Smart Fabrics Market Size

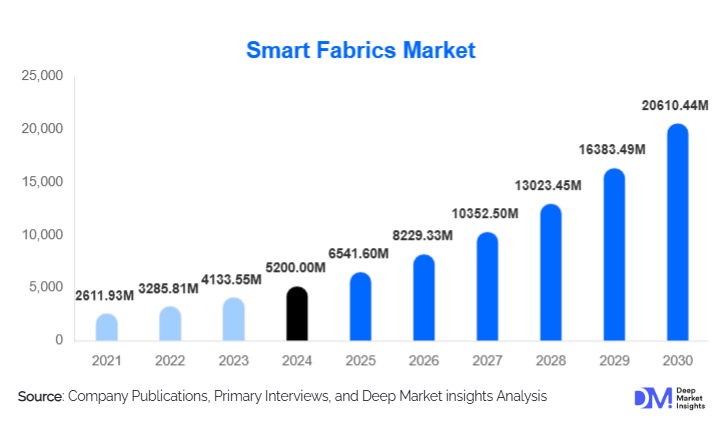

According to Deep Market Insights, the global smart fabrics market size was valued at USD 5,200 million in 2024 and is projected to grow from USD 6,541.60 million in 2025 to reach USD 20,610.44 million by 2030, expanding at a CAGR of 25.8% during the forecast period (2025–2030). The smart fabrics market growth is primarily driven by rapid advancements in flexible electronics, expanding adoption of wearable health monitoring systems, and the rising integration of IoT-enabled functionalities across consumer, defense, sports, and industrial applications.

Key Market Insights

- Sensing-enabled smart fabrics dominate market adoption, driven by strong demand in healthcare, sports, and defense applications for physiological and environmental monitoring.

- North America leads the global market due to high R&D spending, early wearable adoption, and extensive military procurement of advanced smart textiles.

- Asia-Pacific is the fastest-growing region, supported by large-scale textile manufacturing hubs in China and India and aggressive investment in smart manufacturing technologies.

- Energy-harvesting and self-powered textiles are emerging as high-potential innovations, reducing dependence on bulky or rigid batteries.

- Healthcare and medical monitoring applications are expanding rapidly as aging populations and telemedicine adoption increase global demand for continuous, non-invasive biometric tracking.

- Technological convergence—including AI-based signal processing, printed electronics, and IoT integration—is accelerating the commercialization of next-generation smart fabrics.

What are the latest trends in the smart fabrics market?

Rapid Advancement in Wearable Health-Monitoring Textiles

Smart fabrics are increasingly being incorporated into healthcare and wellness ecosystems, enabling continuous monitoring of heart rate, respiration, temperature, posture, and muscle activity. These next-generation garments provide real-time insights for chronic disease management, elder-care support, rehabilitation, and remote patient monitoring. Hospitals and telehealth providers are embracing textile-based sensors for clinical-grade diagnostics, while consumer brands are integrating biometric tracking into everyday apparel. This shift is strengthening the role of smart textiles as a foundational technology for personalized medicine and preventive healthcare.

Energy-Harvesting and Self-Powered Smart Textiles

Emerging innovations in thermoelectric, piezoelectric, and photovoltaic fibers are enabling fabrics that can generate their own power from body heat, movement, or ambient light. These self-sustaining textiles reduce reliance on batteries and increase practicality for long-term use in defense, industrial safety, and outdoor sports. Research centers and startups are rapidly developing flexible power modules, printable circuits, and washable energy-harvesting structures. This trend is expected to play a critical role in enabling fully autonomous smart clothing ecosystems and next-generation IoT wearables.

What are the key drivers in the smart fabrics market?

Growing Demand for IoT-Integrated Wearables

Smart fabrics serve as the next frontier in wearable technology by embedding sensors, conductive yarns, and microelectronics directly into clothing. As IoT adoption accelerates worldwide, consumers are seeking seamless, comfortable, and unobtrusive wearable solutions. Smart textiles provide continuous data flow to mobile devices and cloud platforms, supporting health analytics, activity tracking, and environmental monitoring. The increasing availability of 5G and low-power connectivity technologies enhances the performance and reliability of smart fabric-based systems.

Rising Adoption in Defense, Sports, and Healthcare

Defense organizations worldwide are deploying smart uniforms to monitor soldiers' condition, detect chemical exposure, and enhance situational awareness. In sports and fitness, smart garments enable performance optimization through advanced biometric sensing. Meanwhile, the healthcare sector is integrating fabric-based monitoring into telemedicine and rehabilitation programs. These high-value, mission-critical applications are driving large-scale procurement and long-term demand, strengthening the market’s growth trajectory.

What are the restraints for the global market?

High Production Costs and Manufacturing Complexity

Smart fabric production requires specialized materials such as conductive yarns, printed electronics, and flexible power modules. Integrating electronic components into textiles while maintaining comfort, washability, and durability significantly increases manufacturing costs. Scalability remains a challenge, particularly for ultra-smart fabrics and energy-harvesting textiles. These cost barriers limit mass adoption and present hurdles for small and mid-sized textile manufacturers.

Durability and Reliability Limitations

Ensuring the long-term performance of smart fabrics under conditions such as washing, stretching, and sweat exposure remains a key challenge. Many smart textiles experience degradation in conductivity or sensor accuracy after repeated use. Reliability concerns hinder widespread adoption in sectors like healthcare and industrial safety, where data precision is critical. Standardization and robust testing protocols are still evolving, delaying mass-market commercialization.

What are the key opportunities in the smart fabrics industry?

Clinical-Grade Medical Textiles for Telehealth

The rapid expansion of telemedicine and home healthcare is creating strong opportunities for medically certified smart garments. These fabrics can continuously monitor vital signs, automate data collection, and support early diagnosis of chronic conditions. As global populations age, demand for comfortable, non-invasive monitoring solutions will surge. Opportunities exist for partnerships among textile manufacturers, healthcare providers, and digital health startups to create clinically validated smart textiles.

Expansion into Smart Interiors, Automotive, and Industrial Workwear

Beyond apparel, smart fabrics are making inroads into automotive seating, building interiors, aerospace cabins, and industrial safety gear. Embedded sensors can detect fatigue, posture, occupancy, temperature changes, and pressure variations. Construction, manufacturing, and mining industries are exploring smart uniforms to improve worker safety and operational efficiency. These emerging applications represent high-margin opportunities with long-term commercial potential.

Product Type Insights

Active smart fabrics lead the market, offering functionalities such as temperature regulation, controlled heating, and integrated power modules. These textiles strike a balance between technological capabilities and manufacturing feasibility, making them highly attractive for sportswear, defense gear, and medical monitoring applications. Passive smart fabrics remain widely used for moisture management and basic sensing, while ultra-smart autonomous fabrics are gaining traction in research and high-end defense due to their advanced data-processing and actuation capabilities. Continued innovation in conductive yarns and flexible electronics is expected to support the transition toward more sophisticated textile architectures.

Application Insights

Sensing-based smart fabrics dominate, driven by their use in healthcare monitoring, fitness tracking, and environmental sensing for defense and industrial safety. Energy-harvesting applications are growing rapidly due to demand for self-powered wearables and sustainable IoT devices. Actuation-enabled textiles are emerging in specialized domains such as adaptive fashion, posture correction, and robotics. The integration of communication and data-transfer functionalities is expanding smart fabrics' role in connected ecosystems, enhancing real-time reporting and user interaction.

Distribution Channel Insights

Direct B2B sales account for the majority of smart fabric transactions, as manufacturers collaborate directly with apparel brands, defense agencies, and medical device companies. Online channels are growing as smart textile products become more consumer-facing, particularly in fitness apparel and health monitoring garments. Distributors and specialty textile suppliers play a key role in supplying advanced yarns, printed circuits, and e-textile modules to small and mid-sized manufacturers. Increasing digitalization of textile supply chains is improving transparency, customization, and scalability.

User / End-Use Insights

The defense and military sector remains the largest end-use segment, owing to significant investments in wearable soldier systems, environmental sensing, and protective gear enhancement. The healthcare sector is the fastest-growing, propelled by telehealth integration and demand for continuous remote monitoring. Sports and fitness represent a strong consumer-facing market with growing interest in real-time performance analytics. Emerging applications in automotive, architecture, and industrial safety are expanding the addressable market by integrating smart fabrics into interiors, machinery, and protective uniforms.

Age Group / User Demographics Insights

Smart fabrics designed for health and fitness monitoring are most popular among users aged 25–50 years, driven by lifestyle fitness trends and professional sports adoption. Older demographics (50+ years) represent a growing user base for medical textiles that track vital signs and support chronic disease management. Younger users (18–30 years) are early adopters of smart sportswear, fashionable e-textiles, and tech-enhanced apparel. Industrial users span all age groups in workforce applications, where safety-enhancing smart uniforms are increasingly mandated.

| By Product Type | By Functionality | By Application | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global smart fabrics market, driven by advanced R&D ecosystems, strong defense spending, and high adoption of wearable technologies. The U.S. leads innovation in flexible electronics, printed circuits, and medical smart textiles, with universities and tech corporations actively collaborating on commercialization. Robust demand from sportswear brands, digital health companies, and military procurement agencies continues to strengthen regional market dominance.

Europe

Europe is a major hub for technical textiles, sustainability-focused innovation, and automotive-grade smart interior materials. Countries such as Germany, the U.K., and France are investing in next-generation e-textile research and manufacturing. High consumer awareness of sustainable and functional apparel supports demand for smart fashion and energy-efficient fabrics. The EU’s regulatory emphasis on circular textiles and eco-design is pushing manufacturers to develop washable, safe, and recyclable smart fabric solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, led by China, India, South Korea, and Japan. China and India benefit from massive textile manufacturing bases and the rapid adoption of smart manufacturing technologies. South Korea and Japan are innovation leaders in high-tech smart garments, robotics textiles, and conductive fibers. Rising disposable income, expanding fitness culture, and government-backed digitalization programs are further accelerating regional demand.

Latin America

Latin America is an emerging market for smart fabrics, with growing adoption in sports apparel, industrial safety, and premium health-monitoring garments. Brazil and Mexico are key importers of advanced smart textiles, while regional startups are experimenting with IoT-enabled workwear and fashion-tech applications. As wearable adoption rises and manufacturing ecosystems strengthen, the region is expected to play a larger role in global smart fabric consumption.

Middle East & Africa

The Middle East is experiencing rising interest in smart textiles for defense modernization, luxury fashion, and smart city infrastructure. High-income populations in the UAE and Saudi Arabia are early adopters of performance wear and medical monitoring garments. Africa’s role is growing in manufacturing and application of smart fabrics in industrial safety and healthcare, supported by expanding tech hubs and textile-sector development programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Fabrics Market

- DuPont

- Adidas

- Textronics / AiQ Smart Clothing

- Schoeller Textil AG

- Ohmatex

- Interactive Wear AG

- Sensoria Inc.

Recent Developments

- In April 2025, DuPont announced a new generation of washable conductive fibers designed for medical-grade smart garments and industrial IoT apparel.

- In March 2025, Adidas launched a smart performance clothing line integrating seamless biometric monitoring for athletes and esports competitors.

- In February 2025, Textronics partnered with major Asian textile mills to scale production of energy-harvesting yarns for commercial smart apparel.