Flintstones Chewable Vitamins Market Size

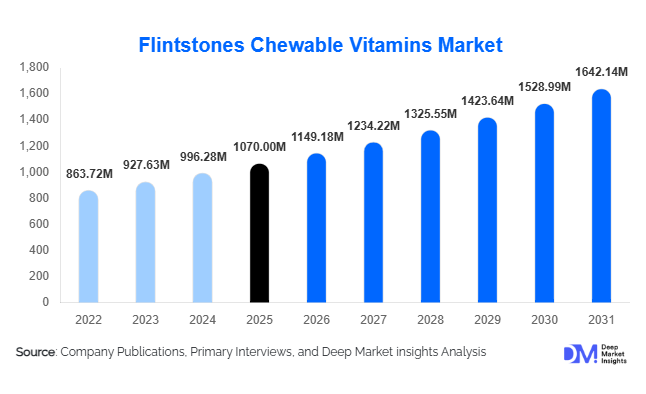

According to Deep Market Insights,the global flintstones chewable vitamins market size was valued at USD 1,070 million in 2025 and is projected to grow from USD 1,149.18 million in 2026 to reach USD 1,642.14 million by 2031, expanding at a CAGR of 7.4% during the forecast period (2026–2031). The market growth is primarily driven by rising parental awareness of pediatric micronutrient deficiencies, increasing preventive healthcare spending, and expanding distribution through pharmacies and digital retail platforms. Growing demand for sugar-free, immunity-focused, and iron-fortified formulations is further strengthening product penetration across developed and emerging economies.

Key Market Insights

- Multivitamin with iron formulations dominate, accounting for nearly 38% of global revenue in 2025 due to high prevalence of pediatric iron deficiency.

- Children aged 4–8 years represent the largest consumer segment, contributing approximately 41% of total market demand.

- Pharmacies and drug stores lead distribution, capturing about 44% of global sales in 2025 due to strong pediatrician endorsement.

- North America remains the largest regional market, holding nearly 38% share in 2025, driven by high supplementation awareness.

- Asia-Pacific is the fastest-growing region, expanding at nearly 9% CAGR due to rising middle-class populations and healthcare awareness.

- Mid-premium pricing tier dominates, accounting for approximately 47% of revenue as consumers balance quality with affordability.

What are the latest trends in the flintstones chewable vitamins market?

Shift Toward Sugar-Free and Clean-Label Formulations

Parents are increasingly seeking sugar-free, allergen-free, and artificial color-free chewable vitamins. Regulatory scrutiny regarding sugar content in children’s supplements has encouraged reformulation strategies. Manufacturers are incorporating natural fruit flavors, plant-based colorants, and gelatin-free ingredients to appeal to health-conscious consumers. Clean-label positioning not only enhances brand perception but also supports premium pricing strategies in developed markets.

Digital Retail Expansion and Subscription Models

E-commerce platforms are transforming purchasing behavior, particularly in urban markets. Subscription-based pediatric vitamin programs are gaining traction, allowing automated monthly deliveries and improving repeat purchase rates. Direct-to-consumer online platforms are enabling personalized supplement bundles based on dietary assessments. This shift toward digital channels is improving accessibility in emerging economies and strengthening brand-consumer engagement.

What are the key drivers in the flintstones chewable vitamins market?

Rising Micronutrient Deficiency Awareness

Iron deficiency anemia and vitamin D insufficiency remain prevalent among children globally. Pediatricians increasingly recommend daily supplementation to bridge nutritional gaps, significantly supporting demand for chewable multivitamins with iron and calcium fortification.

Growing Preventive Healthcare Spending

Rising disposable income and increased focus on preventive health are encouraging parents to invest in nutritional supplements. Preventive pediatric healthcare spending is expanding steadily across North America, Europe, and Asia-Pacific, directly influencing vitamin adoption rates.

Strong Brand Trust and Legacy Positioning

Flintstones chewable vitamins benefit from multi-generational brand recall, enhancing consumer loyalty and repeat purchase cycles. Established safety standards and pharmaceutical-grade manufacturing practices further reinforce consumer confidence.

What are the restraints for the global market?

Regulatory Compliance and Labeling Restrictions

Stringent regulations around pediatric supplement labeling, sugar content, and health claims increase compliance costs. Varying global standards can delay product launches and limit marketing flexibility.

Competition from Private-Label Supplements

Retailer-owned pediatric vitamins priced 20–30% lower than branded offerings present pricing pressure, particularly in price-sensitive markets such as Latin America and parts of Asia.

What are the key opportunities in the flintstones chewable vitamins industry?

Emerging Market Expansion

Countries such as India, Brazil, Indonesia, and UAE present significant growth potential due to rising pediatric populations and increasing healthcare awareness. Government nutrition initiatives create collaboration opportunities for manufacturers.

Functional Ingredient Integration

Incorporating DHA, probiotics, and herbal immunity boosters into chewable formats can unlock premium segment growth. These value-added formulations support cognitive development and immunity enhancement positioning.

Institutional and School Health Programs

Partnerships with schools, daycare centers, and pediatric clinics provide recurring demand channels. Institutional procurement models can significantly expand distribution footprint.

Product Type Insights

The multivitamin with iron segment dominates the global children’s multivitamins market, accounting for approximately 38% of total revenue in 2025. Its leadership is primarily driven by the high global prevalence of pediatric iron deficiency and anemia, particularly in developing economies where dietary gaps remain significant. Pediatricians frequently recommend iron-fortified formulations to support healthy cognitive development, red blood cell formation, and overall growth, further strengthening this segment’s position. Multivitamins without iron represent the second-largest share and are particularly preferred in developed markets where dietary iron intake is generally sufficient and concerns about excess iron consumption exist. Immunity-support formulations enriched with vitamin C and zinc are witnessing rapid expansion due to heightened parental focus on immune resilience following global health awareness trends. Calcium and vitamin D formulations continue to maintain strong demand as parents prioritize bone growth and skeletal development during early childhood years. Meanwhile, specialty blends incorporating omega-3 fatty acids and probiotics are gaining traction within the premium category, supported by growing awareness of cognitive health and gut microbiome benefits, especially among urban and higher-income households.

Age Group Insights

Children aged 4–8 years constitute the leading consumer group, accounting for nearly 41% of total demand in 2025. This dominance is largely attributed to increased nutritional requirements during early schooling years, when immunity support, cognitive enhancement, and overall growth become key parental concerns. Toddlers aged 2–3 years represent a comparatively smaller but steadily expanding segment, driven by rising awareness regarding early-life nutritional supplementation and pediatrician-led recommendations for developmental support. Pre-teens and teenagers collectively account for nearly 35% of market revenue, supported by growing demand for formulations targeting immunity strengthening, academic performance, hormonal balance, and bone health during puberty. The increasing prevalence of busy lifestyles and inconsistent dietary habits among school-aged children further reinforces sustained demand across all age categories.

Distribution Channel Insights

Pharmacies and drug stores lead the market with approximately 44% share in 2025, primarily due to strong parental trust, medical endorsement, and pharmacist guidance in supplement selection. The credibility associated with healthcare-backed retail channels significantly strengthens purchasing decisions, particularly for iron-containing and specialty formulations. Supermarkets and hypermarkets hold a substantial share as well, benefiting from high consumer footfall, attractive in-store promotions, and impulse purchase behavior. Online retail is the fastest-growing channel, expanding at double-digit growth rates driven by increasing digital penetration, subscription-based supplement models, competitive pricing, and the convenience of home delivery. Pediatric clinics and institutional sales channels represent a smaller but stable segment, supported by direct healthcare provider recommendations and preventive care initiatives.

Packaging Insights

Bottle packaging dominates the market with approximately 68% revenue share, owing to its convenience, durability, and suitability for bulk purchasing. Families often prefer bottle packaging for cost efficiency and ease of storage, particularly for daily multivitamin regimens. Blister packs are more prevalent in regulated European markets, where stringent dosage control, child safety compliance, and regulatory labeling standards influence packaging preferences. Additionally, blister formats enhance portion control and preserve product integrity. Refill pouches are gradually emerging as a sustainable packaging alternative, driven by growing environmental awareness and manufacturer efforts to reduce plastic waste, especially in environmentally conscious markets.

| By Product Formulation | By Age Group | By Distribution Channel | By Packaging Type | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 38% of the global market share in 2025, making it the largest regional contributor. The United States accounts for nearly 82% of regional demand, supported by high pediatric supplement penetration, strong pharmacy distribution networks, and widespread preventive healthcare practices. Elevated healthcare expenditure, established pediatric dietary guidelines, and increasing parental focus on immune health and cognitive development further drive market growth. Canada contributes steady expansion, supported by organized retail infrastructure, rising clean-label demand, and strong consumer awareness regarding childhood nutrition. The region also benefits from advanced product innovation, including sugar-free, allergen-free, and organic formulations.

Europe

Europe represents around 27% of global revenue, with Germany, the United Kingdom, and France leading demand. Regional growth is primarily driven by stringent regulatory compliance standards, strong preference for clean-label and sugar-free products, and increasing awareness regarding micronutrient deficiencies among children. Western European markets show higher adoption of iron-free and reduced-sugar variants, reflecting evolving parental concerns about excessive supplementation and sugar intake. Additionally, government-backed health awareness campaigns and established pharmacy chains contribute to stable market expansion across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at nearly 9% CAGR over the forecast period. Key markets such as China and India are major contributors, driven by rising middle-class income levels, increasing urbanization, and expanding awareness regarding pediatric nutrition and immunity support. Government-led nutritional programs and school-based health campaigns further stimulate supplement adoption. Mature markets such as Japan and Australia demonstrate stable demand supported by established healthcare systems and premium product preference. Rapid e-commerce expansion, cross-border supplement availability, and social media-driven health education are accelerating regional growth significantly.

Latin America

Latin America accounts for approximately 8% of global market share, led by Brazil and Mexico. Regional growth is supported by expanding urban populations, improving healthcare access, and the growing presence of organized pharmacy chains. Increasing awareness of childhood anemia and immunity-related concerns further supports product demand. However, price sensitivity remains a key factor influencing purchasing decisions, encouraging manufacturers to introduce cost-effective and locally produced formulations.

Middle East & Africa

The Middle East & Africa region holds nearly 6% of the global share, led by the United Arab Emirates and South Africa. Market expansion is driven by rising healthcare infrastructure investments, increasing pediatric population growth rates, and growing awareness of micronutrient supplementation. Expanding retail pharmacy networks and improved access to imported nutritional products are further contributing to steady growth across urban centers, while public health initiatives targeting child nutrition deficiencies provide additional long-term growth opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flintstones Chewable Vitamins Market

- Bayer AG

- Pfizer Inc.

- Haleon plc

- Church & Dwight Co., Inc.

- Amway Corp.

- Nestlé Health Science

- Herbalife Nutrition Ltd.

- Otsuka Holdings Co., Ltd.

- Nature’s Way Products LLC

- NOW Health Group, Inc.

- GNC Holdings LLC

- Pharmavite LLC

- Jamieson Wellness Inc.

- Blackmores Limited

- Sanofi S.A.