Forskolin Market Size

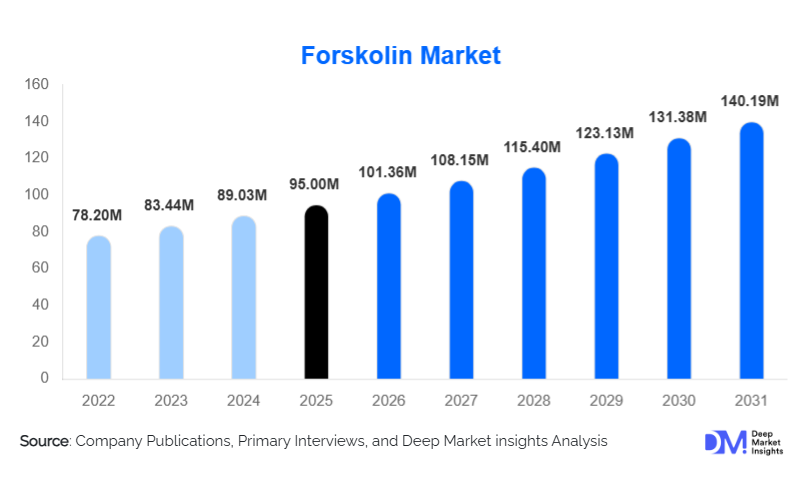

According to Deep Market Insights, the global forskolin market size was valued at USD 95.00 million in 2025 and is projected to grow from USD 101.36 million in 2026 to reach USD 140.19 million by 2031, expanding at a CAGR of 6.7% during the forecast period (2026–2031). The Forskolin market growth is primarily driven by increasing consumer preference for natural and herbal dietary supplements, rising obesity and lifestyle-related health concerns, and the expansion of Forskolin applications across nutraceuticals, pharmaceuticals, and cosmetic industries.

Key Market Insights

- Forskolin is increasingly favored for weight management and fat reduction applications, supported by clinical research and rising awareness of natural herbal solutions.

- North America dominates the Forskolin market, with the U.S. and Canada leading due to high disposable income, health-conscious consumers, and mature nutraceutical adoption.

- Asia-Pacific is emerging as the fastest-growing market, led by rising middle-class health awareness and rapid e-commerce penetration in India, China, and Japan.

- Natural Forskolin extracts from Coleus forskohlii dominate, accounting for the largest market share due to clean-label consumer preference and premium product positioning.

- Online retail channels are gaining traction, allowing direct-to-consumer sales and subscription models for personalized health and wellness solutions.

- Technological advancements, including standardized extraction processes and quality control innovations, are enhancing product consistency and trust across nutraceutical and cosmetic segments.

What are the latest trends in the Forskolin market?

Rise of Herbal and Plant-Based Supplements

Consumers worldwide are shifting toward natural and plant-based products, seeking alternatives to synthetic compounds. Forskolin, derived from the root of Coleus forskohlii, benefits from this trend due to its proven fat metabolism, cardiovascular, and cognitive health properties. Manufacturers are increasingly marketing Forskolin as a clean-label, standardized extract with multi-benefit potential. This trend aligns with broader lifestyle shifts toward wellness, preventive healthcare, and functional nutrition, creating steady demand growth across dietary supplements and functional beverages.

Digital Health Integration and E-Commerce Growth

E-commerce platforms and digital health initiatives are reshaping Forskolin distribution. Online retail allows direct-to-consumer models, subscription services, and personalized supplement recommendations, enhancing accessibility and consumer engagement. AI-driven nutrition apps are incorporating Forskolin-based solutions into customized health programs, while social media campaigns are educating consumers on its benefits. These technological integrations reduce dependency on traditional retail and broaden the reach of Forskolin products globally.

What are the key drivers in the Forskolin market?

Increasing Obesity and Lifestyle-Related Health Concerns

Rising obesity and metabolic health issues worldwide are driving demand for Forskolin-based weight management supplements. The compound’s ability to stimulate fat metabolism through cyclic AMP (cAMP) pathways makes it an attractive ingredient for consumers and supplement manufacturers. Weight management applications accounted for approximately 42% of the market in 2025, reinforcing Forskolin’s role in addressing global health challenges.

Preference for Natural and Clean-Label Products

Consumers are increasingly seeking herbal extracts over synthetic alternatives. Forskolin, sourced naturally from Coleus forskohlii, satisfies this preference, particularly in nutraceutical, cosmetic, and functional food segments. The natural extract segment accounts for 65% of the market, reflecting strong consumer trust in plant-derived ingredients.

Expanding Research and Clinical Applications

Scientific studies supporting Forskolin’s benefits in cardiovascular, respiratory, and cognitive health are encouraging pharmaceutical and nutraceutical companies to innovate new formulations. This evidence-driven adoption strengthens credibility, supports premium pricing, and enhances global market growth prospects.

What are the restraints for the global market?

Raw Material Availability and Price Volatility

The cultivation of Coleus forskohlii is concentrated in India and Nepal, making supply sensitive to climate fluctuations and geopolitical factors. Raw material shortages or price volatility can disrupt production schedules, increase product costs, and challenge consistent market supply, particularly for high-demand segments such as weight management and nutraceuticals.

Regulatory and Standardization Challenges

Inconsistent regulatory frameworks across countries can hinder market expansion. While some regions allow herbal extracts in dietary supplements with minimal requirements, others demand clinical evidence, Good Manufacturing Practices (GMP) compliance, or standardized extract formulations. These variations can limit global scalability for manufacturers and increase compliance costs.

What are the key opportunities in the Forskolin market?

Emerging Markets in Asia-Pacific and LATAM

Increasing awareness of herbal supplements in Asia-Pacific (India, China, Japan) and LATAM (Brazil, Argentina) offers significant growth potential. Urbanization, rising disposable incomes, and digital health adoption are driving demand for Forskolin-based products. Companies can capitalize on these markets with localized campaigns, regional distribution, and product customization to align with cultural health preferences.

Integration with Digital Health and Personalized Nutrition

The growing trend of personalized wellness programs and AI-driven nutrition presents opportunities to integrate Forskolin into digital health ecosystems. Subscription-based supplement delivery and data-driven dosing recommendations can enhance consumer retention and drive higher product adoption. Telehealth partnerships and virtual wellness consultations are additional channels for market penetration.

Pharmaceutical and Cosmetic Applications Expansion

Forskolin is being researched for therapeutic applications in asthma, cardiovascular support, and cognitive function. Cosmetic formulations for anti-aging and skin vitality also offer high-margin opportunities. Investment in R&D and new product formulations can differentiate brands and expand the market beyond conventional nutraceutical applications.

Product Form Insights

The powder form dominates the market, accounting for 38% of 2025 revenues (USD 121 million), due to versatility in supplement blends, capsules, and research applications. Liquid extracts and capsules are growing steadily, driven by convenience and direct-to-consumer demand. Standardized extracts are increasingly preferred in pharmaceutical and cosmetic formulations, ensuring consistent potency and quality. Consumer adoption favors natural extracts over synthetic alternatives, reinforcing premium pricing and higher margins.

Application Insights

Weight management supplements remain the leading application, representing 42% of the global market (USD 134 million in 2025). Cardiovascular health, cognitive enhancement, and skincare segments are emerging applications, contributing to diversified growth. Functional beverages and nootropics incorporating Forskolin are gaining traction, particularly among health-conscious consumers and urban millennials.

Distribution Channel Insights

Online retail dominates with 27% of market share (USD 86 million), driven by direct-to-consumer subscription models, e-commerce platforms, and personalized digital marketing. Offline retail, including pharmacies and health stores, continues to serve established markets, while specialty health stores cater to premium product segments. Digital platforms enable global reach, real-time feedback, and streamlined supply chains, reinforcing e-commerce as a key growth channel.

End-Use Insights

Nutraceuticals account for the greatest end-use demand, with dietary supplements, functional foods, and health-focused beverages driving Forskolin adoption. Cosmetic and pharmaceutical applications are emerging high-growth segments. Export-driven demand is strong from India and China, supplying North America and Europe. The fastest-growing end-use markets are cognitive health supplements, anti-aging skincare, and weight management formulations.

| By Form | By Application | By Source | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market, holding 36% of global revenues (USD 115 million). The U.S. dominates, supported by high disposable income, health-conscious consumers, and mature online retail channels. Canada contributes USD 15 million, with growth driven by nutraceutical awareness and lifestyle-focused applications.

Europe

Europe accounts for 28% of the market, led by Germany (USD 25 million) and the U.K. (USD 20 million). Aging populations and a preference for clean-label, herbal supplements drive demand. Eco-conscious consumers are also fueling interest in sustainably sourced Forskolin extracts.

Asia-Pacific

APAC represents 20% of the global market (USD 33 million), with India (USD 15 million) and China (USD 18 million) showing the fastest growth. Rising health awareness, middle-class affluence, and e-commerce expansion are key growth drivers. Japan and Australia demonstrate steady, mature demand for premium nutraceutical and functional food applications.

Latin America

LATAM holds 10% of the market (USD 32 million), led by Brazil (USD 12 million). Increasing interest in herbal supplements and weight management products supports growth. Niche operators are targeting affluent consumers with premium Forskolin formulations.

Middle East & Africa

MEA accounts for 6% (USD 20 million). UAE, Saudi Arabia, and South Africa are emerging demand centers for premium herbal supplements. High-income populations, lifestyle health trends, and increasing urbanization are fueling Forskolin adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Forskolin Market

- Sabinsa Corporation

- KPC Pharmaceuticals

- Natural Remedies Pvt. Ltd.

- Sami Labs Ltd.

- GNC Holdings

- Nutraceutical Corporation

- Himalaya Wellness

- Herbaceuticals

- Pure Encapsulations

- Indena S.p.A.

- Naturex (Givaudan)

- Nutraceutical International Corp

- Organic India

- Gaia Herbs

- BioNutrition