Global Food Texture Market Size

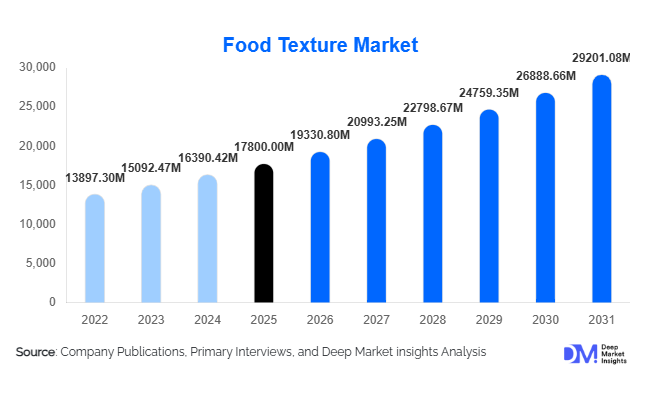

According to Deep Market Insights, the global food texture market size was valued at USD 17,800 million in 2025 and is projected to grow from USD 19,330.80 million in 2026 to reach USD 29,201.08 million by 2031, expanding at a CAGR of 8.6% during the forecast period (2026–2031). The food texture market growth is primarily driven by rising demand for plant-based and alternative protein foods, increasing consumer preference for clean-label ingredients, and technological advancements in texturizing solutions that improve sensory appeal, stability, and shelf life of processed foods.

Key Market Insights

- Plant-based and alternative protein foods are boosting demand for advanced texturizers, as manufacturers seek to replicate animal-like textures in meat, dairy, and snack applications.

- Hydrocolloids and fermentation-derived ingredients are gaining prominence, offering improved functionality, sustainability, and clean-label benefits.

- North America dominates the global market, driven by high processed food consumption, innovation in premium textures, and strong consumer interest in plant-based products.

- Asia-Pacific is the fastest-growing region, led by China and India, fueled by urbanization, rising disposable incomes, and expanding food processing industries.

- Technological adoption in processing and texturizer design, including extrusion, high-pressure processing, and enzyme modification, is enhancing product performance and market expansion.

What are the latest trends in the food texture market?

Plant-Based and Clean-Label Focus

Consumer preference is shifting toward clean-label and plant-based foods, prompting manufacturers to adopt plant-derived hydrocolloids, proteins, and starches as primary texturizers. These ingredients maintain mouthfeel, creaminess, and chewiness without relying on artificial additives. The trend is particularly strong in dairy alternatives, meat analogues, and bakery products, where texture is a key differentiator. Food manufacturers are increasingly reformulating products with allergen-free, vegan, and non-GMO texturizers to meet regulatory requirements and evolving consumer expectations.

Technological Innovations in Texture Solutions

Advancements in extrusion, high-pressure processing, and enzyme-assisted texturization have enabled the creation of more consistent and functional textures. Fermentation-based hydrocolloids and protein structuring solutions are improving mouthfeel, stability, and nutritional performance. These technologies allow manufacturers to produce textures that withstand thermal processing, freezing, and extended storage without compromising quality. Digital formulation tools and application labs are supporting product development, reducing trial-and-error cycles and accelerating time-to-market.

What are the key drivers in the food texture market?

Rising Demand for Processed and Convenience Foods

The increasing consumption of packaged, ready-to-eat, and convenience foods worldwide is driving demand for texture-enhancing ingredients. Busy lifestyles, urbanization, and changing dietary patterns are prompting food manufacturers to deliver consistent sensory quality across high-volume production. Texturizers help maintain product stability, improve mouthfeel, and extend shelf life, making them indispensable in modern food manufacturing.

Growth of Plant-Based and Reduced-Fat Products

The surge in plant-based and reduced-fat foods has created a strong need for texturizers that replicate creaminess, elasticity, and juiciness. Ingredients like hydrocolloids, plant proteins, and fat mimetics are essential to maintain indulgent textures in healthier formulations. This trend is particularly strong in North America and Europe, where consumers are willing to pay premium prices for nutritious and sensory-appealing products.

Expansion of Emerging Markets

Rapid urbanization, rising disposable incomes, and Westernized dietary habits in Asia-Pacific, Latin America, and the Middle East are increasing the adoption of processed and convenience foods. Local manufacturers are investing in texture solutions to improve product appeal, shelf life, and export competitiveness. Government initiatives supporting food processing infrastructure further boost market expansion.

What are the restraints for the global market?

Volatility in Raw Material Prices

Prices of key texturizers such as seaweed-derived hydrocolloids, specialty starches, and dairy proteins are subject to fluctuations, impacting production costs and profit margins. This volatility poses challenges for manufacturers in maintaining stable pricing and long-term supply contracts.

Regulatory and Clean-Label Pressures

Rising scrutiny over artificial additives and the growing demand for clean-label products create challenges for manufacturers. Reformulation with natural ingredients while maintaining desired textures can be technically complex and costly, limiting rapid adoption across all product categories.

What are the key opportunities in the food texture market?

Expansion in Plant-Based and Alternative Proteins

Plant-based meat, dairy alternatives, and protein-enriched snacks require advanced texture systems to replicate traditional food experiences. This presents a significant opportunity for texturizer manufacturers to innovate with plant-derived proteins, hydrocolloids, and fermentation-based ingredients. Companies that can deliver clean-label, allergen-free, and heat-stable textures will capture strong market share, particularly in North America and Europe.

Adoption of Fermentation and Biotechnology

Fermentation-based production of hydrocolloids, proteins, and fat mimetics allows for consistent quality, sustainability, and novel functional properties. Biotechnology enables manufacturers to meet clean-label demands, reduce environmental impact, and offer differentiated textures for plant-based and processed foods, positioning these solutions as a high-value growth area.

Growth in Emerging Markets

Emerging regions such as Asia-Pacific, the Middle East, and Latin America are witnessing rapid demand for processed, ready-to-eat, and convenience foods. Localized texture solutions that cater to regional taste profiles and cost constraints present opportunities for new entrants and established players alike. Government support for food processing infrastructure further strengthens growth potential.

Product Type Insights

Hydrocolloids dominate the ingredient type segment, accounting for approximately 34% of the 2025 market, due to their versatility across gelling, thickening, and stabilizing functions. Powdered texturizers are the preferred physical form, representing 62% of the market, because of ease of handling, blending, and longer shelf life. Stabilizers lead the functionality segment with 28% market share, widely used in dairy, beverages, and sauces to maintain consistency and shelf stability.

Application Insights

Bakery and confectionery remain the largest application, with 24% market share in 2025, driven by high-volume consumption and frequent product innovation. Dairy and plant-based alternatives are rapidly adopting hydrocolloids and protein-based texturizers to enhance creaminess and mouthfeel. Meat analogues, sauces, and ready-to-eat meals are also emerging as high-growth applications requiring advanced texture solutions.

Distribution Channel Insights

Direct B2B sales dominate, with food and beverage manufacturers procuring texturizers for industrial-scale production. Specialty ingredient distributors provide regional support, while e-commerce platforms are gaining traction for small-quantity and niche ingredient sales. Increasingly, manufacturers are offering technical support, application labs, and formulation services to enhance customer adoption and satisfaction.

End-Use Insights

The food and beverage manufacturing segment represents 78% of market demand, led by large-scale producers of bakery, dairy, beverages, and processed foods. The nutraceutical and functional food industry is emerging as a high-growth end-use, while foodservice demand is rebounding, particularly in restaurants and catering sectors. Export-driven demand is increasing, especially from the U.S., Europe, and Asia-Pacific, for processed and specialty foods.

| By Functionality | By Ingredient Type | By Source | By Physical Form | By Application | By End-Use Industry |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounts for 31% of the 2025 market, led by the U.S. due to high processed food consumption, plant-based innovation, and strong consumer preference for clean-label products. Canada contributes to premium and functional food adoption, strengthening regional demand.

Europe

Europe holds 27% share, with Germany, France, and the U.K. leading demand for clean-label, plant-based, and indulgent texture solutions. High regulatory standards and consumer willingness to pay premium prices support growth. Eco-friendly and sustainable texturizers are increasingly adopted in this region.

Asia-Pacific

APAC is the fastest-growing region, with China and India driving adoption at 10.2% CAGR. Rising urbanization, disposable income, and expanding food processing industries are key growth factors. Southeast Asian countries like Indonesia and Vietnam are rapidly increasing processed food consumption, creating new opportunities.

Latin America

Brazil and Mexico are leading countries, with increasing demand for processed foods and bakery products. Growth is moderate, driven by expanding industrial food processing and urban consumption patterns.

Middle East & Africa

South Africa, Saudi Arabia, and UAE are key markets, supported by import-driven processed foods, increasing convenience food consumption, and rising awareness of health-forward texture solutions. Intra-African trade is growing, supporting regional demand for texturizers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|