Global Functional Ice Cream Market Size

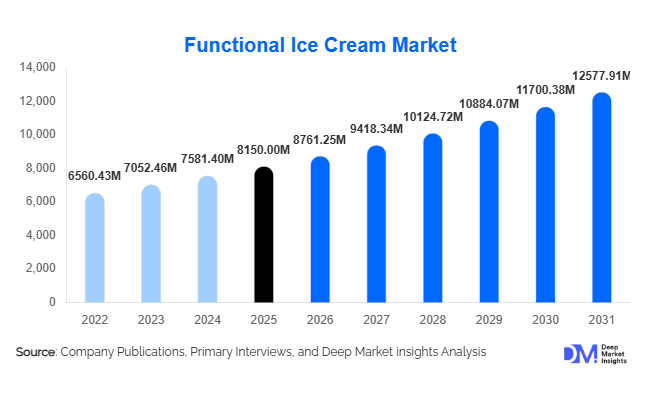

According to Deep Market Insights,the global functional ice cream market size was valued at USD 8,150 million in 2025 and is projected to grow from USD 8,761.25 million in 2026 to reach USD 12,577.91 million by 2031, expanding at a CAGR of 7.5% during the forecast period (2026–2031). The functional ice cream market growth is primarily driven by rising consumer awareness of health and wellness, increasing demand for fortified desserts, and the growing popularity of plant-based and protein-enriched frozen treats.

Key Market Insights

- Probiotic and digestive health-focused ice creams are gaining traction, appealing to consumers seeking gut health benefits and immunity support.

- Plant-based and dairy-free functional ice creams are expanding rapidly, driven by lactose intolerance, vegan trends, and environmental awareness.

- North America dominates the global market, with the U.S. and Canada accounting for the largest share due to high disposable income and premiumization trends.

- Asia-Pacific is the fastest-growing region, led by China and India, where rising urbanization and middle-class expansion drive demand for innovative health-focused ice creams.

- Supermarkets and hypermarkets remain the leading distribution channel, offering wide accessibility and visibility for functional ice cream products.

- Technological advancements, including microencapsulation of probiotics, plant protein integration, and e-commerce distribution, are reshaping production, shelf life, and consumer accessibility.

What are the latest trends in the functional ice cream market?

Health and Wellness-Driven Consumption

Consumers are increasingly seeking desserts that combine indulgence with health benefits. Probiotic, protein-enriched, low-sugar, and vitamin-fortified ice creams are becoming mainstream offerings. Products targeting gut health, immunity, and weight management are capturing high-value consumers in urban regions of North America, Europe, and APAC. Marketing campaigns emphasizing functional benefits alongside premium flavors are strengthening consumer engagement. Functional ice creams are also being promoted as part of fitness diets and wellness routines, enhancing adoption in households and health-conscious consumer segments.

Plant-Based and Alternative Ingredient Innovations

The rise of veganism, lactose intolerance awareness, and environmental consciousness is driving adoption of plant-based functional ice creams. Ingredients such as soy protein, almond milk, oat milk, and coconut milk are increasingly fortified with probiotics, vitamins, and minerals. Food technology innovations, including microencapsulation and advanced blending techniques, allow these functional ingredients to maintain texture, flavor, and shelf life. This trend appeals particularly to younger, health-conscious consumers and premium urban segments seeking both ethical and nutritional benefits in their dessert choices.

What are the key drivers in the functional ice cream market?

Rising Health-Conscious Consumer Base

Globally, consumers are increasingly replacing traditional indulgent ice creams with functional alternatives. Awareness of obesity, diabetes, and digestive health issues is encouraging the adoption of probiotic, low-sugar, and vitamin-fortified ice creams. In 2025, health-focused variants accounted for approximately 35% of global functional ice cream sales, reflecting their dominance in consumer preference.

Technological Innovation in Product Development

Advanced food technologies enable companies to integrate sensitive functional ingredients without compromising taste or texture. Techniques such as microencapsulation of probiotics, protein enrichment, and vitamin fortification improve nutrient stability and shelf life. Companies investing in such technologies gain a competitive edge, particularly in premium and plant-based segments.

Premiumization and Flavor Innovation

Consumers are willing to pay higher prices for functional ice creams that combine unique flavors with health benefits. Innovations including adaptogen-fortified ice creams, immune-boosting formulations, and customized protein blends are driving category growth. This trend is particularly strong in North America and Europe, where premium product adoption is highest.

What are the restraints for the global market?

High Production Costs

Functional ingredients such as probiotics, vitamins, and plant proteins require specialized processing, increasing manufacturing costs by 15–20% compared to conventional ice cream. This higher price point can limit adoption in price-sensitive emerging markets, posing a key restraint for market growth.

Regulatory and Compliance Challenges

Strict labeling and fortification regulations in Europe, North America, and APAC increase time-to-market and compliance costs. Companies need to adhere to nutritional claims standards, which can slow product launches and restrict flexibility in innovation. Regulatory challenges remain a significant barrier to rapid global expansion.

What are the key opportunities in the functional ice cream market?

Expansion in Emerging Markets

Rising urbanization and middle-class incomes in APAC and LATAM offer significant growth potential. Markets like China and India are witnessing a shift toward premiumization and health-oriented diets, creating opportunities for companies to introduce probiotic, protein-enriched, and low-calorie functional ice creams. Early entry into these markets allows companies to capture a first-mover advantage and establish brand loyalty among growing consumer bases.

Technological Advancements in Ingredient Integration

Advanced food processing techniques, including microencapsulation and shelf-life optimization, allow manufacturers to preserve sensitive functional ingredients while maintaining taste and texture. Companies leveraging these technologies can create high-margin products that appeal to urban, health-conscious consumers globally.

E-Commerce and Direct-to-Consumer Channels

The expansion of online grocery platforms and D2C subscriptions provides an efficient channel to reach health-focused urban consumers. Digital channels reduce reliance on traditional retail, improve margins, and allow companies to engage consumers directly with personalized offers and product innovations, fostering brand loyalty.

Product Type Insights

Probiotic ice creams dominate the market, accounting for 30% of global functional ice cream sales in 2025. Their leadership is driven by strong consumer demand for digestive health products, particularly in North America and Europe. Protein-enriched and vitamin-fortified ice creams are also gaining traction, especially in APAC and emerging economies, as urban consumers seek functional desserts aligned with fitness and wellness goals.

Application Insights

Household consumption remains the largest application, contributing 55% of the 2025 market. Fitness and sports nutrition segments are growing rapidly at a CAGR of approximately 9–10%, driven by demand for protein-enriched and low-sugar variants. Healthcare and institutional catering are emerging as new applications, with hospitals and wellness centers increasingly incorporating functional ice creams into dietary programs. Export-driven demand is rising in APAC, with global exports estimated at USD 1,250 million in 2025.

Distribution Channel Insights

Supermarkets and hypermarkets account for 45% of global functional ice cream sales in 2025, offering wide product accessibility and visibility. Specialty stores, online retail, and HoReCa channels are also growing, with e-commerce providing direct-to-consumer engagement, subscription models, and access to urban premium buyers. Convenience stores are increasingly stocking low-sugar and protein variants to target impulse purchases.

| By Product Type | By Function / Health Benefit | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 35% of the global market share, led by the U.S. and Canada. High disposable income, urbanization, and consumer awareness of health and wellness drive demand for premium functional ice creams. Probiotic, protein-enriched, and plant-based variants dominate, particularly in urban centers with high retail density.

Europe

Europe accounts for approximately 30% of global market share, with Germany, UK, and France leading demand. European consumers are increasingly focused on low-sugar, vitamin-fortified, and plant-based ice creams. Sustainability and clean-label preferences further boost adoption of functional desserts.

Asia-Pacific

APAC is the fastest-growing region, led by China and India, due to rising middle-class affluence and urbanization. Protein-enriched and fortified plant-based ice creams are gaining popularity. Japan and Australia represent mature markets with steady demand focused on premium and immunity-boosting variants.

Latin America

Brazil, Argentina, and Mexico are emerging markets for functional ice cream. Demand is growing among affluent consumers for mid-range and premium fortified products, with export-driven imports supplementing domestic production.

Middle East & Africa

MEA accounts for a smaller share (~5%), with the UAE, Saudi Arabia, and South Africa showing gradual adoption. Premium products dominate in urban centers, supported by rising disposable incomes and exposure to international dietary trends.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|