Fabric Freshener Market Size

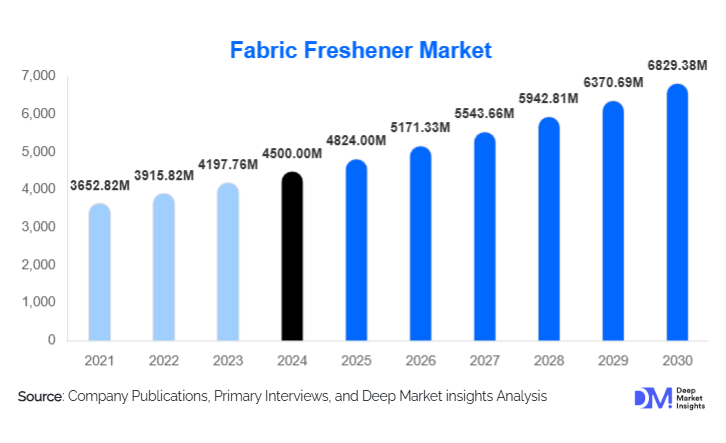

According to Deep Market Insights, the global Fabric Freshener Market size was valued at USD 4,500 million in 2024 and is projected to grow from USD 4,824 million in 2025 to reach USD 6,829.38 million by 2030, expanding at a CAGR of 7.20% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer emphasis on home hygiene, convenience-oriented lifestyle products, and innovation in premium and eco-friendly fragrance formulations. Increasing urbanization, growth of e-commerce distribution, and expanding applications in residential and hospitality sectors are further accelerating demand worldwide.

Key Market Insights

- Perfumed fabric fresheners dominate the market, accounting for nearly 55% of global revenue in 2024, supported by consumer preference for lasting fragrance and premium scent profiles.

- Asia-Pacific is the fastest-growing region, projected to expand at over 7% CAGR, driven by urban population growth, rising disposable incomes, and modern retail penetration.

- Household use leads end-user demand with approximately 39% share in 2024, reflecting strong adoption across residential apartments and family homes.

- Online retail channels are witnessing double-digit growth as digital shopping and direct-to-consumer brands reshape the competitive landscape.

- Eco-friendly and low-VOC formulations are rapidly gaining acceptance, driven by regulatory standards and sustainability-conscious consumers.

- Technological integration in fragrances, including micro-encapsulation and long-release aroma systems, is improving product performance and customer satisfaction.

What are the latest trends in the fabric freshener market?

Premiumization and Multi-Functional Product Innovation

Leading brands are moving beyond simple odor-masking to create multi-functional products that combine fragrance enhancement, fabric care, and anti-bacterial performance. Premium formulations are being infused with essential oils, allergen-reducing agents, and long-lasting scent capsules. The emergence of region-specific scents, such as floral for Europe, citrus for North America, and oriental for Asia, is strengthening local brand identity and driving consumer loyalty. This premiumization trend is also boosting margins for manufacturers and reshaping retail assortments in both online and offline channels.

Eco-Conscious and Sustainable Product Development

The shift toward eco-friendly, biodegradable, and low-VOC formulations has become a defining market trend. Consumers increasingly seek products that are safe for fabrics, health, and the environment. Major manufacturers are investing in plant-based solvents, natural fragrances, and recyclable packaging. Brands introducing “green-certified” or “sustainably sourced” variants are witnessing higher acceptance among younger demographics. This sustainability drive not only aligns with regulatory compliance in regions such as the EU but also enhances brand trust globally.

What are the key drivers in the fabric freshener market?

Urbanization and Changing Household Lifestyles

Rapid urbanization has resulted in smaller living spaces and limited ventilation, leading to increased fabric odor issues in homes. Time-constrained consumers are turning toward instant solutions like fabric fresheners that deliver quick, effective odor control without traditional laundering. This behavioral shift is a core growth driver, especially in densely populated urban centers across Asia and Europe.

Rising Focus on Hygiene and Indoor Air Quality

Post-pandemic hygiene awareness has elevated the importance of maintaining clean and pleasant-smelling indoor environments. Consumers are incorporating fabric fresheners as a routine household essential for upholstered furniture, curtains, and clothing. This growing association between fabric care and personal well-being is expanding both penetration and consumption frequency, supporting market growth.

Expansion of E-Commerce and Omni-Channel Retail

The proliferation of e-commerce and direct-to-consumer (D2C) models has transformed product accessibility and brand reach. Online platforms offer consumers the convenience of discovering niche and premium brands, personalized fragrances, and subscription models. Omni-channel strategies, combining physical retail exposure with digital fulfillment, are enabling established players to sustain growth and compete with emerging local entrants.

What are the restraints for the global fabric freshener market?

Raw Material Price Volatility

Dependence on petrochemical-based solvents, fragrance oils, and propellants exposes manufacturers to fluctuations in raw material costs. Supply chain disruptions and energy price variations can significantly affect production economics, forcing companies to either absorb higher costs or raise consumer prices, both of which can constrain profitability.

Regulatory Constraints and Environmental Concerns

Tighter regulations governing aerosol emissions, volatile organic compounds (VOCs), and chemical ingredients, especially in North America and Europe, pose compliance challenges. The transition toward greener, low-impact formulations often requires investment in reformulation and testing, increasing operational costs. Consumer skepticism about synthetic chemicals also pressures companies to enhance transparency in ingredient disclosure.

What are the key opportunities in the fabric freshener industry?

Emerging Market Expansion

Rising disposable incomes, urban housing growth, and increasing home-care awareness in Asia-Pacific, Latin America, and the Middle East present lucrative opportunities. Local production facilities, regional fragrance customization, and partnerships with e-commerce platforms are helping companies tap underserved markets and build localized value chains.

Technological Integration and Smart Fragrance Delivery

Advances in micro-encapsulation, sustained-release technologies, and “smart scent” systems are enabling longer-lasting and more efficient fragrance diffusion. Innovations such as sensor-activated dispensers and IoT-connected air and fabric care devices are emerging in premium segments, offering new product experiences and upselling opportunities.

Sustainability-Driven Product Differentiation

As consumers increasingly prefer eco-conscious products, brands that prioritize natural ingredients, refillable packaging, and carbon-neutral manufacturing can build long-term loyalty. Integrating sustainability certifications and clean-label positioning is expected to create new growth pathways and pricing power within premium categories.

Product Type Insights

Perfumed fabric fresheners lead the global market with approximately 55% share in 2024, valued at around USD 2.46 billion. These products dominate due to strong consumer demand for aroma-rich, long-lasting freshness. The segment benefits from continuous fragrance innovation and premium line extensions. In contrast, regular or unscented variants cater mainly to sensitive-skin consumers but represent a smaller share of the market.

End-Use Insights

The household segment accounted for roughly 39% of market revenue in 2024, valued at USD 1.75 billion. Rising awareness of home hygiene, increased fabric usage in interior décor, and the popularity of easy-to-use sprays have bolstered this segment. The hospitality sector, including hotels and resorts, is an emerging high-value application area, with growing adoption of premium and bulk-use fabric fresheners for linen and upholstery maintenance. Additionally, niche end uses in automotive interiors and office spaces are contributing incremental demand.

Distribution Channel Insights

Supermarkets and hypermarkets currently dominate distribution, but online retail is the fastest-growing channel, expected to post a double-digit CAGR during 2025–2030. Digital sales are expanding through brand-owned websites, marketplaces, and social media-driven promotions. Subscription models and customizable fragrance bundles are redefining consumer engagement, while traditional retail maintains its relevance in emerging markets through in-store promotions and bundling with home-care products.

| By Product Type | By Fragrance Type | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents approximately 33% of the global market (USD 1.5 billion in 2024), driven by strong consumer purchasing power and established brand presence. The U.S. dominates regional consumption, with continued demand for premium fragrance blends and eco-labeled products. E-commerce penetration and product innovation are maintaining steady growth across this mature market.

Europe

Europe accounts for about 23% of the global market share (USD 1.0 billion). Western European markets such as Germany, the U.K., and France are highly regulated and environmentally conscious, creating strong momentum for low-VOC and recyclable packaging solutions. Consumers prefer subtle fragrances and allergen-free variants, aligning with health and sustainability trends.

Asia-Pacific

Asia-Pacific is the fastest-growing region, contributing around 33% of global revenue (USD 1.48 billion in 2024) and projected to grow at a 7–9% CAGR. China leads regional consumption due to its expanding urban middle class, while India shows exceptional growth potential through increased online retail activity. Rising household incomes, apartment living, and lifestyle upgrades continue to boost product adoption.

Latin America

Latin America holds about 6% share (USD 270 million in 2024), led by Brazil and Argentina. Demand is growing for affordable, fragrance-rich sprays distributed through supermarkets and local convenience chains. Economic fluctuations pose minor challenges, but gradual e-commerce adoption supports market expansion.

Middle East & Africa

MEA contributes around 5% of global demand (USD 225 million in 2024), with growth driven by hospitality expansion, urban housing projects, and increasing awareness of fabric hygiene. GCC countries, particularly the UAE and Saudi Arabia, exhibit strong demand for luxury fragrance-based fabric fresheners, reflecting high-income consumer preferences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fabric Freshener Market

- Procter & Gamble Co.

- Henkel AG & Co. KGaA

- Reckitt Benckiser Group plc

- Godrej Consumer Products Ltd.

- SC Johnson & Son, Inc.

- Kao Corporation

- Clean Control Corporation

- Grow Fragrance Inc.

- Deb Group Ltd.

- Wipro Enterprises Pvt Ltd.

- Church & Dwight Co., Inc.

- Unilever PLC

- Pigeon Corporation

- The Clorox Company

- Colgate-Palmolive Company

Recent Developments

- In June 2025, Procter & Gamble introduced a new “Febreze Naturals” line, formulated with plant-based ingredients and recyclable packaging, strengthening its sustainability positioning.

- In April 2025, Henkel launched smart aerosol technology with micro-encapsulated scent beads for controlled fragrance release, extending freshness duration by 30% compared to conventional sprays.

- In February 2025, Reckitt Benckiser announced an investment in a new manufacturing facility in India under the “Make in India” initiative, aimed at meeting rising regional demand and optimizing supply chains.