Facial Care Appliances Market Size

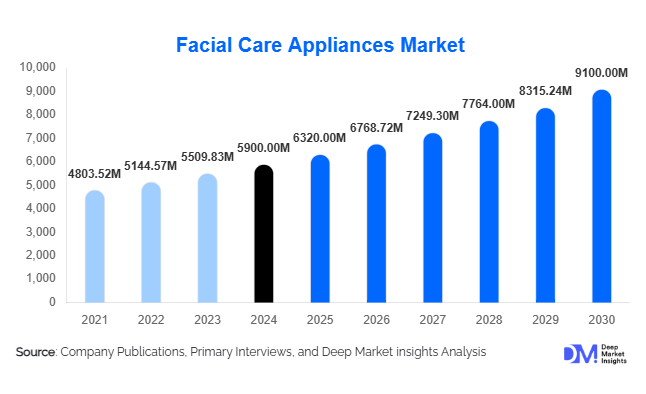

According to Deep Market Deep Market Insights, the global facial care appliances market size was valued at USD 5,900 million in 2024 and is projected to grow from USD 6,320 million in 2025 to reach USD 9,100 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer awareness of skincare routines, rising adoption of advanced at-home facial devices, and the popularity of multifunctional appliances that combine cleansing, anti-aging, and skin rejuvenation features.

Key Market Insights

- Home-use facial appliances are leading demand, reflecting the growing trend of DIY skincare and convenience-oriented beauty routines.

- Technological innovation is a key driver, with devices integrating LED therapy, microcurrent, RF technology, and AI-enabled mobile apps gaining popularity among tech-savvy consumers.

- Online retail dominates distribution, allowing wider accessibility and convenience, particularly in North America and Europe.

- Mid-priced devices (USD 50–200) are the largest market segment, balancing affordability with advanced features.

- APAC is the fastest-growing region, led by China, India, and Japan, due to rising disposable income and increasing beauty awareness.

- Premiumization trends are driving revenue growth in high-end facial appliances, offering higher profit margins and enhanced functionality.

Latest Market Trends

Technologically Advanced Facial Devices

Consumers are increasingly seeking devices that offer multiple skincare benefits in a single appliance. Sonic cleansing brushes, LED therapy masks, and microcurrent facial toners are gaining traction for their ability to address acne, wrinkles, and skin rejuvenation at home. Smart devices equipped with AI-based skin analysis and app integration allow personalized skincare routines, enhancing consumer engagement and driving repeat purchases. Wireless, portable, and rechargeable features further boost adoption, particularly among younger demographics.

Online & E-Commerce Dominance

E-commerce platforms have revolutionized the way consumers purchase facial care appliances. Direct-to-consumer brand websites, marketplaces, and social media-driven sales are expanding market reach. Consumers can compare products, read reviews, and access real-time discounts, which accelerates the adoption of both mid-range and premium appliances. Brands are increasingly leveraging influencer marketing and tutorial content to educate users about device benefits and safety, driving higher conversion rates online.

Facial Care Appliances Market Drivers

Rising Skincare Awareness

Global consumers are increasingly aware of skin health and preventive skincare, prompting widespread adoption of at-home facial appliances. Millennials and Gen Z are particularly driving the trend for daily skin cleansing, anti-aging, and acne-prevention routines. The desire to reduce salon visits due to convenience, cost, and ongoing global health concerns further strengthens demand.

Innovation in Multi-Functional Devices

Manufacturers are focusing on combining multiple functionalities such as cleansing, massaging, and anti-aging into a single device. Integration of LED, RF, and ultrasonic technology, along with smart app-based customization, appeals to tech-savvy consumers seeking comprehensive skincare solutions at home. These innovations enhance perceived value and support premium pricing strategies.

Market Restraints

High Cost of Advanced Devices

Premium devices such as microcurrent facial toners and RF-based appliances have higher price points, limiting accessibility in price-sensitive regions. While mid-priced devices are widely adopted, the high-end segment faces slower penetration, particularly in emerging markets.

Safety & Skin Sensitivity Concerns

Improper use of facial appliances can result in skin irritation or damage. Consumer caution and lack of standardized usage guidelines can restrict adoption, while regulatory standards for certain technologies, including IPL and RF, create compliance challenges for manufacturers.

Facial Care Appliances Market Opportunities

Smart & Connected Skincare Devices

Integration of AI, IoT, and mobile apps in facial appliances represents a major growth opportunity. Devices that track skin health, recommend personalized routines, or connect to subscription-based skincare products provide recurring revenue streams and strengthen brand loyalty. Smart features also appeal to tech-savvy millennials and Gen Z users, creating a differentiated market position for innovators.

Emerging Market Expansion

Rising urbanization, disposable income, and awareness in APAC, Latin America, and the Middle East offer significant growth potential. Countries such as China, India, Brazil, and the UAE are witnessing increasing adoption of home-use facial appliances. Companies that localize product offerings, optimize pricing, and leverage e-commerce channels can tap into these fast-growing markets effectively.

Product Type Insights

Facial cleansing devices dominate the market, capturing 28% of global revenue in 2024. Their popularity is primarily driven by the growing consumer preference for deep cleansing and exfoliation for healthier, radiant skin. Sonic and rotating brush devices are particularly favored in North America and Europe, supported by online tutorials, influencer recommendations, and increased awareness of daily skincare routines. Anti-aging devices are another leading segment, fueled by the rising global aging population and growing demand for non-invasive, at-home treatments that reduce wrinkles and improve skin elasticity. Hair removal devices are seeing steady growth due to the desire for long-term hair removal solutions and the convenience of at-home use. Skin treatment devices, including acne and pigmentation treatment tools, are gaining popularity as consumers increasingly seek solutions for common skin conditions. Lastly, massage and relaxation devices are benefiting from rising stress levels and the growing wellness and self-care trend, with users seeking relaxation and rejuvenation at home.

Technology Insights

LED and IPL technologies lead globally with a 25% market share. Their growth is driven by professional endorsements and proven efficacy in anti-aging and skin rejuvenation. Microcurrent and RF devices are expanding in premium segments due to their multi-functional benefits, particularly in APAC and North America, where consumers increasingly prefer advanced, multifunctional facial care solutions that combine cleansing, toning, and anti-aging functions in one device.

Distribution Channel Insights

Online retail accounts for 32% of market revenue, benefiting from convenience, real-time reviews, home delivery, and the ability to compare multiple products. Social media marketing and influencer-led campaigns further accelerate adoption. Offline channels, including specialty beauty stores, salons, spas, and electronics retail outlets, remain significant for professional-grade and high-end devices, especially in Europe and North America, where consumers often prefer hands-on demonstrations before purchase.

End-Use Insights

Home/personal use dominates with 65% market share, reflecting the global trend toward DIY skincare and convenience. The professional segment, including salons, spas, and wellness centers, is steadily expanding due to increasing demand for premium and multi-functional appliances. Emerging applications in medical aesthetics clinics, dermatology centers, and luxury hotels are also diversifying demand, supporting domestic consumption and export-driven growth. The expansion of professional end-use is further supported by increased awareness of non-invasive facial treatments and preventive skincare solutions.

| By Product Type | By Technology | By Distribution Channel | By Price Range | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 30% of the global market, led by the U.S. and Canada. Growth is primarily driven by high disposable income, strong personal grooming and wellness awareness, and tech-savvy consumers. The popularity of premium and smart devices is increasing due to widespread e-commerce penetration, the adoption of multifunctional facial appliances, and influencer-led awareness campaigns. Consumers in this region are also more inclined toward anti-aging and professional-grade devices, which supports high-margin sales in both home-use and professional segments.

Europe

Europe accounts for 28% of the market, with Germany, the UK, and France leading adoption. Growth is fueled by rising demand for anti-aging solutions and the strong presence of established beauty brands offering innovative products. Consumers prefer mid- to high-end devices, and the multi-functional nature of appliances enhances adoption. Both e-commerce and offline specialty stores play a crucial role in the distribution of premium and professional devices, with digital marketing campaigns and beauty influencer promotions driving awareness and purchase decisions.

Asia-Pacific

APAC is the fastest-growing region. Rapid urbanization, increasing disposable income, and a growing middle-class population are key drivers of market expansion. Countries like China, India, and Japan are witnessing increased adoption of mid-priced and smart facial appliances, supported by a rising interest in home-based skincare, technology-enabled personal care devices, and influencer-led social media marketing. The demand for anti-aging and multifunctional devices is particularly high among urban populations seeking convenient and affordable at-home solutions.

Latin America

Brazil, Argentina, and Mexico are gradually increasing the adoption of facial care appliances. Market growth is driven by rising urban middle-class populations, increasing exposure to digital marketing, and the growing preference for home-use beauty and wellness solutions. While penetration is moderate, the adoption of mid-priced devices and at-home multifunctional appliances is creating opportunities for new entrants and existing players.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa are leading markets, driven by high-income urban populations, luxury consumption trends, and increasing awareness of wellness and self-care routines. Growth is further supported by e-commerce expansion, adoption of premium and professional-grade devices, and rising demand for multifunctional appliances that combine cleansing, anti-aging, and massage benefits. In Africa, regional adoption is gradually increasing due to urbanization and rising beauty consciousness among younger demographics.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Facial Care Appliances Market

- Philips

- Panasonic

- Braun (P&G)

- Revlon

- Foreo

- Nu Skin

- LG Electronics

- Conair

- Beurer

- Xiaomi

- Cosbeauty

- Rowenta

- Remington

- MTG Co. Ltd

- Panasonic Beauty

Recent Developments

- In June 2025, Philips launched an AI-enabled facial cleansing device with app integration and skin health tracking features.

- In May 2025, Foreo introduced a new premium LED mask with customizable treatment modes for anti-aging and acne treatment.

- In March 2025, Panasonic expanded its facial appliance portfolio in APAC, targeting mid-priced smart devices with enhanced cleansing and massage functions.