Flaxseed Oil Market Size

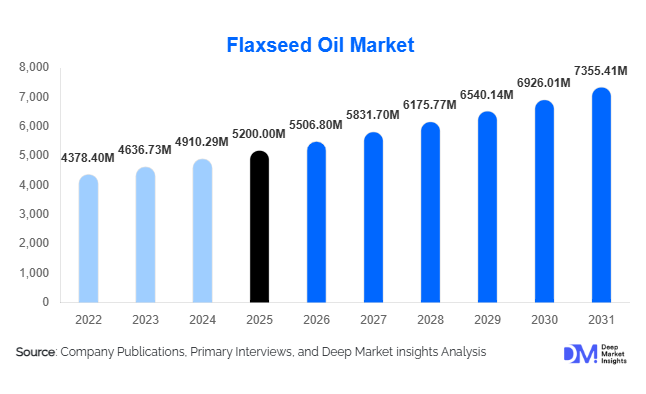

According to Deep Market Insights, the global flaxseed oil market size was valued at USD 5,200.00 million in 2025 and is projected to grow from USD 5,506.80 million in 2026 to reach USD 7,355.41 million by 2031, expanding at a CAGR of 5.9% during the forecast period (2026–2031). The market growth is primarily driven by increasing consumer health awareness, rising demand for plant-based omega-3 sources, and expanding applications across nutraceuticals, cosmetics, and industrial sectors.

Key Market Insights

- Cold-pressed and organic flaxseed oils dominate the market, favored for superior nutritional content, clean-label appeal, and higher bioavailability of alpha-linolenic acid (ALA).

- Food and nutraceutical applications account for the largest share, leveraging the oil’s health benefits and incorporation in dietary supplements, fortified foods, and functional beverages.

- North America and Europe lead global consumption, driven by mature retail channels, health-conscious consumers, and regulatory support for organic and plant-based oils.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class incomes, increasing health awareness, and expanding e-commerce and retail access.

- Technological integration in production and extraction, including cold-press techniques, solvent-free refining, and oxidative stability innovations, is enhancing product quality and shelf life.

- Online retail and specialty organic channels are reshaping distribution, enabling global reach for niche and premium flaxseed oil products.

What are the latest trends in the flaxseed oil market?

Organic and Cold-Pressed Products Gaining Traction

Consumer preference is shifting toward organic and cold-pressed flaxseed oil due to the higher retention of nutrients, particularly omega-3 fatty acids. Cold-pressed oils preserve bioactive compounds, making them attractive for functional foods, dietary supplements, and natural cosmetic formulations. Organic certifications are becoming a major differentiator, particularly in North America and Europe, where consumers associate certified organic products with safety, sustainability, and premium quality. E-commerce and specialty health stores are accelerating adoption by making niche and small-batch products accessible to health-conscious buyers worldwide.

Integration into Cosmetics and Personal Care

Flaxseed oil’s antioxidant and emollient properties are driving its inclusion in natural skincare and haircare products. Premium cosmetic brands increasingly incorporate flaxseed oil into anti-aging creams, serums, and hair treatments. Rising awareness of plant-based, clean-label beauty products in Europe and Asia-Pacific has fueled demand, with formulators prioritizing oils that support skin hydration, oxidative protection, and hair nourishment. This integration enhances the functional appeal of personal care products, opening new revenue streams for flaxseed oil manufacturers.

What are the key drivers in the flaxseed oil market?

Health and Nutritional Awareness

The growing global focus on preventive healthcare and nutrition is boosting demand for flaxseed oil, one of the richest plant-based sources of alpha-linolenic acid (ALA). Consumers are increasingly including flaxseed oil in diets to support cardiovascular health, reduce inflammation, and meet omega-3 requirements, particularly as plant-based alternatives to fish oil. Functional food and dietary supplement applications continue to expand, with health-conscious populations in North America, Europe, and the Asia-Pacific driving adoption.

Rise of E-Commerce and Specialty Retail

Digital platforms have transformed flaxseed oil distribution, allowing niche and premium brands to reach global consumers efficiently. Online retail provides transparency on certifications, sourcing, and quality, attracting younger, health-focused demographics. Specialty organic and natural stores further reinforce the premium positioning of cold-pressed and organic flaxseed oils. Subscription-based models for nutritional oils are also emerging, increasing repeat purchases and brand loyalty.

Expansion into Cosmetics and Personal Care

The personal care segment is witnessing strong growth due to the incorporation of flaxseed oil into skincare, haircare, and anti-aging formulations. Rising demand for natural, plant-derived ingredients and stringent consumer preference for chemical-free products encourage the use of flaxseed oil as an active ingredient, particularly in Europe and the Asia-Pacific markets.

What are the restraints for the global market?

Price Volatility of Raw Materials

Fluctuating flaxseed prices, influenced by agricultural yield variability, climate conditions, and global demand-supply imbalances, pose a significant challenge for manufacturers. Cost increases can limit profitability and make flaxseed oil less competitive against other edible oils and nutritional alternatives.

Oxidative Stability and Shelf-Life Limitations

Due to its high content of polyunsaturated fatty acids, flaxseed oil is prone to oxidation, limiting its shelf life. Manufacturers must invest in controlled storage, dark packaging, nitrogen flushing, and cold-press processing techniques to maintain product quality, increasing production costs and operational complexity.

What are the key opportunities in the flaxseed oil market?

Functional and Nutraceutical Applications

There is a significant opportunity to expand flaxseed oil in functional foods and dietary supplements. With growing global awareness of omega-3 benefits, manufacturers can target preventive health applications such as cardiovascular support, anti-inflammatory formulations, and plant-based nutrition products. Fortified beverages, capsules, and snack bars incorporating flaxseed oil are likely to see rapid adoption, particularly in North America, Europe, and Asia-Pacific.

Cosmetics and Personal Care Integration

Flaxseed oil presents opportunities for the natural beauty industry, where demand for plant-derived ingredients is rising. Its antioxidant and emollient properties can be leveraged in anti-aging creams, moisturizers, and hair care products. Innovative formulations and premium branding can further enhance market share and margins in developed and emerging markets.

Sustainable Production and Technological Innovations

Investments in cold-press extraction, solvent-free refining, and sustainable processing technologies can increase yields, preserve nutritional content, and reduce environmental impact. Governments and industry initiatives supporting organic farming, sustainable sourcing, and agricultural modernization further enhance production efficiency and open new export opportunities, particularly in the Asia-Pacific and Europe.

Product Type Insights

Cold-pressed flaxseed oil dominates globally, accounting for approximately 45–50% of the market in 2025 due to superior nutritional retention and consumer preference for unprocessed oils. Hot-pressed and solvent-extracted variants are primarily used in industrial applications. Organic flaxseed oil holds roughly 35–40% market share, driven by consumer willingness to pay premiums for certification and health benefits. Refined flaxseed oil is used in processed foods and industrial applications where flavor neutrality is required.

Application Insights

Food and beverages account for around 50% of global demand, driven by incorporation into dietary supplements, fortified foods, and functional beverages. Nutraceuticals and dietary supplements are the fastest-growing end-use segment (20% share), supported by preventive health trends and plant-based supplement adoption. Cosmetics and personal care applications are emerging rapidly, particularly in Europe and the Asia-Pacific region, leveraging flaxseed oil’s emollient and antioxidant properties. Industrial applications include paints, coatings, varnishes, and adhesives, with a steady but smaller contribution.

Distribution Channel Insights

Online retail dominates consumer-facing sales, enabling global access to premium and organic flaxseed oil products. Specialty stores and organic retail chains maintain a strong influence in urban markets. Direct B2B supply is essential for industrial and nutraceutical applications. E-commerce growth, subscription models, and social media marketing are increasingly shaping purchasing behavior and brand loyalty.

| By Product Type | By Nature | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for 30–35% of the global market share in 2025. Strong health consciousness, mature dietary supplement markets, and high disposable incomes support growth. The U.S. is the largest consumer, with Canada showing rising organic product adoption. E-commerce and specialty stores drive accessibility for niche premium products.

Europe

Europe holds 30–33% of the market, with Germany, France, and the U.K. leading consumption. Organic and cold-pressed oils are preferred, and regulatory support ensures high-quality standards. Cosmetics and nutraceutical applications are particularly strong, with consumers valuing sustainability and natural ingredients.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China and India. Rising middle-class incomes, increasing awareness of health benefits, and expanding retail and e-commerce access contribute to high growth. Japan and Southeast Asia show moderate adoption, mainly for personal care and dietary applications.

Middle East & Africa

The region accounts for 8–10% of the market. GCC countries are emerging as important markets for organic and bottled oils. South Africa and Nigeria are growing markets for food and industrial applications.

Latin America

Latin America is gradually expanding, with Brazil and Argentina showing increasing adoption in food, supplements, and traditional remedies. Outbound imports from North America and Europe supplement domestic consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flaxseed Oil Market

- Cargill Incorporated

- Archer Daniels Midland Company (ADM)

- Bunge Limited

- Barlean’s Organic Oils

- Sustainable Oils, LLC

- FlaxLinx™ International

- Healthy Oilseeds Grain Millers Inc.

- Rapunzel Naturkost GmbH

- Bartoline Limited

- Natural Factors

- Linwoods®

- Shandong Sanxing Group

- COFCO Group

- Yingma Group

- Changsheng Group