Functional Food Probiotics Market Size

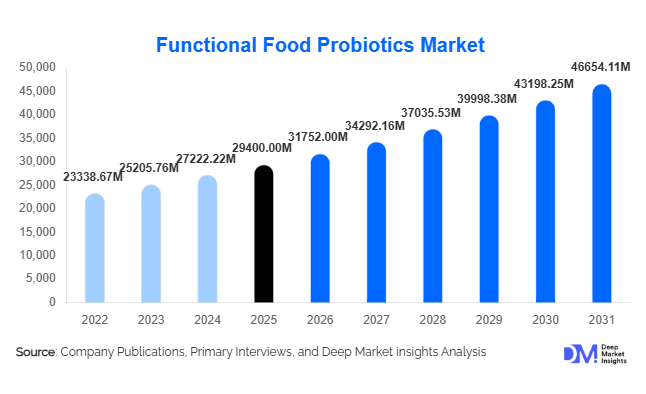

According to Deep Market Insights, the global functional food probiotics market size was valued at USD 29,400 million in 2025 and is projected to grow from USD 31,752.00 million in 2026 to reach USD 46,654.11 million by 2031, expanding at a CAGR of 8.0% during the forecast period (2026–2031). The functional food probiotics market growth is primarily driven by rising consumer awareness of digestive health, increasing demand for immunity-boosting foods, and the growing integration of clinically validated probiotic strains into mainstream food and beverage products.

Probiotic-enriched dairy products continue to dominate global consumption, while non-dairy alternatives are rapidly gaining traction due to lactose intolerance prevalence and the surge in plant-based diets. Asia-Pacific and North America collectively account for a significant share of global demand, supported by strong retail penetration, established cold-chain infrastructure, and aggressive product innovation. Advances in strain stabilization, microencapsulation, and spore-forming probiotics are enabling manufacturers to expand beyond refrigerated dairy into bakery, cereals, and shelf-stable beverages. As preventive healthcare becomes a central consumer priority, probiotic functional foods are transitioning from niche wellness products to daily dietary essentials.

Key Market Insights

- Probiotic dairy products account for nearly 48% of global revenue in 2025, led by yogurt and fermented milk beverages.

- Lactobacillus strains dominate the microbial segment with approximately 42% share, owing to strong clinical validation and regulatory acceptance.

- North America holds around 32% of the global market share, supported by high awareness and premium product consumption.

- Asia-Pacific is the fastest-growing region, projected to expand at a 9–10% CAGR through 2031.

- Supermarkets and hypermarkets account for nearly 55% of global distribution, although online retail is growing at over 12% CAGR.

- The top five players collectively control approximately 40% of the global market, reflecting moderate consolidation.

What are the latest trends in the functional food probiotics market?

Shift Toward Plant-Based and Dairy-Free Probiotics

Consumers are increasingly seeking dairy-free probiotic formats, driven by lactose intolerance, vegan lifestyles, and sustainability concerns. Oat-, almond-, and coconut-based probiotic beverages are rapidly expanding their shelf space across North America, Europe, and Asia. Manufacturers are investing in advanced strain stabilization technologies to ensure probiotic viability in non-dairy matrices. This shift is broadening the addressable consumer base and reducing reliance on traditional refrigerated dairy formats.

Strain-Specific and Clinically Validated Formulations

Scientific validation has become a key differentiator in the functional food probiotics market. Companies are investing in research-backed strains targeting specific health outcomes such as digestive balance, immunity enhancement, and women’s health. Transparent labeling, CFU count disclosures, and strain identification are increasingly influencing purchasing decisions. This trend is strengthening premiumization and enabling manufacturers to command higher margins in developed markets.

What are the key drivers in the functional food probiotics market?

Rising Focus on Preventive Healthcare

Growing global awareness of gut microbiome health has significantly boosted demand for probiotic foods. Increased antibiotic usage, digestive disorders, and post-pandemic immunity concerns have driven consumers to incorporate probiotic yogurt, beverages, and fortified snacks into daily diets. Public health narratives promoting preventive nutrition further reinforce long-term growth.

Expansion of the Functional Food Industry

The broader functional food sector is expanding at approximately 7–9% CAGR, directly benefiting probiotic ingredients. Retail chains are dedicating more shelf space to probiotic SKUs, while manufacturers are diversifying into bakery, cereals, confectionery, and clinical nutrition segments. Technological advancements in microencapsulation and spore-forming strains are enabling shelf-stable product innovations, unlocking new growth avenues.

What are the restraints for the global market?

Regulatory Restrictions on Health Claims

Strict regulatory frameworks, particularly in Europe, limit the use of unsubstantiated probiotic health claims. Compliance costs, clinical trial requirements, and lengthy approval timelines increase operational complexity and restrict rapid product launches.

High Production and Cold-Chain Costs

Maintaining viable probiotic counts requires controlled fermentation, advanced encapsulation, and reliable cold-chain logistics. In developing economies, infrastructure limitations and cost pressures can restrict penetration and reduce affordability.

What are the key opportunities in the functional food probiotics industry?

Personalized and Microbiome-Based Nutrition

Advancements in microbiome research are creating opportunities for personalized probiotic functional foods. Direct-to-consumer platforms offering tailored formulations based on gut health profiling are emerging as high-margin niches. AI-driven recommendations and subscription models are strengthening recurring revenue streams and brand loyalty.

Emerging Market Penetration

Rapid urbanization and rising middle-class incomes in India, China, Brazil, and Southeast Asia present significant volume growth potential. Governments promoting local dairy processing and biotechnology under initiatives such as “Make in India” and “Made in China 2026” are supporting domestic probiotic production infrastructure. Localization of flavors and affordable pack sizes will further enhance adoption.

Product Type Insights

Probiotic dairy products continue to dominate the global functional food probiotics market, with an estimated 48% share in 2025. The segment’s leadership is primarily driven by deep-rooted consumer familiarity with yogurt and fermented milk drinks, strong brand equity built over decades, and well-established cold-chain distribution infrastructure across North America, Europe, and parts of Asia-Pacific. In addition, dairy provides a naturally supportive matrix for probiotic survival, enabling higher CFU stability and stronger clinical positioning. Regular consumption patterns, particularly daily yogurt intake in Europe and fermented milk beverages in Japan and China, further reinforce recurring revenue streams for manufacturers.

Non-dairy probiotic beverages represent the fastest-growing product category, expanding at over 10% CAGR, fueled by rising vegan populations, lactose intolerance prevalence (especially in Asia and Africa), and sustainability-driven consumer choices. Plant-based substrates such as oat, almond, soy, and coconut are enabling brands to reach new demographics while reducing reliance on refrigerated supply chains through improved shelf-stable formulations. Probiotic bakery, cereals, and snack bars are gaining traction due to advancements in microencapsulation technology, allowing viable strains to withstand baking temperatures. Meanwhile, probiotic confectionery, particularly gummies and chewables, is expanding among younger consumers and on-the-go professionals, supported by convenience and improved taste profiles.

Application Insights

Digestive health remains the dominant application, accounting for nearly 50% of total market revenue in 2025. The segment leads due to widespread clinical validation of probiotic efficacy in managing bloating, irritable bowel syndrome (IBS), and antibiotic-associated diarrhea. Strong medical endorsements and increasing physician recommendations have strengthened consumer trust, making digestive positioning the core value proposition across dairy and beverage formats.

Immunity enhancement applications gained substantial momentum post-pandemic and continue to grow as consumers prioritize preventive nutrition. Women’s health probiotics, targeting vaginal microbiota balance and hormonal wellness, are emerging as a premium niche, while weight management formulations are gaining interest among health-conscious urban populations. Clinical and infant nutrition applications are expanding at a 9–11% CAGR, supported by increasing integration of probiotics into pediatric formulas, elderly nutrition products, and hospital dietary programs. This growth is reinforced by rising birth rates in select developing economies and aging populations in developed regions.

Distribution Channel Insights

Supermarkets and hypermarkets dominate distribution with around 55% market share, driven by high consumer footfall, extensive refrigerated aisles, and strong private-label penetration. The dominance of this channel is further supported by impulse purchases and promotional bundling strategies, especially in dairy-heavy markets such as the United States, Germany, and Japan.

Pharmacies and specialty health stores maintain strategic importance for clinically positioned probiotic functional foods, particularly those marketed for digestive disorders and pediatric health. Online retail is expanding rapidly at approximately 12% CAGR, driven by subscription-based probiotic beverage deliveries, direct-to-consumer brand models, and increasing consumer preference for personalized nutrition platforms. Digital marketing, influencer endorsements, and targeted health campaigns are accelerating e-commerce penetration globally.

Consumer Demographics Insights

Adults aged 18–45 account for nearly 60% of total consumption, driven by growing fitness culture, urban lifestyles, and preventive health awareness. This segment demonstrates strong purchasing power and brand engagement, particularly for plant-based and premium probiotic offerings. The geriatric population is a steadily expanding segment, supported by rising digestive sensitivities, weakened immunity, and increasing healthcare expenditures in aging societies such as Japan, Germany, and Italy. Children and infant segments are gaining momentum through fortified baby foods and pediatric probiotic yogurts, encouraged by parental awareness and pediatric recommendations. The integration of probiotics into school nutrition programs in select regions is also contributing to long-term demographic expansion.

| By Product Type | By Application | By Distribution Channel | By Consumer Demographics |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global market share in 2025, with the United States contributing nearly 75% of the regional demand. Regional growth is primarily driven by high consumer awareness of gut health, strong penetration of functional foods, and advanced cold-chain infrastructure. Premium pricing strategies and widespread availability of probiotic yogurt, beverages, and snack bars support revenue expansion. Canada contributes through innovation in dairy-based probiotic formulations and strong regulatory oversight that enhances consumer confidence. The rapid rise of plant-based diets and e-commerce subscription models further strengthens regional growth prospects.

Europe

Europe holds nearly 28% market share, led by Germany, France, and the United Kingdom. The region benefits from a long-standing culture of fermented dairy consumption and strong demand for clean-label, scientifically validated products. Regulatory scrutiny by European authorities encourages high-quality standards, which enhances consumer trust and supports premium pricing. Eastern Europe is emerging as a volume-growth zone due to increasing disposable income and affordable probiotic dairy offerings. Sustainability initiatives and carbon-neutral production targets are also shaping purchasing behavior in Western Europe.

Asia-Pacific

Asia-Pacific commands roughly 30% share and remains the fastest-growing region, expanding at a 9–10% CAGR. China and Japan dominate consumption, supported by cultural familiarity with fermented foods and large urban populations. Japan’s established probiotic beverage culture and China’s expanding middle class are key growth engines. India represents the fastest-growing national market, driven by rising urbanization, improving dairy processing infrastructure, and government initiatives supporting domestic food manufacturing. Increasing health awareness, rising disposable incomes, and expanding modern retail networks across Southeast Asia are further accelerating regional demand.

Latin America

Latin America contributes approximately 6% of global demand, with Brazil and Mexico leading probiotic dairy beverage consumption. Growth drivers include improving retail infrastructure, rising middle-class populations, and increasing awareness of digestive health. Local dairy cooperatives are expanding probiotic product portfolios to capture urban consumers, while international brands are investing in regional manufacturing facilities to reduce import dependency.

Middle East & Africa

The Middle East & Africa account for around 4% share of the global market. The UAE and Saudi Arabia drive demand through premium retail expansion, high per capita income, and strong import networks. South Africa leads sub-Saharan consumption due to established dairy industries and growing urban populations. Infrastructure development, cold-chain improvements, and increasing health awareness campaigns are expected to accelerate regional growth. However, pricing sensitivity and distribution challenges in rural areas remain structural constraints that companies must address to unlock full market potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Functional Food Probiotics Market

- Danone

- Yakult Honsha

- Nestlé

- Chr. Hansen

- BioGaia

- Lallemand

- General Mills

- PepsiCo

- Lactalis

- Arla Foods

- Morinaga Milk Industry

- Meiji Holdings

- Fonterra

- Kerry Group

- DSM-Firmenich