priced micro-transactions and large user bases delivers reliable profitability. Advertising-supported free-to-play remains widespread, especially among hyper-casual games with shorter lifecycles. Subscription-based casual gaming, though nascent, is expected to rise steadily as platforms offer ad-free bundles and cross-game benefits.

Demographic Insights

Young adults (18–35 years) represent nearly half of global casual gaming revenue, driven by high smartphone adoption and digital payment familiarity. Adults aged 36–50 form the second-largest cohort, emphasizing relaxation and cognitive-training gameplay. Meanwhile, seniors are a growing segment, particularly for puzzle and word games designed for cognitive wellness, creating fresh opportunities for developers.

| By Product Type | By Platform | By Monetization Model | By Demographic |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global online casual games market, holding approximately 35% share in 2024. China, Japan, and India are key growth engines, driven by mass mobile connectivity and cultural receptivity to micro-transactions. India’s expanding gaming ecosystem and affordable data plans are accelerating user acquisition. The region is also the fastest-growing, with strong support from local publishers and government digital-economy initiatives.

North America

North America represents one of the most lucrative markets due to high ARPU and well-developed in-app monetization frameworks. The U.S. dominates regional revenue, supported by strong advertising demand and mature app-store ecosystems. Subscription-based and hybrid-casual titles are gaining popularity among middle-aged players.

Europe

Europe contributes a substantial share, with the U.K., Germany, and France leading. Consumer preference for ad-light, premium casual experiences aligns with higher monetization per user. Regulatory compliance (e.g., GDPR) shapes marketing practices, but demand for family-friendly puzzle and simulation games remains strong.

Latin America

Latin America is one of the fastest-growing markets, projected to expand at around 7% CAGR through 2030. Brazil and Mexico lead regional revenue, driven by affordable smartphones and improved payment ecosystems. Local developers are focusing on culturally resonant themes and social-media-integrated games to attract new players.

Middle East & Africa

MEA is still an emerging region, but growing internet penetration and a youthful population are stimulating demand. Countries like Saudi Arabia and the UAE are investing in national gaming strategies, while South Africa leads sub-Saharan adoption. Regional game-development hubs are expected to strengthen domestic content production over the next decade.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Online Casual Games Market

- Tencent Holdings Ltd.

- Activision Blizzard Inc.

- Electronic Arts Inc.

- Sony Corporation

- Nintendo Co., Ltd.

- NetEase Inc.

- Playrix Ltd.

- King Digital Entertainment

- Moon Active Ltd.

- Zynga Inc.

- GungHo Online Entertainment Inc.

- Konami Digital Entertainment Co., Ltd.

- Bandai Namco Holdings Inc.

- Scopely Inc.

- Supercell Oy

Recent Developments

- In July 2025, Tencent announced a major expansion of its casual gaming portfolio with new AR-integrated puzzle titles targeting Southeast Asia.

- In May 2025, Playrix introduced cloud-sync features across its top Match-3 games, enabling seamless play across mobile and PC.

- In March 2025, Zynga launched a subscription-based, ad-free gaming pass, offering bundled rewards and cross-game currency benefits.

- In January 2025, Moon Active acquired a mid-tier European studio to strengthen its presence in trivia and word-game genres.