Fortified Ingredients Market Size

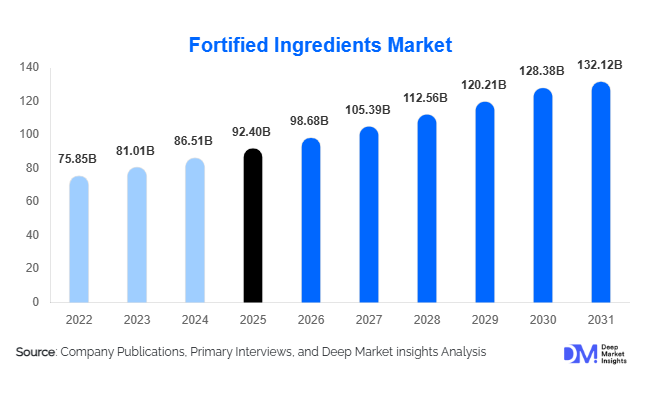

According to Deep Market Insights, the global fortified ingredients market size was valued at USD 92.4 billion in 2025 and is projected to grow from USD 98.68 billion in 2026 to reach USD 137.12 billion by 2031, expanding at a CAGR of 6.8% during the forecast period (2026–2031). The fortified ingredients market growth is primarily driven by rising micronutrient deficiency awareness, increasing demand for functional foods and beverages, expanding nutraceutical consumption, and government-mandated food fortification programs across developing economies.

Key Market Insights

- Vitamins account for nearly 38% of total market revenue, making them the leading ingredient category across food, beverage, and supplement applications.

- Dry fortified premixes dominate with over 62% share, due to longer shelf life, ease of blending, and suitability for staple fortification programs.

- Asia-Pacific holds the largest regional share at approximately 32%, driven by large-scale government nutrition initiatives in China and India.

- Food & beverage manufacturers represent 41% of total demand, supported by mandatory staple fortification and private-label reformulations.

- Nutraceutical applications are the fastest-growing segment, expanding at over 8% CAGR amid rising preventive healthcare adoption.

- Microencapsulation and bioavailability enhancement technologies are enabling fortified ingredient integration into beverages and ready-to-drink products.

What are the latest trends in the fortified ingredients market?

Expansion of Government-Led Staple Fortification Programs

National nutrition missions across Asia, Africa, and Latin America are accelerating the fortification of staple foods such as rice, wheat flour, edible oils, and salt. Countries including India, Indonesia, Brazil, and Nigeria are expanding mandatory fortification policies to address widespread micronutrient deficiencies. These programs provide long-term procurement contracts to fortified ingredient suppliers, ensuring stable demand volumes. Public-private partnerships are increasing, with governments collaborating with large milling and food processing companies to scale up distribution of fortified staples through public distribution systems.

Growth of Personalized and Condition-Specific Nutrition

Consumers are increasingly seeking targeted health benefits such as immunity support, bone strength, cognitive health, and metabolic wellness. This shift is driving demand for customized vitamin-mineral premixes tailored to specific demographic groups. Advances in nutrigenomics and digital diagnostics are further enabling personalized supplementation. Premium fortified ingredient suppliers are investing in small-batch production capabilities and condition-specific blends, allowing nutraceutical brands to differentiate in competitive markets.

What are the key drivers in the fortified ingredients market?

Rising Prevalence of Micronutrient Deficiencies

Iron deficiency anemia, vitamin D insufficiency, and iodine deficiency remain significant public health concerns worldwide. International health agencies continue to promote fortification as a cost-effective solution, driving procurement of vitamin and mineral premixes. Developing regions with large populations are particularly contributing to high-volume growth.

Rapid Expansion of Functional Foods & Beverages

Consumers increasingly prefer food-based supplementation over traditional pills. Fortified dairy, cereals, plant-based beverages, and bakery products are witnessing strong demand growth globally. Manufacturers are reformulating products to include immunity-enhancing vitamins and minerals, directly stimulating upstream ingredient demand.

What are the restraints for the global market?

Raw Material Price Volatility

Vitamin intermediates, particularly Vitamin C and B-complex, are heavily concentrated in Chinese production facilities. Supply disruptions and energy price fluctuations can lead to significant price swings, impacting the profit margins of fortified ingredient suppliers and food manufacturers.

Regulatory and Compliance Complexity

Fortification standards vary significantly across regions, increasing compliance costs and reformulation requirements. Regulatory approvals for health claims and dosage limits can delay product launches, particularly in Europe and North America.

What are the key opportunities in the fortified ingredients industry?

Technological Advancements in Encapsulation

Microencapsulation technology is enhancing stability, taste masking, and bioavailability of sensitive nutrients such as iron and omega-3 fatty acids. This enables incorporation into beverages and ready-to-drink formats, expanding high-margin application areas.

Growth in Emerging Economies

Rising middle-class income levels and expanding packaged food industries in the Asia-Pacific and Africa create significant opportunities. Rapid urbanization and growing retail penetration are increasing fortified packaged food consumption.

Ingredient Type Insights

Vitamins remain the leading ingredient category, accounting for approximately 38% of the global fortified ingredients market value in 2025. The dominance of vitamins is primarily driven by their universal applicability across staple food fortification, dietary supplements, pharmaceuticals, and clinical nutrition. Mandatory fortification programs for vitamin A, D, B-complex, and folic acid in wheat flour, edible oils, and dairy products significantly contribute to large-scale volume demand. Additionally, post-pandemic immunity awareness has accelerated the inclusion of vitamins C and D in functional foods and beverages. Minerals represent the second-largest segment, with iron and calcium driving demand due to anemia reduction programs and bone health-focused dairy fortification. Amino acids and omega fatty acids are expanding steadily, supported by rising sports nutrition, clinical nutrition, and infant formula applications. Meanwhile, probiotics and prebiotics are emerging as high-growth sub-segments in developed markets, fueled by digestive health awareness and microbiome-focused product innovation.

Form Insights

Dry fortified ingredients dominate the market with a 62% revenue share in 2025, largely due to operational efficiency, extended shelf life, and compatibility with large-scale staple fortification systems. Powdered premixes are widely adopted in flour mills, rice fortification units, and dairy processing plants, enabling uniform blending and dosage control. The scalability of dry formats makes them particularly suitable for government-backed mass nutrition programs in Asia and Africa. Liquid fortified ingredients maintain strong relevance in beverage, dairy, and infant nutrition applications, where solubility and dispersion are critical. Encapsulated and microencapsulated formats are witnessing rising adoption in high-value nutraceutical and pharmaceutical applications, driven by the need for improved bioavailability, taste masking, and oxidative stability, particularly for iron, omega-3 fatty acids, and fat-soluble vitamins.

Application Insights

Functional foods account for approximately 29% of total fortified ingredient application revenue in 2025, making them the leading application segment. Growth is driven by rising consumer preference for food-based supplementation over traditional pills, particularly in fortified cereals, dairy products, plant-based beverages, and bakery items. Dietary supplements represent the fastest-growing segment, supported by expanding preventive healthcare adoption and aging populations in North America, Europe, and parts of Asia-Pacific. Infant nutrition remains a stable and premium segment, characterized by stringent regulatory standards and high-value formulations incorporating DHA, iron, and essential vitamins. Animal feed fortification is expanding rapidly in the Asia-Pacific due to increasing meat consumption, export-oriented poultry production, and improved livestock productivity standards.

End-Use Industry Insights

The food & beverage industry leads overall demand, accounting for approximately 41% of total fortified ingredient consumption in 2025. This dominance is driven by mandatory staple fortification policies, private-label reformulation strategies, and increased consumer demand for clean-label, health-enhanced packaged foods. The nutraceutical industry is the fastest-growing end-use segment, projected to expand at nearly 8.5% CAGR through 2031, fueled by personalized nutrition trends and digital health integration. Pharmaceutical and clinical nutrition industries demonstrate steady growth, particularly in therapeutic nutrition and hospital-based dietary formulations. Animal nutrition is benefiting from export-driven meat production, especially in emerging economies where poultry and aquaculture industries are expanding to meet international trade demand.

| By Ingredient Type | By Form | By Application | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 28% of the global fortified ingredients market in 2025, with the United States contributing nearly 75% of regional demand. Growth in this region is driven by high dietary supplement penetration, advanced functional food innovation, and strong regulatory frameworks governing food fortification and labeling. Consumer preference for immunity-enhancing and bone health products continues to stimulate vitamin D, calcium, and omega-3 demand. Additionally, the region benefits from sophisticated R&D capabilities and strong presence of multinational ingredient manufacturers, supporting innovation in encapsulated and high-bioavailability nutrient formats.

Europe

Europe accounts for around 24% of global revenue, led by Germany, France, and the United Kingdom. Regional growth is supported by established dairy and cereal fortification programs, strict regulatory compliance standards, and rising consumer interest in preventive healthcare. The European market is also driven by aging demographics, boosting demand for fortified clinical and senior nutrition products. Sustainability and clean-label trends further accelerate demand for naturally derived fortified ingredients, especially in Western European countries.

Asia-Pacific

Asia-Pacific represents the largest regional market with approximately 32% share in 2025. China and India are the primary growth engines due to large populations, expanding middle-class income levels, and aggressive government-led fortification initiatives targeting anemia and vitamin deficiencies. Rapid urbanization, growth of organized retail, and rising consumption of packaged foods contribute significantly to market expansion. India is projected to be the fastest-growing country in the region, expanding at over 8% CAGR through 2031, supported by national rice and wheat fortification programs and increasing nutraceutical adoption.

Latin America

Latin America contributes roughly 9% of global market revenue, with Brazil and Mexico leading regional demand. Mandatory flour fortification regulations and increasing public health investments drive stable consumption of iron and folic acid premixes. Expanding processed food industries and improving economic conditions are gradually boosting demand for fortified dairy and beverage products. Growth is further supported by rising awareness of micronutrient deficiencies and cross-border trade in fortified staples.

Middle East & Africa

The Middle East & Africa region accounts for approximately 7% of global revenue. Nigeria and South Africa are major demand centers due to government-backed food security initiatives and large-scale wheat flour fortification programs. In the Middle East, countries such as Saudi Arabia and the UAE are witnessing rising demand for premium fortified dairy and beverage products, driven by high disposable incomes and growing health awareness. Infrastructure development in food processing and international support from health organizations are key drivers supporting sustained regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fortified Ingredients Market

- DSM-Firmenich

- BASF SE

- Cargill Incorporated

- Archer Daniels Midland Company

- IFF

- Glanbia plc

- Lonza Group

- Nestlé Health Science

- Corbion

- SternVitamin GmbH

- Prinova Group LLC

- Balchem Corporation

- Farbest Brands

- Nutrilo GmbH

- Wright Enrichment Inc.