Personalized Gifts Market Size

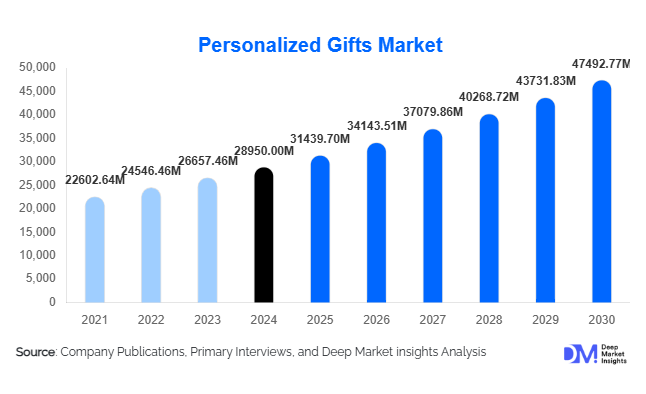

According to Deep Market Insights, the global personalized gifts market size was valued at USD 28,950.00 million in 2024 and is projected to grow from USD 31,439.70 million in 2025 to reach USD 47,492.77 million by 2030, expanding at a CAGR of 8.6% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer preference for customized and meaningful gifting experiences, expansion of e-commerce and direct-to-consumer personalization platforms, and increasing corporate and event-based personalization demand across regions.

Key Market Insights

- Customization and individualization of gifts are becoming a mainstream expectation, with consumers increasingly opting for items engraved, monogrammed, or printed to reflect personal stories and emotions rather than generic gifts.

- Online channels dominate the purchase of personalized gifts, enabled by design tools, print-on-demand manufacturing, and efficient fulfillment logistics, making personalization accessible at scale.

- Corporate and event gifting is emerging as a major adoption driver, as businesses leverage custom-branded and personalized merchandise for client engagement, employee recognition, and event souvenirs.

- North America holds the largest share of the global personalized gifts market, supported by high disposable incomes, a mature e-commerce infrastructure, and a strong gifting culture.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class incomes, accelerating digital adoption, and increasing preference for personalized gifting across festivals, weddings, and life events.

- Technological integration, such as augmented-reality previews, laser engraving, 3D printing, and eco-materials, is reshaping consumer experience and manufacturing efficiency in the personalized gifts market.

Latest Market Trends

Sustainability and Eco-Friendly Personalized Gifting

Consumers are increasingly seeking personalized gifts that not only reflect individuality but also align with the values of sustainability and ethical production. Businesses and brands in the personalized gifts space are responding by offering eco-friendly materials (recycled metals, organic fabrics), minimal or biodegradable packaging, and artisan/hand-craft supply chains. This shift not only enhances brand perception but also allows differentiation in a crowded market. Personalization providers are also integrating certifications for sustainable sourcing, offering customizable gift items with lower environmental impact and packaging tailored to reduce waste.

Technology-Enabled Personalization Platforms

Advances in design and manufacturing technologies are enabling more seamless and interactive personalization experiences. Customers can now use online tools and mobile apps to preview customized items (names, photos, monograms), employ augmented reality (AR) to visualize how the gift will look in real life, and benefit from faster turnaround via print-on-demand, laser-engraving, or 3D printing. On the manufacturing side, personalization suppliers are investing in flexible micro-fulfillment hubs and digital workflows, reducing lead times and the cost of customization. These innovations appeal to younger, digital-native consumers who expect fast, bespoke service.

Personalized Gifts Market Drivers

Rise in Sentiment-Driven and Experience-Oriented Gifting

The modern consumer increasingly values experiences and meaningful connections over mass-produced items. Personalized gifts tap directly into this trend by adding customization, names, dates, or photographs, making the gift integral to the recipient’s identity or memory. This has driven higher willingness to pay for customized items, more frequent gifting for life events, and greater repeat business for personalization providers.

Growth of E-commerce and Direct-to-Consumer Channels

Digital commerce has lowered the barrier for personalized gift ordering. Online platforms allow users to design, preview, and purchase customized items from anywhere, and manufacturers have adopted scalable production technologies and logistics to fulfill personalized orders. This shift has widened geographic reach, enabled cross-border trade, and opened personalization to customers who previously relied on standard retail products.

Technology Advances Enabling Affordable Personalization at Scale

Technologies such as laser-engraving, digital printing, sublimation, 3D printing, and on-demand manufacturing have made personalized goods more cost-effective and scalable. For gift manufacturers and retailers, this means lower inventories, faster custom production, and more diverse product assortments. As a result, personalized gifts are moving from niche to mainstream, broadening market penetration.

Market Restraints

High Lead-Times, Fulfillment Complexity, and Logistics Challenges

Personalized gifts often require custom design approval, special materials, bespoke packaging, and tailored fulfillment, which increases lead times and supply-chain complexity compared to standard goods. Consumers increasingly expect fast delivery, which puts pressure on personalized gift providers. International shipping, customs, returns, and damage risk further raise operational costs, which can constrain margins and scalability.

Seasonality and Occasion-Driven Demand Fluctuations

The personalized gifts market is heavily tied to occasions, holidays, weddings, anniversaries, graduations, and corporate events. This occasion-based demand leads to peaks and troughs in volume, creating challenges around capacity utilization, inventory planning, and cash flow for providers. Off-season slowdowns can hamper smaller firms more severely and limit growth stability.

Personalized Gifts Market Opportunities

Expansion into Emerging-Market Regions

Emerging economies in Asia-Pacific, Latin America, and parts of the Middle East & Africa present significant upside as rising disposable incomes, growing middle classes, and increasing gifting cultural norms converge. Localization of personalization platforms, catering to regional languages, festivals, and customs, offers new entrants and incumbents a major growth engine. Additionally, setting up regional micro-fulfillment hubs can allow faster delivery at lower cost, helping penetrate markets previously underserved.

Growth of Corporate, Event, and B2B Personalized Gifting

Beyond consumer gifting, personalized gifts are increasingly adopted by corporations for client engagement, employee recognition, and event giveaways. This B2B segment often involves larger volumes, repeat orders, and higher value per order. Participants who develop dedicated platforms, bulk fulfillment capabilities, and analytic support for corporate clients can unlock this high-potential space. New entrants can focus on white-label and brand-service models, offering personalization plus logistics and analytics as a package.

Technology and Sustainability as Differentiators

Companies that integrate advanced customization technologies (AR/VR design previews, AI-based design suggestions, print-on-demand, 3D printing) along with sustainable practices (eco-friendly materials, minimal waste packaging, artisan supply chain) can carve out premium market positions. Consumers increasingly reward companies that combine personalization with values, such as ethical sourcing and environmental responsibility. New entrants focusing on “green personalized gifts” or “tech-enabled bespoke gifts” have a strong niche opportunity to drive higher margins.

Product Type Insights

The personalized gifts market is segmented by product type into non-photo personalized gifts, photo-based gifts, edible/consumable personalized items, and corporate or promotional gifts. Among these, non-photo personalized gifts, such as engraved jewelry, monogrammed accessories, and personalized home décor, dominate the global market, accounting for approximately 55% of total revenue in 2024 (USD 16.23 billion). This dominance is attributed to their broader product range, higher perceived value per unit, and stronger emotional appeal compared to photo-based gifts. Consumers increasingly favor items that embody craftsmanship and personal identity rather than simple image printing.

Meanwhile, photo-based gifts, including customized photo books, printed mugs, and canvases, continue to maintain a strong market presence due to their affordability and sentimental value. However, the segment’s growth has stabilized as consumers shift toward premium and non-photo formats. Edible and consumable personalized gifts (e.g., engraved chocolates, custom-labeled beverages) and corporate/promo items (e.g., branded merchandise, employee recognition gifts) are rapidly expanding, supported by demand from corporate clients, digital campaigns, and event personalization. These emerging categories offer lucrative diversification opportunities for manufacturers and retailers seeking new revenue streams.

Overall, the non-photo personalized gift segment’s leadership is sustained by innovation in materials, precision engraving, and premium packaging, while its appeal across both consumer and corporate gifting scenarios cements its position as the market’s growth anchor.

Application Insights

Personal gifting for life events and holidays remains the cornerstone of the personalized gifts market. Birthdays, weddings, anniversaries, and festive celebrations continue to account for a significant share of global revenue. However, corporate and event gifting has emerged as one of the fastest-growing applications, driven by businesses’ rising use of customized gifts for client engagement, employee rewards, conferences, and brand promotions. Corporate buyers favor personalization as a tool for enhancing brand recall and loyalty, fueling steady repeat demand in this segment.

Beyond these traditional applications, digital and tech-accessory personalization, such as custom phone cases, laptop sleeves, and smart-device skins, is gaining momentum among younger demographics. In parallel, experiential gifting bundles that pair physical gifts with experiences (e.g., online classes, virtual workshops, or personalized video messages) are redefining the market’s value proposition. This expanding diversity in applications significantly broadens the market’s addressable base and enhances its year-round relevance.

Distribution Channel Insights

Online platforms dominate the global personalized gifts market, accounting for roughly 60% of total revenue in 2024 (USD 17.7 billion). Growth is propelled by advanced customization tools, intuitive design interfaces, and seamless order fulfillment. The surge in mobile commerce, cross-border shipping, and print-on-demand production has further strengthened online platforms’ reach. Consumers increasingly prefer digital channels for the convenience of previewing designs, comparing prices, and ensuring timely delivery for special occasions.

Nevertheless, offline channels, including boutique gift stores, department stores, and pop-up kiosks, retain importance for luxury and tactile purchases. Customers seeking in-person design consultations or premium finishes often favor physical retail. The industry trend is now shifting toward omnichannel strategies, where consumers design gifts online and either pick them up in-store or receive rapid doorstep delivery. This hybrid model enhances convenience while preserving experiential retail value.

Age Group Insights

While formal segmentation by age is limited, millennials and Gen Z consumers represent the most active demographic, driving the adoption of online personalization tools, shareable designs, and social-media-inspired gift trends. This group favors quick customization, affordable options, and novelty, contributing to high purchase frequency. Meanwhile, older consumers (aged 35–55 years) dominate premium segments, showing a preference for milestone-oriented and high-value personalized items such as keepsake jewelry, luxury pens, and commemorative décor. Companies offering tiered personalization options, from entry-level digital designs to luxury handcrafted products, can effectively engage multiple age demographics and expand market reach.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest regional market, capturing approximately 35% of global revenue in 2024 (USD 10.33 billion). The region’s leadership is anchored by high per-capita gift spending, a mature e-commerce ecosystem, and a deeply ingrained culture of gifting across personal and corporate events. The United States dominates regional performance, supported by advanced personalization technologies such as laser engraving, 3D printing, and AI-driven product customization.

Growth in North America is further propelled by corporate adoption of personalized gifting for marketing and employee engagement, the rise of eco-conscious premium gift lines, and consumer demand for faster, same-day delivery. Additionally, the increasing integration of AR and AI design tools by leading players such as Shutterfly and Etsy enhances user engagement and strengthens regional market resilience.

Europe

Europe accounts for roughly 30% of the global market in 2024 (USD 8.85 billion). Key markets, including the United Kingdom, Germany, France, and Italy, are driven by strong artisanal traditions, premium gifting culture, and regulatory emphasis on sustainability. European consumers display a clear preference for eco-friendly materials, handmade personalization, and luxury-quality presentation, creating demand for mid- to high-end personalized goods.

Europe’s market growth is shaped by the rising popularity of sustainable and ethical gifting practices, government incentives for SME e-commerce expansion, and increased digital adoption among small personalization retailers. Moreover, the surge in cross-border online gifting platforms connecting EU markets has improved fulfillment efficiency and broadened consumer access to personalized options.

Asia-Pacific

Asia-Pacific is the fastest-growing region globally, representing around 20% of the market in 2024 (USD 5.9 billion) and projected to expand at a CAGR of 9–11% through 2030. Countries such as China, India, Japan, South Korea, and Indonesia are leading this surge, backed by rising middle-class incomes, rapid digital adoption, and strong cultural traditions of gifting.

The region’s growth is underpinned by e-commerce expansion across urban and rural areas, festival-driven consumption cycles (e.g., Diwali, Chinese New Year), and localization of personalization platforms offering multi-language, culturally specific designs. Additionally, mobile payment systems and influencer-driven marketing are accelerating online gift purchases, while domestic manufacturers’ investments in print-on-demand and AI-based customization enhance affordability and accessibility.

Latin America

Latin America captures approximately 8% of the global personalized gifts market in 2024 (USD 2.36 billion). Brazil and Mexico lead regional demand, while Colombia, Chile, and Argentina represent emerging pockets of growth. The region’s gifting culture is expanding rapidly, particularly around family celebrations, corporate recognition programs, and digital gifting platforms.

Market expansion is supported by increasing internet penetration, social-media-driven gifting trends, and partnerships between local artisans and online marketplaces. Rising urbanization and growing disposable incomes are fostering online shopping habits, while international personalization brands are entering the region through localized fulfillment centers and regional e-commerce alliances to overcome logistics challenges.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for about 7% of the global market in 2024 (USD 2.07 billion). The Gulf Cooperation Council (GCC) countries, UAE, Saudi Arabia, and Qatar, lead regional performance due to high disposable incomes, a strong culture of corporate gifting, and increasing adoption of luxury and bespoke products. Broader Africa is still in the early stages of personalization adoption but presents long-term potential.

Growth in the MEA market is supported by rising luxury tourism and hospitality gifting demand, expanding corporate and government event gifting programs, and rapid digitalization of retail channels. The UAE, in particular, serves as a logistics and innovation hub for cross-border fulfillment, while African nations such as South Africa and Kenya are seeing growing traction for locally made, culturally themed personalized gifts.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Personalized Gifts Market

- Etsy Inc.

- Shutterfly Inc.

- Cimpress plc (Vistaprint)

- Zazzle Inc.

- Hallmark Cards Inc.

- American Greetings Corporation

- Card Factory plc

- Redbubble Ltd.

- Personalization Mall LLC

- Moonpig Group plc

- Notonthehighstreet Ltd.

- Funky Pigeon Ltd.

- Things Remembered LLC

- IGP.com (India Gifts Portal)

- Other regionally strong D2C personalization brands

Recent Developments

- In 2025, several personalization platforms announced expansions of their micro-fulfillment centers near urban hubs, enabling next-day delivery of custom gifts and boosting same-day turnaround for last-minute gifting occasions.

- In early 2025, companies integrating augmented-reality (AR) design tools launched consumer-facing apps allowing users to preview personalized items (layouts, photos, engravings) in real-world settings, enhancing purchase confidence and reducing returns.

- In mid-2025, a few personalization gift manufacturers announced launches of eco-premium gift lines using recycled materials and minimal packaging, responding to growing consumer demand for sustainable options in the gifting segment.