Fat Burn Supplements Market Size

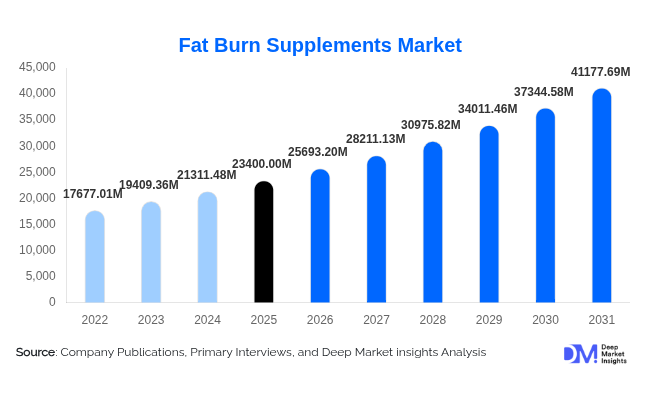

According to Deep Market Insights, the global fat burn supplements market size was valued at USD 23,400.00 million in 2025 and is projected to grow from USD 25,693.20 million in 2026 to reach USD 41,177.69 million by 2031, expanding at a CAGR of 9.8% during the forecast period (2026–2031). The fat burn supplements market growth is primarily driven by rising obesity rates, growing health and fitness consciousness, and increasing consumer preference for natural and herbal formulations that support metabolism, energy, and weight management.

Key Market Insights

- Thermogenic and herbal fat burn supplements are gaining traction globally, as consumers increasingly seek products that enhance metabolic activity while minimizing side effects.

- Online retail and e-commerce channels dominate distribution, enabling direct-to-consumer engagement, subscription models, and global reach for emerging brands.

- North America leads the market, with the U.S. and Canada driving demand due to high obesity prevalence and a strong wellness culture.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, urbanization, and increasing adoption of fitness supplements in countries such as China and India.

- Product innovation and natural ingredient integration are reshaping the market, with blends combining herbal extracts, amino acids, and metabolism enhancers attracting health-conscious consumers.

- Regulatory compliance and quality certifications are emerging as key differentiators for premium players, fostering trust in safety and efficacy.

What are the latest trends in the fat burn supplements market?

Natural and Herbal Formulations Leading Growth

Consumers are increasingly favoring supplements derived from natural or herbal sources, such as green tea extract, L-carnitine, capsicum, and Garcinia cambogia. These ingredients are associated with fewer side effects than synthetic stimulants while providing metabolic and appetite-suppressing benefits. The trend reflects broader shifts toward clean-label products, plant-based nutrition, and evidence-backed formulations. Premium brands are capitalizing on this trend by highlighting clinical studies, third-party testing, and sustainable sourcing of ingredients, which strengthens brand credibility and supports premium pricing strategies.

Digital and E-Commerce Dominance

E-commerce is rapidly transforming the fat burn supplements market. Online platforms, including direct-to-consumer websites and marketplaces, offer convenience, product transparency, and personalized recommendations. Subscription models, targeted social media advertising, and influencer collaborations are driving higher engagement among millennials and Gen Z consumers. Brands leveraging AI-based recommendation engines, user-generated reviews, and content marketing are experiencing higher retention rates, indicating the growing importance of digital channels as primary revenue drivers.

What are the key drivers in the fat burn supplements market?

Rising Obesity and Lifestyle-Related Disorders

The prevalence of obesity, diabetes, and metabolic syndrome is escalating globally, creating substantial demand for over-the-counter fat burn supplements. Consumers are seeking non-pharmaceutical alternatives to manage weight, appetite, and metabolism. This health imperative has expanded the target audience across fitness enthusiasts, working professionals, and aging populations, reinforcing the market’s growth trajectory.

Fitness and Wellness Culture Expansion

Increasing engagement with gyms, fitness studios, wellness programs, and social media-driven health communities is fueling demand for supplements that enhance energy, fat oxidation, and performance. Consumers now integrate fat burn supplements as part of holistic lifestyle routines, which combine exercise, nutrition, and supplementation, boosting repeat purchase rates and overall market adoption.

Product Innovation and Ingredient Advancements

Formulation innovations, including thermogenic blends, metabolism enhancers, and multifunctional herbal complexes, are attracting consumers seeking efficacy and safety. Advances such as microencapsulation, synergistic ingredient combinations, and clean-label certifications improve bioavailability and consumer trust. Companies investing in R&D to validate clinical efficacy are capturing market share and commanding premium pricing.

What are the restraints for the global market?

Regulatory and Safety Concerns

Varying regulatory standards across regions create challenges for manufacturers, particularly in ensuring compliance with ingredient approvals, labeling, and marketing claims. Safety concerns and adverse event reports can undermine consumer confidence, limiting adoption in sensitive markets such as Europe and North America.

Perceived Efficacy and Market Saturation

Consumer skepticism regarding supplement effectiveness, coupled with intense competition from pharmaceutical alternatives and diet programs, constrains growth. The market’s proliferation of low-quality or unsubstantiated products makes it harder for brands to differentiate and maintain repeat purchases.

What are the key opportunities in the fat burn supplements industry?

Expansion in Emerging Regions

Asia-Pacific, Latin America, and the Middle East represent high-growth opportunities due to urbanization, rising disposable incomes, and increasing health awareness. Tailored formulations, culturally adapted marketing campaigns, and educational initiatives can help brands tap into underpenetrated markets, creating new demand streams.

Digital and Subscription-Based Models

The adoption of online and subscription-based sales models allows brands to build recurring revenue, engage with health-conscious consumers, and optimize distribution. Personalized product recommendations, loyalty programs, and targeted campaigns are driving higher engagement, retention, and market penetration.

Regulatory Compliance and Quality Differentiation

Companies investing in clinical validation, third-party testing, and certifications (GMP, NSF, ISO) can position products as premium and trustworthy, enhancing consumer confidence. Regulatory clarity and adherence to safety standards are opening avenues for new entrants to differentiate themselves in a competitive landscape.

Product Type Insights

Among the various product types, thermogenic fat burners dominate the global market, accounting for approximately 35% of the 2024 market. Their leading position is primarily driven by their proven efficacy in enhancing metabolism, promoting fat oxidation, and supporting rapid weight loss, which resonates strongly with fitness enthusiasts and health-conscious consumers. Appetite suppressants follow, representing about 25% of the market, appealing particularly to individuals focused on dietary control and portion management. Meanwhile, fat blockers, carb blockers, and metabolism enhancers collectively contribute the remaining 40%, reflecting a growing preference for multifunctional formulations that combine multiple mechanisms for fat reduction. Innovation in ingredient blends, especially those leveraging natural, herbal, and clinically substantiated compounds, is increasingly shaping consumer choice and sustaining thermogenic fat burners’ dominance.

Application Insights

When considering end-user demographics, men account for a larger share of global demand (approximately 55% of 2024 sales), driven by fitness enthusiasts, bodybuilders, and male consumers aiming to improve muscle definition alongside fat loss. Women represent around 40%, primarily motivated by weight management, wellness, and holistic health goals. Unisex formulations cater to broader adult populations, including lifestyle-conscious consumers seeking metabolic support. Across all demographics, demand is supported by rising health awareness, growing participation in gym and fitness programs, and the integration of fat burn supplements into daily wellness routines as part of preventive health strategies. Emerging product formulations that emphasize natural ingredients, clean labeling, and clinical efficacy are helping brands appeal to both genders, further expanding adoption.

Distribution Channel Insights

Online and e-commerce channels dominate the global distribution landscape, accounting for nearly 45% of 2024 revenue. This growth is driven by the convenience of home delivery, personalized subscription models, targeted digital marketing campaigns, and broader access to international brands. Supermarkets and hypermarkets capture approximately 20% of the market, catering to consumers seeking convenient, in-store purchases. Specialty nutrition stores account for 15%, offering curated selections of premium and herbal fat burn supplements, while pharmacies and drug stores contribute 10%, often appealing to health-conscious consumers seeking professionally recommended products. Direct sales and multi-level marketing channels represent the remaining 10%, highlighting niche opportunities for relationship-driven sales, community engagement, and personalized consultation. The shift toward digital-first distribution is expected to accelerate, particularly in emerging regions where mobile commerce is rapidly expanding.

| By Product Type | By End User | By Distribution Channel | By Form |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global fat burn supplements market, holding approximately 38% of the 2024 market. The U.S. and Canada are key drivers, supported by high obesity prevalence, high disposable incomes, and a mature culture of fitness and wellness. Thermogenic and herbal supplements are particularly popular, reflecting consumers’ preference for both efficacy and natural formulations. The region’s growth is further fueled by digital adoption, with online and e-commerce platforms offering convenience and subscription-based models. Additionally, high awareness of preventive healthcare, widespread gym participation, and influencer-led marketing campaigns continue to drive the adoption of fat burn supplements in North America.

Europe

Europe accounts for roughly 25% of the global market, with the U.K., Germany, and France leading demand. Regulatory compliance, clinical validation, and natural ingredient preferences heavily influence purchasing decisions in this region. Growth is moderate but steady, driven by increasing health and fitness awareness, rising disposable income, and a strong preference for preventive wellness products. Fitness and wellness initiatives, combined with an emphasis on clean-label, clinically supported supplements, are helping brands penetrate both urban and semi-urban markets. The demand for herbal and thermogenic fat burners is rising as consumers increasingly prioritize natural and safe weight management solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region for fat burn supplements, driven by countries such as China, India, Japan, and Australia. Rapid urbanization, rising middle-class incomes, and increasing awareness of fitness and preventive health are key growth drivers. E-commerce penetration, particularly via mobile platforms, is boosting accessibility to global and local brands. Additionally, localized formulations that cater to regional tastes, dietary habits, and herbal ingredient preferences are enhancing market adoption. Social media campaigns, influencer endorsements, and growing participation in fitness trends are further supporting market expansion, making Asia-Pacific a critical growth hub for fat burn supplements in the next five years.

Latin America

Latin America shows emerging demand for fat-burning supplements, particularly in Brazil, Mexico, and Argentina. Consumers in these markets are increasingly aware of global health and wellness trends, which is driving outbound purchasing and local market growth. Rising urbanization, higher disposable incomes, and the adoption of fitness and lifestyle programs are key regional drivers. Despite lower market penetration compared to North America and Europe, the increasing popularity of thermogenic and herbal formulations, along with growing online sales channels, is fueling steady growth in the region.

Middle East & Africa

The Middle East and Africa together account for approximately 12% of the global market, with demand concentrated in the UAE, Saudi Arabia, and South Africa. High disposable income, lifestyle-driven health awareness, and increasing participation in fitness programs are driving demand for premium and herbal fat-burning supplements. Urbanization, rising exposure to global health trends, and government initiatives promoting wellness and preventive healthcare are additional growth enablers. Thermogenic products with natural formulations are particularly popular, reflecting a regional preference for efficacy combined with safety and clean-label ingredients.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fat Burn Supplements Market

- Herbalife Nutrition

- GNC Holdings

- NOW Foods

- Optimum Nutrition

- Nature’s Bounty

- MuscleTech

- USANA Health Sciences

- Garden of Life

- Nutrex Research

- Cellucor

- Met-Rx

- JYM Supplement Science

- BioTech USA

- MusclePharm

- VitaBalance