Domestic Tourism Market Size

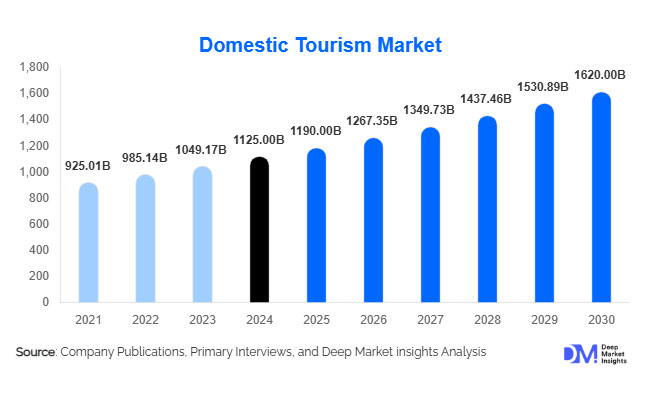

According to Deep Market Insights, the global domestic tourism market size was valued at USD 1,125 billion in 2024 and is projected to grow from USD 1,190 billion in 2025 to reach USD 1,620 billion by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing domestic travel preferences, rising disposable incomes, growth of regional connectivity, and the expanding popularity of experiential and wellness-focused tourism within local regions.

Key Market Insights

- Domestic tourism is increasingly shifting toward experiential and wellness-focused travel, attracting travelers seeking cultural, eco-tourism, and recreational activities close to home.

- Digital platforms and online bookings are transforming travel experiences, enabling travelers to customize itineraries, compare prices, and access real-time reviews.

- Asia-Pacific and Europe are key growth regions, with rising middle-class populations and government-led initiatives supporting regional travel and micro-tourism.

- Weekend and short-term trips are becoming more popular, particularly among millennials and working professionals seeking convenient leisure options.

- Adventure and eco-tourism segments are emerging, providing niche opportunities for operators to offer differentiated and sustainable travel packages.

- Technological adoption, including AI trip planners, mobile apps, and virtual travel previews, is enhancing convenience and personalization for domestic travelers.

Latest Market Trends

Rise of Experiential and Eco-Tourism

Domestic tourism operators are increasingly offering experiences that combine leisure, culture, and sustainability. Activities such as nature treks, heritage tours, local culinary experiences, and eco-lodges are attracting travelers who prioritize meaningful engagement over conventional sightseeing. Regional governments are promoting lesser-known destinations through marketing campaigns, infrastructure development, and policy incentives. Travelers are also showing a preference for environmentally responsible travel, driving the adoption of low-impact accommodation, renewable energy usage, and community-based tourism programs. These trends have reshaped the domestic tourism market toward holistic and immersive travel experiences.

Digital and Technology-Driven Travel Booking

The adoption of digital solutions has transformed the domestic tourism landscape. Mobile applications, AI-powered recommendations, and online travel agencies are enabling travelers to plan and book personalized trips effortlessly. Virtual tours and interactive destination previews are influencing decision-making, particularly among younger demographics. Operators are integrating advanced analytics to track traveler preferences and provide customized packages, while real-time updates on availability and pricing improve transparency. This shift to tech-driven solutions has made domestic tourism more accessible, streamlined, and appealing to modern consumers.

Domestic Tourism Market Drivers

Growing Disposable Income and Middle-Class Expansion

The rise in disposable income and expanding middle-class populations globally are driving domestic travel. Travelers are increasingly seeking short-term getaways, luxury accommodations, and premium experiences within their own countries. Economic growth in emerging markets has created a new consumer segment willing to spend on leisure and adventure travel, contributing significantly to domestic tourism revenue growth. The increasing affordability of domestic flights, road transport, and digital booking solutions has further enabled higher travel frequency among the population.

Government Support and Infrastructure Development

Government initiatives such as regional tourism promotion, transport connectivity projects, and subsidized accommodations have enhanced domestic tourism. Investments in airports, highways, and rail networks facilitate easier access to key destinations, while public-private partnerships improve the quality of hospitality services. Campaigns promoting cultural and rural tourism create awareness and incentivize travelers to explore local regions, driving both economic growth and social inclusion. Policy support has been especially impactful in Asia-Pacific and Europe, stimulating consistent market expansion.

Preference for Short-Distance and Experiential Travel

Post-pandemic travel behavior has shifted toward domestic destinations and short-duration trips. Travelers now favor weekend getaways, regional tours, and activity-focused travel, including wellness retreats, cultural experiences, and adventure tourism. This trend has encouraged operators to design flexible packages and itineraries tailored to local travelers’ preferences. Customized experiences, combined with proximity to home, ensure repeat travel and higher adoption of domestic tourism offerings across diverse demographic segments.

Market Restraints

High Operational Costs for Premium Offerings

High-quality domestic tourism experiences, particularly luxury and adventure-focused packages, require significant investment in infrastructure, staff, and specialized services. This restricts participation to premium travelers, limiting market penetration among mid- and lower-income segments. Seasonal fluctuations and maintenance costs for resorts, eco-lodges, and transport services also impact profitability.

Environmental and Capacity Challenges

Overcrowding at popular destinations, inadequate waste management, and pressure on natural resources can limit sustainable growth. Operators and local authorities need to manage carrying capacity, ensure preservation of natural and cultural sites, and maintain the quality of travel experiences. Failure to address these issues may constrain long-term expansion and reduce traveler satisfaction.

Domestic Tourism Market Opportunities

Rural and Offbeat Destination Development

Underserved rural and offbeat regions offer significant potential for tourism development. Operators can create curated packages highlighting local culture, heritage sites, and nature-based activities. Governments are also promoting these destinations through marketing campaigns and subsidies. Early investments in these emerging regions provide a competitive advantage and attract travelers seeking unique, less-crowded experiences.

Technology Integration and Personalization

Advanced digital platforms, AI trip planners, and mobile apps are enabling highly personalized travel experiences. Operators can leverage these technologies to recommend tailored itineraries, provide real-time travel updates, and facilitate convenient bookings. Enhanced customer engagement through technology-driven solutions increases satisfaction, repeat visits, and brand loyalty, offering significant growth opportunities for both established and new entrants.

Wellness and Adventure Tourism

The convergence of wellness and adventure tourism is creating niche opportunities within the domestic market. Wellness retreats, spa-centric resorts, and adventure-focused packages are attracting health-conscious travelers and millennials seeking active leisure. Integrating activities such as trekking, yoga, and eco-volunteering into travel offerings differentiates service providers and captures high-value segments willing to pay premium prices for unique experiences.

Product Type Insights

Leisure tourism dominates the domestic tourism market, accounting for the majority of trips, particularly in urban and semi-urban regions. Business tourism contributes significantly, especially in countries with well-developed corporate sectors. Adventure and eco-tourism segments are emerging strongly, driven by millennials and Gen Z travelers. Accommodation choices range from luxury hotels and resorts to budget lodges, with mid-range offerings capturing the largest market share due to affordability and convenience. Short-term trips remain the most common format, while long-duration stays are increasing among family and high-spending travelers seeking immersive experiences.

Application Insights

Recreational, cultural, and wellness-based tourism are the most popular applications within domestic tourism. Adventure travel, eco-tourism, and short-term weekend getaways are gaining traction, particularly in emerging economies. Increasing focus on local cultural experiences, community engagement, and nature conservation has expanded opportunities for specialized tourism packages. Photographic, eco-volunteering, and heritage-focused itineraries are also growing in demand among niche traveler segments.

Distribution Channel Insights

Online travel agencies (OTAs) and mobile apps dominate domestic tourism bookings due to convenience, transparent pricing, and access to reviews. Direct hotel and resort bookings are rising as operators improve digital presence and marketing strategies. Travel agencies specializing in experiential, adventure, and wellness tourism continue to attract high-value travelers. Social media, influencer marketing, and subscription-based packages are emerging as influential channels to drive repeat visits and engagement.

Traveler Type Insights

Family travelers constitute a major share of domestic tourism, seeking multi-member accommodation and recreational activities. Solo travelers are rising in number, particularly among younger demographics looking for flexibility and cultural immersion. Couples favor short-duration trips and wellness experiences. Senior citizens represent a niche segment focused on comfort, accessibility, and healthcare-enabled travel. The market is witnessing higher adoption among millennials and working professionals due to disposable income and preference for short-term getaways.

| By Travel Type | By Traveler Demographics | By Accommodation | By Transportation Mode | By Spending Patterns |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is a mature domestic tourism market, with strong demand in the U.S. and Canada driven by disposable income, regional connectivity, and urban weekend getaways. The market share of North America in 2024 is approximately 27% of global domestic tourism revenue. Wellness tourism, adventure trips, and nature-focused itineraries are particularly popular.

Europe

Europe represents 25% of the 2024 market share, with Germany, the U.K., and France leading domestic travel demand. Short-duration cultural and recreational trips dominate, supported by strong transport infrastructure and regional policies promoting tourism. Europe is also among the fastest-growing regions due to increasing interest in eco-tourism and experiential travel among younger demographics.

Asia-Pacific

Asia-Pacific is the fastest-growing region, particularly in India, China, and Southeast Asia. Rapid urbanization, growing middle-class incomes, and government-led tourism campaigns contribute to strong growth. Weekend getaways, heritage tourism, and adventure activities are increasingly popular.

Latin America

Brazil, Mexico, and Argentina are the leading domestic tourism markets, with growth driven by regional connectivity and increasing urban leisure spending. Emerging eco-tourism destinations offer growth potential for niche operators.

Middle East & Africa

Middle East countries such as the UAE and Saudi Arabia show high per capita spending on domestic leisure trips. Africa, particularly South Africa, Kenya, and Morocco, has a growing domestic travel base, supported by urban-rural tourism and adventure-focused experiences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Domestic Tourism Market

- Expedia Group

- Booking Holdings

- MakeMyTrip

- Trip.com Group

- Thomas Cook India

- Cox & Kings

- TUI Group

- KKR-backed RedDoorz

- Airbnb

- OYO Rooms

- Accor Hotels

- Marriott International

- Hilton Worldwide

- InterContinental Hotels Group

- Hyatt Hotels Corporation

Recent Developments

- In March 2025, MakeMyTrip launched a series of experiential domestic travel packages in India, combining cultural tours with adventure activities for millennials.

- In January 2025, Expedia Group expanded partnerships with eco-resorts in Southeast Asia to provide sustainable domestic travel options.

- In February 2025, Airbnb introduced local weekend getaway packages in North America and Europe, focusing on wellness and rural tourism.