Flame Retardant Apparel Market Size

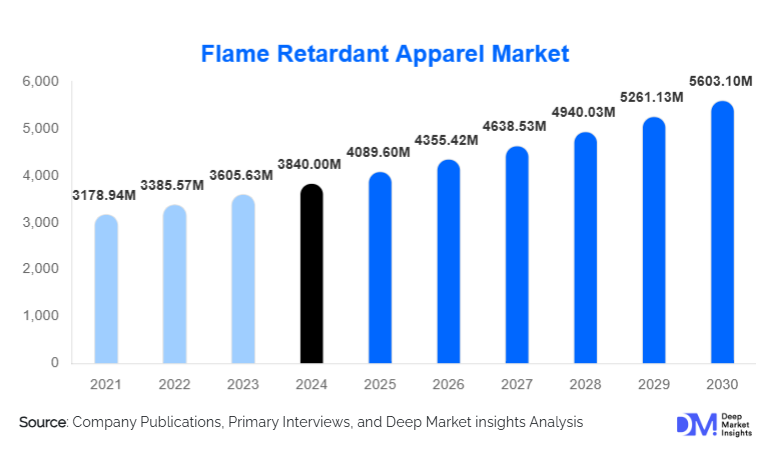

According to Deep Market Insights, the global flame-retardant apparel market size was valued at USD 3,840 million in 2024 and is projected to grow from USD 4,089.6 million in 2025 to reach USD 5,603.1 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing regulatory compliance across high-risk industries, rising industrial accidents and workplace safety awareness, and the adoption of technologically advanced flame-retardant fabrics that offer both protection and comfort.

Key Market Insights

- Regulatory compliance is a major driver, as governments globally are enforcing stricter occupational safety standards, making certified flame-retardant apparel essential across industries such as oil & gas, utilities, and manufacturing.

- Technological innovations in fabrics, including inherently flame-resistant fibers, moisture-wicking properties, and smart apparel integration, are increasingly adopted to improve safety and comfort.

- North America dominates the global market, with the U.S. leading demand due to stringent safety regulations, extensive industrial operations, and high compliance spending.

- Asia-Pacific is the fastest-growing region, led by China and India, driven by rapid industrialization, infrastructure expansion, and rising enforcement of workplace safety norms.

- End-use demand is expanding, particularly in oil & gas, utilities, and manufacturing, with new applications emerging in renewable energy and electric vehicle infrastructure sectors.

- Distribution channels are evolving, with direct enterprise sales dominating, supplemented by online B2B platforms and specialized industrial safety distributors.

What are the latest trends in the flame-retardant apparel market?

Shift Towards Inherently Flame-Resistant Fabrics

Manufacturers are increasingly adopting inherently flame-resistant fabrics such as aramids and modacrylic blends, which provide longer protection life compared to treated cotton. These fabrics enhance durability, reduce replacement cycles, and offer improved wearer comfort, aligning with the demand for high-performance safety apparel. The trend is strongest in utilities and oil & gas, where long-term cost efficiency and compliance with international standards such as NFPA and IEC are critical.

Smart and Multi-Hazard Protection Apparel

Emerging innovations in smart textiles are being integrated into flame-retardant apparel. Features such as heat sensors, wear-life indicators, anti-static properties, and multi-hazard protection against arc flash, flash fire, and molten metal splashes are gaining popularity. Companies are leveraging these technologies to provide value-added differentiation, allowing end-users to monitor garment integrity and ensuring enhanced safety in hazardous work environments.

What are the key drivers in the flame-retardant apparel market?

Industrial Safety Compliance and Regulation

The enforcement of workplace safety regulations globally, including OSHA standards in North America and international IEC norms, drives demand for certified flame-retardant garments. Companies are obligated to provide certified apparel to minimize legal risks, workplace accidents, and insurance liabilities. This has resulted in strong and sustained adoption across high-risk industries.

Expansion of Industrial and Energy Sectors

Growth in sectors such as oil & gas, utilities, chemicals, and manufacturing has significantly increased the workforce exposed to fire and heat hazards. Large-scale infrastructure projects and energy sector expansion in Asia-Pacific and the Middle East are fueling demand for protective apparel, particularly arc flash and flash fire-resistant garments, creating a steady market for FR apparel manufacturers.

Increased Awareness of Worker Safety

Incidents of industrial fires and arc flash accidents have heightened awareness among employers and employees about occupational safety. Organizations are prioritizing comprehensive personal protective equipment (PPE) programs, incorporating advanced flame-retardant apparel that ensures multi-hazard protection. This trend drives both replacement demand and premiumization of products.

What are the restraints for the global market?

High Product Cost

Inherent flame-resistant fabrics and technologically advanced apparel are costlier than conventional protective clothing, making adoption challenging for small and medium enterprises, especially in developing regions. High initial procurement costs can delay widespread implementation, despite long-term safety benefits.

Raw Material Price Volatility

Prices of aramid fibers, modacrylic blends, and specialty chemicals fluctuate based on global supply chain dynamics, affecting manufacturing costs and profit margins. Such volatility can influence pricing strategies and limit market expansion, particularly in price-sensitive segments.

What are the key opportunities in the flame-retardant apparel industry?

Regulatory Compliance Expansion in Emerging Markets

Emerging economies in the Asia-Pacific, the Middle East, and Latin America are tightening occupational safety regulations and enforcing international compliance standards. This provides an opportunity for existing manufacturers to supply certified apparel and for new entrants to establish a foothold in compliance-driven markets.

Technological Innovation and Smart Fabrics

Development of multi-hazard protection garments, wearable sensors, and smart fabrics offers premium growth opportunities. Companies can differentiate their products by integrating comfort, durability, and performance analytics, appealing to industrial clients seeking safety with operational efficiency.

Regional Manufacturing and Localization

Governments in India, China, and Vietnam are incentivizing domestic manufacturing and export-oriented production through industrial policies like “Make in India” and “Made in China 2025.” Establishing regional manufacturing hubs reduces lead times, enhances cost competitiveness, and improves market penetration, particularly for large government and infrastructure contracts.

Product Type Insights

Flame-retardant coveralls dominate the global flame-retardant apparel market, accounting for approximately 34% of the total market value in 2024. Their leadership is primarily driven by the need for full-body, multi-hazard protection in high-risk work environments where exposure to fire, arc flash, molten metal, and chemical splashes is frequent. Coveralls are extensively adopted across the oil & gas, utilities, manufacturing, and mining sectors, where regulatory compliance mandates comprehensive protection rather than partial garment coverage.

In addition to safety performance, coveralls offer operational efficiency by reducing garment layering complexity and ensuring consistent compliance with safety standards such as NFPA, IEC, and ISO. Employers prefer coveralls for large workforces due to easier standardization, simplified procurement, and lower compliance risk. While flame-retardant shirts, trousers, and jackets remain essential for layered or task-specific protection, coveralls continue to be the preferred choice for high-exposure applications, particularly in hazardous industrial zones and outdoor environments.

Fabric Type Insights

Inherently flame-resistant fabrics hold the largest market share, representing approximately 46% of global demand, driven by their superior durability, long service life, and consistent protection performance. Unlike treated fabrics, inherent FR materials such as aramid and modacrylic blends maintain their flame-resistant properties throughout the garment’s lifespan, even after repeated laundering and extended use.

This segment’s leadership is reinforced by the growing emphasis on total cost of ownership rather than upfront garment pricing. Industrial employers increasingly favor inherent FR fabrics due to reduced replacement frequency, lower maintenance costs, and higher worker acceptance driven by improved comfort and breathability. Treated cotton and synthetic blends continue to be used in cost-sensitive applications; however, their share is gradually declining as safety-conscious industries transition toward long-term, high-performance solutions, particularly in utilities, oil & gas, and heavy manufacturing.

Application Insights

Arc flash protection apparel accounts for nearly 29% of the total market, making it the leading application segment globally. This dominance is largely attributed to the rapid expansion of power generation, transmission, and distribution infrastructure, along with stricter electrical safety regulations governing utilities and industrial facilities. Arc flash incidents pose severe risks, and compliance with electrical safety standards has made arc-rated apparel mandatory in many regions.

Flash fire, molten metal splash, and chemical protection apparel also contribute significantly to market growth, particularly in oil refining, metal processing, and chemical manufacturing. Notably, demand for multi-hazard protection apparel is rising, as industries increasingly seek garments that offer protection against multiple risks within a single certified product. This trend is especially strong in renewable energy installations, chemical processing plants, and mining operations, where workers face overlapping hazard exposures.

Distribution Channel Insights

Direct enterprise sales dominate the flame-retardant apparel market, accounting for approximately 52% of total revenue. Large corporations, utilities, oil majors, and government entities prefer direct procurement models to ensure compliance with safety standards, secure customized garment specifications, and maintain consistent supply for large workforces. Long-term supply contracts and enterprise-level agreements further reinforce the dominance of this channel.

Industrial safety distributors and online B2B platforms play an increasingly important complementary role, particularly for small and medium-sized enterprises and international buyers. Digital procurement platforms are gaining traction due to their ability to offer quick access to certified products, transparent pricing, and global reach, supporting market penetration in emerging economies and remote industrial regions.

| By Product Type | By Fabric Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 32% of the global flame-retardant apparel market in 2024, with the United States representing the largest share. Regional growth is driven by stringent OSHA regulations, high enforcement of electrical and fire safety standards, and substantial compliance spending across industries. The presence of mature oil & gas operations, extensive utility networks, and advanced manufacturing facilities sustains strong demand for arc flash and multi-hazard protective apparel.

Additionally, frequent safety audits, unionized labor environments, and high insurance compliance requirements encourage employers to adopt premium inherently flame-resistant garments, supporting steady replacement demand and market stability.

Europe

Europe held around 26% of the global market, led by Germany, the U.K., and France. Growth in this region is driven by robust enforcement of EU workplace safety directives, increasing focus on worker welfare, and a strong culture of preventive industrial safety. European manufacturers and utilities are early adopters of innovative FR fabrics, contributing to rising demand for lightweight, ergonomic, and sustainable flame-retardant apparel.

In addition, Europe’s emphasis on industrial modernization, renewable energy expansion, and chemical sector safety continues to support demand for arc flash and multi-hazard protection garments.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR exceeding 9%, led by China and India. Rapid industrialization, large-scale infrastructure development, and expanding energy and manufacturing sectors are key growth drivers. Governments across the region are increasingly enforcing workplace safety regulations, narrowing the compliance gap with Western standards.

Growth is further supported by rising foreign direct investment in industrial facilities, increasing awareness of worker safety, and localization of flame-retardant apparel manufacturing, which improves affordability and availability across the region.

Middle East & Africa

The Middle East & Africa region is experiencing steady growth, primarily driven by large-scale oil & gas investments in Saudi Arabia, the UAE, and Qatar. Expansion of petrochemical complexes, refining capacity, and energy infrastructure has significantly increased demand for flame-retardant coveralls and multi-hazard protective clothing. Government-backed industrial diversification initiatives and heightened focus on workforce safety in high-risk environments are further strengthening demand across the region.

Latin America

Latin America, led by Brazil and Mexico, is witnessing gradual but consistent growth in flame-retardant apparel demand. Export-oriented manufacturing, mining operations, and utility infrastructure upgrades are key drivers. Increasing adoption of international safety standards by multinational companies operating in the region is accelerating the transition from basic protective wear to certified flame-retardant apparel.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flame Retardant Apparel Market

- DuPont

- 3M

- VF Corporation

- Lakeland Industries

- Ansell

- Bulwark Protection

- Sioen Industries

- Portwest

- Fristads

- Carhartt

- Tranemo Group

- Honeywell (PPE division)

- Workrite Uniform Company

- Alsico Group

- National Safety Apparel