Gaming Simulators Market Size

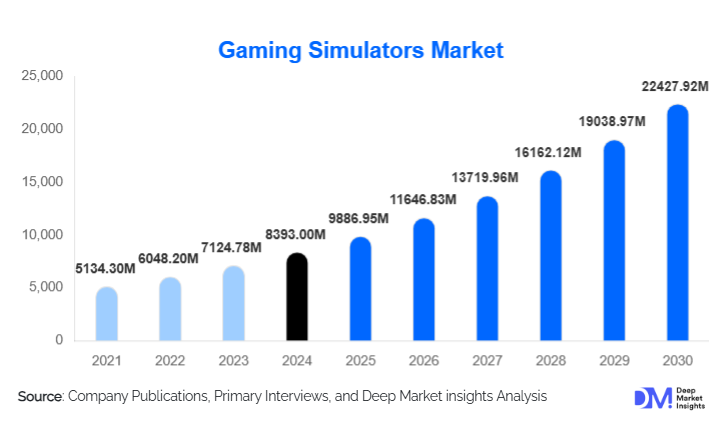

According to Deep Market Insights, the global gaming simulators market size was valued at USD 8393.00 million in 2024 and is projected to grow from USD 9886.95 million in 2025 to reach USD 22427.92 million by 2030, expanding at a CAGR of 17.80% during the forecast period (2025–2030). The gaming simulators market growth is primarily driven by the increasing global adoption of VR/AR systems, the rise of esports and sim-racing leagues, and expanding enterprise use cases in aviation, defense, construction, logistics, and industrial training. Growing demand for hyper-realistic, immersive gameplay and training environments is further accelerating investments across consumer, commercial, and government sectors.

Key Market Insights

- Racing simulators remain the largest product category, accounting for more than 34% of global demand in 2024, fueled by esports growth and rising adoption of professional-grade home racing rigs.

- VR/AR-based immersive simulators are among the fastest-growing technologies, driven by improvements in motion tracking, haptics, and AI-enhanced physics engines.

- APAC is the fastest-growing region, led by China, Japan, South Korea, and India, where aviation training expansion and esports popularity are accelerating simulator uptake.

- North America leads in enterprise and defense adoption, with strong procurement for aviation schools, military training centers, and industrial workforce development.

- AI-driven predictive modeling and cloud streaming are creating new market segments, making high-end simulators more accessible through subscription-based models.

- Growing government investment in pilot training, driver education, and military modernization continues to strengthen demand for professional-grade simulators.

What are the latest trends in the gaming simulators market?

AI-Enhanced and XR-Integrated Simulation Platforms

Gaming simulators are increasingly utilizing AI-driven behavior modeling, real-time decision engines, and adaptive difficulty systems. These technologies significantly enhance realism for both entertainment and professional training applications. Extended Reality (XR) platforms that blend augmented and virtual environments are transforming user immersion, enabling multi-user collaborative simulations and remote cloud-based training. This trend is accelerating adoption in aviation, defense, and industrial sectors where simulation accuracy and real-time data analytics are critical. AI also supports dynamic scenario generation, making training simulators more flexible, customizable, and scalable.

Rise of Esports, Sim Racing, and Location-Based Entertainment (LBE)

The expansion of global esports leagues, particularly in sim racing, is fueling large-scale investments in competitive-grade racing rigs, motion platforms, and cockpit systems. Location-based entertainment venues, including VR arcades, racing lounges, and flight simulation centers, are adopting next-generation simulators that incorporate multi-sensory inputs such as motion seats, tactile feedback, and panoramic display systems. Younger demographics are driving this shift, seeking high-fidelity immersive experiences. Commercial venues increasingly integrate subscription models, tournaments, and cross-platform gaming ecosystems to engage repeat users and expand revenue streams.

What are the key drivers in the gaming simulators market?

VR/AR Technology Advancement and Consumer Adoption

Rapid innovation in VR headsets, motion controllers, haptic suits, and sensory feedback systems has significantly enhanced the realism of gaming simulators. As hardware becomes lighter, more affordable, and more precise, consumer adoption continues to grow. This trend is especially strong among tech-savvy gamers who prioritize immersive and interactive entertainment. The rising availability of VR-ready games and simulation content further propels market expansion.

Growing Demand for Simulation Training Across Aviation, Defense & Industrial Sectors

Governments and corporations are investing heavily in simulation-based training to reduce operational risk, improve safety, and control costs. Aviation schools rely on commercial flight simulators for pilot certification, while defense agencies use advanced tactical simulators for mission rehearsal and skill development. Construction, mining, and logistics companies deploy machinery simulators to minimize workplace accidents and optimize workforce readiness. These enterprise applications represent a stable, recurring demand for high-end simulation systems.

What are the restraints for the global market?

High Initial Costs and Integration Challenges

High-end simulators, especially full-motion platforms, cockpit-grade systems, and industrial simulators, require substantial investments in hardware, software, calibration, and maintenance. Small-scale entertainment centers and cost-sensitive markets often struggle with adoption due to these financial barriers. Additionally, integrating simulators with legacy IT systems and real-world telemetry requires specialized technical expertise, increasing operational complexity.

Regulatory and Infrastructure Limitations

Aviation, defense, and industrial simulators must comply with strict government and safety standards. Certification processes can be lengthy and costly, delaying procurement cycles. In emerging markets, limited broadband infrastructure and a shortage of skilled technicians pose challenges for deploying cloud-based or networked simulation systems. These constraints may slow overall market penetration in developing regions.

What are the key opportunities in the gaming simulators industry?

AI-Cloud Hybrid Simulation Ecosystems

The integration of cloud streaming, AI-driven analytics, and XR technologies offers a major opportunity for simulator manufacturers. Cloud platforms enable remote access to high-end simulators without expensive local hardware, unlocking new subscription-based business models. AI supports automated performance tracking, scenario customization, and real-time optimization for enterprise and gaming users. These combined technologies will expand adoption among small businesses, esports teams, and training academies looking for scalable, cost-efficient simulation solutions.

Government-Backed Training and National Skill Development Initiatives

Countries across APAC, the Middle East, and Latin America are prioritizing aviation expansion, defense modernization, and road safety programs. This has led to increased procurement of flight simulators, combat simulators, and driver education systems. Public infrastructure investments, combined with workforce upskilling programs, create long-term opportunities for simulation vendors. Governments are also establishing training centers equipped with simulators to support industrialization and smart city initiatives, boosting demand across transportation, construction, and logistics sectors.

Product Type Insights

Racing simulators dominate the global market, accounting for approximately 34% of total demand in 2024. Their popularity is driven by the rapid expansion of sim racing esports, widespread home adoption, and partnerships between simulator manufacturers and automotive OEMs. Flight simulators represent a major professional segment, with commercial aviation simulators contributing nearly 12% of the overall market share, primarily due to pilot training requirements. Sports simulators, especially golf simulators, continue expanding across commercial centers and homes. VR/AR immersive platforms are the fastest-growing product category, propelled by advancements in haptics, motion systems, and next-generation XR displays.

Application Insights

Gaming simulators are widely used for entertainment, esports competitions, and professional training. Entertainment applications, including home gaming and VR arcades, represent the largest application share. Aviation and defense training remain core enterprise applications, leveraging high-fidelity simulators for critical decision-making and safety training. Industrial applications, including construction, mining, and maritime training, are expanding rapidly due to increasing workplace safety regulations. Esports-driven applications such as competitive sim racing, virtual flight competitions, and sports simulation leagues are among the fastest-growing segments globally.

Distribution Channel Insights

Online channels dominate simulator sales, with consumers increasingly purchasing racing rigs, VR accessories, and motion platforms through direct-to-consumer (D2C) brand websites and e-commerce marketplaces. Enterprise and government buyers typically procure simulators through direct sales, tenders, and specialized system integrators. Subscription-based access to cloud simulators is emerging as a transformative distribution model, especially for training academies and esports teams. Physical retail plays a smaller role but is growing in electronics stores, offering VR and gaming hardware experience zones.

End-User Insights

Consumer gamers represent a significant share of demand, especially for home-based racing and VR simulators. Esports organizations invest heavily in high-performance rigs for professional training and competitions. Aviation schools, defense agencies, and industrial training institutes rely on simulators for skill development and safety compliance. Commercial venues, such as gaming lounges, VR parks, and theme-based entertainment centers, constitute a growing segment due to location-based entertainment trends. Emerging end-users include edtech platforms and universities integrating simulation-based learning.

| By Simulator Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the gaming simulators market with strong demand from aviation schools, defense departments, esports organizations, and home gaming enthusiasts. The U.S. accounts for the majority of regional revenue, supported by high disposable income, advanced technological infrastructure, and the presence of major simulator manufacturers. Canada shows rising adoption of industrial and training simulators, particularly in logistics and mining sectors.

Europe

Europe holds a prominent share of global demand, driven by Germany, the U.K., France, and the Nordic countries. The region is a global hub for sim racing culture, with numerous competitive leagues and automotive OEM partnerships. Europe’s aviation training ecosystem and regulatory emphasis on safety contribute to growing investments in professional-grade flight simulators. VR adoption in entertainment centers is also accelerating.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, accounting for nearly 30% of global demand and expanding rapidly due to increased aviation training needs, booming esports participation, and rising consumer spending on gaming. China leads the region with strong government support for aviation and defense training. Japan and South Korea are mature simulator markets, driven by VR adoption and popular golf and racing simulator culture. India is emerging as a high-growth market with significant investments in driver education and defense training.

Latin America

Latin America is witnessing steady adoption, led by Brazil and Mexico. The growing middle class and expanding esports scene are driving demand for racing and sports simulators. Mining and construction industries in Chile and Brazil are investing in machinery simulators to improve workforce training and operational safety.

Middle East & Africa

MEA is experiencing rising demand for aviation, defense, and entertainment simulators. The UAE and Saudi Arabia lead in the procurement of flight and tactical simulators due to national aviation expansion and defense modernization. Africa shows strong potential as South Africa and Kenya expand gaming centers and educational institutions integrate simulation-based learning. Regional tourism hubs are increasingly adopting VR-based simulation attractions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Gaming Simulators Market

- CAE Inc.

- Thales Group

- L3Harris Technologies

- Varjo Technologies

- D-Box Technologies

- CXC Simulations

- Playseat®

- RSEAT

- SimXperience

- Vesaro Ltd.

- Pimax Innovation

- Adacel Technologies

- Quantum3D

- BlueSpace Simulation

- VRC (Virtual Racing Components)

Recent Developments

- In March 2025, CAE Inc. expanded its next-generation XR-based flight simulator portfolio, introducing AI-driven scenario modeling for aviation academies.

- In February 2025, Varjo launched a new mixed-reality headset optimized for enterprise simulation and training, enhancing fidelity for industrial and defense applications.

- In January 2025, D-Box Technologies partnered with leading esports leagues to deploy haptic motion platforms for competitive sim racing events across Europe and North America.