Food Immunomodulator Market Size

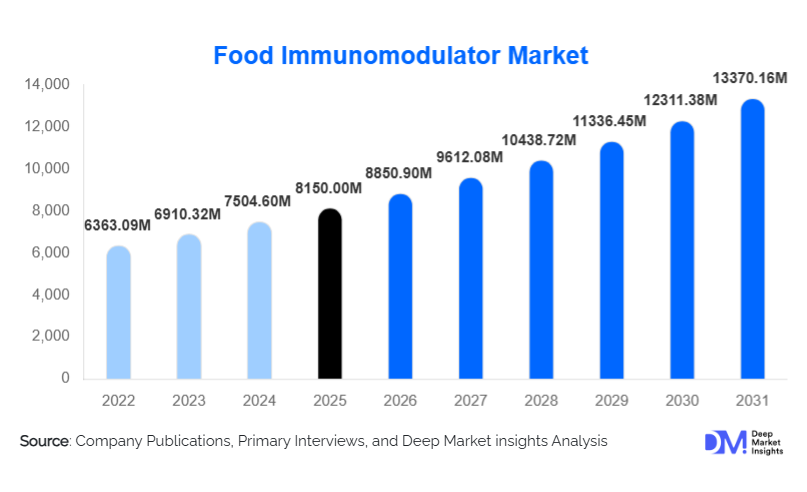

According to Deep Market Insights, the global food immunomodulator market size was valued at USD 8,150.00 million in 2025 and is projected to grow from USD 8,850.90 million in 2026 to reach USD 13,370.16 million by 2031, expanding at a CAGR of 8.6% during the forecast period (2026–2031). The food immunomodulator market growth is primarily driven by rising consumer awareness of preventive healthcare, increasing demand for functional and fortified foods, and growing scientific validation linking nutrition with immune system regulation.

Key Market Insights

- Food immunomodulators are transitioning from niche supplements to daily dietary staples, supported by growing interest in preventive and holistic health management.

- Probiotics and gut-health-focused products dominate the market, reflecting strong consumer understanding of the gut–immune system connection.

- North America leads global consumption, driven by high functional food penetration and strong regulatory recognition of immune health claims.

- Asia-Pacific is the fastest-growing region, supported by rising middle-class incomes, urbanization, and increasing adoption of fortified foods.

- Plant-based and clean-label formulations are gaining momentum, aligning with vegan, natural, and sustainability-focused consumer preferences.

- Digital and direct-to-consumer distribution channels are reshaping market access through personalized nutrition and subscription-based models.

What are the latest trends in the food immunomodulator market?

Shift Toward Gut-Health-Centric Immunity Solutions

One of the most prominent trends in the food immunomodulator market is the growing focus on gut health as the foundation of immune regulation. Products enriched with probiotics, prebiotics, and postbiotics are being positioned as daily immunity solutions rather than therapeutic supplements. Advances in microbiome research have strengthened consumer confidence in gut-targeted functional foods, leading to expanded applications across dairy, beverages, snacks, and infant nutrition. Manufacturers are increasingly investing in strain-specific probiotics and clinically validated formulations, enhancing differentiation and premiumization within the market.

Rise of Clean-Label and Plant-Based Immunomodulators

Consumers are increasingly demanding transparency, natural ingredients, and sustainability, accelerating the shift toward plant-based and clean-label immunomodulatory foods. Botanical extracts, polyphenols, beta-glucans, and medicinal mushroom-derived compounds are gaining traction as alternatives to synthetic immune boosters. This trend is particularly strong in Europe and North America, where regulatory scrutiny and consumer awareness are high. Manufacturers are reformulating products to remove artificial additives, allergens, and GMOs, while highlighting traceability and ethical sourcing as key value propositions.

What are the key drivers in the food immunomodulator market?

Rising Demand for Preventive Healthcare Through Nutrition

Escalating healthcare costs and the growing prevalence of lifestyle-related and immune-compromising conditions have accelerated the shift toward preventive healthcare. Consumers increasingly view food immunomodulators as an accessible, daily solution to maintain immune resilience. Functional foods and beverages offering immune benefits are perceived as safer and more sustainable compared to pharmaceutical interventions, driving widespread adoption across age groups.

Scientific Validation and Technological Advancements

Advances in food science, fermentation technology, and bioavailability enhancement have significantly improved the efficacy and stability of immunomodulatory ingredients. Improved encapsulation techniques allow sensitive compounds such as probiotics and omega-3 fatty acids to be incorporated into a wider range of food matrices. Growing clinical evidence supporting immune health claims has further strengthened regulatory acceptance and consumer trust, fueling market growth.

What are the restraints for the global market?

Regulatory Complexity and Inconsistent Health Claims

The food immunomodulator market faces regulatory challenges due to varying standards for ingredient approvals, labeling, and health claims across regions. These inconsistencies increase compliance costs and slow global product rollouts, particularly for smaller and mid-sized manufacturers. Strict regulations in Europe and selective claim approvals in North America can limit marketing flexibility.

Raw Material Price Volatility

Fluctuations in the prices of key raw materials, including probiotics, omega-3 sources, and plant-based bioactives, pose challenges for manufacturers. Dependence on agricultural yields, marine resources, and fermentation substrates exposes the market to supply chain disruptions, impacting margins and pricing stability.

What are the key opportunities in the food immunomodulator industry?

Personalized and Precision Nutrition

The integration of personalized nutrition represents a significant growth opportunity. Advances in microbiome diagnostics and digital health platforms enable customized immunomodulatory food solutions tailored to age, lifestyle, and health conditions. Subscription-based and D2C models are allowing companies to deliver targeted formulations, increasing consumer engagement and lifetime value.

Expansion in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and the Middle East present strong growth opportunities due to rising disposable incomes and government-led nutrition awareness initiatives. Localized formulations, affordable pricing strategies, and domestic manufacturing are enabling deeper penetration in countries such as India, China, Brazil, and Saudi Arabia.

Product Type Insights

Probiotic-based food immunomodulators dominate the market, accounting for approximately 34% of global revenue in 2024, supported by strong clinical evidence and broad consumer acceptance. Prebiotics and postbiotics are gaining momentum as complementary solutions that enhance gut microbiota function. Bioactive plant compounds, including polyphenols and flavonoids, are expanding rapidly due to clean-label demand. Vitamins and minerals such as vitamin D and zinc continue to play a critical role, particularly in fortified staple foods and beverages.

Application Insights

Gut immunity remains the leading application, representing nearly 31% of total market demand in 2024. Pediatric and geriatric immunity applications are growing steadily, driven by demographic shifts and preventive care awareness. Sports and active nutrition are emerging as a high-growth application, leveraging immunomodulators to support recovery and resilience among athletes. Clinical nutrition applications, including hospital and elderly care settings, are also expanding due to increasing institutional adoption.

Distribution Channel Insights

Supermarkets and hypermarkets remain the dominant distribution channel, benefiting from high consumer footfall and product visibility. Online and direct-to-consumer platforms account for approximately 22% of global sales and represent the fastest-growing channel, driven by convenience, personalization, and subscription-based offerings. Pharmacies and specialty health stores continue to play a key role in premium and clinically positioned products.

End-Use Insights

Household consumption represents the largest end-use segment, accounting for over 60% of total demand, as consumers incorporate immunomodulatory foods into daily diets. Clinical nutrition and institutional use, including hospitals, elderly care facilities, and sports institutes, are growing at over 13% CAGR. Infant nutrition remains a high-value segment due to strong regulatory oversight and premium pricing.

| By Ingredient Type | By Food Format | By Source | By Health Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 32% of the global food immunomodulator market in 2024, led by the United States. High consumer awareness, advanced functional food infrastructure, and strong regulatory clarity support market leadership. Demand is particularly strong for probiotics, fortified beverages, and personalized nutrition solutions.

Europe

Europe accounts for nearly 27% of global market share, driven by Germany, the U.K., and France. Strong demand for clean-label, plant-based, and sustainably sourced immunomodulators characterizes the region. Regulatory emphasis on food safety and health claims continues to shape product development.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR of approximately 13.8%. China and India together contribute over 21% of global demand, supported by large populations, rising health awareness, and government nutrition initiatives. Japan and South Korea remain strong markets for probiotic-rich functional foods.

Latin America

Latin America represents around 8% of global demand, with Brazil and Mexico leading regional consumption. Growing middle-class populations and increasing exposure to functional nutrition trends are supporting steady market expansion.

Middle East & Africa

The Middle East & Africa region accounts for approximately 6% of the global market. Saudi Arabia and the UAE are key growth markets, driven by health diversification strategies, premium food imports, and rising preventive healthcare adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Food Immunomodulator Market

- Nestlé

- Danone

- DSM-Firmenich

- BASF

- Kerry Group

- IFF (DuPont Nutrition)

- Yakult Honsha

- Chr. Hansen

- Abbott Nutrition

- General Mills

- Arla Foods

- Glanbia

- Mead Johnson Nutrition

- Herbalife

- FrieslandCampina