Football Market Size

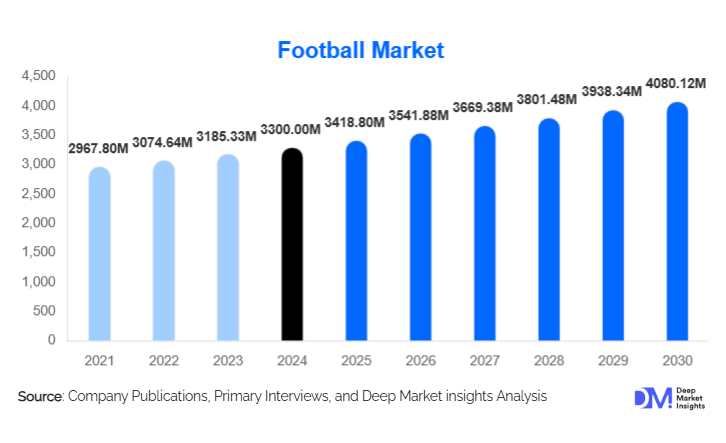

According to Deep Market Insights, the global football market size was valued at USD 3,300.00 million in 2024 and is projected to grow from USD 3,418.80 million in 2025 to reach USD 4,080.12 million by 2030, expanding at a CAGR of 3.60% during the forecast period (2025–2030). The football market growth is primarily driven by the rising commercialisation of global leagues, increasing youth participation, digital fan engagement, and growing investment in football infrastructure and performance technologies around the world.

Key Market Insights

- Football apparel dominates the product landscape, supported by global fandom, replica jersey sales, and year-round kit demand.

- Europe remains the largest football market, benefiting from elite leagues, advanced clubs, and strong merchandise consumption.

- Asia-Pacific is the fastest-growing region, driven by grassroots investments in India, China, Japan, and Southeast Asia.

- North America is experiencing rapid adoption due to MLS expansion, rising youth participation, and growing fan engagement.

- Technology integration, GPS wearables, AI coaching, and smart equipment are transforming training ecosystems across professional clubs and academies.

- Sustainable and recycled football equipment is gaining traction as global brands shift toward environmental compliance and ethical production.

- Media rights and digital merchandising continue to be major revenue generators across leading clubs worldwide.

What are the latest trends in the football market?

Digital Transformation & Smart Performance Technologies

Football is undergoing a profound digital shift, with AI-driven analytics, GPS-enabled wearables, VAR systems, and IoT-enhanced stadium infrastructure becoming mainstream across professional leagues. Smart footballs and connected training systems enable clubs to monitor player performance, optimise training loads, and minimise injury risks. Digital fan engagement, through VR match experiences, mobile apps, fantasy leagues, and club-specific e-commerce platforms, is widening revenue opportunities. As consumer expectations evolve, football brands increasingly integrate augmented reality (AR) for kit previews, personalised merchandise, and immersive pre-match experiences. This technological evolution is reshaping football from a traditional sport into a technology-enhanced entertainment ecosystem.

Sustainable Football Equipment & Eco-Friendly Infrastructure

A growing shift toward environmentally conscious sports equipment is prominent across the global football industry. Brands are introducing biodegradable footballs, recycled polyester kits, and carbon-neutral production processes in response to consumer demand and regulatory expectations. Stadiums across Europe, the Middle East, and Asia are adopting LED lighting, solar energy, and sustainable turf systems to reduce environmental footprints. Clubs and federations are increasingly committed to net-zero initiatives, pledging to reduce waste, promote circular economy models, and integrate sustainability milestones into commercial contracts. These innovations not only appeal to eco-conscious consumers but also help clubs comply with emerging global environmental standards.

What are the key drivers in the football market?

Commercial Expansion of Global Football Leagues

Top-tier leagues such as the English Premier League, La Liga, and Bundesliga continue to secure multi-billion-dollar broadcasting deals that amplify global fan engagement. The commercialisation of broadcasting rights, growing sponsorship deals, and club-led digital merchandising initiatives have significantly boosted market growth. With football becoming an entertainment powerhouse, clubs invest heavily in facilities, academies, and technology, thus increasing demand for equipment, apparel, boots, and infrastructure solutions.

Growing Youth Participation & Government Sports Development Initiatives

Governments across Asia, Africa, Europe, and Latin America are investing in school-level football programs, infrastructure development, and national academies to boost youth participation. Countries like India, China, Saudi Arabia, and Qatar are implementing long-term football development frameworks. These initiatives drive the sales of training equipment, balls, apparel, and turf systems. As football becomes more accessible at the grassroots level, the market experiences sustained growth across multiple product segments.

What are the restraints for the global market?

High Infrastructure & Technology Deployment Costs

Advanced football systems, such as VAR, smart tracking wearables, and artificial turf, require significant investment. Amateur clubs, schools, and small training centres often struggle to adopt these technologies due to cost barriers. Moreover, stadium modernisation projects involve high capital expenditure, slow adoption in cost-sensitive markets and limiting the penetration of advanced football technologies.

Counterfeit Football Equipment Impacting Brand Revenues

In developing markets across Asia and Africa, counterfeiting remains a significant concern. Fake football boots, replica kits, and low-quality balls distort pricing and erode brand trust. Despite increasing regulatory scrutiny, counterfeit products continue to hinder the revenue potential of major brands. Rising online marketplaces exacerbate the issue, creating challenges for premium product manufacturers in maintaining quality control and pricing discipline.

What are the key opportunities in the football industry?

Emerging Demand Across Asia-Pacific & Middle East

Football markets in India, China, Indonesia, Saudi Arabia, and the UAE are expanding rapidly due to national sports initiatives, investments in youth academies, and upgrades to stadium infrastructure. The Middle East is aggressively building its football portfolio through league enhancements, international player acquisitions, and multi-billion-dollar facility investments. Brands that localise manufacturing, partner with clubs, and create region-specific merchandise can unlock massive commercial opportunities.

Integration of Sustainable Football Ecosystems

Eco-friendly footballs, recycled polyester kits, and sustainable turf systems are gaining strong commercial momentum. Clubs and brands that integrate sustainable production processes and adopt circular manufacturing models can secure long-term market differentiation. As fans increasingly prioritise ethical consumption, sustainability-centred supply chains represent a major growth frontier for both global manufacturers and regional suppliers.

Product Type Insights

Football apparel holds the largest share of the global market, contributing approximately 32% of the total 2024 revenue. Replica jerseys, fan merchandise, and professional kits continue to fuel growth across Europe, APAC, and North America. Football boots represent another high-value segment, driven by technological advancements in soleplate design, lightweight materials, and customisation features. Match balls and training balls remain essential consumables, contributing to steady annual demand from schools, academies, and clubs. Smart equipment, such as connected footballs and GPS wearables, is emerging rapidly as professional clubs adopt analytics-driven performance systems.

Application Insights

Individual consumers form the largest application segment, accounting for nearly 38% of market demand, supported by strong e-commerce sales of boots, apparel, training balls, and fan merchandise. Professional clubs and leagues drive significant spending in high-performance equipment, AI-based coaching tools, and stadium technology solutions. Schools and universities represent a fast-growing segment driven by government sports programs and expanding football curricula. Training academies invest heavily in drills, smart equipment, and facility upgrades, while stadium operators focus on lighting, seating, and turf systems.

Distribution Channel Insights

Online retail dominates global football product sales, capturing approximately 41% of market share in 2024. E-commerce platforms allow rapid global kit launches, better customisation, and broader access to premium equipment. Club-owned online stores and D2C brand channels, such as Nike and Adidas, drive high-margin revenue streams. Offline sporting goods stores remain relevant for boots, training equipment, and youth kits, particularly in Europe and APAC. Institutional sales channels serve schools, academies, and professional clubs requiring bulk equipment and specialised gear.

End-User Insights

Professional clubs and leagues represent high-value buyers, investing in stadium modernisation, training systems, and coaching technologies. Schools and universities are the fastest-growing end-user segment, expanding at a projected 8% CAGR through 2030. Individual consumers remain the largest revenue contributors across apparel and footwear. Sports academies show rising demand for infrastructure solutions and smart equipment as emerging markets scale their football development programs.

| By Product Type | By Application / End User | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds approximately 14% of the global football market share in 2024. Demand is driven by MLS expansion, strong youth participation, and widespread consumption of club merchandise. The U.S. leads regional growth with rising investments in training facilities, stadium upgrades, and analytics-driven coaching technologies. Canada also contributes a notable demand across apparel, turf systems, and grassroots football initiatives.

Europe

Europe remains the largest and most mature football market, accounting for around 37% of global revenue. Demand is led by the U.K., Germany, France, Italy, and Spain, supported by elite leagues, advanced clubs, and strong merchandise sales. Europe also leads the adoption of VAR systems, eco-friendly stadium infrastructure, and high-end performance technologies.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a forecast CAGR of 8.5%. Demand is driven by India’s ISL expansion, China’s large-scale football infrastructure program, and strong participation in Japan and South Korea. Growing middle-class income and digital consumption of football content are fueling e-commerce sales of kits, boots, and accessories. Southeast Asian markets such as Indonesia and Vietnam are emerging as notable demand centres.

Latin America

Latin America, home to some of the world’s most passionate football cultures, contributes about 12% of global market share. Brazil leads regional demand, driven by strong domestic leagues, widespread consumer interest, and large-scale grassroots football. Argentina, Chile, and Colombia also generate steady demand for apparel, boots, and training equipment.

Middle East & Africa

The Middle East and Africa region is rapidly transforming due to Saudi Arabia's and Qatar’s sports investments. Africa remains a core football consumption market with high grassroots participation in Nigeria, South Africa, Morocco, and Egypt. The Middle East continues to rise as a football hub through stadium development, league expansion, and large-scale investment in player development and youth academies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Football Market

- Nike Inc.

- Adidas AG

- Puma SE

- Decathlon

- Under Armour

- Mizuno Corporation

- New Balance

- Umbro

- Lotto Sport Italia

- Joma Sport

- Asics Corporation

- Li-Ning

- Diadora

- Select Sport

- Molten Corporation

Recent Developments

- In March 2025, Nike expanded its smart football technology program, introducing advanced wearable tracking sensors for elite training environments.

- In January 2025, Adidas launched a new sustainable kit line made entirely from ocean-recycled plastics across select European clubs.

- In April 2025, Puma announced a partnership with leading football academies in Asia to supply advanced performance equipment and AI-driven training systems.