Functional Flour Market Size

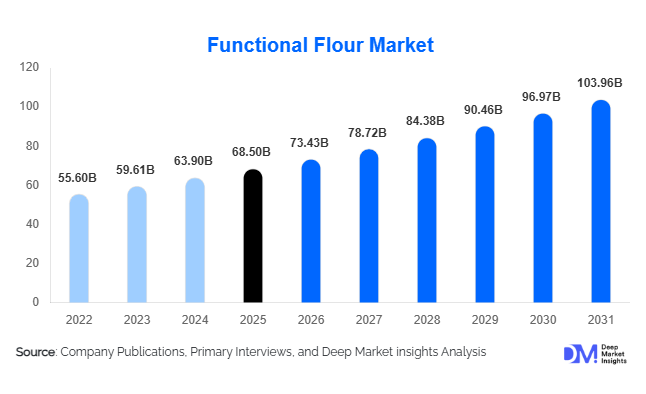

According to Deep Market Insights, the global functional flour market size was valued at USD 68.5 billion in 2025 and is projected to grow from USD 73.43 billion in 2026 to reach USD 103.96 billion by 2031, expanding at a CAGR of 7.2% during the forecast period (2026–2031). The functional flour market growth is primarily driven by increasing demand for health-oriented food products, rising prevalence of lifestyle-related disorders such as diabetes and obesity, and the rapid reformulation of staple foods with enhanced nutritional and functional benefits.

Key Market Insights

- Functional flours are increasingly replacing conventional flour in bakery and processed foods due to their added benefits, such as digestive health, protein enrichment, and glycemic control.

- Protein-enriched and fiber-enriched flours dominate demand, supported by sports nutrition, weight management, and clean-label product trends.

- North America leads the global market, driven by strong consumer awareness, advanced food processing infrastructure, and high adoption of functional foods.

- Asia-Pacific is the fastest-growing region, supported by food fortification programs, rising middle-class income, and expanding processed food consumption.

- B2B demand from food manufacturers accounts for the majority of sales, reflecting large-scale industrial adoption across bakery, snacks, and convenience foods.

- Technological advancements in enzymatic processing, micronutrient stabilization, and protein extraction are improving product performance and scalability.

What are the latest trends in the functional flour market?

Rising Demand for Digestive Health and Low-GI Formulations

Digestive health-focused functional flours, including prebiotic fiber-enriched and resistant starch flours, are gaining strong traction globally. Increasing awareness of gut health and its link to immunity and overall wellness has accelerated demand across bakery, cereals, and medical nutrition applications. Low-glycemic index flours are increasingly incorporated into diabetic-friendly foods, particularly in North America and Europe, where food manufacturers are reformulating everyday staples to address blood sugar management concerns.

Expansion of Plant-Based and Pulse-Based Functional Flours

Pulse-based and pseudocereal-based functional flours derived from chickpeas, lentils, peas, quinoa, and amaranth are witnessing rapid growth. These flours offer high protein content, gluten-free properties, and sustainable sourcing advantages. Demand is particularly strong in plant-based foods, vegan bakery products, and clean-label snacks. Sustainability considerations and lower carbon footprints compared to traditional wheat are further strengthening adoption among global food brands.

What are the key drivers in the functional flour market?

Growing Health-Conscious Consumer Base

Rising consumer focus on preventive healthcare through diet is a primary driver of the functional flour market. Functional flours enable food manufacturers to deliver added health benefits such as improved digestion, enhanced protein intake, and cardiovascular support without altering consumer eating habits. Increasing diagnosis rates of obesity and diabetes are accelerating demand for fortified and low-GI flour-based foods across both developed and emerging markets.

Food Fortification Policies and Regulatory Support

Government-led food fortification initiatives are significantly contributing to market growth. Several countries across Asia, Africa, and Latin America are promoting fortified staple foods to combat micronutrient deficiencies. These initiatives are driving large-scale demand for vitamin- and mineral-fortified functional flours, particularly in public distribution systems, school feeding programs, and institutional catering.

What are the restraints for the global market?

High Production and Processing Costs

Functional flours require advanced processing techniques such as enzymatic modification, protein isolation, and micronutrient encapsulation, which increase production costs. This limits price competitiveness in cost-sensitive regions and poses challenges for mass-market adoption, particularly in developing economies where conventional flour remains dominant.

Raw Material Price Volatility

Fluctuating prices of wheat, pulses, and specialty grains directly impact functional flour manufacturing costs and profit margins. Climate variability, supply chain disruptions, and geopolitical factors affecting agricultural commodities remain persistent challenges for long-term pricing stability.

What are the key opportunities in the functional flour industry?

Growth of Medical and Clinical Nutrition Applications

Functional flours are increasingly being used in medical nutrition products designed for elderly care, diabetes management, and cardiac health. Hospitals, care facilities, and nutraceutical brands are adopting food-based functional solutions, creating high-margin, long-term demand opportunities for manufacturers.

Regional Expansion in Asia-Pacific and the Middle East

Rapid urbanization, rising income levels, and government nutrition programs in Asia-Pacific and the Middle East present strong growth opportunities. Customized functional flour formulations aligned with local dietary habits are gaining traction, enabling both multinational and regional players to scale operations effectively.

Product Type Insights

Protein-enriched functional flour represents the largest product segment, accounting for approximately 28.6% of the global market in 2025. This segment’s leadership is driven by the rapid expansion of sports nutrition, high-protein bakery products, and meal replacement foods, particularly in North America and Europe. Food manufacturers are increasingly using protein-enriched flours derived from wheat, pulses, and pseudocereals to enhance nutritional density while maintaining familiar taste and texture profiles. Rising consumer preference for high-protein diets, muscle recovery products, and satiety-enhancing foods continues to reinforce this segment’s dominance.

Fiber-enriched and digestive health functional flours represent the second-largest product category, supported by growing awareness of gut health, immunity, and metabolic wellness. Prebiotic fibers, resistant starches, and beta-glucan-rich flours are increasingly incorporated into breads, cereals, and snacks to support digestive regulation and cholesterol management. Meanwhile, gluten-free functional flours are among the fastest-growing product types, particularly in North America and Europe, driven by rising diagnoses of celiac disease, gluten sensitivity, and lifestyle-driven gluten avoidance. Improvements in formulation technology have significantly enhanced the baking performance of gluten-free flours, accelerating adoption across mainstream food categories.

Application Insights

Bakery and confectionery applications account for the largest share of functional flour consumption, representing nearly 36.8% of global demand in 2025. Bread, biscuits, cakes, and snacks are increasingly reformulated using functional flours to improve protein content, fiber levels, and glycemic response without altering traditional consumption patterns. The ability of functional flours to integrate seamlessly into existing bakery formulations makes this application segment the primary revenue driver globally.

Processed and convenience foods form the second-largest application segment, driven by rising urbanization, busy lifestyles, and demand for ready-to-eat and ready-to-cook products with enhanced nutritional value. Functional and medical nutrition represents the fastest-growing application, supported by aging populations, increasing prevalence of chronic diseases, and growing reliance on food-based nutritional interventions. Functional flours are increasingly used in meal replacements, clinical nutrition formulas, and fortified foods designed for elderly and diabetic populations, particularly in developed economies.

Distribution Channel Insights

B2B distribution dominates the functional flour market, accounting for approximately 62% of total sales, driven by bulk procurement from bakery manufacturers, processed food companies, and nutrition product producers. Large-scale food manufacturers prefer long-term supply contracts with functional flour producers to ensure consistent quality, formulation stability, and cost efficiency, reinforcing the dominance of this channel.

Retail distribution through supermarkets, hypermarkets, and specialty health food stores is expanding steadily as consumer awareness of functional ingredients increases. Branded functional flour products targeting home bakers, fitness-focused consumers, and gluten-free households are gaining shelf space. Online and direct-to-consumer channels are growing at a faster pace, supported by targeted digital marketing, subscription-based nutrition models, and growing demand for specialty and customized functional flour blends. These channels are particularly effective in reaching health-conscious and younger consumers.

End-Use Industry Insights

Food and beverage manufacturing remains the primary end-use industry for functional flours, driven by large-scale adoption across bakery, snacks, cereals, and convenience foods. Manufacturers are increasingly using functional flours to differentiate products, comply with clean-label trends, and meet nutritional claims related to protein, fiber, and digestive health.

Institutional and foodservice demand is rising steadily through hospitals, schools, corporate catering, and elderly care facilities, where nutritionally optimized meals are becoming a priority. Export-driven demand is particularly strong in the Asia-Pacific region, with functional flour-based processed food exports growing at over 8% annually, supported by rising global demand for fortified and value-added food products. Emerging applications in infant nutrition and geriatric care foods are further expanding the end-use landscape, creating long-term, high-margin demand opportunities.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 32.4% of the global functional flour market in 2025, making it the largest regional market. The United States dominates regional demand due to high consumer awareness of functional nutrition, advanced food processing infrastructure, and widespread adoption of clean-label and fortified food products. Strong demand from sports nutrition, medical nutrition, and premium bakery segments continues to support market leadership. Additionally, well-established regulatory frameworks and high R&D investments by ingredient manufacturers enable the rapid commercialization of innovative functional flour formulations.

Europe

Europe holds around 27.1% of the global market share, led by Germany, France, and the United Kingdom. Growth in the region is driven by strong regulatory support for food fortification, high consumer demand for sustainable and plant-based products, and increasing prevalence of gluten intolerance. European consumers show a strong preference for fiber-rich, digestive health, and clean-label foods, encouraging manufacturers to integrate functional flours into everyday staples. Sustainability-driven sourcing and strict food quality standards further reinforce adoption across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR of 8.6%. China and India together account for more than 60% of regional demand, supported by large populations, government-led nutrition and food fortification initiatives, and rapid expansion of the processed food industry. Rising urbanization, increasing disposable incomes, and growing awareness of lifestyle-related diseases are accelerating demand for protein-enriched and low-glycemic functional flours. The region also benefits from expanding export-oriented food manufacturing, positioning Asia-Pacific as a key growth engine for the global market.

Latin America

Latin America is experiencing steady growth, led by Brazil and Mexico. Rising middle-class income, increasing consumption of packaged foods, and gradual adoption of fortified food products are supporting market expansion. Government-backed nutrition programs and growing awareness of dietary health are encouraging food manufacturers to incorporate functional flours, particularly in bakery and staple food applications.

Middle East & Africa

The Middle East & Africa region is witnessing moderate but stable growth driven by food security initiatives, wheat fortification programs, and increasing reliance on imported functional food ingredients. Governments across the region are prioritizing fortified staples to address micronutrient deficiencies, while rising urban populations and expanding foodservice sectors are supporting incremental demand for functional flours.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|