Fluid Lecithin Market Size

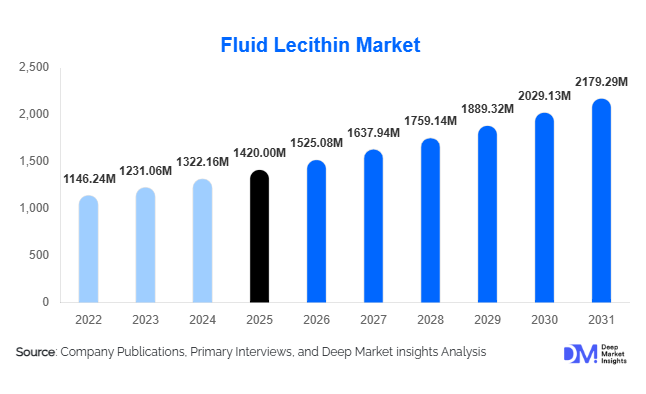

According to Deep Market Insights, the global fluid lecithin market size was valued at USD 1,420 million in 2025 and is projected to grow from USD 1,525.08 million in 2026 to reach USD 2,179.29 million by 2031, expanding at a CAGR of 7.4% during the forecast period (2026–2031). The fluid lecithin market growth is primarily driven by rising demand for natural emulsifiers in food processing, expanding applications in animal nutrition and pharmaceuticals, and increasing regulatory and consumer preference for clean-label, plant-based ingredients.

Key Market Insights

- Soy-based fluid lecithin continues to dominate the market due to cost efficiency, abundant raw material availability, and widespread acceptance across food and feed applications.

- Sunflower-based fluid lecithin is the fastest-growing segment, driven by non-GMO, allergen-free, and clean-label demand in Europe and North America.

- Food & beverage remains the largest application segment, accounting for nearly half of global demand, supported by bakery, confectionery, and processed food consumption.

- Asia-Pacific leads global consumption, supported by large-scale food manufacturing expansion in China and India.

- Pharmaceutical and nutraceutical applications are emerging as high-margin segments, particularly for customized and pharmaceutical-grade lecithin.

- Pricing and margins are closely linked to oilseed volatility, especially soybean and sunflower seed prices.

What are the latest trends in the fluid lecithin market?

Rising Shift Toward Non-GMO and Allergen-Free Lecithin

The fluid lecithin market is witnessing a pronounced shift toward non-GMO and allergen-free alternatives, particularly sunflower-based fluid lecithin. Food manufacturers are increasingly reformulating products to meet clean-label requirements and avoid allergen declarations associated with soy. This trend is especially strong in Europe, where regulatory scrutiny and consumer awareness are high. As a result, sunflower lecithin is commanding premium pricing and driving investments in dedicated crushing and processing facilities.

Customization and Functional Optimization

Manufacturers are increasingly offering customized fluid lecithin formulations tailored to specific applications such as instant foods, pharmaceutical lipid carriers, and aquafeed. Hydrolyzed and de-oiled fluid lecithin variants are gaining traction due to improved dispersibility, enhanced emulsification, and better performance in low-fat formulations. This trend reflects a broader shift from commodity-grade lecithin toward value-added functional ingredients.

What are the key drivers in the fluid lecithin market?

Expanding Processed Food and Bakery Industry

The global expansion of processed food, bakery, and confectionery industries is a major driver of fluid lecithin demand. Lecithin improves dough handling, shelf life, and texture, making it indispensable in large-scale food manufacturing. Bakery applications alone account for over 30% of food-grade fluid lecithin consumption, supported by rising urbanization and changing dietary habits.

Growing Demand from Animal Feed and Aquaculture

Fluid lecithin is increasingly used in animal feed and aquafeed formulations to enhance fat digestion, nutrient absorption, and growth performance. The rapid growth of poultry, swine, and aquaculture production particularly in Asia-Pacific and Latin America is driving strong demand for feed-grade fluid lecithin, making this one of the fastest-growing end-use segments.

Natural Ingredient Replacement in Pharmaceuticals and Cosmetics

In pharmaceuticals and personal care products, fluid lecithin is gaining traction as a natural emulsifier and bioavailability enhancer. Its compatibility with lipid-based drug delivery systems and topical formulations is supporting adoption, particularly as manufacturers reduce reliance on synthetic surfactants.

What are the restraints for the global market?

Raw Material Price Volatility

The fluid lecithin market is highly sensitive to fluctuations in soybean and sunflower seed prices. Climatic variability, geopolitical trade disruptions, and biofuel demand can significantly impact oilseed availability and pricing, directly affecting lecithin production costs and margins.

Allergen and Regulatory Challenges

Soy-based lecithin faces regulatory and labeling challenges in allergen-sensitive markets. Compliance with evolving food safety standards, non-GMO certification, and traceability requirements increases operational complexity and costs for manufacturers.

What are the key opportunities in the fluid lecithin industry?

Growth in Nutraceutical and Pharmaceutical Applications

The expanding global nutraceutical and pharmaceutical industries present a major opportunity for fluid lecithin producers. Lecithin’s role in improving bioavailability and encapsulation efficiency is driving demand for pharmaceutical-grade and customized formulations, offering higher margins than conventional food-grade products.

Emerging Market Food Processing Expansion

Rapid industrialization of food processing in Asia-Pacific, Africa, and Latin America is creating new demand centers for fluid lecithin. Localized production and strategic partnerships with regional food manufacturers can significantly reduce import dependence and logistics costs.

Source Insights

Soy-based fluid lecithin remains the dominant source in the global market, accounting for approximately 52% share in 2024. Its leadership is supported by established, large-scale soybean processing infrastructure, cost efficiency, and widespread adoption in food, feed, and industrial applications. Sunflower-based fluid lecithin represents roughly 28% of the market and is currently the fastest-growing segment due to strong consumer preference for non-GMO, allergen-free, and clean-label products. Its growth is further fueled by regulatory support and increasing use in European and North American food formulations. Rapeseed- and egg-based lecithin together account for a smaller but stable share, primarily catering to niche pharmaceutical, specialty food, and high-value applications where functional properties such as emulsification and bioavailability are critical. The segmental growth trend indicates a steady shift toward sunflower and specialty lecithin, driven by health-conscious consumers and expanding pharmaceutical applications.

Application Insights

Food & beverage applications dominate the global fluid lecithin market, accounting for nearly 48% of total market value. This is largely driven by bakery, confectionery, and processed food manufacturers who rely on lecithin for dough conditioning, emulsification, shelf-life enhancement, and texture improvement. The animal feed segment contributes around 22% of demand and is experiencing robust growth at over 8% CAGR, primarily due to rising poultry, aquaculture, and swine production in emerging economies, where lecithin enhances fat digestion and nutrient absorption. Pharmaceutical and nutraceutical applications, though smaller in volume, are the fastest-growing in value terms, as lecithin improves bioavailability and stability in lipid-based formulations. Cosmetic and industrial applications account for the remaining market share, with growth driven by the demand for natural emulsifiers in personal care products and eco-friendly industrial formulations.

Grade Insights

Food-grade fluid lecithin leads the market with approximately 55% share, benefiting from its versatility across bakery, confectionery, processed foods, and beverage formulations. Feed-grade lecithin accounts for around 23% of the market, supported by its proven role in improving animal feed efficiency. Pharmaceutical-grade lecithin, while smaller in volume, contributes disproportionately to revenue due to premium pricing, strict quality and regulatory requirements, and growing demand for nutraceutical and drug delivery applications. Industrial-grade lecithin is gaining gradual traction in coatings, paints, lubricants, and agrochemical applications, particularly in markets emphasizing natural and environmentally friendly ingredients.

| By Source | By Functionality | By Application | By Grade | By Formulation Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific is the largest regional market, representing approximately 34% of global demand in 2024. China and India are the major contributors, driven by expanding food processing industries, rapid growth of animal feed production, and increasing investment in nutraceutical and pharmaceutical manufacturing. Rising urbanization, disposable incomes, and preference for processed foods have further fueled lecithin demand. Japan and South Korea contribute a steady demand for high-purity and specialty lecithin, particularly for pharmaceutical and functional food applications. The region’s growth is also supported by government initiatives to enhance food security, industrial modernization programs, and rising exports of processed foods and feed products.

Europe

Europe holds around 27% market share, with Germany, France, and the Netherlands leading consumption. The region’s growth is strongly influenced by regulatory frameworks favoring non-GMO and clean-label ingredients, accelerating the adoption of sunflower-based lecithin. Rising consumer awareness about health, allergens, and sustainability has increased demand for natural emulsifiers in bakery, confectionery, and functional foods. Pharmaceutical and nutraceutical applications are also expanding, supported by strong R&D infrastructure and high consumer willingness to pay for premium and specialty lecithin products.

North America

North America is a mature yet innovation-driven market, dominated by the U.S., with Canada contributing a smaller but consistent demand. Growth is primarily driven by the increasing use of functional and customized lecithin formulations in food, beverages, dietary supplements, and pharmaceuticals. Clean-label initiatives, higher health-conscious consumer spending, and the rising demand for non-GMO and sunflower-based lecithin are key drivers. Additionally, technological adoption in processing and distribution, along with investments in specialty lecithin for nutraceutical and pharma applications, is fueling market expansion.

Latin America

Latin America, led by Brazil and Argentina, benefits from abundant oilseed production, which enables competitive pricing and export-oriented lecithin manufacturing. Growth is driven by rising domestic consumption in the bakery, confectionery, and feed sectors, as well as expanding exports to North America, Europe, and the Asia-Pacific. Increasing industrialization of the food and feed sectors, coupled with government incentives for agro-processing and value-added production, further supports regional growth.

Middle East & Africa

MEA remains a developing market, with demand largely driven by food imports, expanding poultry and aquaculture production, and the increasing incorporation of emulsifiers in processed foods. Growth is supported by urbanization, rising disposable incomes in Gulf countries, and the expansion of retail and food service sectors. Countries like the UAE, Saudi Arabia, and South Africa are witnessing increased adoption of functional and high-quality lecithin products for both food and feed applications, while regulatory alignment with international quality standards enhances market confidence and encourages import-driven expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fluid Lecithin Market

- ADM

- Cargill

- Bunge

- Wilmar International

- Lipoid GmbH

- Stern-Wywiol Gruppe

- IFF (DuPont)

- Lasenor Emul

- American Lecithin Company

- Lecico GmbH

- Clarkson Grain

- Novastell

- Kewpie Corporation

- Shankar Soya Concepts

- Patnjali Foods (Ruchi Soya)