Modified Food Starch Market Size

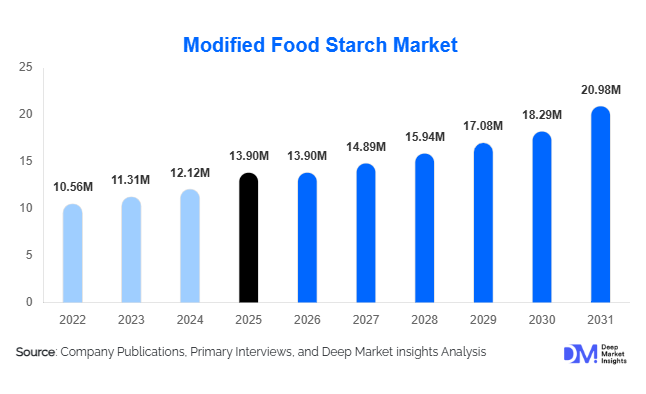

According to Deep Market Insights,the global modified food starch market size was valued at USD 13.9 billion in 2025 and is projected to grow from USD 14.89 billion in 2026 to reach USD 20.98 billion by 2031, expanding at a CAGR of 7.1% during the forecast period (2026–2031). The modified food starch market growth is primarily driven by rising consumption of processed and convenience foods, increasing demand for texture stability and shelf-life enhancement, and the growing adoption of plant-based and clean-label food formulations across global food manufacturing industries.

Key Market Insights

- Corn-based modified starch dominates the global supply, supported by abundant raw material availability and cost efficiency across North America and Asia-Pacific.

- Chemically modified starch remains the most widely used category, offering superior stability under extreme processing conditions such as heat, shear, and acidity.

- Asia-Pacific leads global demand, driven by large-scale food processing growth in China, India, and Southeast Asia.

- North America remains a mature yet high-value market, supported by innovation in clean-label and specialty starch solutions.

- Processed and convenience foods represent the largest application segment, accounting for over 40% of total starch consumption.

- Technological advancements in enzymatic modification are enabling customized starch solutions for premium and functional food products.

What are the latest trends in the modified food starch market?

Rising Demand for Clean-Label and Non-GMO Starches

Food manufacturers are increasingly reformulating products to meet clean-label expectations, reducing the use of chemically intensive additives while maintaining product performance. This trend is driving demand for physically and enzymatically modified starches that can be labeled as natural or minimally processed. Europe and North America are leading this shift, particularly in bakery, dairy, and infant nutrition applications. Manufacturers are investing in proprietary processing technologies to deliver starches with clean-label compatibility, enabling premium pricing and long-term customer contracts.

Growth of Convenience and Ready-to-Eat Foods

Urbanization, rising disposable incomes, and changing lifestyles are accelerating demand for ready meals, frozen foods, sauces, and instant products. Modified food starch plays a critical role in these categories by providing thickening, stabilization, freeze–thaw resistance, and improved mouthfeel. Asia-Pacific and Latin America are witnessing particularly strong growth, as local food processors expand capacity to serve both domestic and export markets.

What are the key drivers in the modified food starch market?

Expansion of Global Food Processing Industry

The rapid expansion of industrial food manufacturing is a primary driver of modified food starch demand. Large-scale producers rely on starches to ensure consistency, scalability, and cost optimization across high-volume production lines. Increasing investments in food parks, cold-chain infrastructure, and export-oriented processing hubs—especially in China, India, Vietnam, and Brazil—are significantly boosting starch consumption.

Functional Superiority Over Native Starch

Modified food starches outperform native starches in terms of thermal stability, viscosity control, and resistance to processing stress. These functional advantages make them indispensable in applications such as dairy desserts, soups, sauces, meat products, and beverages. As food formulations become more complex, demand for application-specific starch solutions continues to rise.

What are the restraints for the global market?

Volatility in Raw Material Prices

Price fluctuations in corn, wheat, cassava, and energy inputs directly impact production costs and margins for starch manufacturers. Climatic variability, geopolitical trade restrictions, and biofuel demand contribute to input cost volatility, posing challenges for long-term pricing stability.

Regulatory and Labeling Constraints

In certain regions, particularly Europe, regulatory scrutiny over chemically modified food ingredients and labeling requirements can limit product adoption. Compliance costs and reformulation pressures may slow growth for traditional modified starch categories, pushing manufacturers toward alternative processing methods.

What are the key opportunities in the modified food starch industry?

Emerging Market Demand in Asia and Africa

Rapid population growth, urbanization, and rising packaged food consumption in Asia-Pacific and Africa present substantial opportunities. Countries such as India, Indonesia, Vietnam, Nigeria, and Kenya are witnessing double-digit growth in food processing output, creating sustained demand for cost-effective functional ingredients like modified food starch.

Customized and Application-Specific Starch Solutions

Food manufacturers increasingly seek tailored starch systems designed for specific applications such as gluten-free bakery, plant-based meat analogues, and clinical nutrition. Suppliers offering customized blends, technical support, and co-development capabilities are well positioned to capture higher margins and long-term contracts.

Product Type Insights

Chemically modified starch dominates the global modified starch market, accounting for over 50% of total demand due to its superior stability, viscosity control, heat tolerance, and resistance to shear and acidic conditions. These functional advantages make chemically modified starch the preferred choice across processed foods, sauces, bakery fillings, and dairy formulations where consistent performance is critical during industrial processing and storage.

Physically modified starch is gaining increasing traction, particularly in clean-label and minimally processed food applications. This segment is witnessing strong adoption in Europe and North America, where regulatory pressures and consumer preference for recognizable ingredients are driving demand for starches modified through physical processes such as heat and pressure rather than chemical agents.Enzymatically modified starch represents a fast-growing niche within the market, driven by rising demand for precision functionality, enhanced digestibility, and natural positioning. Its growing use in premium food products, infant nutrition, and specialized dietary formulations is supported by advancements in enzyme technology and increasing investment in high-value starch innovation.

Application Insights

Processed and convenience foods constitute the largest application segment, supported by sustained global demand for ready meals, instant soups, sauces, gravies, and frozen foods. Modified starch plays a critical role in improving texture, stability, shelf life, and freeze-thaw performance, making it indispensable in modern food processing.

Bakery and confectionery applications follow closely, leveraging modified starch for moisture retention, crumb softness, texture enhancement, and improved mouthfeel. The growth of packaged bakery products, artisanal-style breads, and premium confectionery items continues to fuel demand in this segment.Dairy products, including yogurts, flavored milk, desserts, and dairy alternatives, represent a key growth area, particularly in emerging markets. Modified starch is widely used as a stabilizer and thickener, supporting product consistency and cost optimization amid fluctuating dairy raw material prices.

Distribution Channel Insights

Direct B2B supply agreements dominate the global market, with large food and beverage manufacturers sourcing modified starch through long-term contracts to ensure consistent quality, technical support, and reliable supply. These partnerships often involve customized starch solutions tailored to specific processing requirements.

Regional distributors and ingredient suppliers play a vital supporting role by serving small and mid-sized food processors that require flexible volumes and localized technical assistance. Additionally, increasing digitalization of procurement systems and technical sales platforms is improving transparency, customer engagement, and supply-chain efficiency across the market.

End-Use Industry Insights

The food and beverage manufacturing sector accounts for more than 80% of total modified starch demand, driven by its extensive use across processed foods, beverages, dairy, bakery, and confectionery applications. Modified starch remains a core functional ingredient due to its versatility, cost-effectiveness, and adaptability to diverse formulations.

Foodservice operators and quick-service restaurant (QSR) chains represent the second-largest end-use segment, utilizing modified starch in sauces, dressings, coatings, and ready-to-use mixes to ensure consistency and scalability.Emerging demand from nutraceuticals, clinical nutrition, infant food, and plant-based food manufacturers is expanding the addressable market for high-value and specialty starch products. This trend is supported by rising health awareness and innovation in functional and fortified food offerings.

| By Source | By Modification Type | By Functionality | By Application | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global modified starch market, accounting for approximately 38% of total demand in 2025. China remains the largest consumer due to its vast processed food manufacturing base, strong domestic consumption, and expanding export-oriented food sector.

India represents the fastest-growing market in the region, driven by rapid urbanization, increasing consumption of packaged and convenience foods, and government-led initiatives promoting food processing and agri-value chains. Rising investments in dairy processing, bakery, and ready-to-eat foods further support regional growth.

North America

North America accounts for around 26% of global modified starch demand, led primarily by the United States. The region benefits from strong innovation in specialty and functional starches, high adoption of clean-label products, and advanced food processing technologies.

Growth is further supported by rising consumption of convenience foods, expanding plant-based and dairy alternative segments, and continuous product reformulation to meet clean-label and nutritional requirements.

Europe

Europe represents nearly 22% of the global market, with Germany, France, and the United Kingdom driving demand. The region places a strong emphasis on sustainability, clean labeling, and strict regulatory compliance, influencing starch formulation strategies across food applications.

Demand for physically and enzymatically modified starches is increasing as manufacturers seek alternatives to chemically modified ingredients while maintaining performance and shelf-life standards.

Latin America

Latin America is experiencing steady market growth, led by Brazil and Mexico. Expansion of the regional food processing industry, rising domestic consumption of packaged foods, and growing food exports are key drivers supporting modified starch demand.

Additionally, increasing investments in local manufacturing facilities and improved access to raw materials are enhancing the competitiveness of regional starch producers.

Middle East & Africa

The Middle East & Africa region represents an emerging growth market, with rising demand observed in South Africa, Saudi Arabia, and the United Arab Emirates. Growth is supported by population expansion, increasing urbanization, and changing dietary patterns favoring processed and convenience foods.

Government initiatives focused on food import substitution, along with investments in local food manufacturing and food security programs, are expected to drive long-term demand for modified starch across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Modified Food Starch Market

- Cargill Incorporated

- ADM (Archer Daniels Midland)

- Ingredion Incorporated

- Tate & Lyle PLC

- Roquette Frères

- Avebe

- Südzucker Group

- Emsland Group

- Grain Processing Corporation

- AGRANA Group

- COFCO Biochemical

- Global Bio-chem Technology Group

- Thai Wah Public Company

- PT Budi Starch & Sweetener

- Manildra Group