Game-Based Learning Market Size

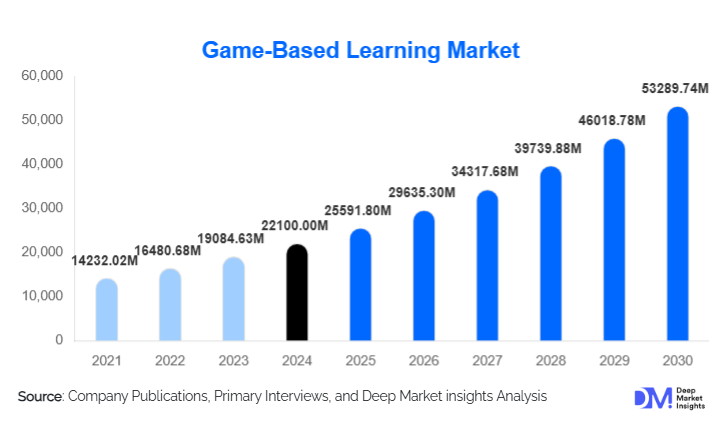

According to Deep Market Insights, the global game-based learning market size was valued at USD 22,100.00 million in 2024 and is projected to grow from USD 25,591.80 million in 2025 to reach USD 53,289.74 million by 2030, expanding at a CAGR of 15.8% during the forecast period (2025–2030). The market growth is primarily driven by the rapid digitalization of education systems, increasing corporate focus on workforce reskilling, and the proven effectiveness of interactive and immersive learning methodologies in improving engagement and knowledge retention.

Key Market Insights

- Digital game-based learning dominates the market, accounting for over two-thirds of total revenue, supported by widespread mobile and cloud adoption.

- Corporate training is the fastest-growing end-use segment, driven by demand for scalable reskilling, leadership development, and compliance training.

- Cloud-based deployment leads, offering cost efficiency, scalability, and real-time analytics for institutions and enterprises.

- North America holds the largest market share, while Asia-Pacific is the fastest-growing region globally.

- AI-enabled adaptive learning games are rapidly gaining traction, enabling personalized learning paths and data-driven performance tracking.

- AR/VR-based simulation learning is expanding adoption in healthcare, defense, and industrial safety training.

What are the latest trends in the game-based learning market?

AI-Powered Personalized Learning Experiences

Artificial intelligence is increasingly being embedded into game-based learning platforms to deliver adaptive, personalized learning journeys. AI algorithms analyze learner behavior, progress, and engagement patterns in real time, dynamically adjusting content difficulty and learning pathways. This trend is particularly strong in corporate training and K–12 education, where learner diversity is high. AI-driven analytics dashboards are also enabling educators and enterprises to measure learning outcomes more effectively, making game-based learning a results-oriented instructional model rather than a supplementary engagement tool.

Immersive AR/VR and Simulation-Based Learning

The adoption of augmented reality (AR) and virtual reality (VR) is transforming game-based learning into highly immersive, experiential environments. Simulation-based games are increasingly used for complex training scenarios such as surgical procedures, military drills, industrial safety, and crisis management. These solutions reduce real-world risk, lower training costs, and improve decision-making capabilities. As AR/VR hardware becomes more affordable, adoption is expanding beyond large enterprises into mid-sized organizations and educational institutions.

What are the key drivers in the game-based learning market?

Rising Demand for Workforce Reskilling and Upskilling

Rapid technological change is forcing organizations to continuously reskill employees in areas such as artificial intelligence, data analytics, cybersecurity, and digital collaboration. Game-based learning provides scalable, engaging, and measurable training solutions, making it a preferred alternative to traditional classroom or static e-learning models. Enterprises are increasingly adopting subscription-based game learning platforms to support continuous professional development.

Growing Adoption of Digital Learning in Education

Educational institutions globally are modernizing curricula to improve student engagement and learning outcomes. Game-based learning aligns with digital-native student expectations and supports interactive STEM education, problem-solving, and collaborative learning. Government-backed digital education initiatives and increased EdTech funding are further accelerating adoption, particularly in emerging economies.

What are the restraints for the global market?

High Development and Content Creation Costs

Developing high-quality educational games—especially those incorporating AI, AR, or VR—requires significant investment in technology, instructional design, and subject matter expertise. These high upfront costs can limit adoption among smaller institutions and restrict market entry for new players without strong funding.

Resistance from Traditional Education Frameworks

In some regions, conservative academic structures and limited teacher training hinder the adoption of game-based methodologies. Skepticism regarding the academic rigor of learning games and challenges in aligning them with standardized curricula can slow penetration in public education systems.

What are the key opportunities in the game-based learning industry?

Government-Led Digital Education Programs

Governments across Asia-Pacific, the Middle East, and Latin America are investing heavily in digital education infrastructure. National initiatives aimed at improving digital literacy, reducing learning gaps, and expanding vocational training present significant opportunities for scalable, cloud-based game learning platforms tailored to public education systems.

Expansion into Healthcare and Defense Training

Game-based simulations are increasingly being adopted in healthcare and defense for high-stakes training applications. Medical institutions are using serious games for surgical simulations and clinical decision-making, while defense organizations are leveraging them for tactical training. These segments offer high-value, long-term contracts and strong barriers to entry.

Learning Mode Insights

Digital game-based learning continues to dominate the global market, accounting for approximately 68% of total revenue in 2024. This leadership is primarily driven by the widespread adoption of mobile- and PC-based learning platforms that enable anytime, anywhere access to educational content. The rapid proliferation of smartphones, increased internet penetration, and growing acceptance of remote and hybrid learning models have significantly accelerated demand for digital game-based learning solutions. Additionally, digital platforms allow for seamless integration of advanced technologies such as artificial intelligence, real-time analytics, cloud computing, and adaptive learning algorithms, making them highly scalable and cost-efficient for both educational institutions and enterprises.

Digital game-based learning is particularly strong in K–12 education, higher education, and corporate training, where interactive simulations, gamified assessments, and personalized learning paths improve engagement and knowledge retention. The ability to continuously update content, track learner performance, and deploy subscription-based models further reinforces the dominance of this segment.

End-User Insights

Academic institutions account for approximately 41% of global game-based learning demand, making them the largest end-user segment in 2024. This dominance is led by K–12 education, where schools increasingly adopt game-based learning to improve student engagement, reduce dropout rates, and enhance learning outcomes in subjects such as mathematics, science, and language learning. Governments and education boards are actively encouraging digital curriculum modernization, further strengthening adoption across public and private schools.

Corporate and enterprise learning is the fastest-growing end-user segment, expanding at a CAGR of nearly 18% during the forecast period. Organizations are increasingly leveraging game-based learning for employee onboarding, leadership development, compliance training, and technical skill development. The segment’s rapid growth is driven by the need for continuous reskilling amid digital transformation, remote work adoption, and evolving job roles. Gamified learning platforms offer measurable performance outcomes, higher completion rates, and improved learner motivation, making them attractive alternatives to traditional training methods.

Deployment Model Insights

Cloud-based deployment dominates the game-based learning market with approximately 72% market share in 2024. The segment’s leadership is driven by its scalability, lower upfront infrastructure costs, rapid deployment capabilities, and centralized content management. Cloud platforms enable real-time data analytics, learner performance tracking, and seamless content updates, making them highly suitable for large-scale deployments across schools, universities, and multinational enterprises.

The growing preference for subscription-based software-as-a-service (SaaS) models further strengthens cloud adoption, as organizations seek predictable pricing and flexible usage. Cloud deployment is also critical in supporting AI-driven personalization and cross-device accessibility, which are key differentiators in modern game-based learning platforms. On-premise deployment continues to maintain relevance in defense, government, and highly regulated industries, where data sovereignty, security, and compliance requirements are paramount. While this segment represents a smaller share of the overall market, it remains strategically important due to higher contract values and long-term deployment cycles.

| By Learning Mode | By End User | By Deployment Model | By Technology |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is expected to account for approximately 38% of the global game-based learning market in 2024, making it the largest regional market. The United States is the primary contributor, supported by high EdTech penetration, strong corporate training budgets, and early adoption of advanced technologies such as AI, AR, and VR. The region benefits from a mature digital learning ecosystem, strong venture capital funding, and the presence of leading game-based learning and EdTech providers.

Corporate demand for workforce reskilling, particularly in technology-driven industries such as IT, healthcare, and financial services, is a key driver of regional growth. Additionally, favorable government initiatives promoting digital education and STEM learning in schools further reinforce North America’s market leadership.

Europe

Europe holds approximately 24% of the global market share, with strong demand from countries such as the United Kingdom, Germany, and France. Regional growth is driven by progressive digital education policies, widespread adoption of e-learning platforms, and strong emphasis on lifelong learning and workforce upskilling. European enterprises are increasingly integrating game-based learning into corporate training to improve employee engagement and compliance training effectiveness.

Additionally, the region’s focus on data privacy, quality standards, and structured learning frameworks has encouraged the development of robust, outcome-driven game-based learning solutions, supporting sustained market expansion.

Asia-Pacific

Asia-Pacific represents nearly 28% of the global market and is the fastest-growing region, with a CAGR exceeding 19%. Growth is led by China and India, supported by large student populations, rapid digitalization of education systems, and government-backed digital learning initiatives. Expanding corporate sectors in IT, manufacturing, and services are also driving enterprise adoption of game-based training platforms.

Rising smartphone penetration, improving internet infrastructure, and increasing investment in EdTech startups are further accelerating market growth across Southeast Asia, Japan, and South Korea. The region’s scale and cost sensitivity are encouraging the adoption of cloud-based, mobile-first game learning solutions.

Latin America

Latin America accounts for approximately 4% of global market share, with Brazil and Mexico leading regional demand. Growth in this region is supported by rising digital literacy, expanding access to affordable internet, and increasing adoption of cloud-based education platforms. Governments and private institutions are gradually modernizing education delivery models, creating opportunities for scalable game-based learning solutions.

While market penetration remains lower than in developed regions, increasing awareness of interactive learning benefits and growing enterprise training needs are expected to drive steady long-term growth.

Middle East & Africa

The Middle East & Africa region accounts for approximately 6% of global demand. Growth is driven by government-led education reform programs, defense training investments, and national digital transformation agendas. Countries such as the UAE and Saudi Arabia are investing heavily in smart education infrastructure, EdTech platforms, and immersive learning technologies as part of broader economic diversification strategies.

In Africa, increasing adoption of mobile-based learning platforms, supported by international development programs and improving connectivity, is expanding access to game-based learning, particularly in K–12 and vocational education.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|