Floating Hotels Market Size

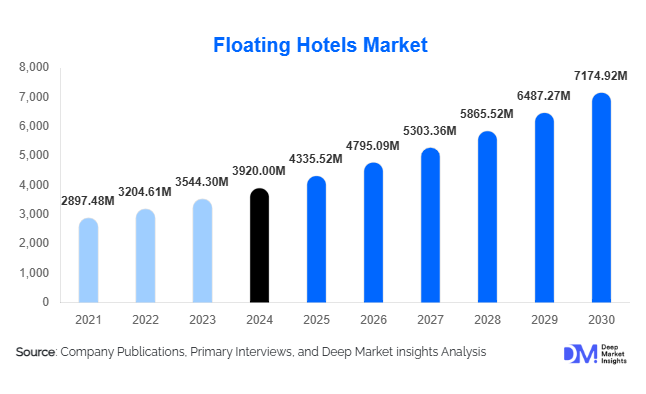

According to Deep Market Insights, the global floating hotels market size was valued at USD 3,920.00 million in 2024 and is projected to grow from USD 4,335.52 million in 2025 to reach USD 7,174.92 million by 2030, expanding at a CAGR of 10.6% during the forecast period (2025–2030). The floating hotels market growth is driven by rising demand for experiential tourism, increasing development of waterfront infrastructure, and the growing adoption of floating hospitality solutions as alternatives to land-based hotels in space-constrained coastal and urban regions.

Key Market Insights

- Experiential and luxury tourism is a core demand driver, with floating hotels offering immersive waterfront, river, and ocean-based stays.

- Cruise-based floating hotels dominate the market, accounting for nearly half of global revenue due to high guest capacity and diversified onboard services.

- Europe leads global demand, supported by mature river cruise tourism across Germany, France, and the Netherlands.

- Asia-Pacific is the fastest-growing region, fueled by rising tourism investments in China, India, Southeast Asia, and island economies.

- Luxury and ultra-luxury floating hotels command premium pricing, generating higher margins compared to mid-scale offerings.

- Sustainability and modular marine technologies are reshaping floating hotel construction and operations.

What are the latest trends in the floating hotels market?

Shift Toward Stationary Floating Hotels

The market is witnessing a growing shift from traditional cruise-based accommodations toward stationary floating hotels located in rivers, lakes, and coastal zones. These properties cater to travelers seeking waterfront experiences without long-distance travel. Cities facing land constraints are adopting stationary floating hotels as part of urban regeneration and tourism infrastructure projects, particularly in Europe and the Asia-Pacific.

Sustainable and Smart Floating Hospitality

Sustainability is becoming central to floating hotel development. Operators are integrating solar power, hybrid propulsion systems, wastewater recycling, and energy-efficient marine materials. Smart technologies such as AI-driven demand forecasting, digital guest management systems, and automated navigation controls are enhancing operational efficiency while reducing environmental impact.

What are the key drivers in the floating hotels market?

Rising Demand for Experiential and Luxury Travel

Global travelers increasingly prioritize unique lodging experiences over standardized hotel stays. Floating hotels provide panoramic views, destination mobility, and curated onboard experiences, enabling operators to command higher average daily rates. Growth in high-net-worth populations across North America, Europe, the Middle East, and Asia-Pacific continues to support premium demand.

Urban Land Scarcity and Waterfront Development

Limited availability and high costs of coastal land are encouraging governments and developers to adopt floating hotels as viable hospitality solutions. Waterfront redevelopment initiatives across major tourism cities are accelerating the deployment of floating accommodations without extensive land acquisition or zoning challenges.

What are the restraints for the global market?

High Capital and Construction Costs

Floating hotels require specialized marine engineering, safety compliance, and mooring infrastructure, resulting in higher upfront capital expenditure compared to land-based hotels. These costs can limit participation to well-capitalized operators and delay project execution in developing markets.

Regulatory and Maritime Compliance Complexity

Floating hotels must comply with both hospitality regulations and maritime safety standards, which vary widely across countries. Lengthy approval processes, environmental clearances, and navigation restrictions can slow market expansion and increase operational risk.

What are the key opportunities in the floating hotels industry?

Government-Backed Waterfront Tourism Projects

Public-private partnerships focused on waterfront tourism development present major growth opportunities. Governments in Asia, the Middle East, and Europe are actively promoting floating hotels to enhance tourism capacity while preserving land resources, creating long-term project pipelines for operators.

Luxury and Boutique Floating Hotel Concepts

There is a strong opportunity in ultra-luxury and boutique floating hotels that target affluent travelers seeking exclusivity and bespoke experiences. These concepts offer higher margins, brand differentiation, and strong demand resilience compared to mass-market offerings.

Platform Type Insights

Cruise-based floating hotels dominate the market, accounting for approximately 46% of global revenue in 2024 due to large guest capacity and diversified onboard amenities. Barge-based and river floating hotels form a significant secondary segment, particularly in Europe. Semi-submersible and modular pontoon floating hotels are gaining traction for luxury, eco-tourism, and stationary hospitality applications.

Service Class Insights

Luxury and ultra-luxury floating hotels lead the market with around 39% share, driven by high average daily rates and strong demand from premium travelers. Premium and mid-scale segments cater to mainstream tourism and business travel, while budget floating hotels are emerging in developing regions to support domestic tourism growth.

Application Insights

Leisure tourism is the dominant application, contributing approximately 61% of total market revenue, supported by vacation travel and destination experiences. Business and MICE tourism is growing rapidly as floating hotels are increasingly used for conferences, exhibitions, and corporate retreats. Long-stay residential and event-based temporary accommodation represent emerging applications.

End-User Capacity Insights

Large-capacity floating hotels accommodating more than 300 guests account for about 44% of the market, benefiting from economies of scale and multiple revenue streams. Medium-capacity hotels serve premium and boutique segments, while small floating hotels are favored for niche luxury and eco-tourism offerings.

| By Platform Type | By Water Body Type | By Service Class | By Application | By Ownership Model |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe holds the largest share of the floating hotels market at approximately 34% in 2024. Strong river cruise tourism across Germany, France, the Netherlands, and Switzerland continues to drive demand, supported by well-established inland waterway networks and high passenger volumes. The region benefits from mature tourism infrastructure, consistent investment in fleet upgrades, and early adoption of environmentally compliant floating hospitality models aligned with EU sustainability regulations.

Asia-Pacific

Asia-Pacific accounts for around 29% of global market revenue and is the fastest-growing region, with a forecast CAGR of nearly 10%. China, India, Thailand, and Indonesia are key markets, supported by rising domestic tourism, expanding river and coastal infrastructure, and increased government investment in cruise terminals and inland waterway development. Growing middle-class travel demand and a shift toward experiential tourism further strengthen regional growth.

North America

North America represents about 21% of the market, dominated by the United States. Cruise-based floating hotels remain the primary revenue contributors, supported by strong domestic and outbound tourism, high spending per traveler, and established cruise operators. Demand is concentrated along major coastal routes and inland waterways, with ongoing investments in vessel modernization and port facilities.

Middle East & Africa

The Middle East & Africa region accounts for roughly 9% of global demand, led by the UAE and Saudi Arabia. Growth is driven by large-scale waterfront tourism developments, luxury-focused hospitality projects, and government-led diversification initiatives. High disposable incomes and strong international tourist inflows support the adoption of premium floating hotel concepts.

Latin America

Latin America holds approximately 7% of the market, with Brazil and Mexico emerging as key countries. Coastal tourism, river-based leisure travel, and increasing investment in tourism infrastructure are supporting market expansion. Interest in destination-driven and nature-focused travel experiences is gradually strengthening demand for floating hotel offerings.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Floating Hotels Market

- Carnival Corporation

- Royal Caribbean Group

- Norwegian Cruise Line Holdings

- MSC Cruises

- Genting Group

- Viking Cruises

- Hurtigruten Group

- Lindblad Expeditions

- Ponant

- Scenic Group

- TUI Group

- Dream Cruises

- Silversea Cruises

- Uniworld Boutique River Cruises

- Emerald Cruises