Racing Simulator Market Size

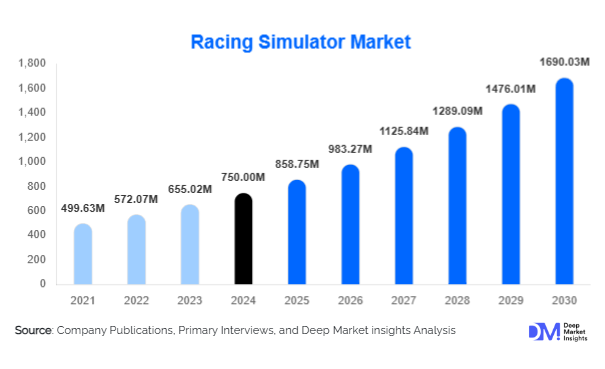

According to Deep Market Insights, the global racing simulator market size was valued at USD 750 million in 2024 and is projected to grow from USD 858.75 million in 2025 to reach USD 1,690.03 million by 2030, expanding at a CAGR of 14.5% during the forecast period (2025–2030). The racing simulator market growth is primarily driven by increasing adoption of VR and AI-based simulation technologies, rising demand for professional driver training, and the growth of eSports and competitive sim racing globally.

Key Market Insights

- Professional racing simulators are gaining prominence among automotive manufacturers, racing teams, and driver training centers due to high-fidelity simulation capabilities and cost-effective R&D applications.

- Consumer and home-based simulators are expanding rapidly,

- North America dominates the market,

- Asia-Pacific is the fastest-growing region,

- Technological integration,

What are the latest trends in the racing simulator market?

Professional Simulators for Automotive R&D

Automotive manufacturers and racing teams are increasingly using high-end simulators for vehicle design, testing, and driver training. Professional simulators with advanced motion platforms, VR headsets, and AI-based vehicle dynamics software allow engineers and drivers to replicate real-world conditions safely and cost-effectively. This trend reduces the need for physical prototypes, shortens development cycles, and enhances driver performance evaluation. As a result, professional-grade simulators are emerging as essential tools in both motorsports and automotive R&D globally.

Consumer Adoption and eSports Integration

The rise of sim racing competitions and online racing leagues is driving the adoption of consumer-grade racing simulators. VR and PC-based simulators are increasingly used by hobbyists and amateur racers to experience realistic driving in competitive environments. Integration with online multiplayer platforms and motion feedback systems provides immersive experiences that appeal to younger, tech-savvy audiences. Gaming influencers and eSports tournaments further amplify consumer demand, creating a vibrant ecosystem for home-based and arcade simulators.

What are the key drivers in the racing simulator market?

Technological Advancements

Rapid advancements in VR/AR, motion feedback platforms, and AI-based simulation software are enhancing realism, improving user engagement, and expanding market opportunities. These innovations appeal to both professional racing teams for driver training and automotive testing, as well as consumers seeking immersive gaming experiences. Software updates and modular hardware systems ensure longevity and customization, driving repeat purchases and higher revenue per user.

Rising Popularity of eSports and Sim Racing

The global eSports ecosystem, including competitive sim racing leagues, is expanding rapidly. Players and enthusiasts invest in high-fidelity simulators to improve skills, compete virtually, and participate in tournaments. Professional eSports sponsorships and prize pools are increasing, attracting mainstream attention and boosting the adoption of both consumer and professional simulators. This growth is particularly strong in North America, Europe, and the Asia-Pacific.

Automotive Industry Adoption

Racing simulators are increasingly used in vehicle testing, driver safety training, and performance evaluation. Automakers are leveraging simulation technologies to reduce costs, improve design accuracy, and optimize vehicle performance. This adoption is further supported by government initiatives promoting automotive R&D, training programs, and technology innovation in regions such as North America, Europe, and the Asia-Pacific.

What are the restraints for the global market?

High Cost of Professional Simulators

Premium simulators with advanced motion platforms, VR capabilities, and AI-driven software remain expensive, limiting adoption among individual consumers and smaller institutions. The high upfront investment and ongoing maintenance costs can discourage potential buyers and restrict market expansion in price-sensitive regions.

Technical Complexity and Maintenance Challenges

Advanced simulators require skilled personnel for installation, calibration, and upkeep. Technical complexity and high maintenance requirements can be barriers for smaller enterprises, educational institutes, and new entrants seeking to adopt simulator solutions, potentially slowing market growth.

What are the key opportunities in the racing simulator industry?

Emerging Markets and Regional Expansion

Asia-Pacific, Latin America, and the Middle East represent high-growth opportunities due to rising disposable incomes, gaming adoption, and investments in eSports infrastructure. Localized and cost-effective simulator packages can attract new consumer segments, while professional-grade solutions are gaining traction among regional automotive and training institutes.

Integration of Advanced Technologies

Opportunities exist to integrate AI analytics, cloud-based multiplayer platforms, and enhanced VR/AR features. These technologies can improve realism, attract professional teams, and differentiate consumer simulators. AI-driven driver coaching and analytics are particularly valuable for professional and educational applications.

Strategic Collaborations

Partnerships with automotive manufacturers, eSports leagues, and educational institutions can open new revenue streams. Simulator providers can offer co-branded solutions, simulator-as-a-service models, and training programs. Government initiatives supporting skill development, technology adoption, and R&D create additional opportunities for market expansion.

Product Type Insights

Professional racing simulators dominate the market, capturing a significant share due to demand from automotive R&D, driver training, and competitive racing. Consumer/home simulators are growing rapidly due to affordability, VR adoption, and eSports integration. Motion platforms, high-precision steering wheels, and VR systems drive premium pricing, while software-focused simulators provide a cost-effective entry point for casual users and gaming enthusiasts.

Application Insights

Professional training and eSports are the leading applications, driven by racing team adoption and competitive gaming growth. Entertainment and gaming use, including arcade and home setups, is expanding, particularly in the Asia-Pacific region. Automotive R&D applications, such as vehicle testing and design validation, are creating consistent demand for high-end simulators. Emerging applications include autonomous vehicle simulation and educational training in driving and engineering programs.

Distribution Channel Insights

Online platforms, including D2C websites and e-commerce marketplaces, dominate simulator sales, providing access to global consumers and easy comparisons. Direct B2B sales cater to automotive manufacturers, racing teams, and educational institutions. Specialty gaming and simulation stores remain relevant for high-end hardware purchases. Subscription and simulator-as-a-service models are emerging for professional and training segments, offering recurring revenue opportunities.

End-User Insights

Automotive manufacturers and racing teams account for the largest share, leveraging simulators for vehicle design, testing, and driver training. Individual consumers and gamers are growing rapidly, particularly in the Asia-Pacific and North America. Educational and training institutes are gradually adopting simulators for skill development. Entertainment centers, including arcades and theme parks, represent a smaller yet expanding segment. Export-driven demand is strong, particularly from North America and Europe, for both professional and consumer-grade simulators.

| By Hardware | By End-use | By Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest market, with the U.S. and Canada driving growth through automotive R&D, professional racing teams, and eSports adoption. Advanced infrastructure, disposable income, and technology adoption contribute to significant demand, capturing approximately 35% of the global market in 2024.

Europe

Europe accounts for roughly 30% of the global market, with Germany, the U.K., and France leading adoption due to motorsport popularity and automotive innovation. The region is characterized by high awareness of professional training simulators and growing eSports participation.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and Australia. Rising gaming culture, disposable income growth, and investment in eSports infrastructure fuel the adoption of both professional and consumer simulators. Growth in VR and PC-based setups is particularly strong.

Latin America

Brazil, Mexico, and Argentina are emerging markets for racing simulators, with increasing demand from gaming enthusiasts and professional racing academies. Outbound purchases from North America and Europe also support growth.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is growing in high-end consumer simulator adoption. Africa is primarily a destination for professional and educational applications, supported by automotive R&D projects and racing academies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Racing Simulator Market

- Logitech

- Thrustmaster

- Fanatec

- SimXperience

- RaceRoom

- Cruden

- VI-grade

- Motion Systems

- Next Level Racing

- SimCraft

- Reiza Studios

- Ozone Simulations

- SimLab

- ProSimu

- Studio 397

Recent Developments

- In March 2025, Logitech launched a new high-fidelity racing wheel and pedal system, optimized for VR integration and competitive eSports use.

- In February 2025, SimXperience unveiled an advanced motion platform simulator for professional racing teams, supporting AI-driven driver analytics and vehicle dynamics testing.

- In January 2025, Fanatec expanded its consumer simulator product line with modular VR-compatible solutions, targeting both home users and eSports enthusiasts in North America and Europe.