Fruit Fillings Market Size

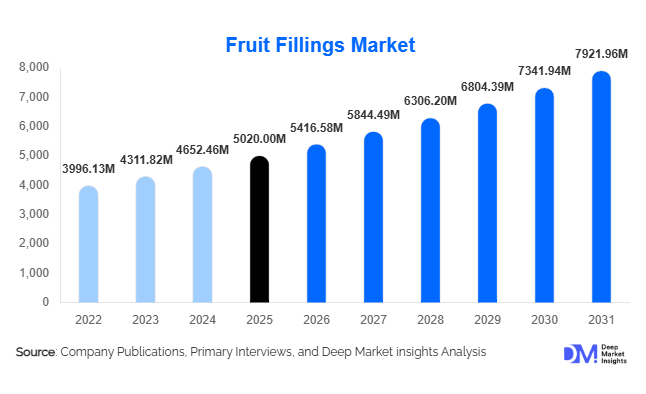

According to Deep Market Insights, the global fruit fillings market size was valued at USD 5,020 million in 2025 and is projected to grow from USD 5,416.58 million in 2026 to reach USD 7,921.96 million by 2031, expanding at a CAGR of 7.9% during the forecast period (2026–2031). The fruit fillings market growth is primarily driven by rising global consumption of bakery and dairy desserts, increasing demand for premium and fruit-forward formulations, and continuous innovation in clean-label and reduced-sugar ingredients used by industrial food manufacturers.

Key Market Insights

- Bakery applications dominate global demand, supported by the expansion of industrial bakeries and premium patisserie products.

- Gel-based fruit fillings remain the most widely used form, offering superior thermal stability and processing efficiency.

- Europe leads the market by value, driven by strong consumption of filled pastries, cakes, and artisanal baked goods.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable income, urbanization, and Westernized eating habits.

- Low-sugar and clean-label formulations are gaining rapid adoption amid tightening food labeling regulations.

- Industrial B2B supply channels dominate, as most fruit fillings are consumed by large-scale food processors.

What are the latest trends in the fruit fillings market?

Clean-Label and Reduced-Sugar Formulations Gaining Momentum

Food manufacturers are increasingly reformulating fruit fillings to align with clean-label trends, replacing artificial colors, flavors, and preservatives with natural alternatives. Reduced-sugar and no-added-sugar fruit fillings are witnessing strong adoption, particularly in Europe and North America, where regulatory scrutiny and health-conscious consumers are influencing purchasing decisions. High-fruit-content fillings using natural pectin systems are being positioned as premium offerings, allowing manufacturers to command higher margins while meeting consumer expectations for transparency and authenticity.

Premiumization and Exotic Flavor Innovation

The market is experiencing a shift toward premium fruit fillings featuring real fruit pieces, exotic blends, and region-specific flavors such as mango, passion fruit, and mixed berries. Premium bakery and dairy brands are leveraging these fillings to differentiate products and enhance sensory appeal. Customization for foodservice and artisanal bakery clients is also increasing, with suppliers offering tailored textures, sweetness levels, and fruit profiles to meet evolving culinary trends.

What are the key drivers in the fruit fillings market?

Expansion of the Global Bakery Industry

The rapid expansion of industrial and artisanal bakeries worldwide is a major growth driver for fruit fillings. Cakes, pastries, pies, and croissants increasingly rely on standardized fruit fillings to ensure consistency, flavor stability, and extended shelf life. Growth in packaged bakery products across emerging economies is further amplifying demand, as manufacturers seek scalable fruit-based solutions that maintain product quality during transportation and storage.

Rising Consumption of Value-Added Dairy Desserts

Dairy desserts such as yogurts, cheesecakes, and ice creams are increasingly incorporating fruit fillings to enhance flavor and nutritional appeal. Fruit fillings provide controlled sweetness and visual differentiation, making them a preferred ingredient for large-scale dairy processors. This trend is particularly pronounced in North America and Europe, where premium and indulgent dairy products continue to gain shelf space.

What are the restraints for the global market?

Volatility in Raw Fruit Prices

Fluctuating prices of key fruits such as apples, berries, and tropical fruits pose a significant challenge to market participants. Climate variability, seasonal supply constraints, and rising agricultural input costs can impact raw material availability and pricing, leading to margin pressure for fruit filling manufacturers.

Stringent Food Safety and Labeling Regulations

Compliance with stringent food safety standards and labeling regulations increases operational complexity and costs, particularly in developed markets. Requirements related to sugar content disclosure, allergen management, and traceability can limit flexibility in formulation and slow product development cycles.

What are the key opportunities in the fruit fillings industry?

Emerging Market Demand and Flavor Localization

Asia-Pacific, Latin America, and the Middle East present significant growth opportunities due to rising consumption of bakery and dessert products. Localized fruit flavors and region-specific formulations are gaining traction, enabling manufacturers to penetrate new markets while catering to local taste preferences.

Technological Advancements in Fruit Processing

Advancements in aseptic processing, enzyme-controlled texture stabilization, and automated quality control are enabling longer shelf life and improved product consistency. These technologies support export-oriented production and open opportunities for premium, high-margin fruit filling products.

Product Type Insights

Apple-based fruit fillings lead the global market, accounting for approximately 24% of total demand in 2025. This dominance is primarily driven by cost efficiency, consistent year-round availability, neutral flavor compatibility, and extensive usage across mass-produced bakery products such as pies, danishes, and turnovers. Apple fillings also benefit from stable supply chains and long shelf life, making them a preferred choice for large-scale food manufacturers.

Berry-based fruit fillings, particularly strawberry and blueberry, represent the fastest-growing product segment. Growth is fueled by rising consumer preference for premium, indulgent flavors, vibrant color profiles, and perceived naturalness, especially in artisanal bakery, dairy desserts, and confectionery applications.Tropical fruit fillings including mango, pineapple, and passion fruit are gaining strong traction in Asia-Pacific and Latin America. This growth is supported by localized taste preferences, increasing incorporation of regional flavors into modern bakery formats, and expanding middle-class consumption of premium desserts.

Form Insights

Gel-based fruit fillings dominate the global market with nearly 38% market share in 2025. Their leadership is driven by superior thermal stability, smooth texture consistency, extended shelf life, and ease of integration into automated and high-speed bakery production lines. These characteristics make gel-based fillings ideal for industrial-scale bakery and dairy applications.

Chunky and particulate fruit fillings are witnessing increasing adoption, particularly in premium and artisanal product lines, where visible fruit content enhances product authenticity and sensory appeal.Meanwhile, low-sugar and reduced-sugar formulations are gaining momentum as health-conscious consumers seek clean-label and better-for-you indulgence options, especially in yogurt, snack bars, and specialty bakery products.

Application Insights

Bakery applications account for approximately 46% of total global market demand, making it the leading application segment. Growth is driven by high consumption of filled pastries, cakes, croissants, and cookies, along with the continuous introduction of innovative baked goods by both industrial and artisanal bakeries.

Dairy desserts represent the second-largest application segment at around 28% market share, supported by rising demand for fruit-filled yogurts, cheesecakes, ice creams, and layered desserts. The segment benefits from consumer preference for flavor-enhanced dairy products with natural fruit positioning.Confectionery and breakfast/snack products account for a smaller but steadily expanding share. Growth in this segment is driven by innovation in filled chocolates, cereal bars, pastries, and on-the-go snacks, particularly those positioned as premium or functional foods.

Distribution Channel Insights

The B2B industrial supply channel dominates the global fruit fillings market with nearly 68% share, reflecting the strong reliance of food manufacturers on bulk, customized, and application-specific fruit filling solutions. Long-term supply contracts and formulation flexibility further strengthen this channel.

Foodservice and HoReCa channels are expanding steadily, driven by growth in cafés, bakeries, quick-service restaurants, and dessert chains, particularly in urban markets.Retail-ready fruit fillings remain a niche but growing segment, primarily catering to home baking enthusiasts and small-scale artisanal producers, supported by the rise of home cooking trends and premium baking ingredients.

| By Fruit Type | By Form | By Nature | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global fruit fillings market with approximately 32% share in 2025. Strong demand is driven by deep-rooted bakery and pastry consumption in Germany, France, the U.K., and Italy. The region benefits from a well-established premium pastry culture, high adoption of clean-label and organic ingredients, and continuous innovation in artisan and industrial bakery products.

North America

North America accounts for around 28% of the global market share, led primarily by the U.S. bakery and dairy industries. Regional growth is driven by innovation in reduced-sugar, organic, and non-GMO fruit fillings, along with strong demand for convenience foods, frozen bakery products, and value-added dairy desserts.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, projected to expand at over 9% CAGR during the forecast period. Growth is supported by rapid urbanization, rising disposable incomes, and increasing adoption of Western-style bakery and dessert products. China and India serve as key growth engines, while localized tropical flavors further enhance regional demand.

Latin America

Latin America shows steady growth, led by Brazil and Mexico. Expansion is supported by rising consumption of packaged and filled bakery products, improving food processing infrastructure, and increasing availability of locally sourced fruits. The region also benefits from growing investments in modern retail and foodservice channels.

Middle East & Africa

The Middle East & Africa market is driven by the expanding foodservice sector in the UAE, Saudi Arabia, and South Africa. Growth is supported by rising demand for premium desserts, increasing imports of processed bakery ingredients, and the rapid expansion of international café and bakery chains.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fruit Fillings Market

- AGRANA Group

- Puratos Group

- Barry Callebaut

- Dawn Foods

- Zentis GmbH

- Andros Group

- Orana A/S

- Tree Top Inc.

- Hero Group

- Ingredion Incorporated

- Valio Ltd

- Welch Foods Inc.

- Fuji Nihon Seito

- BINA Group

- Fresh Del Monte Produce