Five-Star Hotel Market Size

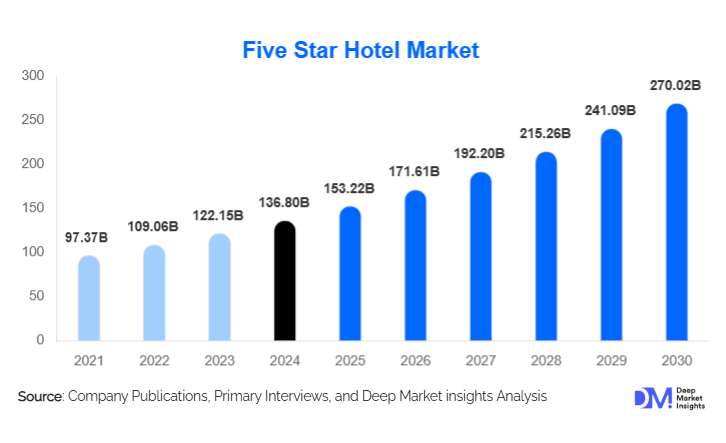

According to Deep Market Insights, the global five-star hotel market size was valued at USD 136.80 billion in 2024 and is projected to grow from USD 153.22 billion in 2025 to reach USD 270.02 billion by 2030, expanding at a CAGR of 12.0% during the forecast period (2025–2030). The five-star hotel market growth is driven by the resurgence of international tourism, rising high-net-worth populations, increasing demand for experiential luxury travel, and large-scale investments in premium hospitality infrastructure across both developed and emerging economies.

Key Market Insights

- Luxury hospitality demand is shifting toward experience-led offerings, with guests prioritizing personalization, wellness, and immersive cultural experiences over traditional accommodation.

- Asia-Pacific is the fastest-growing region, supported by rising disposable incomes, expanding outbound tourism, and aggressive expansion of global luxury hotel brands.

- Asset-light business models, including management contracts and franchising, are becoming the preferred expansion strategy for major hotel groups.

- Urban five-star hotels dominate global revenues, driven by corporate travel, MICE activities, and premium city tourism.

- Sustainability and ESG compliance are becoming critical differentiators, influencing both customer choice and institutional investment decisions.

- Technology adoption, including AI-driven concierge services and smart room solutions, is reshaping guest engagement and operational efficiency.

What are the latest trends in the five-star hotel market?

Experience-Driven Luxury Hospitality

The five-star hotel industry is witnessing a clear shift from standardized luxury toward experience-driven hospitality. Guests increasingly seek curated experiences such as destination-based dining, cultural immersion, private tours, and bespoke wellness programs. Hotels are investing heavily in experiential elements, including celebrity-chef restaurants, heritage-inspired architecture, and locally rooted storytelling. This trend is particularly strong among younger affluent travelers who value authenticity, exclusivity, and personalization. As a result, experiential and lifestyle five-star hotels are gaining market share, especially in urban and resort destinations.

Digitalization and Smart Luxury Hotels

Technology integration has become a core trend shaping the modern five-star hotel experience. AI-powered concierge platforms, mobile check-ins, facial recognition access, and IoT-enabled smart rooms are increasingly deployed to enhance convenience and personalization. Data analytics is being used to predict guest preferences, optimize pricing, and improve service delivery. Digital loyalty ecosystems and direct booking platforms are also expanding, reducing dependency on OTAs. These advancements not only improve guest satisfaction but also help operators reduce operational costs and improve margins.

What are the key drivers in the five-star hotel market?

Recovery of Global Travel and Tourism

The rebound in international travel has been a major growth catalyst for the five-star hotel market. Premium leisure travel, destination weddings, and long-haul vacations have returned strongly, driving higher occupancy rates and average daily rates (ADR). Major global events, international exhibitions, and business travel recovery have further strengthened demand for luxury accommodations, particularly in metropolitan hubs and resort destinations.

Rising High-Net-Worth Population

The global increase in high-net-worth individuals is directly boosting demand for five-star hotels. Affluent travelers prioritize privacy, exclusivity, and superior service quality, allowing luxury hotels to maintain strong pricing power. Emerging wealth centers in Asia-Pacific and the Middle East are significantly contributing to this growth, with luxury hospitality becoming a key lifestyle and status indicator.

Growth of MICE and Corporate Travel

Five-star hotels continue to dominate the MICE segment due to their superior infrastructure, brand credibility, and service excellence. The revival of corporate travel, global conferences, and incentive tourism has led to increased bookings for large luxury properties with integrated convention facilities, particularly in North America, Europe, and Asia-Pacific.

What are the restraints for the global market?

High Capital and Operating Costs

Developing and operating five-star hotels requires substantial capital investment in land acquisition, construction, premium interiors, and skilled labor. Ongoing operational expenses related to staffing, energy, and maintenance can compress profit margins, particularly during periods of demand volatility. These high entry barriers limit new market participation and increase financial risk.

Economic and Geopolitical Sensitivity

Luxury hospitality demand is highly sensitive to global economic downturns, geopolitical instability, and travel disruptions. Factors such as inflation, currency volatility, and regional conflicts can significantly impact international travel flows, posing challenges to sustained growth in the five-star hotel market.

What are the key opportunities in the five-star hotel industry?

Expansion in Emerging Luxury Destinations

Emerging markets such as India, Vietnam, Indonesia, Saudi Arabia, and parts of Africa present significant growth opportunities for five-star hotels. Government-led tourism initiatives, infrastructure development, and favorable investment policies are encouraging luxury hotel development. Early market entry allows operators to establish brand dominance and capture long-term demand.

Wellness, Medical, and Sustainable Luxury Hotels

The convergence of luxury hospitality with wellness and medical tourism is creating new revenue streams. Five-star hotels offering integrated wellness programs, medical services, and eco-luxury experiences are attracting health-conscious and sustainability-focused travelers. This segment is expected to grow faster than traditional luxury accommodation formats.

Ownership & Operating Model Insights

Chain-owned and operated five-star hotels continue to dominate the global market, accounting for approximately 38% of total revenues in 2024. This segment’s leadership is driven by strong brand equity, standardized service quality, and extensive global loyalty programs, which ensure consistent guest experiences across multiple regions. These hotels also benefit from operational efficiencies, centralized reservation systems, and marketing scale, enabling them to capture both corporate and luxury leisure demand effectively.

Asset-light models, including management contracts and franchising, are experiencing rapid growth as operators aim to expand their footprint without heavy capital investment. These models allow hotels to enter high-demand locations quickly while leveraging established brand recognition. Independent luxury hotels, although smaller in scale, continue to hold niche appeal, particularly in heritage, boutique, and culturally immersive segments, attracting travelers seeking exclusivity, personalized experiences, and distinctive local character.

Location Insights

Urban and metropolitan five-star hotels account for the largest share of the market, contributing nearly 45% of global revenue in 2024. This dominance is driven by high corporate travel volumes, premium tourism demand, and a robust MICE (Meetings, Incentives, Conferences, and Exhibitions) ecosystem. Cities such as New York, London, Paris, Dubai, and Tokyo command high average daily rates (ADR) and strong occupancy rates, making urban luxury properties highly profitable.

Resort and leisure destination hotels are the fastest-growing sub-segment, propelled by experiential travel trends, destination weddings, luxury vacations, and health/wellness tourism. These properties appeal to affluent leisure travelers seeking immersive experiences in scenic or culturally significant locations. The rise in wellness and sustainable tourism, combined with increasing interest in private villas, all-inclusive luxury resorts, and curated adventure packages, is further fueling growth in this segment.

Customer Type Insights

Luxury leisure travelers represent the largest customer segment, accounting for approximately 41% of total demand. This segment is growing due to increasing disposable incomes, desire for experiential travel, and rising international vacation trends. Business and corporate travelers remain critical revenue contributors, particularly for urban hotels in major metropolitan hubs, as they drive consistent occupancy and premium rates during weekdays.

The MICE segment is emerging as the fastest-growing customer category, benefiting from the post-pandemic recovery of large-scale international conferences, incentive trips, and corporate events. Hotels with integrated convention facilities, banquet spaces, and advanced event technology are capturing a growing share of this high-value segment. Demand for hybrid events combining in-person and virtual participation is also boosting bookings for luxury hotels equipped with state-of-the-art technology infrastructure.

| By Ownership & Operating Model | By Location | By Customer Type | By Service & Experience Model | By Property Size |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 32% of the global five-star hotel market in 2024, with the United States leading regional demand. Strong corporate travel activity, mature luxury travel preferences, and high average room rates drive market dominance. Key revenue centers include New York, Los Angeles, Miami, Las Vegas, and Chicago, where premium tourism, international conventions, and high-spending leisure travelers converge. Growth in luxury business travel, destination weddings, and experiential city tourism is further strengthening market demand. Additionally, regional drivers such as advanced infrastructure, ease of connectivity, and robust MICE ecosystems support continued expansion.

Europe

Europe held approximately 27% of the global five-star hotel market in 2024. Leading countries include France, the United Kingdom, Italy, Germany, and Spain. Strong heritage tourism, cultural travel, and premium city experiences underpin steady growth. Drivers include high international tourist arrivals, the popularity of luxury urban resorts, and established corporate travel networks. Sustainability initiatives, eco-lodges, and cultural immersion programs are increasingly influencing guest choices, particularly among younger European travelers, which is further propelling growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR exceeding 8%. Key markets include China, India, Japan, Thailand, and Indonesia. Growth is fueled by rising disposable incomes, rapid urbanization, and the expansion of both domestic and outbound luxury tourism. The surge in high-net-worth individuals and millennial travelers seeking experiential travel is driving demand for both urban five-star hotels and leisure resorts. Additionally, government support for tourism infrastructure, visa facilitation, and high-profile international events is creating favorable conditions for new hotel development. The adoption of digital booking platforms and app-based guest services is also accelerating growth in this region.

Middle East & Africa

The Middle East, led by the UAE, Saudi Arabia, and Qatar, is emerging as a major global luxury hospitality hub, supported by mega tourism projects, such as Expo 2025 Dubai and Saudi Vision 2030 initiatives. Growth drivers include high-income populations, rising demand for luxury leisure and business travel, and government-backed infrastructure investments. Africa continues to attract luxury leisure demand, particularly in resort and safari-linked five-star properties. Key drivers include expanding tourism in South Africa, Kenya, Botswana, and Morocco, as well as increasing international air connectivity and the rising popularity of adventure and eco-tourism experiences.

Latin America

Latin America holds a smaller but growing share, with Mexico, Brazil, and Argentina leading demand. Growth is driven by the expansion of luxury tourism infrastructure, international brand entries, and increased high-spending leisure travel. Rising domestic affluence, combined with a growing interest in cultural and adventure-based tourism, is creating new opportunities for five-star hotels. Additionally, cities such as Mexico City, São Paulo, and Buenos Aires are witnessing strong demand from both corporate travelers and international vacationers, fueling regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Five-Star Hotel Market

- Marriott International

- Hilton Worldwide

- Accor

- Hyatt Hotels Corporation

- InterContinental Hotels Group (IHG)

- Four Seasons Hotels & Resorts

- Mandarin Oriental Hotel Group

- Shangri-La Group

- Rosewood Hotel Group

- Kempinski Hotels

- Raffles Hotels & Resorts

- Aman Resorts

- Jumeirah Group

- Oberoi Hotels & Resorts

- Taj Hotels (IHCL)