Flat Iron Hair Straighteners Market Size

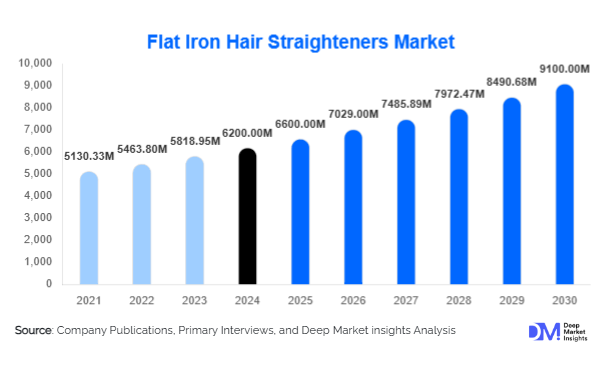

According to Deep Market Insights, the global flat iron hair straighteners market size was valued at USD 6,200 million in 2024 and is projected to grow from USD 6,600 million in 2025 to reach USD 9,100 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). Growth is primarily driven by increasing personal grooming awareness, rising adoption of premium hairstyling tools, and the rapid expansion of e-commerce channels globally. Growth is primarily driven by increasing personal grooming awareness, rising adoption of premium hairstyling tools, and the rapid expansion of e-commerce channels globally.

Key Market Insights

- Ceramic flat irons dominate the product mix, accounting for nearly 40% of the 2024 market due to affordability and widespread availability.

- Digital/automatic temperature control flat irons are gaining popularity, as consumers seek advanced tools that minimize hair damage.

- Online retail channels account for 45% of global sales, supported by influencer marketing, brand D2C models, and marketplace growth.

- Personal/home use dominates end-use demand, holding nearly 50% share, fueled by the self-grooming trend and DIY hairstyling culture.

- Asia-Pacific is the fastest-growing region, expected to post a CAGR of 8% through 2030, driven by urbanization and middle-class expansion.

- Premiumization is reshaping the market, with titanium and hybrid flat irons emerging as high-margin growth segments.

Latest Market Trends

Integration of Smart and Digital Technologies

Manufacturers are embedding smart features such as automatic shut-off, heat sensors, and app connectivity into premium flat irons. Infrared heating, AI-assisted temperature adjustment, and hybrid ceramic-tourmaline plates are now common in professional-grade tools. These innovations not only differentiate brands in a competitive market but also attract tech-savvy consumers seeking hair-protection solutions.

Eco-Friendly and Sustainable Designs

The market is witnessing rising demand for sustainable and energy-efficient hair styling devices. Consumers increasingly prefer flat irons with recyclable materials, low-emission coatings, and reduced energy consumption. Brands are aligning with regulatory pushes for greener electronics while tapping into a younger, eco-conscious consumer base.

Flat Iron Hair Straighteners Market Drivers

Rising Awareness of Personal Grooming

Growing global interest in beauty and grooming, particularly among millennials and Gen Z, is fueling demand. Social media platforms like Instagram, YouTube, and TikTok play a critical role in popularizing at-home hairstyling trends, creating sustained demand for both entry-level and professional flat irons.

Technological Advancements in Heating Technology

Innovations such as digital temperature control, rapid heating, and infrared plates have improved product safety and performance. Hybrid materials offering smoother glides and reduced frizz appeal strongly to professional stylists and premium consumers, driving high-value growth in the segment.

Expansion of E-Commerce Channels

Online retail contributes nearly 45% of global sales in 2024. Easy access to product reviews, competitive pricing, and influencer endorsements are fueling online demand. Direct-to-consumer brand stores are also gaining traction, particularly in developed markets like North America and Europe.

Market Restraints

High Price Sensitivity in Emerging Markets

Premium flat irons priced above USD 150 remain inaccessible to large middle-class populations in emerging economies. This limits penetration of advanced technologies in markets like India, Brazil, and Southeast Asia, where affordability drives purchasing decisions.

Concerns about Hair Damage and Alternatives

Despite innovation, consumer concerns about heat damage persist. Alternatives such as curling irons, blow dryers, and chemical treatments are competing products that can slow adoption rates in certain demographics.

Flat Iron Hair Straighteners Market Opportunities

Rising Demand in Emerging Economies

Markets such as India, Indonesia, and Brazil are underpenetrated but growing quickly due to rising disposable incomes and increasing beauty awareness. Strategic partnerships with e-commerce players and localized pricing can unlock new consumer bases.

Smart Technology Integration

Temperature sensors, Bluetooth connectivity, and app-based styling assistance present lucrative opportunities. These innovations allow manufacturers to command premium pricing and differentiate themselves from mass-market players.

Sustainable Manufacturing and Government Incentives

Programs like “Make in India” and “Made in China 2025” are incentivizing local production. Meanwhile, eco-friendly designs and recyclable components are opening new growth avenues aligned with regulatory and consumer sustainability demands.

Product Type Insights

Ceramic flat irons lead the market with a 40% share in 2024, thanks to their affordability, ease of use, and wide availability. Titanium flat irons dominate professional salons due to rapid heating and high performance, while tourmaline and hybrid irons are increasingly popular among premium users seeking frizz-free results.

Application Insights

Personal/home use accounted for 50% of demand in 2024, making it the largest application segment. Consumers are increasingly investing in mid-range models for everyday styling. Professional salons contribute significant value demand through premium products, while travel-friendly compact flat irons are gaining traction among mobile and younger users.

Distribution Channel Insights

Online retail dominates the distribution landscape, holding a 45% share in 2024. E-commerce platforms and brand-owned D2C channels are reshaping buying behavior, particularly in APAC and North America. Offline channels, including supermarkets and specialty beauty stores, remain important in Europe and Latin America, supporting impulse and experiential purchases.

Price Tier Insights

Mid-range products ($50–$150) hold the largest market share at 55% in 2024. These appeal to both home users and semi-professional stylists by balancing affordability with advanced features. Premium products (>$150) are growing fastest, driven by professional demand and rising consumer preference for high-tech, damage-preventive solutions.

| By Product Type | By Heating Technology | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for around 30% of the global market in 2024, led by the U.S. High adoption of premium products, professional salon culture, and e-commerce penetration drive growth. Canada and Mexico contribute moderately, with rising demand for mid-range tools.

Europe

Europe represented about 25% of the market in 2024, led by the U.K., Germany, and France. Consumer preference for high-quality, sustainable devices supports steady demand. The region is also seeing growth in compact and travel-friendly irons aligned with high mobility lifestyles.

Asia-Pacific

APAC is the fastest-growing region, expected to post ~8% CAGR by 2030. China and India dominate demand, driven by rising middle-class incomes, beauty-conscious youth, and influencer-driven marketing. Japan and South Korea remain mature but innovative markets, often pioneering new styling technologies.

Latin America

Brazil leads Latin American demand, with salons driving premium segment growth. Argentina and Mexico show moderate adoption, primarily in the mid-range price tier. Rising grooming culture among younger populations will support future expansion.

Middle East & Africa

MEA markets are smaller but growing, led by the UAE, Saudi Arabia, and South Africa. Luxury and professional flat irons dominate, as consumers in these regions prefer premium international brands. Growing tourism and salon expansions further drive regional demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flat Iron Hair Straighteners Market

- Dyson

- Philips

- Braun

- Remington

- CHI

- Conair

- GHD

- Babyliss

- Panasonic

- Kemei

- HSI Professional

- Herstyler

- Vogue

- NuMe

- Revlon

Recent Developments

- In May 2025, Dyson launched a new premium flat iron featuring AI-enabled heat regulation, targeting professional salons in North America and Europe.

- In April 2025, Philips expanded its mid-range ceramic flat iron line in India and Southeast Asia, focusing on affordability and localized marketing campaigns.

- In February 2025, GHD introduced a sustainable flat iron model with recyclable materials and energy-efficient heating technology, aimed at eco-conscious consumers in Europe.