Fish Gelatin Market Size

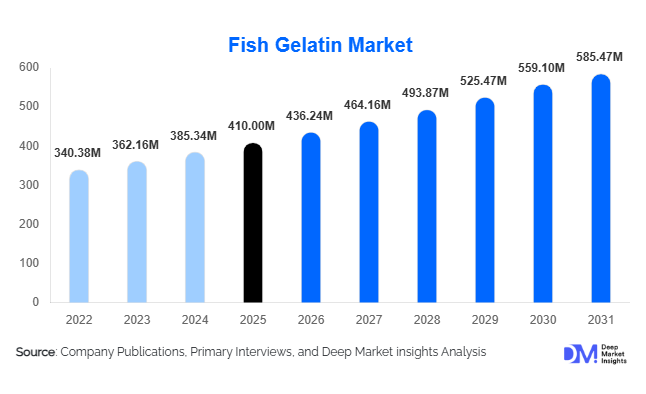

According to Deep Market Insights, the global fish gelatin market size was valued at USD 410.00 million in 2025 and is projected to grow from USD 436.24 million in 2026 to reach USD 585.47 million by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). The fish gelatin market growth is primarily driven by rising demand for halal- and kosher-compliant ingredients, increasing pharmaceutical and nutraceutical applications, and growing adoption of sustainable marine by-product utilization across food, healthcare, and cosmetic industries.

Key Market Insights

- Fish gelatin is increasingly replacing bovine and porcine gelatin in halal, kosher, and pescatarian formulations, particularly in pharmaceuticals and nutraceuticals.

- Asia-Pacific dominates global demand, supported by strong seafood processing infrastructure and expanding pharmaceutical manufacturing in China, Japan, and India.

- Pharmaceutical- and nutraceutical-grade fish gelatin represents the fastest-growing application segment, driven by capsule manufacturing and collagen supplements.

- Sustainability and circular economy initiatives are accelerating investment in fish gelatin extraction from marine by-products.

- Cold-water fish sources lead the market due to superior gel strength and clarity required for high-value applications.

- Technological advancements in enzyme-based extraction are improving functional performance and expanding end-use adoption.

What are the latest trends in the fish gelatin market?

Shift Toward Halal and Kosher Pharmaceutical Ingredients

One of the most prominent trends in the fish gelatin market is its growing use in pharmaceutical and nutraceutical formulations as a halal- and kosher-compliant alternative to mammalian gelatin. Capsule manufacturers are increasingly reformulating hard and soft gelatin capsules using fish gelatin to cater to religious and cultural compliance requirements. This trend is especially pronounced in Southeast Asia, the Middle East, and Europe, where regulatory bodies and healthcare providers emphasize ingredient transparency and compliance. As a result, pharmaceutical-grade fish gelatin with high purity and consistent bloom strength is gaining traction globally.

Technological Improvements in Extraction and Processing

Advancements in enzyme-based extraction technologies are significantly enhancing the functional properties of fish gelatin. Improved thermal stability, clarity, and gel strength are enabling fish gelatin to penetrate applications previously dominated by bovine gelatin, such as confectionery and biomedical materials. Manufacturers are investing in advanced purification systems to meet stringent pharmaceutical and food safety standards. These innovations are also helping reduce variability caused by raw material differences, making fish gelatin more reliable for large-scale industrial applications.

What are the key drivers in the fish gelatin market?

Rising Demand from Pharmaceuticals and Nutraceuticals

The rapid expansion of the global pharmaceutical and nutraceutical industries is a major growth driver for the fish gelatin market. Fish gelatin is increasingly used in capsule shells, tablet coatings, and collagen supplements due to its biocompatibility and clean-label appeal. The nutraceutical sector, in particular, is driving strong demand for fish gelatin-based collagen products used in joint health, skin care, and sports nutrition. This demand is further amplified by aging populations and growing preventive healthcare awareness worldwide.

Growth of Sustainable and Circular Bioeconomy Models

Fish gelatin production aligns strongly with sustainability objectives by converting fish skins, bones, and scales—by-products of seafood processing—into high-value functional ingredients. Governments and seafood processors are promoting waste reduction and resource efficiency through investments in marine bio-refining infrastructure. This focus on circular economy models is encouraging capacity expansion, especially in Asia-Pacific and Northern Europe, and is supporting long-term market growth.

What are the restraints for the global market?

Functional Limitations Compared to Mammalian Gelatin

Despite technological progress, fish gelatin generally exhibits lower melting points and thermal stability than bovine or porcine gelatin. These functional limitations restrict its use in certain high-temperature food and industrial applications. Although enzyme processing is narrowing this performance gap, consistency remains a challenge for manufacturers targeting mass-market applications.

Higher Production and Processing Costs

Fish gelatin production involves higher costs due to cold-chain logistics, advanced purification requirements, and seasonal variability in raw material supply. Pharmaceutical-grade fish gelatin, in particular, requires stringent quality control, resulting in prices that are 20–40% higher than conventional gelatin. This cost premium limits adoption in price-sensitive markets.

What are the key opportunities in the fish gelatin industry?

Expansion of Biomedical and Medical Applications

Fish gelatin’s biocompatibility and low immunogenicity create strong opportunities in biomedical applications such as wound dressings, tissue engineering scaffolds, and plasma expanders. Growing investments in healthcare infrastructure and regenerative medicine are expected to drive demand for high-purity fish gelatin in medical-grade applications.

Emerging Demand in Developing Regions

Rapid growth in pharmaceutical manufacturing and functional food consumption in Asia-Pacific, Latin America, and the Middle East presents significant opportunities for market expansion. New entrants focusing on local production and certification capabilities can capitalize on rising regional demand while reducing import dependence.

Source Species Insights

Cold-water fish species, including cod, pollock, and haddock, dominate the global fish gelatin market, accounting for approximately 38% of total revenue in 2025. The leadership of this segment is primarily driven by the superior functional characteristics of cold-water fish gelatin, including higher bloom strength, enhanced gel clarity, and improved film-forming ability. These properties make cold-water fish gelatin particularly suitable for high-value applications such as pharmaceutical capsules, nutraceutical formulations, and biomedical materials, where consistency and purity are critical.

Warm-water fish species, including tilapia, pangasius, and catfish, are steadily gaining market share, particularly in the Asia-Pacific region. Growth in this segment is driven by abundant raw material availability, lower procurement costs, and proximity to large seafood processing hubs. While warm-water fish gelatin typically exhibits lower gel strength compared to cold-water variants, ongoing technological improvements in extraction and purification are expanding its adoption in food, cosmetics, and mid-grade nutraceutical applications.

Extraction Type Insights

Acid-processed fish gelatin remains the leading extraction type, accounting for nearly 62% of the global market share in 2024. The dominance of this segment is driven by its cost-effectiveness, scalability, and suitability for large-volume food and beverage applications. Acid processing allows manufacturers to achieve commercially viable yields with relatively lower capital investment, making it the preferred method for food-grade gelatin production. This extraction method is widely adopted in confectionery, dairy desserts, and functional food applications, where ultra-high purity is less critical than price stability and volume availability. The established nature of acid-processing technology also enables easier integration into existing gelatin manufacturing facilities.

Enzyme-processed fish gelatin, while currently holding a smaller share, represents the fastest-growing extraction segment. Growth is driven by increasing demand for pharmaceutical- and biomedical-grade gelatin, where higher purity, controlled molecular weight distribution, and consistent functional performance are essential. Enzyme processing significantly reduces impurities and improves batch-to-batch consistency, making it increasingly attractive for capsule manufacturing, wound care products, and tissue engineering applications.

Form Insights

Powdered fish gelatin is the dominant product form, representing approximately 55% of total market demand. Its leadership is driven by ease of transportation, extended shelf life, and superior compatibility with automated dosing and mixing systems used in food, pharmaceutical, and nutraceutical manufacturing. Powdered gelatin also offers greater formulation flexibility, enabling precise control over viscosity and gelling behavior.

Granulated fish gelatin holds a meaningful share in applications where controlled dissolution rates are required, particularly in pharmaceutical and specialty food formulations. Sheets, while representing a smaller niche segment, continue to be used in artisanal food production, traditional confectionery, and select pharmaceutical applications where manual handling or visual quality is prioritized.

End-Use Industry Insights

The food and beverages industry remains the largest end-use segment, accounting for approximately 34% of global fish gelatin demand in 2024. Demand is driven by increasing use of fish gelatin in confectionery, dairy desserts, marshmallows, and functional foods, particularly in regions with halal and kosher dietary requirements. Clean-label trends and consumer preference for non-mammalian ingredients are further supporting adoption in food applications.

The pharmaceuticals and nutraceuticals segment follows closely, holding around 31% market share and representing the fastest-growing end-use category. Growth is fueled by rising production of hard and soft capsules, collagen supplements, and excipients that require halal- and allergen-free alternatives. The increasing global focus on preventive healthcare and dietary supplementation continues to accelerate demand from this segment. Cosmetics and personal care applications are expanding steadily, driven by the growing popularity of marine collagen, anti-aging formulations, and beauty-from-within products. Fish gelatin is increasingly incorporated into skincare, haircare, and nutricosmetic products due to its bioavailability and natural origin.

| By Source Species | By Extraction Type | By Form | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global fish gelatin market with nearly 38% share in 2025, making it the largest and fastest-growing regional market. China alone accounts for approximately 18% of global demand, supported by its extensive seafood processing industry, large pharmaceutical manufacturing base, and strong export-oriented production. The availability of raw materials from warm-water fish species and increasing government support for marine by-product utilization are key growth drivers. Japan contributes significantly through high demand for pharmaceutical- and nutraceutical-grade gelatin, while India is emerging as a growth hub due to expanding capsule manufacturing, rising healthcare expenditure, and strong demand for halal-compliant ingredients. Favorable labor costs, growing domestic consumption, and increasing foreign investment in food and pharma manufacturing continue to reinforce Asia-Pacific’s leadership.

Europe

Europe accounts for approximately 27% of the global fish gelatin market, driven by strong pharmaceutical demand and advanced processing capabilities. Germany leads regional consumption, particularly in pharmaceutical and nutraceutical applications, supported by strict quality standards and high adoption of specialty excipients. Norway plays a critical role as a raw material supplier, leveraging its well-established cold-water fisheries and sustainable seafood processing infrastructure. France and other Western European countries contribute through growing demand for clean-label food ingredients and cosmetics. Stringent regulatory frameworks and emphasis on sustainability further support stable market growth across the region.

North America

North America holds around 21% market share, driven primarily by strong nutraceutical demand in the United States. The region benefits from high consumer awareness regarding dietary supplements, increasing preference for non-mammalian ingredients, and regulatory acceptance of fish gelatin in pharmaceutical formulations. Growth is further supported by rising demand for collagen-based supplements, functional foods, and clean-label personal care products. Advanced manufacturing capabilities and strong distribution networks enable steady adoption despite higher product costs.

Middle East & Africa

The Middle East & Africa region represents approximately 8% of global demand, largely driven by import-dependent consumption. Saudi Arabia, the UAE, and Egypt are key markets due to strong halal compliance requirements across the food, pharmaceutical, and nutraceutical sectors. Rising healthcare investments, growing pharmaceutical manufacturing, and increasing awareness of halal-certified excipients are supporting market growth. Limited domestic production capacity continues to drive reliance on imports from Europe and Asia-Pacific.

Latin America

Latin America accounts for roughly 6% of the global fish gelatin market, with Brazil, Chile, and Peru emerging as key contributors. Growth is supported by expanding pharmaceutical manufacturing, rising nutraceutical consumption, and export-oriented seafood processing industries. Chile and Peru benefit from strong fisheries and increasing investment in value-added marine by-product processing, while Brazil’s growing healthcare and food industries are driving domestic demand. Although the region remains smaller in scale, improving industrial capabilities and rising health awareness are expected to support steady long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fish Gelatin Market

- Gelita AG

- Nitta Gelatin Inc.

- Rousselot

- Weishardt Group

- Tessenderlo Group

- Sterling Gelatin

- Junca Gelatines

- Lapi Gelatine

- PB Gelatins

- Nippi Inc.