Fantasy Football Market Size

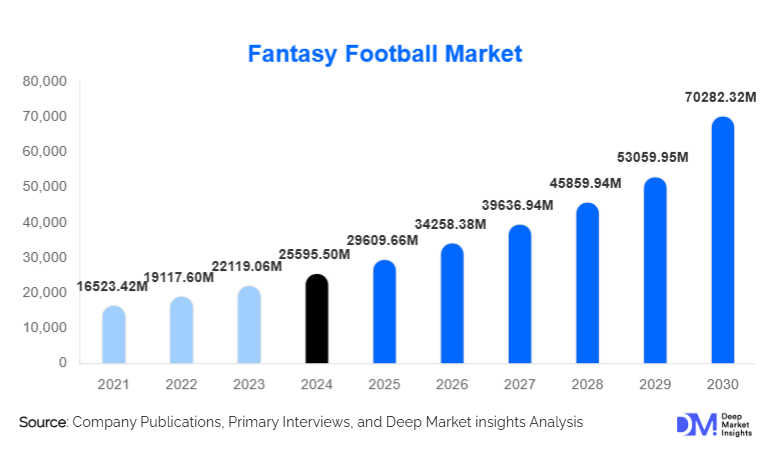

According to Deep Market Insights, the global fantasy football market size was valued at USD 25,595.50 Million in 2024 and is projected to grow from USD 29,609.66 Million in 2025 to reach USD 70,282.32 Million by 2030, expanding at a CAGR of 15.70% during the forecast period (2025–2030). Market growth is strongly driven by rising smartphone penetration, increased fan engagement with global football leagues, and the rapid proliferation of mobile-first fantasy platforms offering real-time data analytics, gamification, and immersive gameplay experiences.

Key Market Insights

- Daily and weekly fantasy formats dominate global adoption, driven by demand for fast-paced, flexible gameplay that appeals to both casual and seasoned users.

- Mobile applications account for nearly two-thirds of total fantasy football participation, supported by the widespread availability of low-cost smartphones and high-speed internet.

- Europe leads the global market due to its deep-rooted football culture and high digital engagement among fans of major leagues such as the EPL, LaLiga, and Bundesliga.

- Asia-Pacific is the fastest-growing region, driven by rising digital adoption, expanding middle-class consumption, and surging popularity of international football.

- Blockchain, AI analytics, and NFT-enabled rewards are emerging as transformative technologies enhancing personalization and monetization.

What are the latest trends in the fantasy football market?

AI-Driven Personalization and Predictive Analytics

Fantasy football platforms are rapidly adopting AI-powered performance prediction engines, personalized lineup recommendations, injury forecasting, and automated draft assistants. These capabilities enable players to make data-driven decisions and reduce the skill gap between seasoned and casual users. AI models analyze player form, team dynamics, historical trends, injury likelihood, and opponent strength, creating highly accurate forecasts. Advanced analytics has become a core differentiator for platforms seeking to improve user retention and competitive engagement. Furthermore, AI-driven gamification elements, such as adaptive challenges and skill-based matchmaking, are enhancing platform stickiness and monetization potential.

Rise of NFT and Blockchain-Enabled Fantasy Assets

Blockchain adoption is reshaping digital ownership in fantasy football, allowing participants to acquire, trade, and monetize player-card NFTs that hold in-game or real-world value. Platforms such as blockchain-enabled fantasy leagues offer transparent scoring, secure asset ownership, and new revenue models for both developers and players. Tokenized in-game rewards and marketplace-driven collector economies are attracting younger, crypto-savvy audiences. These innovations also open pathways for interoperability across fantasy ecosystems, enabling players to transfer or repurpose assets across platforms. This trend signals the evolution of fantasy football from a pure gaming activity into a hybrid entertainment and digital-asset investment ecosystem.

What are the key drivers in the fantasy football market?

Growing Global Football Fandom and Digital Engagement

Football remains the world’s most-watched sport, and increasing consumption of live matches, streaming content, and social media engagement is directly boosting fantasy football participation. Fans desire deeper interaction with real-world matches, and fantasy platforms fulfill this by transforming spectators into active strategists. Major leagues are amplifying this demand by integrating fantasy-driven content, real-time statistics, and interactive fan experiences into broadcasts. As global viewership expands, particularly in Asia-Pacific and Latin America, fantasy football adoption is accelerating at scale.

Mobile-First Ecosystem and User Accessibility

The surge in smartphone usage and affordable mobile data plans has made fantasy football accessible to billions of potential users. Mobile apps now represent the dominant platform for gameplay, offering intuitive interfaces, push notifications, live score integrations, and community-driven features. In emerging markets, mobile penetration is the single largest enabler of user growth. Robust application updates, such as one-tap lineups, app-based community leagues, and instant withdrawals, enhance convenience and encourage frequent gameplay, significantly boosting user retention.

What are the restraints for the global market?

Regulatory Uncertainty in Key Markets

Fantasy football often operates in a grey area between gaming and gambling legislation. Several countries impose stringent entry-fee restrictions or lack clear policy frameworks, which creates compliance risks for operators. Unpredictable regulatory shifts can lead to platform bans, taxation changes, or limitations on paid contests. Operators face rising legal and operational costs to ensure responsible gaming compliance, age verification, and transparent prize structures. This remains one of the most significant barriers to multinational expansion.

Market Saturation and High User-Acquisition Costs

In mature markets, particularly Europe, fantasy platforms face intense competition and player fatigue. Marketing costs have surged as companies spend heavily on influencer partnerships, ad placements, and league sponsorships. User churn is rising due to increasing contest complexity and the emergence of competing digital entertainment options such as esports and immersive gaming. High acquisition and retention expenses may pressure profitability for newer entrants lacking scale advantages.

What are the key opportunities in the fantasy football industry?

Rapid Expansion Across Emerging Markets

Asia-Pacific and Latin America offer massive untapped potential, supported by strong football culture, expanding digital penetration, and rising youth populations. Localized language interfaces, region-specific contests, micro-entry fees, and seamless payment integrations can accelerate platform adoption. Companies entering these fast-growing regions can capture millions of first-time players and establish long-term loyalty before markets mature. As football popularity increases through global streaming, these regions will become central to industry revenue growth.

Integrated Media, Sponsorship, and Live Broadcast Experiences

Fantasy football is increasingly merging with sports broadcasting and digital media ecosystems. Broadcasters are adding on-screen fantasy statistics, interactive polls, second-screen watching experiences, and partnership-driven fantasy leagues. Sponsorship opportunities, from sportswear brands to telecom operators, are rising as fantasy platforms provide access to highly engaged, sport-focused communities. These integrations create multi-channel revenue streams and position fantasy football as a key pillar of sports entertainment infrastructure.

Product Type Insights

Daily and weekly fantasy contests dominate the market due to their flexibility, accounting for over half of global revenue. These short-duration formats are especially popular among younger users and casual fans who prefer faster outcomes over season-long commitment. Season-long leagues remain significant, appealing to traditional fantasy players who value strategy, drafting, and league management. Emerging categories, such as live in-play fantasy and blockchain-driven player-card formats, are gaining momentum as they offer dynamic, real-time participation and digital asset ownership. Micro-contests tailored to regional markets are also expanding participation among low-stakes users.

Application Insights

Recreational gameplay remains the largest application segment, driven by rising demand for social competition among friends and communities. Competitively paid contest formats are expanding rapidly as users seek monetary rewards and social prestige. Professional fantasy analytics and advisory tools form a rising niche used by high-frequency players who rely on predictive algorithms for competitive advantage. Digital collectibles and NFT-based applications are emerging as high-growth categories, enabling players to own, trade, and monetize digital assets linked to real-world football performance.

Distribution Channel Insights

Mobile app stores and direct-to-consumer (D2C) websites dominate distribution, thanks to ease of access, in-app notifications, and seamless user onboarding. Online platforms enable transparent contest structures, instant payments, and integrated social features. Affiliate channels, sports media platforms, and influencers also play key roles in driving user acquisition. Blockchain-based platforms are emerging as decentralized distribution channels, providing borderless access and asset interoperability. Traditional digital advertising and sports content ecosystems continue to amplify visibility and conversion rates.

User Type Insights

Intermediate players aged 25–40 constitute the largest share of the fantasy football market, driven by stable income levels, strong football knowledge, and active digital lifestyles. Casual users are rapidly increasing, especially in emerging markets, due to free-entry contests and simplified interfaces. High-frequency players, who engage daily and participate in competitive paid contests, represent a lucrative segment due to higher monetization potential. Youth users under 25 are instrumental in driving social and community-based contests, while older audiences (40+) are increasingly adopting analytics-driven gameplay to enhance their strategic participation.

Age Group Insights

The 25–40 age group dominates total participation, reflecting strong familiarity with digital platforms, disposable income, and engagement with professional football leagues. Users aged 18–25 drive growth in social fantasy leagues, short-format games, and influencer-led contests. The 40–55 demographic contributes significantly to paid-entry formats and season-long leagues, favoring strategic and community-driven gameplay. Older age groups (55+) represent a smaller but growing segment interested in simplified, low-pressure formats that emphasize entertainment and analytics-driven recommendations.

| By Platform Type | By Contest Format | By Revenue Model | By User Type |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe remains the largest fantasy football market, accounting for an estimated 35–45% of global revenue in 2024. Strong regional engagement with top football leagues, high digital adoption, and widespread sports media integration drive consistent growth. The U.K., Germany, Spain, Italy, and France lead participation, with platforms offering highly localized experiences. Season-long leagues are more popular in Europe compared to other regions, reinforcing cultural preferences for long-term strategic gameplay.

Asia-Pacific

Asia-Pacific is the fastest-growing region, propelled by rising smartphone penetration, expanding internet access, and increasing enthusiasm for European football leagues. India, Indonesia, Malaysia, and the Philippines show explosive user growth in short-format contests. China and Japan exhibit strong adoption of premium and analytics-driven formats. APAC will play a crucial role in doubling the global market by 2030 as younger demographics enter the digital gaming ecosystem.

Latin America

Latin America is emerging as a major opportunity market, supported by a passionate football culture and rapidly improving digital infrastructure. Brazil, Argentina, Colombia, and Mexico lead demand, particularly for mobile-based, low-entry-fee contests. Regional platforms are focusing on localized language interfaces and community league structures to align with local football fandom.

North America

North America's adoption of fantasy football (soccer) remains modest compared to Europe, but is growing steadily among fans of international leagues and Major League Soccer (MLS). The region holds an estimated 5–10% share, with strong potential for expansion driven by rising interest in global football and youth participation in soccer.

Middle East & Africa

MEA represents a developing but promising market driven by young populations, increasing smartphone penetration, and strong football enthusiasm. Countries such as the UAE, Saudi Arabia, Nigeria, and Kenya are key growth centers. Africa's deep-rooted football culture positions the region for rapid mobile-first adoption as digital infrastructure improves.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Fantasy Football Market

- Dream Sports (Dream11)

- FanDuel (Flutter Entertainment)

- DraftKings

- ESPN Fantasy

- Yahoo Fantasy Sports

- Sorare

- MyTeam11

- FanTeam

- PlayOn

- Goal Fantasy

- Premier League Fantasy (Official EPL)

- UEFA Fantasy

- Mondogoal

- WinZO Sports

- Superbru

Recent Developments

- In March 2025, Sorare launched an expanded NFT-based fantasy football marketplace integrating real-time player statistics and tradable digital assets.

- In January 2025, Dream Sports announced an AI-powered predictive analytics engine to enhance personalized lineup recommendations for fantasy football users.

- In October 2024, DraftKings introduced micro-contests tailored to emerging markets, enabling low-stakes participation supported by advertising-based monetization.