Gaming Merchandise Market Size

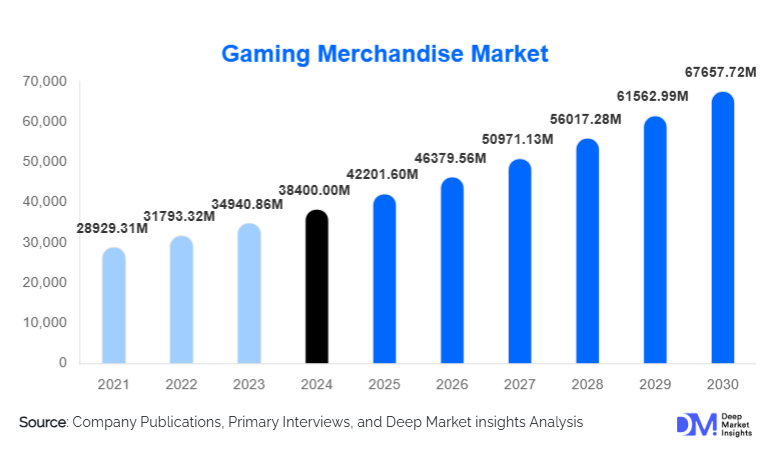

According to Deep Market Insights, the global gaming merchandise market size was valued at USD 38,400 million in 2024 and is projected to grow from USD 42,201.60 million in 2025 to reach USD 67,657.72 million by 2030, expanding at a CAGR of 9.9% during the forecast period (2025–2030). The gaming merchandise market growth is primarily driven by the rapid expansion of the global gaming population, the commercialization of esports, and increasing consumer affinity toward gaming-related lifestyle and fashion products.

Key Market Insights

- Gaming merchandise has evolved into a core revenue stream for publishers, esports teams, and influencers, extending monetization beyond digital gameplay.

- Apparel and wearables dominate product demand, supported by streetwear collaborations and lifestyle branding.

- North America leads the market due to high disposable income, strong IP ownership, and mature esports ecosystems.

- Asia-Pacific is the fastest-growing region, driven by expanding gamer populations in China, India, and Southeast Asia.

- Online direct-to-consumer channels dominate distribution, fueled by exclusive drops, influencer marketing, and global reach.

- Limited-edition and premium collectibles are driving margin expansion and repeat purchases.

What are the latest trends in the gaming merchandise market?

Premiumization and Limited-Edition Drops

Gaming merchandise is increasingly shifting toward premium and limited-edition offerings. Collectibles, high-quality apparel, and exclusive collaborations with designers and artists are enabling brands to command higher price points. Scarcity-driven drops tied to game launches, esports tournaments, or influencer milestones are creating urgency and boosting direct-to-consumer sales. This trend is powerful among collectors and hardcore gamers, who value exclusivity and brand authenticity.

Influencer and Esports-Led Merchandise Growth

Merchandise linked to esports teams, leagues, and gaming influencers is gaining strong traction. Streamers and professional players leverage highly engaged fan communities to launch branded apparel and accessories, often selling out within hours. Revenue-sharing and white-label manufacturing models are lowering entry barriers and accelerating product launches. This trend is reshaping marketing strategies, with social media and live-stream platforms becoming primary sales drivers.

What are the key drivers in the gaming merchandise market?

Expansion of the Global Gaming Population

The global gaming audience continues to expand across age groups and geographies, driving higher demand for physical products that reflect gamer identity. Gaming merchandise enables fans to express affiliation with franchises, teams, and creators beyond digital environments, supporting repeat purchases and long-term brand loyalty.

Growth of Esports and Gaming Culture

The professionalization of esports and the mainstream acceptance of gaming culture are accelerating merchandise demand. Live tournaments, conventions, and online events create strong sales opportunities for team-branded and event-specific merchandise. Esports fandom mirrors traditional sports merchandising, further legitimizing gaming merchandise as a mass-market category.

What are the restraints for the global market?

High Licensing and Royalty Costs

Licensing popular gaming IPs involves significant royalty fees and strict brand guidelines, which can compress margins and limit participation by smaller manufacturers. Negotiating rights for top franchises remains a key challenge for new entrants.

Inventory Risk and Trend Volatility

Gaming trends evolve rapidly, increasing the risk of unsold inventory if merchandise is tied to declining titles or short-lived hype cycles. Companies must balance speed-to-market with demand forecasting accuracy to avoid excess stock and margin erosion.

What are the key opportunities in the gaming merchandise industry?

Emerging Market Expansion in Asia-Pacific and Latin America

Asia-Pacific and Latin America offer substantial growth opportunities due to large, young gaming populations and rising disposable income. Localized designs, affordable price tiers, and region-specific IP collaborations can significantly expand merchandise penetration in these markets.

Technology-Enabled Customization and On-Demand Manufacturing

Advancements in print-on-demand, AI-driven design tools, and small-batch manufacturing enable personalized merchandise with minimal inventory risk. Blockchain-based authentication and digital-physical hybrid collectibles also present premium monetization opportunities.

Product Type Insights

Apparel and wearables remain the dominant product category in the gaming merchandise market, accounting for approximately 34% of total market revenue in 2024. This segment leads primarily due to its high purchase frequency, universal sizing scalability, and strong crossover appeal with streetwear and lifestyle fashion. Gaming-branded apparel, such as hoodies, T-shirts, caps, and jackets, has transitioned from niche fandom items to mainstream casual wear, supported by collaborations with fashion designers, esports teams, and influencers. The relatively lower price points compared to collectibles also encourage impulse buying and repeat purchases, particularly among Gen Z and millennial consumers.

Collectibles and figurines represent the fastest-growing product segment, driven by rising demand for limited-edition releases, premium statues, and licensed figurines tied to AAA franchises and esports milestones. This segment benefits from scarcity-driven pricing, strong resale value, and increasing adoption of authentication technologies such as blockchain certificates. Collector-focused merchandise generates higher margins and strengthens brand loyalty, particularly among hardcore gamers and enthusiasts.

Licensing Type Insights

AAA game franchise licensed merchandise dominates the market with nearly 42% market share, supported by globally recognized intellectual properties, long franchise lifecycles, and continuous content updates. Established franchises benefit from multigenerational fan bases, enabling recurring merchandise refresh cycles aligned with new game launches, downloadable content, and anniversary editions. Strong publisher-backed marketing and strict brand consistency further enhance consumer trust and perceived product value.

Esports team and influencer-branded merchandise is the fastest-growing licensing category, fueled by highly engaged digital communities and direct fan relationships. Unlike traditional IP licensing, influencer-led merchandise leverages authenticity, limited drops, and real-time promotion via streaming platforms and social media. Revenue-sharing models and white-label manufacturing have lowered entry barriers, allowing rapid scaling while maintaining high sell-through rates.

Distribution Channel Insights

Online direct-to-consumer (DTC) platforms lead the gaming merchandise market with approximately 38% market share. This channel’s dominance is driven by exclusive product launches, customization capabilities, higher margins, and direct engagement with fan communities. DTC platforms allow brands to control pricing, manage limited-edition releases, and gather consumer data for targeted marketing, making them particularly effective for influencer and esports merchandise.

Online marketplaces provide volume scalability and global reach, especially for mass-market merchandise and international buyers. Offline specialty stores remain relevant for collectibles and experiential retail, where physical display, authenticity assurance, and impulse purchases play a critical role. Mass retail channels focus on standardized, high-volume products, catering primarily to casual gamers and gift buyers.

End-User Insights

Core and hardcore gamers represent the largest spending segment, accounting for roughly 36% of total market demand. This segment drives consistent purchases across apparel, collectibles, and premium accessories due to strong emotional attachment to franchises and long-term engagement with gaming ecosystems. Higher per-capita spending and willingness to pay for limited editions reinforce their dominance.

Esports fans and collectors are the fastest-growing end-user segments, supported by event-driven purchases, premium pricing strategies, and the rise of digital fandom culture. Tournament-linked drops, signed merchandise, and exclusive collaborations are accelerating demand, particularly among younger demographics seeking community identity and status signaling.

| By Product Type | By Licensing Type | By Distribution Channel | By End User | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global gaming merchandise market, with the U.S. alone contributing nearly 27%. Regional leadership is driven by high disposable income, strong IP ownership by major publishers, and a mature esports and streaming ecosystem. Well-established licensing frameworks, advanced e-commerce infrastructure, and high consumer willingness to pay for premium and limited-edition merchandise further support market dominance. The strong presence of influencer culture and frequent gaming conventions also boosts merchandise sales.

Asia-Pacific

Asia-Pacific holds around 29% market share and is the fastest-growing region, registering a CAGR above 11%. Growth is driven by massive gamer populations, rapid adoption of smartphones and PCs for gaming, and the expansion of esports ecosystems. China, Japan, and South Korea dominate value due to high spending on collectibles and licensed goods, while India and Southeast Asia contribute volume growth through rising youth populations and increasing disposable income. Government support for esports, localized manufacturing, and improving digital payment infrastructure further accelerates regional demand.

Europe

Europe represents approximately 22% of the market, led by Germany, the U.K., and France. Demand is supported by strong affinity for retro gaming franchises, collectibles, and sustainable apparel. European consumers show high sensitivity to ethical sourcing and environmentally friendly materials, driving premium growth and sustainably produced merchandise. The region also benefits from a strong convention culture and cross-border e-commerce adoption.

Latin America

Latin America contributes nearly 9% of global revenue, with Brazil and Mexico leading demand. Growth is driven by rapid esports adoption, expanding internet penetration, and a young, gaming-focused population. Price-sensitive merchandise tiers and team-based esports apparel are particularly popular, while increasing localization of designs is improving market penetration.

Middle East & Africa

The Middle East & Africa region accounts for roughly 6% of the market. Growth is supported by high-income consumers in the GCC, increasing government investment in gaming and esports infrastructure, and a young demographic profile across Africa. Rising smartphone gaming adoption, expanding retail infrastructure, and growing cultural acceptance of gaming are strengthening long-term merchandise demand in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|