Frozen Bakery Emulsifier Blends Market Size

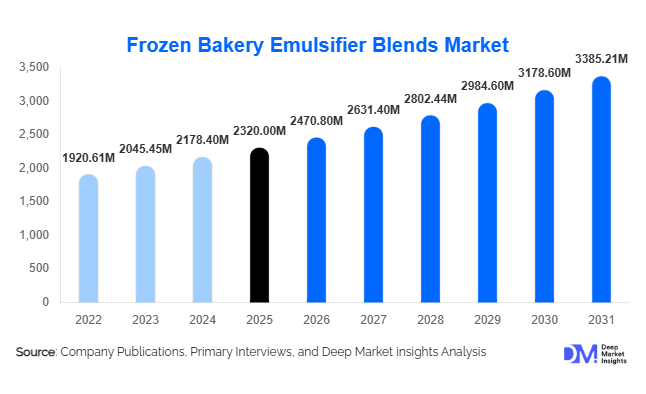

According to Deep Market Insights, the global frozen bakery emulsifier blends market size was valued at USD 2,320 million in 2025 and is projected to grow from USD 2,470.80 million in 2026 to reach USD 3,385.21 million by 2031, expanding at a CAGR of 6.5% during the forecast period (2026–2031). The market growth is primarily driven by increasing demand for frozen bakery products, rising urbanization, and technological advancements in emulsifier blends that improve dough quality, texture, and shelf-life, particularly for industrial and retail bakery applications.

Key Market Insights

- Mono- and diglycerides dominate as versatile emulsifier blends used across bread, cakes, and pastries, providing improved volume, softness, and stability.

- Industrial and commercial bakeries are the leading end-users, relying on emulsifier blends for high-volume production and consistent product quality.

- Asia-Pacific is the fastest-growing region, driven by rising urbanization, modern retail bakery expansion, and increasing disposable incomes in China and India.

- Clean-label and enzyme-enhanced emulsifiers are gaining traction, reflecting consumer preference for healthier and allergen-friendly bakery products.

- North America and Europe remain significant markets, with high frozen bakery product consumption and established industrial bakery chains contributing to demand.

- Technological adoption, including automated dosing systems and multi-functional emulsifier blends, is enhancing production efficiency and product quality globally.

What are the latest trends in the frozen bakery emulsifier blends market?

Integration of Clean-Label and Enzyme Technologies

Manufacturers are increasingly developing emulsifier blends that are non-GMO, plant-based, and enzyme-enhanced to meet consumer demand for clean-label bakery products. These emulsifiers improve dough handling, extend frozen product shelf-life, and enhance softness without compromising quality. The integration of enzymes and natural stabilizers has become a key differentiator in industrial bakery applications, particularly in Europe and North America, where regulatory compliance and health-conscious trends shape purchasing decisions.

Automation and Multi-Functional Blends in Industrial Bakeries

Automated bakery lines are increasingly adopting powdered and liquid emulsifier blends that simplify dosing and ensure uniform dough quality. Multi-functional blends combining softness, stability, and improved shelf-life are replacing single-purpose emulsifiers. This trend allows large-scale industrial bakeries to optimize production efficiency while meeting growing demand for frozen bakery products, particularly in high-volume markets such as North America, Europe, and Asia-Pacific.

What are the key drivers in the frozen bakery emulsifier blends market?

Rising Demand for Frozen Bakery Products

Urbanization, busy lifestyles, and the expansion of retail bakery chains have increased the adoption of frozen bakery products. Consumers prefer products that retain freshness and texture with minimal preparation time. Bread, cakes, and pastries dominate this consumption, contributing to higher emulsifier blend usage in industrial bakeries. Demand for frozen bakery products is projected to grow significantly in emerging markets like India and China, where retail modernization and QSR expansion are accelerating adoption.

Technological Advancements in Emulsifier Formulations

Innovations in emulsifier blends, including enzyme-enhanced and multi-functional solutions, have improved dough stability, volume, and softness. These technological advancements allow bakeries to reduce waste, improve product consistency, and meet diverse consumer preferences, including clean-label and plant-based formulations. The shift towards high-performance emulsifiers is reshaping competitive dynamics, enabling companies to capture market share by providing value-added solutions.

Expansion of Industrial and Commercial Bakeries

The growth of industrial bakery chains and QSR outlets globally has increased the demand for standardized and scalable frozen bakery products. Emulsifier blends play a crucial role in ensuring uniform product quality across multiple production lines. Large-scale adoption of these blends in automated bakery systems drives market growth, particularly in regions with mature bakery infrastructure such as North America and Europe.

What are the restraints for the global market?

Fluctuating Raw Material Prices

Volatility in the cost of glycerides, lecithin, and other key inputs can raise production costs for emulsifier blends, particularly in price-sensitive markets. This may affect profitability and slow down adoption in certain regions, especially where frozen bakery margins are tight.

Regulatory Compliance and Food Safety Standards

Strict food additive regulations, especially in Europe and North America, require significant investment in testing and certification. Compliance costs can limit the introduction of new emulsifier formulations or slow down market entry for smaller players, acting as a key restraint to global growth.

What are the key opportunities in the frozen bakery emulsifier blends market?

Emerging Market Expansion

Emerging economies such as China, India, and Brazil offer significant growth potential due to rising urbanization, higher disposable incomes, and expanding modern retail bakery chains. Industrial bakeries in these markets are increasingly adopting frozen bakery products, creating opportunities for manufacturers to introduce cost-effective, high-quality emulsifier blends. Local partnerships and regional production facilities can further enhance market penetration.

Development of Clean-Label and Specialty Blends

Health-conscious consumers are driving demand for allergen-free, non-GMO, and plant-based emulsifier blends. Manufacturers have the opportunity to develop specialty emulsifiers for gluten-free, vegan, and high-protein bakery products. These innovations cater to niche markets while enhancing brand differentiation in competitive regions like Europe and North America.

Government and Policy Support for Food Processing

Initiatives such as “Make in India” and industrial modernization programs in China and Southeast Asia encourage investment in bakery infrastructure. Improved cold storage, logistics, and automation indirectly boost the demand for frozen bakery emulsifier blends. Companies can leverage these initiatives to expand regional production and distribution capabilities.

Product Type Insights

Mono- and diglycerides dominate the global frozen bakery emulsifier market, holding approximately 35% of the 2025 market share. These blends are highly preferred due to their versatility across bread, cakes, and pastry applications, enhancing dough handling, product volume, and frozen shelf-life. Following closely, DATEM and SSL blends are widely used in specialty bakery applications that require superior stability, texture, and uniform crumb structure. Enzyme-enhanced and multi-functional proprietary blends are witnessing rapid adoption, driven by the rising clean-label trend, demand for improved production efficiency, and the need for natural and multifunctional solutions in industrial-scale bakeries. The growth of these advanced blends is also propelled by bakery manufacturers seeking products that reduce chemical additives while maintaining product quality and consistency.

Application Insights

Bread and rolls constitute the largest application segment, contributing around 40% of 2025 consumption. The segment growth is fueled by increasing consumer preference for convenience-oriented frozen bread and rolls with consistent texture and extended shelf-life. Pastries and cakes are also experiencing strong demand, particularly in retail chains and quick-service restaurants (QSRs), due to rising frozen bakery consumption and growing urban lifestyles. Specialty bakery products, including gluten-free and plant-based items, are emerging niches that reflect evolving consumer preferences and dietary awareness. Overall, the trend toward ready-to-bake and pre-packaged frozen bakery products is driving emulsifier blend adoption across all application segments, with bread being the leading driver due to high consumption volumes and repeat usage in industrial settings.

Distribution Channel Insights

Industrial bakeries primarily procure emulsifier blends via direct supply agreements with manufacturers, ensuring consistency, bulk availability, and regulatory compliance. Retail bakeries and QSR chains increasingly rely on B2B distributors and specialized suppliers for flexible supply and access to clean-label or niche formulations. Online platforms are emerging as secondary channels, particularly for smaller-scale bakeries seeking specialty or enzyme-enhanced blends. Distribution strategies emphasize reliable logistics, adherence to quality standards, integration with automated bakery lines, and the ability to meet evolving consumer demand for natural and functional bakery ingredients.

End-Use Insights

Industrial and commercial bakeries account for approximately 50% of global consumption in 2025, driven by the need for high-volume, consistent-quality bakery products. Retail bakery chains and food service outlets follow closely, spurred by demand for frozen and ready-to-bake items. Emerging applications, such as plant-based and gluten-free bakery products, are seeing rapid adoption of specialized emulsifier blends, reflecting the increasing health consciousness and dietary preferences of consumers. Export-driven demand is significant, particularly from Europe and North America to Asia-Pacific and the Middle East, where frozen bakery consumption is growing steadily. The industrial bakery market size is projected to reach USD 1,700 million by 2031, supporting sustained growth of emulsifier blend utilization across end-use segments.

| By Product Type | By Application | By End-Use Industry | By Form |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

The U.S. and Canada lead demand for frozen bakery emulsifier blends, accounting for approximately 28% of the 2025 market share. Growth is primarily driven by high frozen bakery consumption, well-established modern retail chains, and technological adoption in industrial bakeries. Key drivers include the expansion of QSR chains, increasing demand for convenience foods, and the clean-label movement, which encourages the use of enzyme-enhanced and natural emulsifier blends. Additionally, strong investment in bakery automation and research into multifunctional ingredients further strengthens regional growth.

Europe

Germany, France, and the UK represent around 30% of the 2025 market share, supported by strong adoption of frozen bakery products and multi-functional emulsifiers. Europe is at the forefront of clean-label formulations, driving the growth of enzyme-enhanced and natural blends. Other key drivers include the region’s focus on bakery automation, high-volume industrial production, and innovation in specialty bakery applications such as gluten-free, vegan, and premium pastries. Regulatory emphasis on food quality and consumer preference for functional bakery ingredients also supports sustained market growth.

Asia-Pacific

China and India are the fastest-growing markets, registering a CAGR of approximately 8%. Urbanization, expanding retail chains, and rising disposable incomes drive demand for frozen bakery products. Additional growth drivers include increasing awareness of bakery quality standards, adoption of automated bakery systems, and the growing influence of Western-style baked goods. The region also benefits from the rising trend of on-the-go consumption and convenience-oriented products, which promotes the use of emulsifier blends to ensure consistency and extended shelf-life.

Latin America

Brazil and Argentina demonstrate moderate growth, driven by the expansion of industrial bakeries and increasing retail bakery adoption. Growth is further supported by the rising popularity of frozen bakery imports and modernization of domestic bakery infrastructure. The market is still niche compared to North America and Europe, but increasing urban retail penetration and QSR growth are significant drivers for emulsifier blend adoption in the region.

Middle East & Africa

The GCC countries and South Africa exhibit rising demand for frozen bakery emulsifier blends, mainly fueled by retail bakery expansion and imported frozen bakery products. Urbanization, tourism, and the expansion of QSRs contribute to market growth. Africa remains a smaller but notable market, with growth driven by industrial bakery infrastructure development, urban retail expansion, and the increasing adoption of functional and enzyme-enhanced emulsifier blends to improve product quality and shelf-life.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Frozen Bakery Emulsifier Blends Market

- Cargill, Inc.

- Archer Daniels Midland Company

- AB Mauri (Associated British Foods)

- Kerry Group plc

- Koninklijke DSM N.V.

- Corbion N.V.

- DuPont de Nemours, Inc.

- Puratos Group

- Ingredion Incorporated

- Olam International

- Tate & Lyle PLC

- Lesaffre

- Bunge Limited

- AAK AB

- Corbion Purac