Experience Gift Market Size

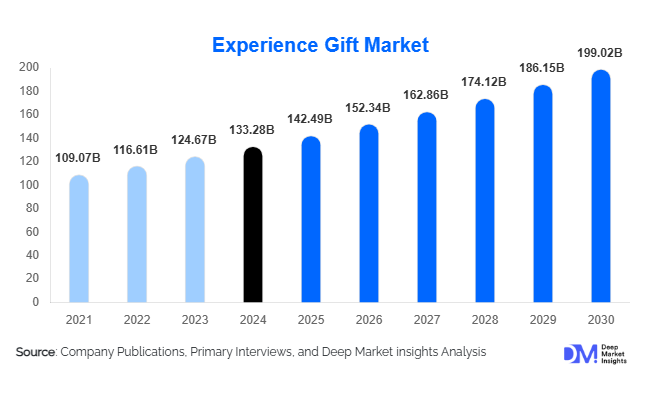

According to Deep Market Insights, the global experience gift market size was valued at USD 133.28 billion in 2024 and is projected to grow from USD 142.49 billion in 2025 to reach USD 199.02 billion by 2030, expanding at a CAGR of 6.91% during the forecast period (2025–2030). Market growth is being accelerated by the shift toward experience-driven gifting, rapid digitalization of booking platforms, and strong demand across wellness, travel, adventure, and culinary categories. Rising consumer preference for meaningful, memory-based gifting, particularly among Millennials and Gen Z, combined with increased adoption of experience-based incentives in the corporate sector, is further reshaping global gifting trends.

Key Market Insights

- Consumers worldwide are increasingly favoring experiential gifts over traditional physical products, driven by wellness trends, emotional value, and the desire for memorable celebrations.

- Digital platforms and mobile-first booking ecosystems dominate the market, enabling seamless gift card purchases, instant delivery, and personalized recommendations.

- Spa & wellness experiences remain the most in-demand category globally, capturing a strong share due to rising self-care and lifestyle spending.

- Corporate gifting is becoming a major growth engine, with organizations adopting experience-based rewards for employee engagement and client relations.

- Asia-Pacific is the fastest-growing region, driven by young populations, rising disposable incomes, and digital adoption in India, China, and Southeast Asia.

- Experience marketplaces are integrating AI, AR/VR previews, and dynamic personalization, transforming how consumers discover and book experience gifts.

What are the latest trends in the experience gift market?

Personalized & AI-Enhanced Experience Gifting

Personalization has become a defining trend, with platforms increasingly using AI-driven algorithms to recommend tailored experiences based on user behavior, demographic profiles, and past gifting patterns. Consumers are seeking thoughtful, customized gifts such as curated wellness packages, bespoke adventure itineraries, and unique culinary activities. AI-enabled curation engines now match recipients with highly relevant experiences, improving purchase satisfaction and conversion rates. This evolution is reshaping the gifting journey from discovery to redemption by creating emotionally resonant options that go far beyond generic vouchers.

Rise of Wellness, Mindfulness & Self-Care Experiences

Wellness-oriented experiences are experiencing accelerated adoption across global markets. From luxury spa retreats and mindfulness workshops to wellness weekends, sound healing sessions, and detox programs, self-care–driven gifting is becoming a mainstream trend. The post-pandemic emphasis on mental health, stress reduction, and work-life balance has further fueled demand. Many platforms now highlight wellness bundles, couple-spa experiences, and restorative getaways as high-value gifting categories. This trend is particularly strong among urban professionals and younger consumers seeking “experience over ownership.”

Digital Gift Experiences & Instant Delivery Ecosystems

With the rise of e-commerce and mobile-first buying habits, digital vouchers, instant delivery gift cards, and app-based redemption systems are becoming standard. Experienced gift companies are integrating virtual previews, AR-enhanced experience exploration, and one-tap gifting features for birthdays, anniversaries, and last-minute celebrations. Digital gift cards for dining, local adventure activities, or hotel stays now dominate seasonal sales events such as Christmas, Valentine’s Day, and festivals, enabling global gifting across borders. This digital transformation significantly increases accessibility and scalability.

What are the key drivers in the experience gift market?

Growing Shift Toward Experiences Over Physical Goods

Consumers globally are reprioritizing how they spend discretionary income, with experiences increasingly preferred over traditional material gifts. This shift is rooted in emotional value, rising wellness consciousness, and the desire for unique social-media-friendly memories. Millennials and Gen Z are leading this behavioral change, with surveys consistently showing their preference for travel, adventure, dining, and wellness experiences over products. This widespread cultural movement is the single largest driver of long-term market expansion.

Rapid Digitalization & On-Demand Booking Platforms

The proliferation of digital experience marketplaces, mobile apps, and instant voucher delivery systems has made experience gifting easier, faster, and more convenient. Consumers can now browse curated experiences, check availability, personalize gift messages, and send e-vouchers instantly. Enhanced user experience (UX), secure payment systems, AI-based recommendations, and customer reviews are boosting platform adoption. As digital adoption deepens globally, online channels are expected to dominate over 70% of experience gift bookings by 2030.

Corporate Adoption of Experience-Based Incentives

Companies are rapidly replacing conventional corporate gifts with experience vouchers to improve employee morale, retention, and client engagement. Experiences deliver higher emotional value, better recall, and stronger brand associations than merchandise-based gifts. Corporate demand spans spa retreats, culinary workshops, adventure outings, hotel stays, and professional development experiences. The rise of remote and hybrid workplaces has further accelerated the adoption of experiences that enhance team bonding or reward performance, making the corporate segment one of the fastest-expanding channels.

What are the restraints for the global market?

Economic Sensitivity & Price Constraints

Experience gifts, especially travel, adventure, or luxury wellness offerings, often involve higher price points than traditional gifts. During periods of inflation, recession, or reduced disposable income, consumers may delay or downshift experience purchases. Seasonal pricing surges in travel, hospitality, and adventure segments can further discourage budget-conscious buyers. These financial uncertainties remain the primary barrier to mass-market penetration.

Operational Complexity & Service Delivery Risks

The experience gift ecosystem relies heavily on third-party service providers such as hotels, adventure operators, restaurants, and event organizers. Variability in service quality, regional regulatory requirements, weather conditions, and safety compliance can create fulfillment challenges. Cross-border experiences introduce additional complexities related to visas, travel restrictions, and liability. Ensuring uniform service quality across diverse geographies remains a critical operational restraint.

What are the key opportunities in the experience gift industry?

Corporate Experience Gifting & Employee Reward Ecosystems

One of the most promising opportunities lies in expanding corporate engagement. Companies are increasingly allocating budgets to experiences that promote employee well-being, recognition, and loyalty. Tailored corporate gift platforms that integrate HR dashboards, bulk redemption options, and branded experiences represent a major growth frontier. Enterprises seeking meaningful ways to reward talent and enhance workplace culture will significantly boost B2B adoption.

Emerging Market Expansion in APAC & LATAM

Rising incomes and rapid urbanization in Asia-Pacific, Latin America, and the Middle East present a high-growth opportunity. Younger populations in India, China, Indonesia, Brazil, and Mexico are adopting lifestyle spending behaviors similar to Western markets, creating demand for spa, travel, dining, and adventure experiences. Localizing offerings, partnering with regional hospitality providers, and cultural tailoring will help global players penetrate these high-potential markets. APAC is expected to post the fastest CAGR through 2030.

Personalized, Hybrid & Niche Experience Verticals

There is a rising demand for unique formats such as culinary masterclasses, artisan workshops, immersive cultural tours, romantic weekend getaways, pet-friendly experiences, and wellness retreats. Hybrid experience bundles combining adventure with wellness, travel with gourmet dining, or spa treatments with mindfulness sessions offer strong differentiation. Platforms that innovate with niche, personalized experiences will capture premium users and boost repeat purchases.

Product Type Insights

Spa & Wellness experiences lead the market, accounting for approximately 20–25% of global demand. They appeal to a broad demographic and align with trends in self-care, stress management, and holistic well-being. Adventure & Outdoor experiences remain popular among young travelers seeking thrill-based activities. Culinary experiences such as fine dining and cooking workshops are growing rapidly, particularly in urban markets. Travel & getaway experiences capture a significant premium segment due to higher pricing and season-driven demand. Emerging niches such as creative workshops, cultural immersion activities, and hybrid wellness-adventure packages are expanding the experiential ecosystem.

Application Insights

Couple-oriented experiences dominate applications, representing a large share driven by anniversaries, date nights, Valentine’s Day, and romantic travel packages. Family experiences, including weekend getaways, amusement park passes, and learning workshops, are rising in popularity among middle-income households. Self-gifting, where individuals buy experiences for personal milestones, is quickly becoming a mainstream segment, fueled by wellness and lifestyle trends. Corporate gifting applications are expanding due to employee engagement programs, team-building events, and client appreciation, positioning B2B as a strategic growth avenue.

Distribution Channel Insights

Online platforms dominate global distribution, accounting for more than half of bookings due to convenience, real-time availability, digital gift cards, and personalized recommendations. OTA-style experience marketplaces and D2C websites are increasingly preferred for instant gifting needs. Specialist agencies continue to support high-end, customized experiences, particularly in the travel and luxury segments. Direct bookings through hotels, adventure parks, and spa chains are rising as providers enhance digital capabilities. Subscription-based experience clubs and curated membership programs are emerging as new channels for repeat buyers.

Traveler / Gifter Type Insights

Couples are the largest gifting demographic, driving high-value purchases in wellness, travel, dining, and romantic activities. Group gifting is prominent for birthdays, celebrations, and milestone events that involve shared experiences. Solo consumers increasingly purchase self-care and personal adventure experiences, especially among Gen Z and Millennials. Family gifters contribute steadily through seasonal purchases and holiday gifting cycles. Corporate buyers represent a distinct high-volume segment characterized by bulk purchases and recurring demand.

Age Group Insights

Adults aged 31–50 years account for the largest share, supported by higher disposable income, family-oriented gifting, and lifestyle-driven spending. Younger consumers aged 18–30 are the fastest-growing demographic, favoring adventure, wellness, and digital-first gifting. Mature consumers aged 51–65 increasingly prefer premium wellness retreats, cultural experiences, and slow-travel packages. The 65+ demographic forms a niche but high-value group for luxury, accessible, and comfort-focused experiences.

| By Experience Type | By Gifting / Purchasing Channel | By End-Use / Occasion |

|---|---|---|

|

|

|

Regional Insights

North America

North America represents one of the largest regional markets, accounting for approximately 25–30% of global demand in 2024. High disposable income, strong adoption of online gifting platforms, and a cultural preference for wellness, travel, and adventure experiences fuel market growth in the U.S. and Canada. Seasonal gifting peaks around Christmas, Valentine’s Day, and anniversaries, driving substantial sales through digital platforms.

Europe

Europe holds around a 20–25% share, characterized by mature gifting cultures in the U.K., Germany, France, and Scandinavia. European consumers show strong interest in spa, culinary, and boutique travel experiences. Sustainable, wellness-focused, and culturally immersive experiences perform particularly well in this region. Europe is also a major hub for weekend getaways and short-haul experiential travel.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by India, China, Japan, South Korea, and Southeast Asia. Rising middle-class income and urban lifestyles are boosting demand for spa experiences, local travel, gourmet dining, and adventure activities. Digital-native young consumers in India and China are propelling rapid online adoption, contributing to APAC’s double-digit growth trajectory through 2030.

Latin America

Latin America is a smaller but emerging region, led by Brazil, Mexico, Argentina, and Chile. Growing interest in adventure and culinary experiences, along with improving digital payment systems, is supporting steady growth. Middle-class expansion and increased exposure to experiential lifestyles through social media are pushing adoption upward.

Middle East & Africa

MEA represents a developing but high-potential region. The Middle East, including the UAE, Saudi Arabia, and Qatar, demonstrates strong demand for luxury experiences, premium wellness retreats, and travel-related gifting. In Africa, South Africa and Kenya show rising traction through local adventure and cultural experiences. Government investment in tourism infrastructure indirectly benefits experience gift providers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Experience Gift Market

- Virgin Experience Days

- Moonpig Group

- Red Letter Days

- Groupon (Experiences Division)

- Viator (Tripadvisor Experiences)

- Klook

- KKday

- Tinggly

- Buyagift

- Golden Moments

- Experience Oz

- Adrenaline

- Breakaway Experiences

- Gifting Owl

- Dreamdays

Recent Developments

- In January 2025, Klook expanded its experience gifting portfolio by launching AI-personalized experience bundles targeting Millennials and Gen Z consumers.

- In March 2025, Virgin Experience Days introduced a corporate gifting platform offering customizable bulk experience packages for enterprises.

- In April 2025, Tinggly partnered with leading hotel chains to offer multi-destination travel experience gift boxes with flexible redemption options.