Fruit Concentrates Market Size

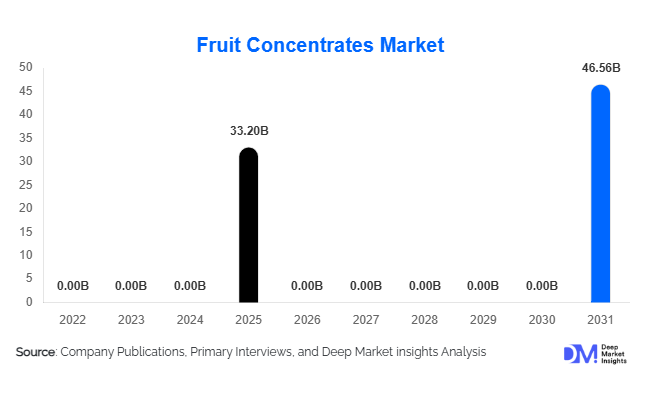

According to Deep Market Insights,the global fruit concentrates market size was valued at USD 33.2 billion in 2025 and is projected to grow from USD 35.13 billion in 2026 to reach USD 46.56 billion by 2031, expanding at a CAGR of 5.8% during the forecast period (2026–2031). The fruit concentrates market growth is primarily driven by rising demand for processed and ready-to-drink beverages, increasing preference for natural sweeteners over refined sugar, and expanding applications across dairy, bakery, infant nutrition, and functional food industries.

Key Market Insights

- Fruit concentrates are increasingly replacing refined sugar in beverages and packaged foods due to clean-label and natural ingredient demand.

- Beverages remain the dominant application segment, accounting for nearly half of global fruit concentrate consumption.

- Asia-Pacific leads the global market by volume, supported by expanding food processing infrastructure and export-oriented production.

- North America and Europe dominate value terms, driven by premium pricing, organic demand, and regulatory emphasis on clean labeling.

- Apple and citrus concentrates account for the largest share due to availability, cost efficiency, and functional versatility.

- Advancements in low-temperature evaporation and spray-drying technologies are improving nutritional retention and operational efficiency.

What are the latest trends in the fruit concentrates market?

Rising Demand for Clean-Label and Organic Fruit Concentrates

Consumer preference for clean-label food products is significantly influencing the fruit concentrates market. Manufacturers are increasingly adopting organic fruit sourcing, non-GMO certifications, and minimal processing techniques to meet regulatory and consumer expectations. Organic fruit concentrates are gaining strong traction in North America and Europe, where food brands are actively reformulating products to remove artificial additives and synthetic sweeteners. This trend is also pushing suppliers to invest in traceable sourcing systems and sustainability certifications, strengthening long-term procurement partnerships with multinational food and beverage companies.

Expansion of Functional and Nutritional Applications

Fruit concentrates rich in antioxidants, vitamins, and polyphenols are increasingly used in functional beverages, sports nutrition, and medical foods. Demand for immunity-boosting drinks and fortified nutrition products has accelerated the adoption of berry, citrus, and tropical fruit concentrates. Manufacturers are leveraging fruit concentrates not only for sweetness but also for functional positioning, enabling higher-value product offerings. This trend is particularly strong in urban Asia-Pacific markets and developed economies where preventive healthcare consumption is rising.

What are the key drivers in the fruit concentrates market?

Growth of Processed Beverage Consumption

The global expansion of juice-based beverages, flavored waters, energy drinks, and ready-to-drink formulations is a major driver of fruit concentrate demand. Beverage manufacturers favor concentrates due to consistent quality, extended shelf life, and cost-effective logistics. Rapid urbanization and changing lifestyles are further accelerating demand for convenient, fruit-based beverages, particularly in emerging markets.

Shift Toward Natural Sweeteners

Rising concerns over sugar consumption and obesity have encouraged food manufacturers to replace refined sugar with naturally derived alternatives. Fruit concentrates such as apple, grape, and date are increasingly used as natural sweeteners, enabling reduced-sugar claims while maintaining taste and texture. This shift supports long-term market growth across bakery, dairy, and infant food applications.

What are the restraints for the global market?

Volatility in Raw Fruit Prices

Fruit concentrate production is highly dependent on raw fruit availability, which is increasingly affected by climate variability, water scarcity, and extreme weather conditions. Fluctuating fruit prices impact production costs and profit margins, creating pricing instability for both suppliers and buyers.

Regulatory and Sugar Labeling Challenges

Despite being natural, fruit concentrates are often classified as sugar sources under food labeling regulations. This limits their usage in certain health-positioned products and requires manufacturers to balance formulation compliance with consumer expectations, acting as a restraint to broader adoption.

What are the key opportunities in the fruit concentrates industry?

Emerging Market Processing Expansion

Countries such as India, Vietnam, Brazil, and Thailand are investing heavily in food processing infrastructure to reduce post-harvest losses and enhance export competitiveness. Government-supported food parks, cold-chain logistics, and export incentives are enabling local processors to scale fruit concentrate production and access global markets.

Technological Advancements in Concentration Processes

Adoption of membrane filtration, vacuum evaporation, and energy-efficient spray-drying technologies is improving yield efficiency and nutritional retention. Companies integrating advanced processing technologies can lower operating costs, meet sustainability goals, and offer higher-quality concentrates to premium buyers.

Product Type Insights

Apple concentrates dominate the global fruit concentrates market, accounting for approximately 27% of total demand in 2025. This leadership is primarily driven by abundant raw material availability, year-round processing capability, cost efficiency, and their widespread use as a natural sweetener and flavor enhancer in beverages, bakery products, and dairy formulations. Apple concentrates also benefit from strong acceptance in clean-label and sugar-reduction strategies, where they are used as partial replacements for refined sugars.

Citrus concentrates, particularly orange concentrates, represent a substantial market share due to their strong presence in juice blends, carbonated beverages, and functional drinks. High vitamin C content and established consumer familiarity continue to support demand. Meanwhile, berry and tropical fruit concentrates are witnessing faster growth compared to traditional segments, supported by rising demand for antioxidant-rich ingredients, exotic flavor profiles, and premium positioning in health-focused beverages, nutraceuticals, and specialty food applications.

Form Insights

Liquid fruit concentrates account for nearly 62% of global consumption, driven by their ease of handling, efficient blending characteristics, and seamless integration into large-scale industrial beverage and food production lines. The dominance of this segment is reinforced by high demand from juice manufacturers and ready-to-drink beverage producers seeking consistent quality and rapid processing.

Powdered fruit concentrates are gaining increasing traction, particularly in nutraceuticals, infant nutrition, bakery, and dry beverage mixes. Growth in this segment is driven by longer shelf life, reduced storage costs, improved transport efficiency, and precise dosage control. Frozen concentrates continue to hold relevance in regions with well-developed cold-chain infrastructure, especially for applications requiring superior flavor retention and minimal nutrient degradation.

Application Insights

Beverages remain the largest application segment, representing approximately 48% of global fruit concentrate demand in 2025. The segment’s dominance is driven by strong consumption of fruit juices, flavored waters, energy drinks, and functional beverages enriched with vitamins and antioxidants. Rapid innovation in low-sugar and plant-based drinks further strengthens demand for fruit concentrates as natural flavoring agents.

Dairy and frozen desserts are growing steadily, supported by rising consumption of flavored yogurts, ice creams, and plant-based dairy alternatives. Bakery and confectionery applications utilize fruit concentrates for natural flavor enhancement, moisture retention, and clean-label coloring solutions. Meanwhile, infant nutrition and medical foods are emerging as high-growth segments, driven by stringent quality standards, traceability requirements, and premium pricing structures.

Distribution Channel Insights

B2B industrial supply dominates the distribution landscape, accounting for over 65% of total market value. This dominance is supported by long-term bulk supply contracts with beverage, dairy, and food manufacturers, ensuring stable demand and predictable pricing. Large-scale processors prefer direct sourcing to maintain consistency and cost control.

Retail and private-label channels are expanding steadily, particularly for organic, single-fruit, and specialty fruit concentrates targeted at health-conscious consumers and home-use applications. Export-driven bulk trade plays a critical role in linking fruit-producing regions with high-consumption markets, supported by global supply chains and contract processing agreements.

| By Fruit Type | By Form | By Application | By Processing Type | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific held approximately 38% of the global fruit concentrates market share in 2025, making it the largest regional market. Growth is led by China, India, and Japan, supported by expanding beverage manufacturing capacity, rising disposable incomes, and increasing demand for packaged and functional drinks.

China accounts for nearly 14% of global demand, driven by large-scale beverage production, export-oriented processing facilities, and strong domestic consumption. India is the fastest-growing market, expanding at over 7% CAGR, fueled by rising investments in fruit processing infrastructure, government support for food processing, and growing domestic consumption of juices and flavored dairy products.

North America

North America represents around 24% of global demand, with the United States accounting for approximately 19%. Regional growth is driven by strong demand for clean-label beverages, organic food products, and functional nutrition offerings. Consumers increasingly prefer natural sweeteners and fruit-derived ingredients over artificial additives.

Advanced processing technologies, high-quality standards, and premium pricing structures enhance regional value share. Innovation in fortified beverages and plant-based formulations continues to support sustained demand for fruit concentrates.

Europe

Europe accounts for roughly 22% of global consumption, led by Germany, France, and the United Kingdom. The region benefits from strict food safety regulations, strong sustainability standards, and high consumer awareness regarding ingredient transparency.

Demand for organic and clean-label fruit concentrates is accelerating across the region, particularly in beverages, baby food, and specialty nutrition products. Established supply chains and strong import dependence on tropical fruit concentrates further support market growth.

Latin America

Latin America serves as both a major production hub and an emerging consumption market. Brazil and Mexico play key roles due to abundant fruit availability, cost-competitive processing, and export-oriented operations.

Rising domestic consumption of fruit-based beverages, coupled with increasing investments in processing facilities, supports regional growth. Export demand from North America and Europe continues to strengthen Latin America’s strategic importance in the global supply chain.

Middle East & Africa

The Middle East and Africa region is witnessing steady market growth, driven by rising urbanization, increasing imports of packaged beverages, and expanding food processing activities. The UAE and South Africa serve as key demand centers due to strong retail penetration and hospitality sector growth.

North Africa is emerging as a processing and export base for European markets, supported by favorable climatic conditions, proximity to Europe, and growing investments in agri-processing infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fruit Concentrates Market

- Döhler Group

- AGRANA Beteiligungs-AG

- SVZ International

- Kerry Group

- Ingredion Incorporated

- ADM

- Tereos Group

- Louis Dreyfus Company

- SunOpta

- Tree Top Inc.

- Ashurst Fruit

- Diana Food (Symrise)

- Frutco AG

- Capricorn Food Products

- Taiyo Kagaku