Emergency Light Stick Market Size

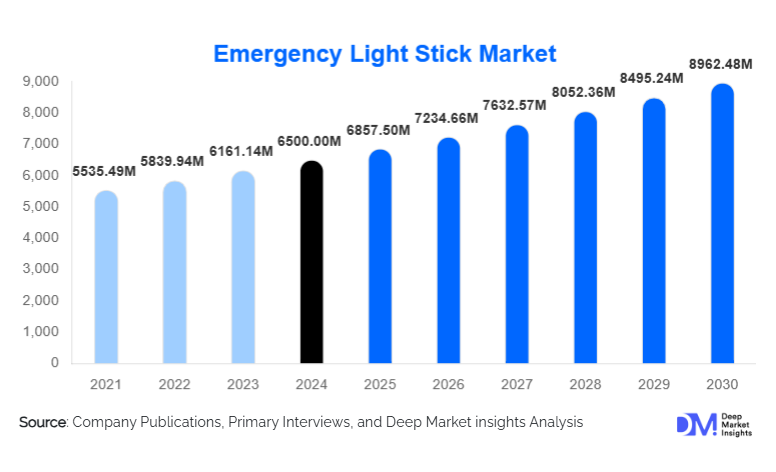

According to Deep Market Insights, the global emergency light stick market size was valued at USD 6,500.00 million in 2024 and is projected to grow from USD 6,857.50 million in 2025 to reach USD 8,962.48 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The emergency light stick market growth is primarily driven by rising disaster-preparedness initiatives, expanding industrial safety requirements, growth in outdoor recreation activities, and increased government procurement for emergency and public-safety programs.

Key Market Insights

- Chemiluminescent emergency light sticks dominate global volume share due to low cost, portability, and widespread adoption in disaster kits and outdoor applications.

- Rechargeable LED-based light sticks are the fastest-growing product category, supported by sustainability concerns and longer operational lifecycles.

- Asia-Pacific leads global demand, driven by rapid industrialization, natural-disaster vulnerability, and rising participation in outdoor activities.

- Government and public-safety agencies represent the largest end-user segment, accounting for increasing bulk procurement volumes.

- E-commerce is reshaping distribution strategies, enabling manufacturers to reach a global consumer base without reliance on traditional retail channels.

- Technological innovation, including rugged LED designs, extended runtimes, waterproof builds, and hybrid chem-luminescent systems, is differentiating product portfolios.

What are the latest trends in the emergency light stick market?

Growing Emphasis on Disaster Preparedness and Public Safety

Governments and humanitarian organizations are increasingly prioritizing disaster readiness following the rising frequency of storms, earthquakes, and extreme-weather events. Emergency light sticks, especially chemiluminescent variants, are being included in national emergency kit standards due to their reliability, low cost, and zero dependence on batteries. NGOs and relief agencies are integrating bulk procurement of light sticks into emergency shelter programs, evacuation kits, and first-responder equipment. This trend is particularly strong in Asia-Pacific, Latin America, and coastal regions prone to natural hazards. As preparedness becomes institutionalized, long-term demand for emergency light sticks is expected to rise significantly.

Shift Toward Rechargeable and Eco-Friendly Lighting Solutions

Growing environmental concerns around disposable chemical sticks are accelerating the transition toward rechargeable LED light sticks. Manufacturers are integrating lithium-ion batteries, USB-C charging ports, waterproof casings, adjustable brightness, and SOS-strobe capabilities. These innovations significantly extend the lifespan of light sticks and reduce waste, appealing to environmentally conscious consumers and corporate/institutional buyers. Industrial users, such as mining, construction, and energy sectors, are adopting rugged LED light sticks as part of mandatory safety equipment. The trend is reinforced by global sustainability policies and upcoming waste-reduction regulations.

Rising Demand from Outdoor Recreation and Adventure Tourism

The global surge in camping, trekking, boating, and adventure tourism is creating sustained demand for portable emergency lighting tools. Outdoor enthusiasts value light sticks for signaling, campsite lighting, low-light navigation, and safety preparedness. Social-media-driven adventure culture further boosts adoption, with influencers showcasing emergency kits and gear essentials. Premium outdoor brands are partnering with light-stick manufacturers to create co-branded, high-durability LED light devices for enthusiasts, positioning emergency light sticks as both recreational and safety tools.

What are the key drivers in the emergency light stick market?

Increasing Global Focus on Safety & Emergency Preparedness

The increasing prioritization of personal safety, workplace readiness, and disaster mitigation is a major market driver. Governments, municipalities, and emergency services procure millions of light sticks annually for disaster-response centers, rescue teams, and community kits. Households in vulnerable regions are also purchasing emergency lighting to prepare for power outages and extreme weather events. This growing safety culture significantly strengthens baseline demand.

Expansion of Industrial and Corporate Safety Programs

Industrial facilities such as chemical plants, mines, construction sites, and large-scale factories mandate emergency lighting solutions for worker safety and regulatory compliance. Emergency light sticks provide reliable illumination in confined spaces, hazardous environments, and evacuation scenarios. With global industrialization advancing, especially in APAC, Latin America, and the Middle East, corporate procurement is rising steadily. Reusable LED light sticks, in particular, are experiencing increased adoption due to durability and long-term cost efficiency.

Growth in Outdoor Leisure, Tourism, and Night-Time Activities

The expanding outdoor recreation economy, supported by camping, festivals, night events, marine sports, and adventure travel, is a strong demand generator. Consumers integrate emergency light sticks into daypacks, survival kits, and travel gear. The trend aligns with rising disposable incomes and global interest in practical, portable safety products.

What are the restraints for the global market?

Environmental Concerns Around Disposable Chemical Sticks

Traditional chemiluminescent sticks are single-use and generate waste, triggering growing scrutiny from regulators and eco-conscious consumers. Environmental concerns may limit adoption in regions with strict waste-management policies and push manufacturers to shift toward reusable LED alternatives, impacting the long-term growth rate of traditional segments.

Availability of Substitute Portable Light Sources

Flashlights, headlamps, mobile-phone torches, and rechargeable lanterns compete directly with emergency light sticks for consumer attention. While light sticks offer unique advantages (non-electric, waterproof, instant illumination), substitutes reduce dependence on single-purpose lighting, especially in urban and high-income regions. As multi-functional lighting devices improve, competitive pressure may restrain growth in certain segments.

What are the key opportunities in the emergency light stick market?

Rising Government & Institutional Procurement

Governments, disaster-management authorities, defense forces, and public safety agencies are increasing their procurement budgets. Emergency light sticks are integral to field kits, evacuation gear, and mass-distribution emergency supplies. New entrants can target B2G contracts, while established manufacturers can expand supply capacities to support nationwide preparedness programs.

Technological Innovation in Rechargeable LED Light Sticks

Manufacturers can differentiate by launching advanced LED-based products with superior runtime, adjustable brightness, ruggedized housing, and hybrid illumination systems. Integration of IoT connectivity for search-and-rescue tracking, digital SOS signaling, UV-enabled detection, and modular lighting attachments offers high-value innovation opportunities. These developments can command premium pricing and open new industrial and defense markets.

Emerging Market Penetration & Export Expansion

Asia-Pacific, Africa, and Latin America are undergoing rapid urbanization and infrastructure expansion, presenting strong opportunities for bulk distribution. In regions with frequent power outages, emergency light sticks serve as essential household tools. Export-focused manufacturers, especially in China, India, and Southeast Asia, can scale operations and meet increasing global demand at competitive price points.

Product Type Insights

Chemiluminescent light sticks dominate the market, contributing approximately 55–60% of total 2024 revenues. Their advantages include low cost, immediate activation, no battery dependence, and high reliability during disasters. They remain heavily used in emergency kits, public-safety packs, and outdoor recreation. Rechargeable LED light sticks are the fastest-growing segment. With longer lifespan, adjustable output, waterproof designs, and eco-friendly profiles, they appeal to industrial users, outdoor enthusiasts, and safety-conscious consumers seeking durability and performance.

Application Insights

Outdoor and recreational use leads demand with a 30–35% market share, supported by surging interest in hiking, camping, marine activities, and nighttime events. Industrial and workplace safety use cases are expanding rapidly due to regulatory compliance requirements. Government and public-safety agencies remain the most stable, high-volume procurement category, driven by disaster preparedness and emergency operations.

Distribution Channel Insights

Online retail accounts for 25–30% of global sales, boosted by e-commerce marketplaces and brand-direct digital channels. Consumers increasingly prefer online purchases due to the ease of comparing product features, durability, and customer reviews. Specialty stores and tactical/outdoor shops remain important for performance-focused buyers, while institutional/B2B channels dominate government and industrial procurement, often through long-term contracts.

End-User Insights

Government and public safety agencies represent the largest end-user category (20–25% share), driven by mass procurement for emergency-response programs. Industrial and manufacturing sectors are growing rapidly as companies reinforce workplace safety practices. Outdoor recreation users represent a significant portion of consumer demand, as light sticks become staple accessories for travel and adventure activities.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 20–25% of the global 2024 market. The U.S. leads with strong demand from emergency services, industrial facilities, and recreational users. Canada demonstrates consistent adoption due to an active outdoor culture and disaster management standards. High product penetration results in steady, but moderate growth.

Europe

Europe represents 15–20% of the global share, led by Germany, the U.K., France, and the Nordic countries. Strict workplace-safety regulations, outdoor recreation trends, and growing emergency-preparedness awareness support demand. Sustainability-focused consumers are increasingly shifting toward rechargeable LED-based light sticks.

Asia-Pacific

Asia-Pacific dominates with a 35–40% market share in 2024 and is the fastest-growing region. China and India drive large-scale demand due to population size, frequent natural disasters, industrial expansion, and rising outdoor tourism. Japan, Australia, and Southeast Asia contribute significant secondary demand through recreational and institutional channels.

Latin America

Latin America holds approximately 5–7% of the market share. Brazil, Mexico, and Chile are key demand hubs. Economic development, rising safety awareness, and vulnerability to natural disasters contribute to the gradual but steady adoption of emergency light sticks.

Middle East & Africa

MEA contributes 3–5% of global revenue, driven by industrial safety usage in oil, gas, and mining, along with disaster-readiness initiatives in African nations. Growing tourism and outdoor activities in the Middle East further support demand expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Emergency Light Stick Market

- Cyalume Technologies

- Nite Ize

- Dorcy International

- Orion Safety Products

- Coghlan’s Ltd.

- Lumica

- UST (Ultimate Survival Technologies)

- LifeGear

- Pelican Products (LED category)

- Adventure Medical Kits (AMK)

- SOG Speciality Knives & Tools

- Streamlight Inc. (LED-oriented)

- Eveready Industries (select markets)

- Princeton Tec