Fermentation-Based Natural Vanillin Market Size

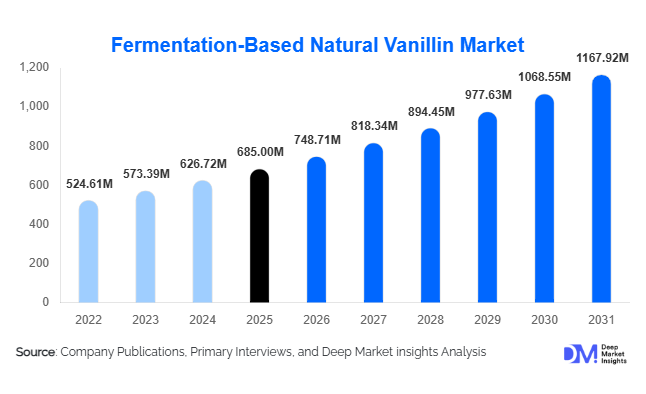

According to Deep Market Insights, the global fermentation-based natural vanillin market size was valued at USD 685 million in 2025 and is projected to grow from USD 748.71 million in 2026 to reach USD 1,167.92 million by 2031, expanding at a CAGR of 9.3% during the forecast period (2026–2031). The market growth is primarily driven by increasing clean-label demand, rising reformulation of food and beverage products to eliminate synthetic additives, and growing sustainability concerns associated with petrochemical-derived vanillin and volatile vanilla bean supply chains.

Key Market Insights

- Ferulic acid-based fermentation dominates production, accounting for nearly 48% of the 2025 market share due to scalable feedstock availability and stable yield efficiency.

- Food & beverage applications represent the largest demand segment, contributing approximately 67% of global revenue in 2025.

- Powder/crystalline vanillin leads by form, capturing nearly 55% share owing to superior stability and ease of formulation in bakery and dairy products.

- North America holds the largest regional share (32% in 2025), driven by strict clean-label standards and high processed food consumption.

- Asia-Pacific is the fastest-growing region, expanding at over 11% CAGR due to rising processed food production in China and India.

- Top five players collectively control approximately 54% of the global market, indicating moderate consolidation with strong competition in biotechnology innovation.

What are the latest trends in the fermentation-based natural vanillin market?

Precision Fermentation and Strain Engineering Advancements

Recent investments in microbial strain engineering and metabolic pathway optimization are significantly improving vanillin yield per substrate unit. Biotechnology firms are deploying CRISPR-enabled yeast and bacterial strains to enhance productivity and reduce impurity formation. This technological shift is lowering production costs by 15–20%, narrowing the price gap with synthetic vanillin. Continuous fermentation systems and bioreactor automation are also improving scalability and operational efficiency, making large-volume production more commercially viable for multinational flavor houses.

Clean-Label Reformulation Across FMCG Portfolios

Major global food manufacturers are actively reformulating product lines to replace artificial flavors with naturally derived alternatives. Fermentation-based vanillin qualifies as “natural flavor” under U.S. and EU regulations, making it a strategic replacement ingredient in bakery, confectionery, beverages, and dairy alternatives. Private-label brands are increasingly adopting natural vanillin to strengthen premium positioning. This trend is particularly evident in plant-based beverages and protein products where vanillin is used to mask off-notes while maintaining natural claims.

What are the key drivers in the fermentation-based natural vanillin market?

Rising Clean-Label and Regulatory Compliance Requirements

Consumer preference for natural ingredients has accelerated demand for fermentation-based vanillin. Over 60% of new premium bakery launches globally emphasize natural flavor labeling. Regulatory scrutiny on synthetic additives has further encouraged food manufacturers to shift toward fermentation-derived alternatives, reinforcing long-term demand growth.

Volatility in Natural Vanilla Bean Prices

Vanilla bean cultivation is concentrated in limited geographies and remains highly vulnerable to climatic disruptions and geopolitical instability. Price fluctuations exceeding 40% in certain years have pushed manufacturers to seek stable supply alternatives. Fermentation-based vanillin offers predictable pricing and supply security while maintaining natural labeling status.

Sustainability and ESG Commitments

Corporate ESG frameworks are influencing ingredient sourcing decisions. Fermentation-based vanillin reduces reliance on land-intensive vanilla cultivation and petrochemical feedstocks. Lower carbon footprint and scalable production make it attractive to global FMCG companies committed to sustainability reporting and carbon neutrality targets.

What are the restraints for the global market?

Higher Cost Compared to Synthetic Vanillin

Despite technological improvements, fermentation-based vanillin remains 2–3 times more expensive than petrochemical-derived alternatives. This price premium limits adoption in cost-sensitive emerging markets and low-margin product categories.

Regulatory and Labeling Variability

Natural flavor definitions differ across regions, creating compliance complexity for exporters. Harmonization challenges between North America, Europe, and Asia can delay product approvals and increase administrative costs for suppliers.

What are the key opportunities in the fermentation-based natural vanillin industry?

Expansion into Emerging Food Processing Hubs

Rapid industrialization of food manufacturing in India, China, Brazil, and Southeast Asia presents significant growth opportunities. Government-backed biotechnology incentives and increasing processed food exports from these countries are encouraging local fermentation investments.

Premium Fragrance and Personal Care Applications

Sustainable aroma compounds are gaining traction in fine fragrances and clean beauty formulations. Fermentation-based vanillin offers traceable sourcing and natural labeling advantages, positioning it strongly in premium cosmetic and perfumery applications.

Production Source Insights

Ferulic acid-based fermentation dominates the global bio-vanillin market, accounting for approximately 48% of total market share in 2025. The leading segment driver is the cost efficiency and abundant availability of rice bran and corn bran feedstocks, which significantly reduce production costs while ensuring consistent supply. This pathway also aligns with sustainability objectives by utilizing agro-industrial by-products, making it attractive for manufacturers pursuing circular economy strategies and carbon footprint reduction goals.Eugenol-based production holds a comparatively smaller share due to feedstock limitations and price volatility, as eugenol is largely derived from clove oil and other essential oil sources with limited scalability. However, it remains relevant in specialty fragrance and high-purity applications.

Glucose-based bioconversion is emerging as a flexible and scalable platform technology, supported by advancements in microbial engineering and precision fermentation. This method enables higher yield optimization and consistent product quality, making it attractive for large-scale industrial adoption.Lignin-derived bio-vanillin remains a niche segment but represents a high-potential future growth avenue. The leading growth driver for this segment is its alignment with circular bioeconomy and waste valorization initiatives, particularly in regions with advanced pulp and paper industries seeking to monetize lignin by-products.

Application Insights

Food & beverage applications account for nearly 67% of total market revenue in 2025, making it the dominant application segment. The leading segment driver is the rising consumer preference for natural flavoring agents in processed and packaged foods, coupled with clean-label reformulation trends.Within this segment, bakery and confectionery represent the largest sub-segment due to extensive use of vanillin in cakes, cookies, chocolates, and candies. Growing demand for premium desserts and indulgence products continues to stimulate consumption. Dairy and plant-based beverages follow, driven by the expansion of flavored milk, yogurt, and alternative protein drinks.

Fragrances and personal care contribute approximately 18% of total revenue, supported by increasing demand for naturally derived aroma compounds in perfumes, body care, and cosmetic formulations. Pharmaceutical, nutraceutical, and animal nutrition applications collectively account for the remaining share, benefiting from vanillin’s antioxidant properties and flavor-masking capabilities in oral formulations.

Form Insights

Powder/crystalline vanillin leads the market with around 55% share in 2025. The leading segment driver is its superior stability, longer shelf life, ease of storage, and simplified transportation logistics, making it highly preferred for bulk manufacturing in food processing industries.Liquid formats are widely adopted in beverage and dairy formulations where rapid solubility and uniform blending are critical. Meanwhile, encapsulated vanillin is gaining traction in premium bakery, nutraceutical, and functional food applications. The growth driver for this sub-segment is the increasing need for controlled-release functionality and improved flavor retention during high-temperature processing.

Distribution Channel Insights

Direct B2B contracts dominate the market with approximately 58% share, reflecting long-term procurement agreements between flavor manufacturers and multinational food producers. The leading segment driver is the need for stable supply, price predictability, and customized formulation support in large-scale food production.Ingredient distributors play a vital role in serving mid-sized and regional manufacturers, offering technical support and smaller order volumes. Digital procurement platforms are gradually emerging as alternative sourcing channels, particularly among small and specialty brands seeking flexible supply arrangements and transparent pricing structures.

| By Production Source | By Form | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of global revenue in 2025, led by the United States. Regional growth is primarily driven by high consumption of processed and convenience foods, strong clean-label adoption, and stringent regulatory frameworks that encourage the use of bio-based ingredients. The presence of major flavor houses and advanced biotechnology infrastructure further supports innovation and large-scale fermentation production capacity in the region.

Europe

Europe holds nearly 28% of global market share, with Germany and France serving as leading consumer markets. Growth in this region is supported by strict EU clean-label regulations, sustainability mandates, and increasing consumer demand for natural and traceable ingredients. Additionally, strong policy support for bio-based industries and circular economy initiatives accelerates the adoption of fermentation-derived vanillin.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at over 11% CAGR. China and India are major growth engines due to expanding processed food production, rising disposable incomes, and rapid urbanization. Government-backed biotechnology initiatives such as “Made in China 2025” and “Make in India” significantly support domestic fermentation manufacturing capabilities. The region also benefits from abundant agricultural feedstock availability and cost-competitive production infrastructure.

Latin America

Brazil and Mexico represent key markets within Latin America. Regional growth is driven by expanding confectionery exports, growing beverage production, and increasing demand for flavored dairy products. Improving food processing infrastructure and rising middle-class consumption further contribute to steady market expansion.

Middle East & Africa

The UAE and South Africa are emerging demand centers in this region. Growth is primarily supported by rising imports of processed foods, expanding premium retail sectors, and increasing consumption of personal care and fragrance products. Additionally, gradual modernization of food manufacturing capabilities across Gulf Cooperation Council (GCC) countries supports future demand growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fermentation-Based Natural Vanillin Market

- Givaudan

- Firmenich

- Symrise AG

- International Flavors & Fragrances Inc.

- Solvay SA

- Evolva Holding SA

- Borregaard ASA

- Advanced Biotech

- Ennloys Biotech

- Lesaffre

- Omega Ingredients

- Aurochemicals

- De Monchy Aromatics

- Apple Flavor & Fragrance

- Shandong Longda Bio-Products